New Mexico Grantor Retained Annuity Trust

Description

How to fill out Grantor Retained Annuity Trust?

If you need to finalize, obtain, or print sanctioned document templates, utilize US Legal Forms, the largest compilation of legal forms available online.

Employ the site`s straightforward and convenient search feature to locate the documents you require.

An array of templates for both business and personal purposes are categorized by type and claims, or keywords.

Step 4. After finding the form you need, click on the Buy now button. Choose the pricing plan you prefer and enter your details to create an account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the purchase.

- Utilize US Legal Forms to find the New Mexico Grantor Retained Annuity Trust in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click on the Download button to obtain the New Mexico Grantor Retained Annuity Trust.

- You can also access forms you previously acquired from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

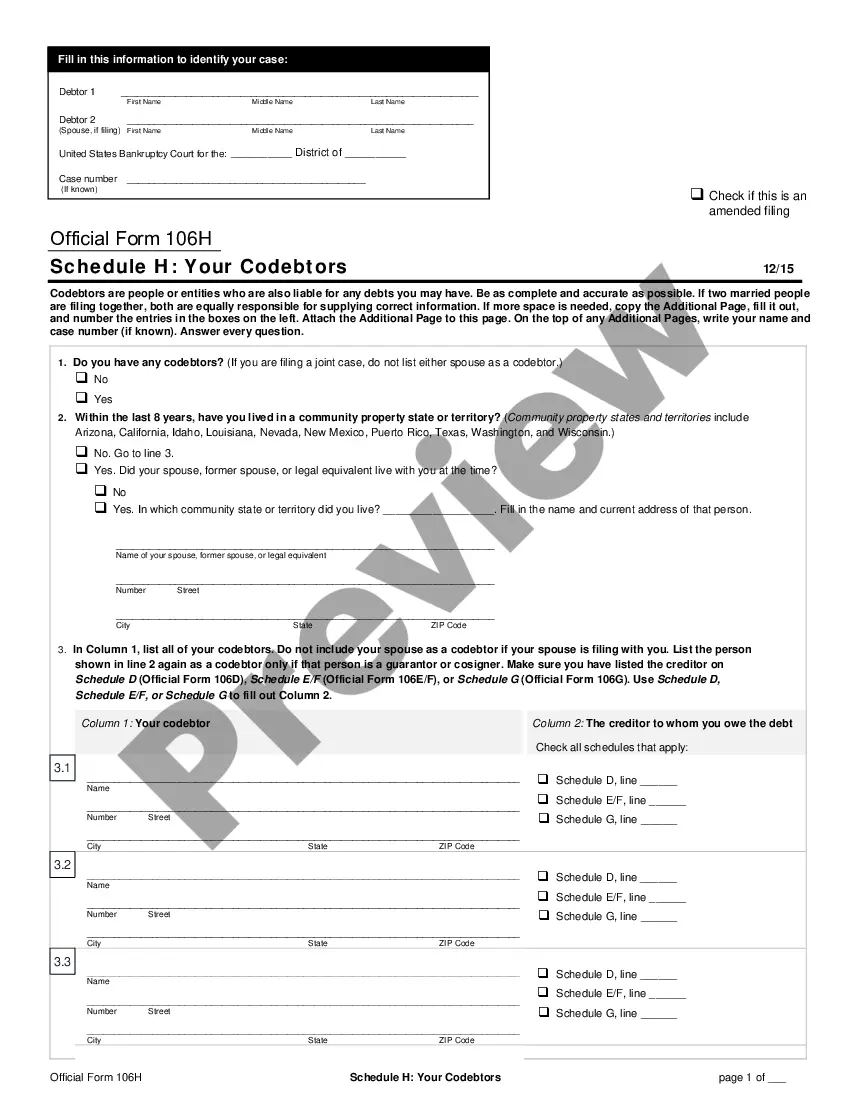

