New Mexico Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years

Description

How to fill out Grantor Retained Income Trust With Division Into Trusts For Issue After Term Of Years?

Are you presently in a position where you require documents for both professional and personal use almost daily.

There are numerous valid document templates available online, but finding ones you can trust isn’t straightforward.

US Legal Forms offers a plethora of document templates, such as the New Mexico Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years, which are designed to meet federal and state regulations.

Choose the pricing plan you want, fill in the required information to create your account, and pay for your order using your PayPal or Visa or Mastercard.

Select a convenient document format and download your copy. Find all of the document templates you have purchased in the My documents menu. You can obtain an additional copy of the New Mexico Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years anytime if needed. Just click on the necessary form to download or print the template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the New Mexico Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct region/area.

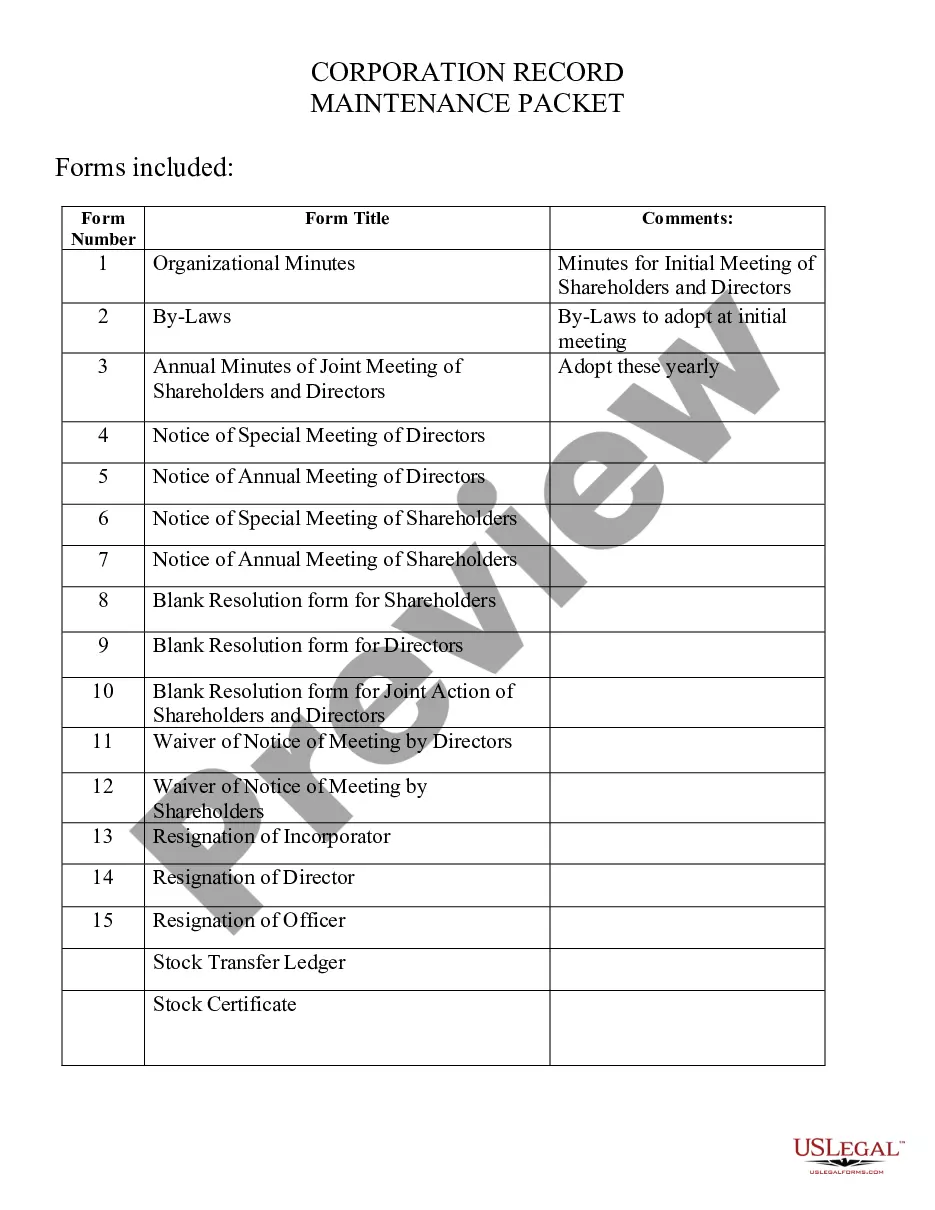

- Use the Preview button to view the form.

- Read the description to confirm that you have selected the right form.

- If the form isn’t what you are looking for, utilize the Search section to locate the form that suits your needs and requirements.

- Once you find the appropriate form, click Get now.

Form popularity

FAQ

Key Takeaways. A 5 by 5 Power in Trust is a clause that lets the beneficiary make withdrawals from the trust on a yearly basis. The beneficiary can cash out $5,000 or 5% of the trust's fair market value each year, whichever is a higher amount.

The creator of the trust (the Grantor) transfers assets to the GRAT while retaining the right to receive fixed annuity payments, payable at least annually, for a specified term of years. After the expiration of the term, the Grantor will no longer receive any further benefits from the GRAT.

Commonly referred to as the 21 year rule, the rule deems certain types of trusts to dispose of their capital property and recognize the accrued gains every 21 years. Without this rule, trusts could be used to defer the realization of a capital gain for more than 21 years (80 years in BC).

The annuity amount is paid to the grantor during the term of the GRAT, and any property remaining in the trust at the end of the GRAT term passes to the beneficiaries with no further gift tax consequences.

Grantor Retained Income Trust, Definition A grantor retained income trust allows the person who creates the trust to transfer assets to it while still being able to receive net income from trust assets. The grantor maintains this right for a fixed number of years.

Commonly referred to as the 21 year rule, the rule deems certain types of trusts to dispose of their capital property and recognize the accrued gains every 21 years. Without this rule, trusts could be used to defer the realization of a capital gain for more than 21 years (80 years in BC).

To implement this strategy, you zero out the grantor retained annuity trust by accepting combined payments that are equal to the entire value of the trust, including the anticipated appreciation. In theory, there would be nothing left for the beneficiary if the trust is really zeroed out.

At the end of the initial term retained by the Grantor, if the Grantor is still living, the remainder beneficiaries (or a trust to be administered for the benefit of the remainder beneficiaries) receive $100,0000 plus all capital growth (which is the amount over and above the net income that was paid to the Grantor).

Since a GRAT represents an incomplete gift, it is not a suitable vehicle to use in a generation-skipping transfer (GST), as the value of the skipped gift is not determined until the end of the trust term.

Year Trust, also known as a Legacy Trust or Medicaid Asset Protection Trust, can be established to protect assets from being spent down on long term care in a nursing home. The assets you place in the Legacy Trust will become exempt from the Medicaid spend down requirements after a 5 year look back period.