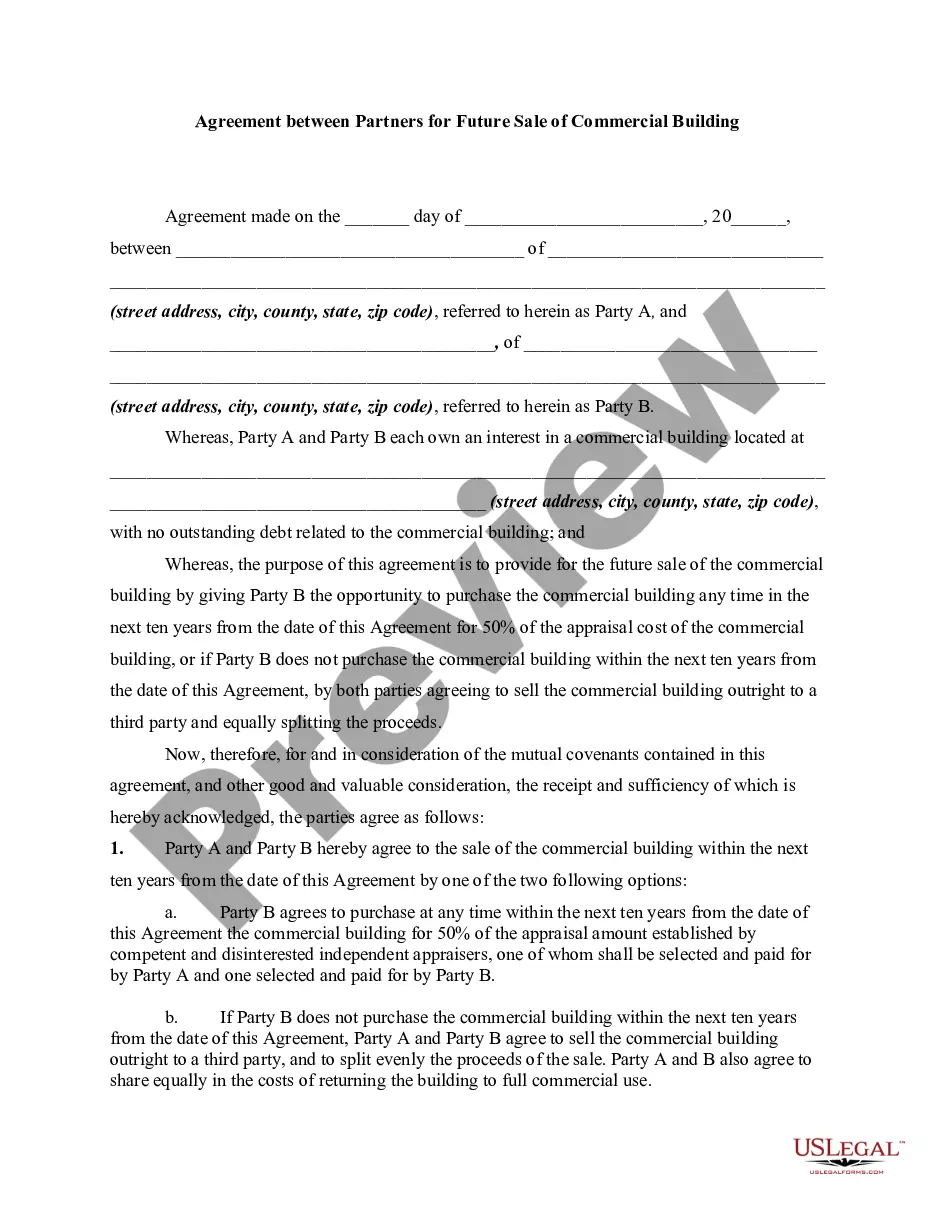

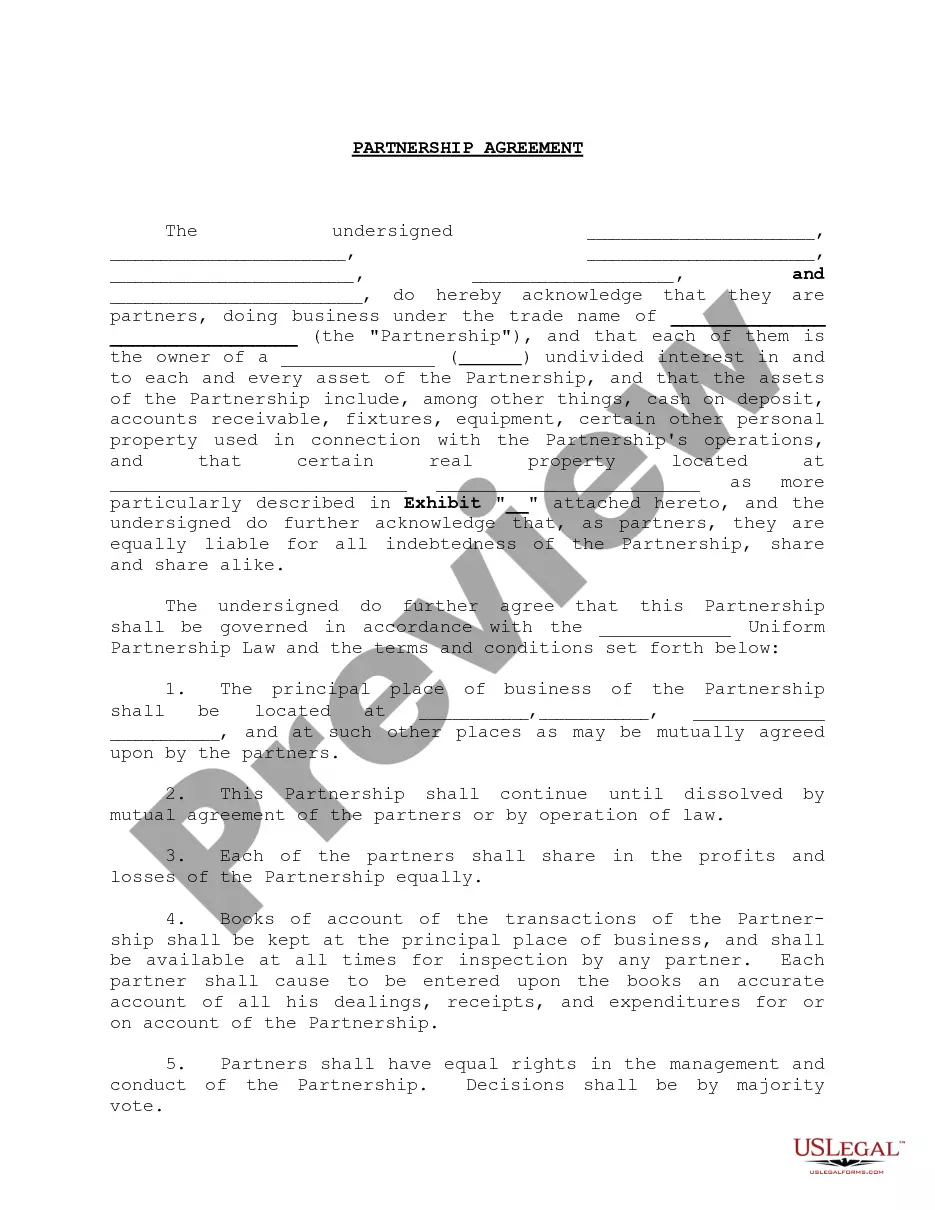

New Mexico Agreement to Sell Real Property Owned by Partnership to One of the Partners

Description

carry on as co-owners of a business for profit.

How to fill out Agreement To Sell Real Property Owned By Partnership To One Of The Partners?

Selecting the appropriate official document format can be a challenge.

It goes without saying that there are numerous templates accessible online, but how can you locate the official form that you require.

