New Mexico Agreement to Form Partnership in Future to Conduct Business

Description

How to fill out Agreement To Form Partnership In Future To Conduct Business?

It is feasible to spend multiple hours online attempting to locate the endorsed document template that aligns with the state and federal requirements you need.

US Legal Forms offers a vast array of official forms that have been reviewed by professionals.

You can easily download or print the New Mexico Agreement to Form Partnership in Future to Conduct Business from this service.

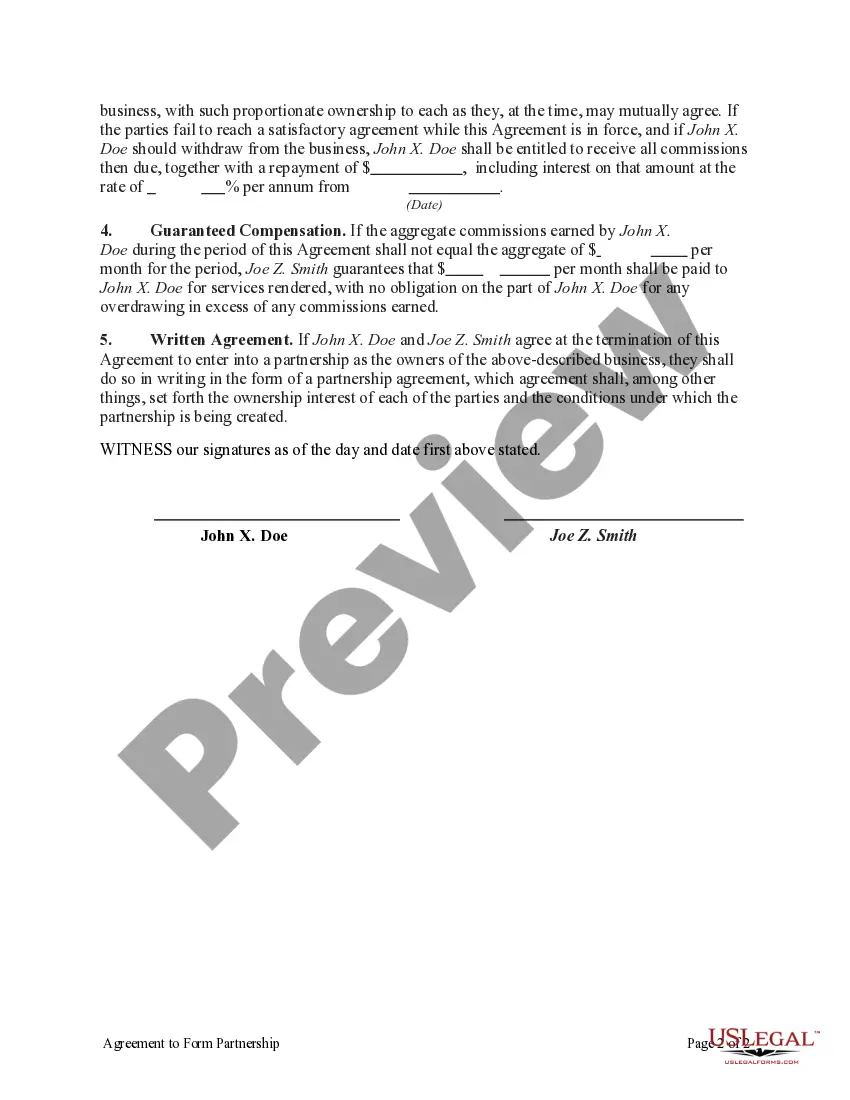

If available, utilize the Preview button to examine the document template as well.

- If you possess a US Legal Forms account, you can Log In and click on the Acquire button.

- Afterward, you can complete, modify, print, or sign the New Mexico Agreement to Form Partnership in Future to Conduct Business.

- Every legal document template you purchase is yours indefinitely.

- To obtain another copy of any purchased form, visit the My documents tab and click on the appropriate button.

- If you're using the US Legal Forms website for the first time, follow the basic instructions below.

- First, make sure you have selected the correct document template for your preferred county/city.

- Review the form description to confirm you have chosen the correct form.

Form popularity

FAQ

Understanding the four types of key partnerships is crucial when considering a New Mexico Agreement to Form Partnership in Future to Conduct Business. These partnerships include strategic alliances, joint ventures, equity partnerships, and franchise agreements. Strategic alliances allow businesses to collaborate on projects while maintaining their independence. Joint ventures involve creating a new entity for a specific purpose. Equity partnerships share ownership, and franchise agreements enable businesses to expand by allowing others to operate under their brand. Each type serves unique business needs and growth strategies.

In the context of a New Mexico Agreement to Form Partnership in Future to Conduct Business, recognizing the four stages of partnership is vital for success. These stages include initiation, development, maintenance, and dissolution. During initiation, partners come together to define their shared goals and agreement terms. The development stage focuses on building relationships and establishing roles, while maintenance ensures ongoing collaboration and communication. Finally, dissolution involves closing the partnership, which can be smooth when a clear agreement exists.

When you consider a New Mexico Agreement to Form Partnership in Future to Conduct Business, it's important to understand the four main types of business partnerships: general partnerships, limited partnerships, limited liability partnerships, and joint ventures. Each type has its unique structure and liability considerations. General partnerships involve equal responsibility among partners, while limited partnerships include both general and limited partners, with the latter having limited liability. Limited liability partnerships provide personal liability protection to all partners, and joint ventures are temporary partnerships for specific projects.

Partnerships in New Mexico typically need to complete a Certificate of Partnership form when filing with the state. This form includes essential details about the partnership, such as its title, purpose, and the names of the partners. Depending on your business type, additional forms or licenses may also be required. The New Mexico Agreement to Form Partnership in Future to Conduct Business can provide clarity on the necessary forms.

Filling out a partnership form involves providing accurate details about the partnership's name, address, and the nature of the business. You must indicate each partner's information, including their contributions and roles. Once completed, ensure all partners review the form for accuracy before submission. A well-prepared New Mexico Agreement to Form Partnership in Future to Conduct Business can assist you with this form.

To form a partnership in New Mexico, you need at least two individuals or entities willing to engage in business together. You'll also require a clear partnership agreement that defines each partner's role and the business goals. Additionally, consider obtaining legal advice to ensure compliance with local laws. Creating a New Mexico Agreement to Form Partnership in Future to Conduct Business is a great first step toward a solid foundation.

To establish a partnership in New Mexico, you typically need to file a Certificate of Partnership with the state. This document should include the partnership's name, the purpose of the business, and the details of the partners involved. Additionally, you may need to obtain any necessary business licenses or permits based on your industry. Utilizing a New Mexico Agreement to Form Partnership in Future to Conduct Business can help guide you through these requirements.

To create a business partnership, begin by choosing your partners wisely, considering their skills and financial contributions. Draft a partnership agreement that outlines the terms of the partnership, including roles, responsibilities, and profit-sharing. A New Mexico Agreement to Form Partnership in Future to Conduct Business not only simplifies this process but also promotes a strong foundation for your new venture.

The four types of partnerships in business include general partnerships, limited partnerships, limited liability partnerships, and joint ventures. Each type has distinct characteristics that affect liability and management responsibilities. Selecting the right type is important, and a New Mexico Agreement to Form Partnership in Future to Conduct Business can provide guidance on your rights and obligations.

To write a simple business partnership agreement, start by outlining the partnership’s purpose and each partner’s contributions. Specify how profits and losses will be divided, along with guidelines for decision-making and dispute resolution. A New Mexico Agreement to Form Partnership in Future to Conduct Business can simplify this task and ensure all critical elements are included.