New Mexico Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption

Description

How to fill out Certification Of No Information Reporting On Sale Or Exchange Of Principal Residence - Tax Exemption?

Are you located in a venue where you frequently require documents for various business or personal activities every day.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers an extensive selection of form templates, such as the New Mexico Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption, which are designed to comply with federal and state regulations.

Once you find the appropriate form, simply click Get now.

Select the pricing plan you prefer, provide the necessary information to create your account, and complete the payment using your PayPal or credit card. Choose a convenient document format and download your version. Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the New Mexico Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption at any time, if needed. Click the desired form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal documents, to save time and prevent errors. This service offers properly developed legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the New Mexico Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct location/county.

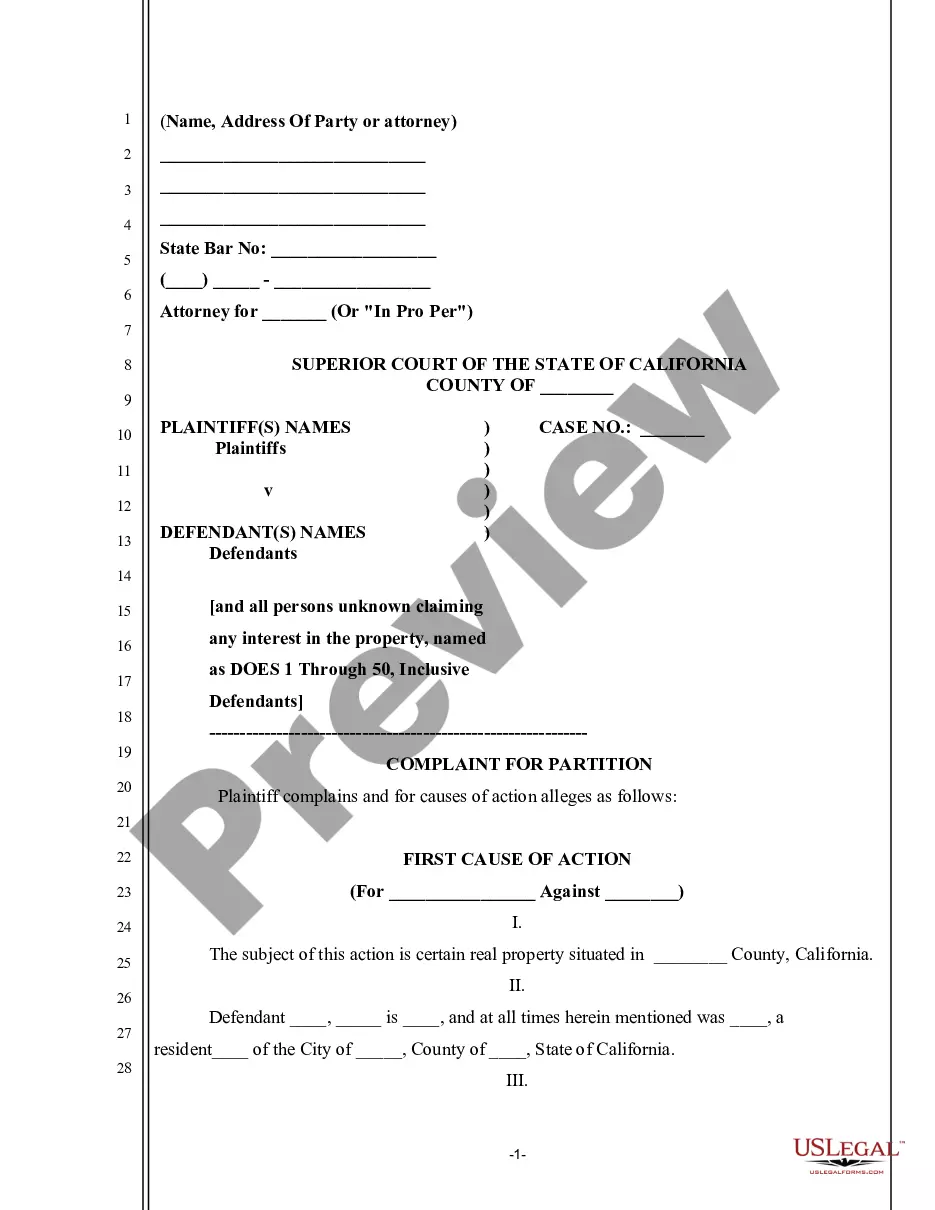

- Use the Preview button to examine the form.

- Review the details to make sure that you have chosen the correct form.

- If the form is not what you are looking for, use the Search field to locate the form that matches your needs and specifications.

Form popularity

FAQ

To acquire an NTTC certificate in New Mexico, start by thoroughly reviewing the application requirements on the state’s tax department website. The application requires certain details about your property and transaction that relate to the New Mexico Certification of No Information Reporting on Sale or Exchange of Principal Residence - Tax Exemption. Once you have completed all necessary forms, submit them to the appropriate department for approval.

NTTC Type(s) Requested check all that apply: Type 2: Purchase or lease of tangible personal property for resale. 25a1 Type 5: Purchase of services for resale. 25a1 Type 6: Purchase of construction materials/services or leased construction equipment as part.

In order to have a New Mexico resale certificate, you must first apply for a New Mexico sales tax permit. This permit will provide you with a New Mexico Tax ID number (sales tax number) which will be a necessary field on the New Mexico resale certificate.

New Mexico does not require sellers to have a sales tax permit to use a resale certificate. For that reason, New Mexico has two different resale certificate forms. One for those registered with the state and one for sellers who are not.

If you receive an informational income-reporting document such as Form 1099-S, Proceeds From Real Estate Transactions, you must report the sale of the home even if the gain from the sale is excludable. Additionally, you must report the sale of the home if you can't exclude all of your capital gain from income.

After registering with TRD and receiving a CRS identification number, you may obtain an NTTC through TRD's NTTC webservice. Note: TRD has the right to refuse to issue NTTCs to taxpayers who are delinquent in paying taxes. Please note that resale certificates issued by other states are not valid in New Mexico.

To obtain NTTCs, the applicant must have a New Mexico business tax identification number (CRS Identification Number) issued by this Department. A buyer or lessee may register solely to obtain NTTCs by marking the NTTC only checkbox on the application for a New Mexico business tax identification number.

Non-Taxable Transaction Certificates (NTTC)

TYPE 9 certificates may be executed for the purchase of tangible personal. property only and may not be used for the purchase of services, the pur- chase of a license or other intangible property, for the lease of property or to. purchase construction materials for use in construction projects (except as.

A New Mexico resale certificate (also commonly known as a resale license, reseller permit, reseller license and tax exemption certificate) is a tax-exempt form that permits a business to purchase goods from a supplier, that are intended to be resold without the reseller having to pay sales tax on them.