New Mexico Packing Slip

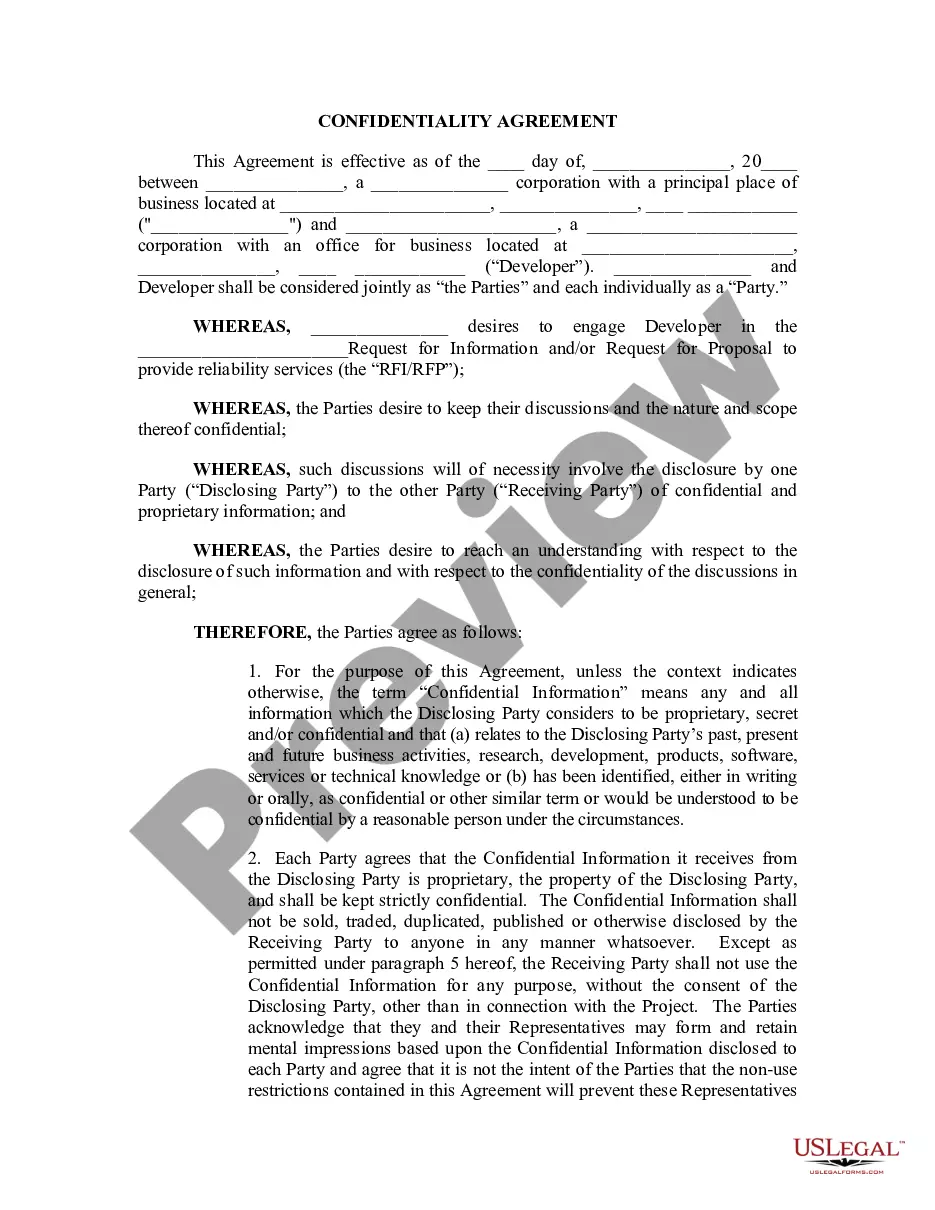

Description

How to fill out Packing Slip?

Are you presently in a circumstance where you require documentation for both business and personal reasons almost every workday.

There are numerous legitimate document templates accessible online, but locating ones you can trust isn’t straightforward.

US Legal Forms provides thousands of form templates, including the New Mexico Packing Slip, which can be designed to comply with federal and state regulations.

Once you find the appropriate form, click Purchase now.

Choose the pricing plan you wish to proceed with, provide the necessary information to process your payment, and finalize your order using either PayPal or a credit card.

- If you are already acquainted with the US Legal Forms website and have an account, simply sign in.

- After that, you can download the New Mexico Packing Slip template.

- If you do not possess an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you desire and ensure it is for the correct municipality/region.

- Utilize the Preview feature to review the form.

- Examine the details to confirm you have selected the right form.

- If the form isn’t what you are looking for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

You can file your New Mexico state taxes online through the New Mexico Taxation and Revenue Department’s portal. This method is efficient and offers instant confirmation of your submission. Integrating a New Mexico Packing Slip in your online filing can help you keep track of your documents and submissions successfully.

Your New Mexico PIT should be mailed to the address outlined on your return form. Ensure that you have filled out the form correctly and attached any necessary documentation. A New Mexico Packing Slip can assist you in keeping everything orderly and make sure you have not missed anything important.

To send your New Mexico PIT, direct your submission to the address indicated for your specific form and situation on the New Mexico Taxation and Revenue Department’s site. It's crucial to confirm the mailing address based on whether you include a payment. You can use a New Mexico Packing Slip to ensure you've included all necessary attachments.

Send your New Mexico tax return to the address listed on the form or the New Mexico Taxation and Revenue Department’s website. If you owe taxes, make sure to follow the instructions to include payment information clearly. Don't forget to use a New Mexico Packing Slip for an organized presentation of all required documents.

You should mail Form PIT-1, your New Mexico personal income tax return, to the state’s Taxation and Revenue Department. The specific mailing addresses differ depending on whether you are submitting a payment or not. Using a New Mexico Packing Slip can help you verify you included the necessary documents before mailing.

To mail a Colorado state tax return, you should send it to the address specified on the Colorado Department of Revenue’s website. Generally, the mailing address varies based on whether you are including a payment or if it is a return without payment. Be sure to attach your New Mexico Packing Slip for clarity and tracking.

A New Mexico PIT return is a document you file to report your personal income tax liabilities in New Mexico. It details your income, deductions, and credits, ultimately determining how much tax you owe or what refund you may receive. If you need assistance with your return, consider using a New Mexico Packing Slip to organize your documents and ensure accurate submissions.

A packing list must include the sender’s and recipient’s names and addresses, detailed item descriptions, and quantities. This information facilitates easy reference during shipping and receiving. Using a platform like US Legal Forms can simplify the creation of your New Mexico packing slip, ensuring you meet all documentation requirements.

To read a New Mexico packing slip, start at the top where you find the sender and recipient addresses. Then, move to the list of items, which includes descriptions and quantities. This format helps you confirm if the received items match the order placed, simplifying the receiving process.

A packing list typically includes the item descriptions, quantities, and any relevant SKU numbers. It may also contain a reference number to link back to the order for easy tracking. This information is vital for both the sender and receiver to verify the shipment contents.