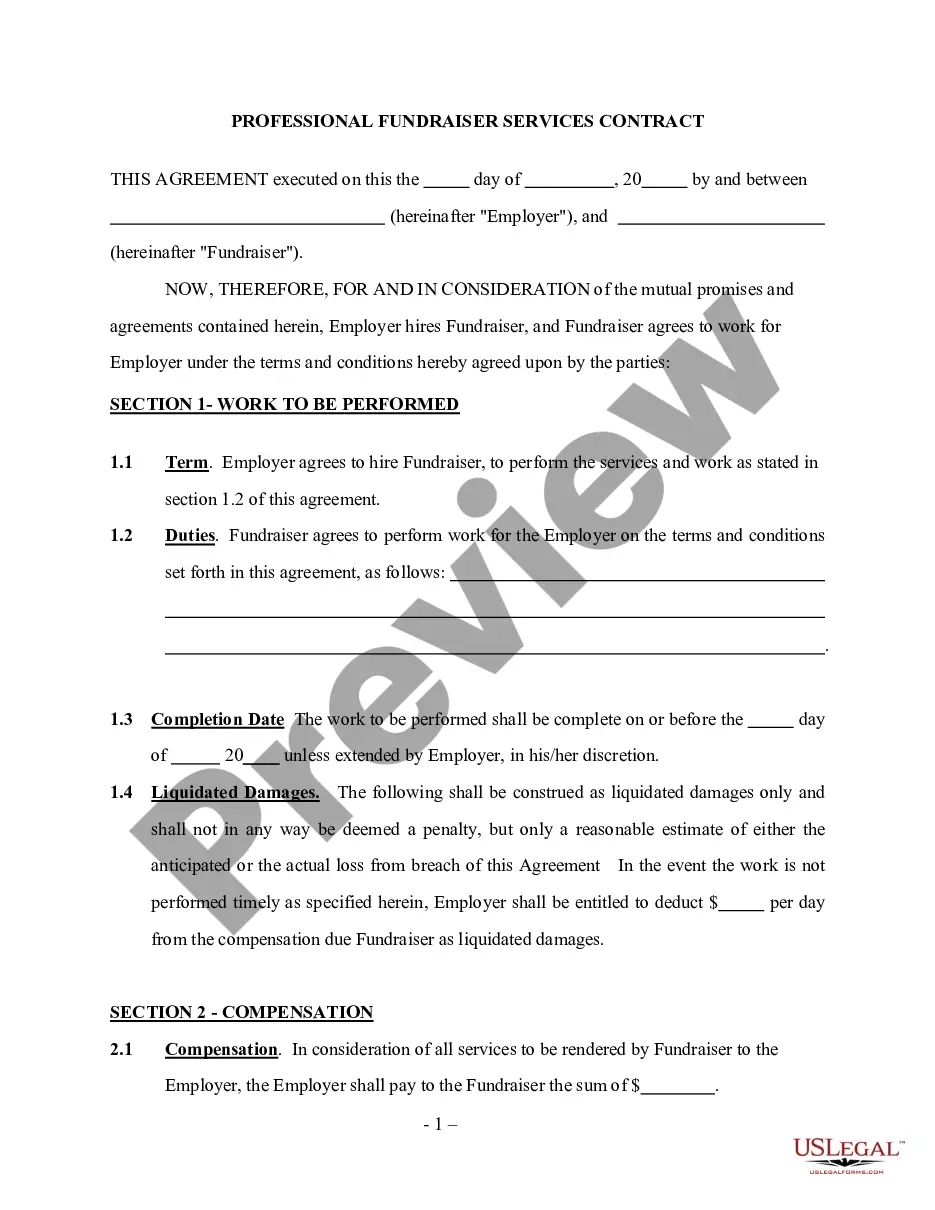

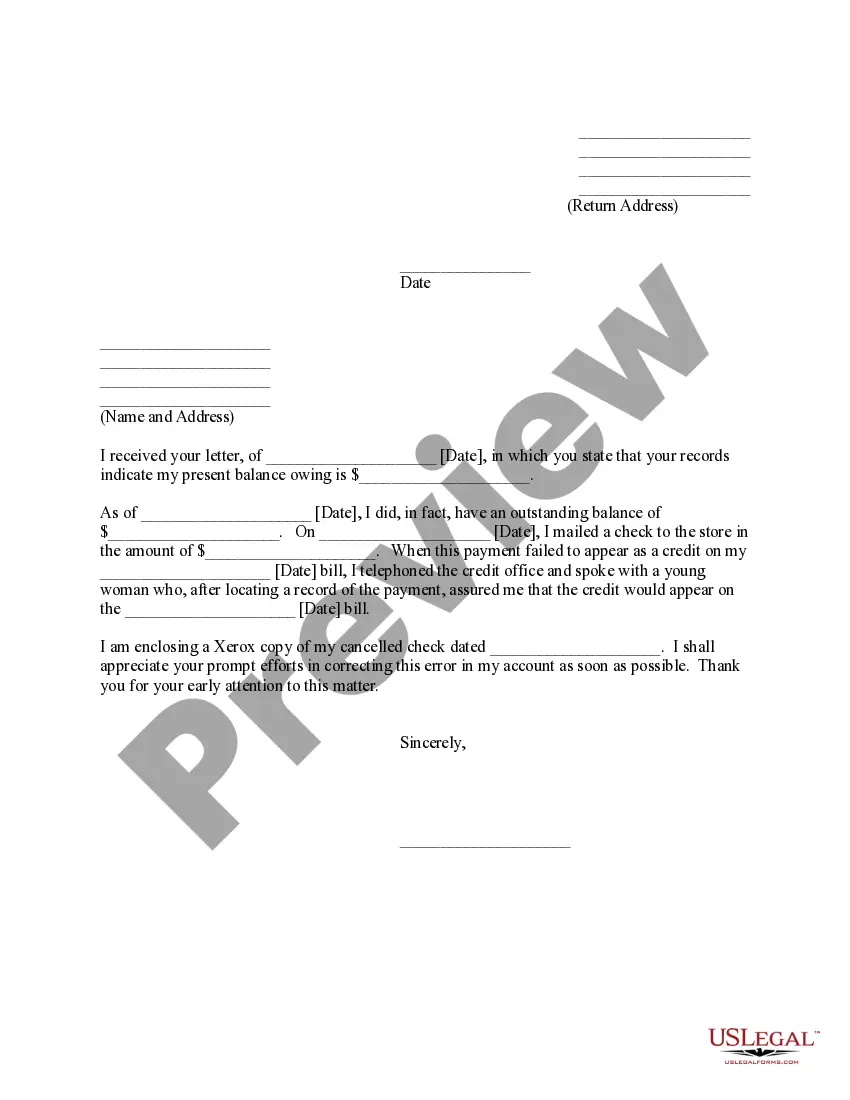

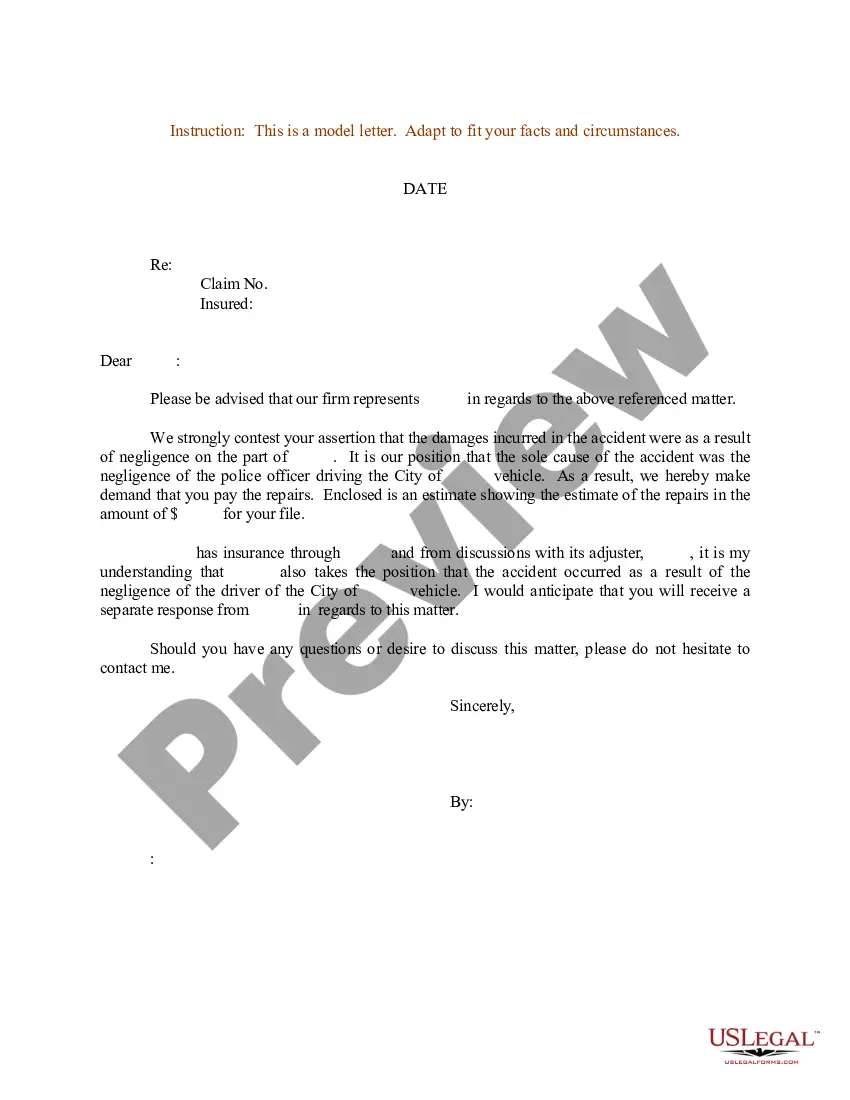

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form`s details. Be sure to read the description.

- Step 3. If you are not satisfied with the form, employ the Search field at the top of the screen to explore alternative variations in the legal form template.

Form popularity

FAQ

With respect to income taxes, the grantor is treated as the owner of the assets during the GRAT term and reports all income earned by the GRAT on his individual income tax return. To avoid having to file its own fiduciary income tax return, the GRAT should not apply for a separate taxpayer identification number.

In other words, during the initial term of the GRAT (the term that the Grantor is to receive the annuity payments) the Grantor will be taxed on all of the income earned by the GRAT during each such year, including capital gains.