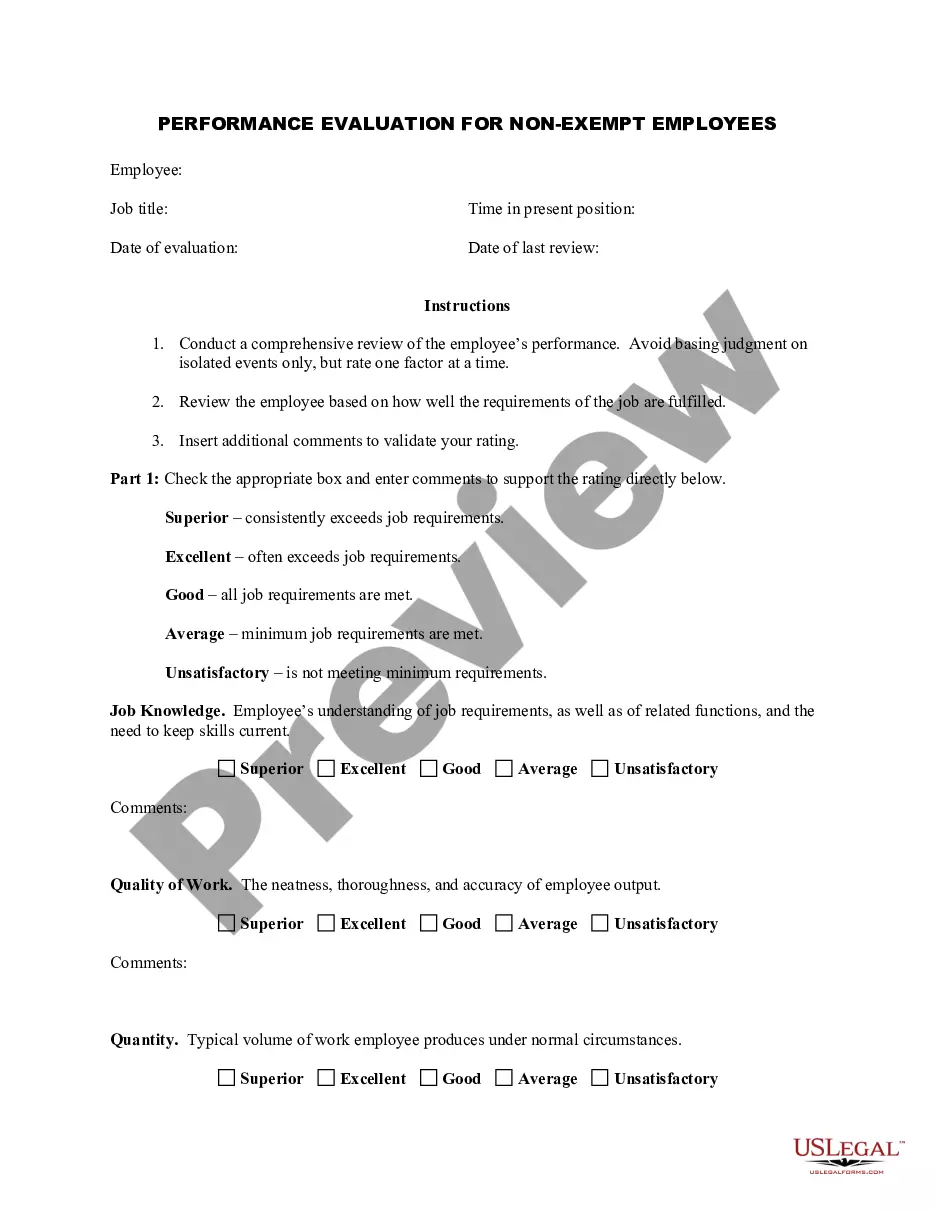

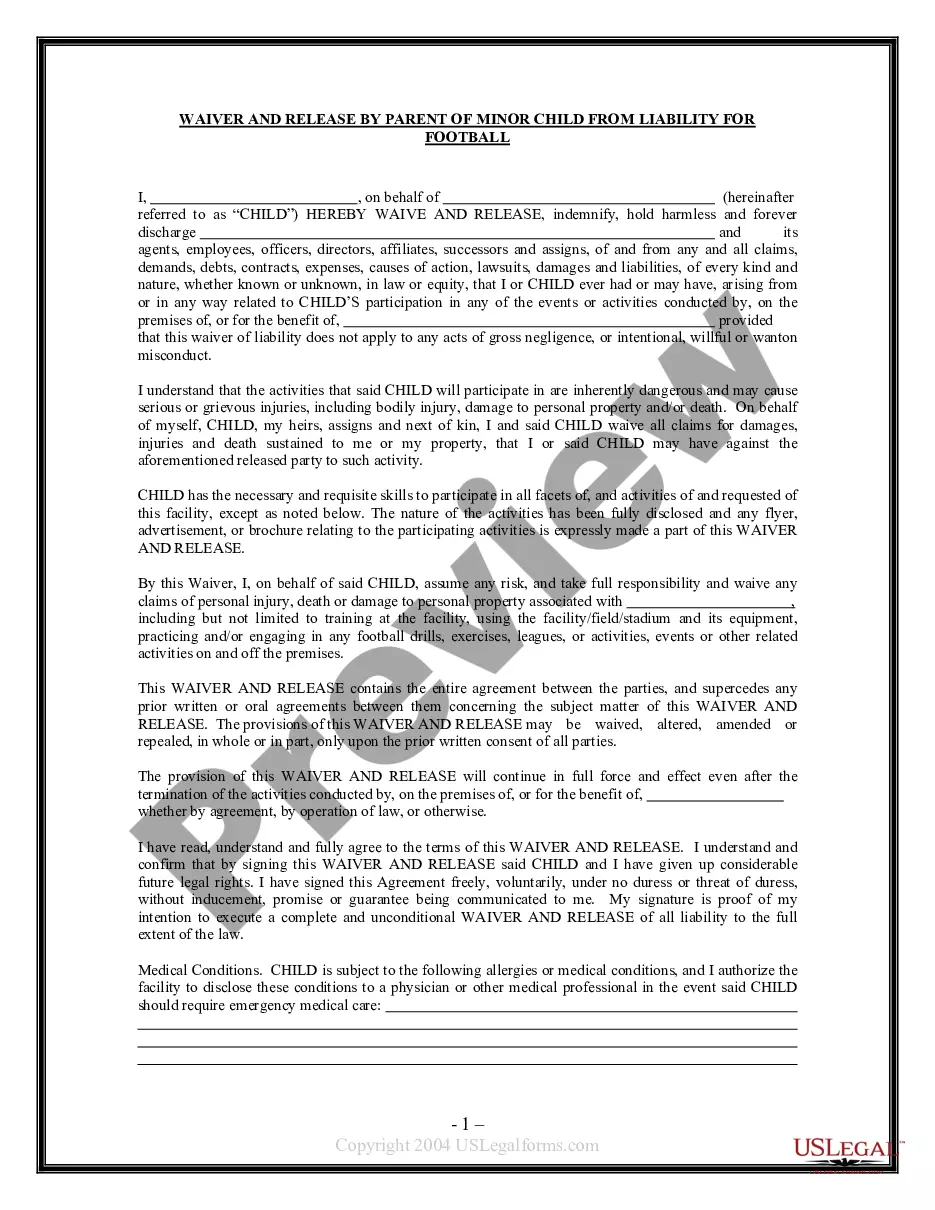

Utilize the US Legal Forms website. The service offers thousands of templates, including the New Mexico Agreement to Sell Real Property Owned by Partnership to One of the Partners, which can serve both business and personal purposes.

You can browse the form using the Review button and read the form description to confirm it is suitable for you.

- All forms are reviewed by professionals and satisfy state and federal regulations.

- If you are already registered, sign in to your account and click on the Acquire button to download the New Mexico Agreement to Sell Real Property Owned by Partnership to One of the Partners.

- Use your account to access the official forms you have previously purchased.

- Go to the My documents section of your account and get an additional copy of the documents you need.

- If you are a new user of US Legal Forms, here are quick steps for you to follow.

- First, ensure you have selected the correct form for your city/area.

Form popularity

FAQ

In community property states, including California, spouses and registered domestic partners take title as community property unless they elect otherwise. Each spouse has a half-interest in the property, and equal control over the property's management and use. To sell the property, both spouses must act together.

California's current law abandons indirection and unequivocally provides: A partner is not a coowner of partnership property and has no interest in partnership property that can be transferred, either voluntarily or involuntarily. Cal.

A partnership property includes all property and rights, and interest in property that the partnership firm purchases. These purchases can also be made for the purpose and in course of the business of the firm, including the goodwill of the firm. All partners collectively own such properties.

Partnership and co-ownership are two different things. For example, if two brothers purchase a property, that is co-ownership. Both brothers must agree if the property is to be sold, and the two would share the proceeds from the sale.

Acquired Business AssetsOnce a business partnership is formed, it can acquire business property in its own right, leasing or purchasing materials and equipment as it sees fit for its own account.

Because a partnership is not a legal person, it cannot acquire or hold a registered interest in real property. In order to acquire and hold real property, the partnership requires an individual or corporation to become a registered owner.

A partnership is a single business in which two or more people share ownership. Each partner contributes to all aspects of the business, including money, property, labor, or skill. In return, each partner shares in the profits and losses of the business.

A partnership has no separate legal personality and it cannot therefore own property and it will be owned by the individual property owning partners. The Land Registry will allow up to four property owning partners to be named at the Land Registry as legal owners.

Because a partnership is not a legal person, it cannot acquire or hold a registered interest in real property. In order to acquire and hold real property, the partnership requires an individual or corporation to become a registered owner.

A general partnership is an unincorporated business with two or more owners who share business responsibilities. Each general partner has unlimited personal liability for the debts and obligations of the business. Each partner reports their share of business profits and losses on their personal tax return.