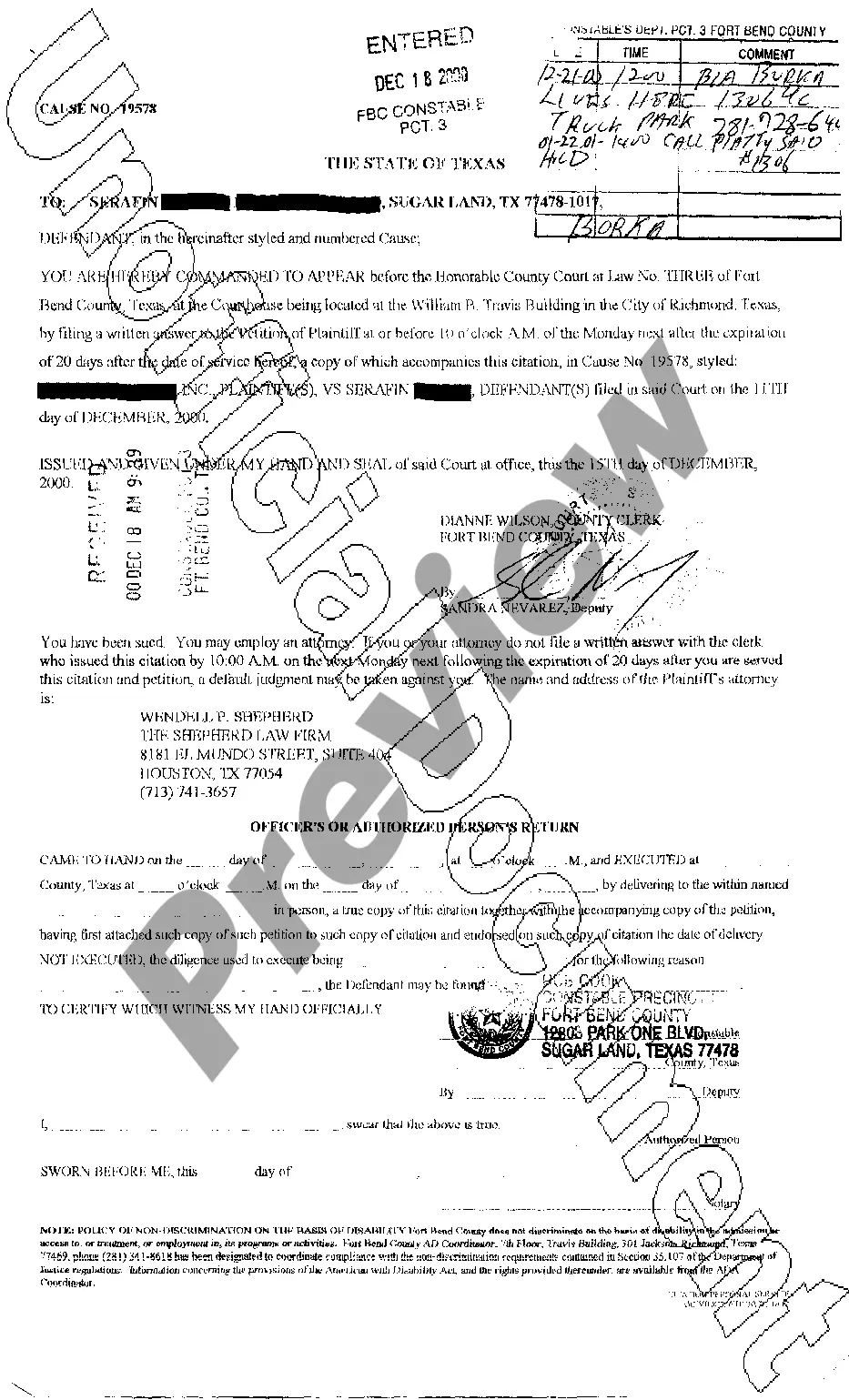

New Mexico Requisition Slip

Description

How to fill out Requisition Slip?

Selecting the optimal legal document type may pose a challenge. Clearly, there is an array of templates accessible online, but how can you locate the legal format you need? Utilize the US Legal Forms website. The platform provides a vast selection of templates, including the New Mexico Requisition Slip, which can be utilized for both business and personal purposes. All forms are reviewed by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to obtain the New Mexico Requisition Slip. Use your account to review the legal forms you have previously acquired. Navigate to the My documents tab in your account and download another copy of the document you need.

If you are a new user of US Legal Forms, here are simple steps for you to follow.

Fill out, modify, print, and sign the downloaded New Mexico Requisition Slip. US Legal Forms is the premier repository of legal templates where you can discover numerous document formats. Leverage the service to download professionally-crafted documents that comply with state regulations.

- First, ensure you have chosen the correct form for your city/state.

- You can preview the form using the Review button and examine the form details to confirm it meets your needs.

- If the form does not meet your criteria, utilize the Search field to locate the appropriate form.

- When you are certain that the form is suitable, click on the Buy now button to obtain the form.

- Select the pricing plan you prefer and enter the necessary details. Create your account and finalize your order with your PayPal account or credit card.

- Select the file format and download the legal document template to your device.

Form popularity

FAQ

Filing small claims court in New Mexico requires you to fill out specific court forms and submit them to your local District Court. Make sure you include all relevant evidence and files to support your case. Utilizing the New Mexico Requisition Slip can help you gather and submit the necessary documentation to strengthen your claim.

Filing your New Mexico state taxes online is simple. You can use the New Mexico Taxation and Revenue Department's website, where you can find various forms and instructions for electronic submission. Be sure to have your financial information handy, including any supporting documents, which can often be organized with a New Mexico Requisition Slip for easier filing.

To apply for a New Mexico CRS number, you need to complete an online application through the New Mexico Taxation and Revenue Department's website. The process is straightforward and requires basic business information. You can also use the New Mexico Requisition Slip to help organize your submission and ensure that you include all necessary details.

In New Mexico, seniors may be eligible to stop paying property taxes when they reach 65 years old, provided they apply for the exemption. This tax benefit can significantly ease the financial burden for older homeowners. However, to qualify, you must complete the necessary forms, including the New Mexico Requisition Slip, to initiate your request.

The PIT B form, or Personal Income Tax B form, is used for reporting income by individuals or businesses in New Mexico. This form allows you to accurately report your income and determine any tax liabilities. If you are submitting expenses or claims associated with your business activities, such as using the New Mexico Requisition Slip, you may need to reference this form. It’s important to ensure that all information is filled out completely and accurately to avoid delays.

In New Mexico, the primary form for an S Corporation is the Form 1120S, which is used to report income, deductions, and other financial details. Filing this form accurately helps your S Corp maintain compliance with state laws. You may need to include the New Mexico Requisition Slip if you are dealing with specific transactions. It’s advisable to consult with a tax professional to ensure that you complete everything correctly.

To claim your New Mexico sales tax refund, you need to file a refund request through the state's taxation department. Gather your sales tax receipts and fill out the appropriate forms, including the New Mexico Requisition Slip. Ensure that you meet all eligibility criteria and provide adequate documentation to support your claim. This organized approach will enhance your chances of receiving your refund promptly.

A CRS identification number is a unique identifier assigned to businesses in New Mexico for tax purposes. It stands for 'Combined Reporting System' and helps you report gross receipts and other taxes to the state. When filing forms like the New Mexico Requisition Slip, having a CRS number is essential for compliance and accuracy. You can apply for this number through the New Mexico Taxation and Revenue Department.