Because the grantor may use a valuation formula, a GRAT allows the grantor to transfer a difficult to value asset without a significant risk of unexpected gift tax. The following is an example of how a valuation formula will reduce the risk of unexpected gift tax consequences when dealing with hard to value assets.

Tax Implications of the GRAT During the term of the GRAT, the Donor will be taxed on all of the income and capital gains earned by the trust, without regard to the amount of the annuity paid to the Donor.

With respect to income taxes, the grantor is treated as the owner of the assets during the GRAT term and reports all income earned by the GRAT on his individual income tax return. To avoid having to file its own fiduciary income tax return, the GRAT should not apply for a separate taxpayer identification number.

If the grantor dies during the GRAT term, the value of the remainder interest in the trust is included in the grantor's taxable estate under either section 2036 (retained income, possession, or enjoyment of property) or 2039 (retained right to receive annuity in transferred property).

GRATs are expressly permitted under the Internal Revenue Code. If they fail, you incur only a minimal tax cost and the professional fees associated with the project. If they succeed, you can transfer significant wealth to your beneficiaries, essentially gift-tax free.

Do gnats go away on their own? No, it's unlikely that gnats will go away on their own once they start reproducing. You will need to take proper measures to get rid of them, such as putting away your fruits, flushing out your drains, or changing the soil in your indoor plants' pots.

GRATs are taxed in two ways: Any income you earn from the appreciation of your assets in the trust is subject to regular income tax, and any remaining funds/assets that transfer to a beneficiary are subject to gift taxes.

Depending on the type of asset being transferred, clients may also consider creating GRATs of various terms. While we still remain in a low interest rate climate, GRATs continue to be particularly effective planning tools to gift assets without using any gift tax exemption.