New Mexico Angel Investor Agreement

Description

How to fill out Angel Investor Agreement?

If you intend to total, procure, or print legal document templates, utilize US Legal Forms, the primary collection of legal documents, available on the Internet.

Employ the website's straightforward and user-friendly search to acquire the papers you require.

Numerous templates for business and personal purposes are categorized by sections and categories, or keywords.

Each legal document template you receive is yours indefinitely.

You have access to all forms you have downloaded within your account. Click on the My documents section and select a document to print or download again.

- Use US Legal Forms to secure the New Mexico Angel Investor Agreement with just a few clicks.

- If you are a current US Legal Forms user, sign in to your account and click the Download button to locate the New Mexico Angel Investor Agreement.

- You can also view documents you have previously downloaded in the My documents tab of your account.

- If you are utilizing US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have chosen the form for the correct state/country.

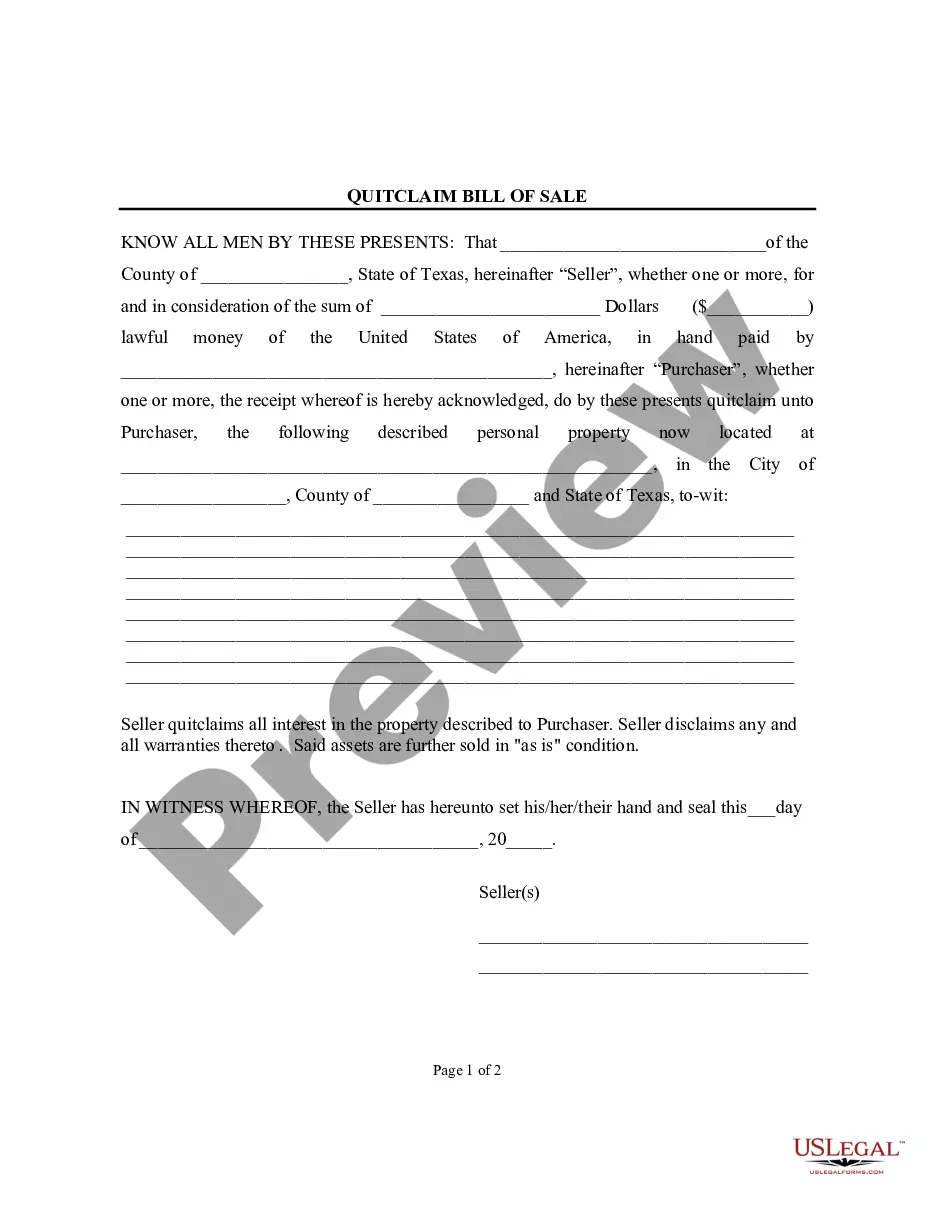

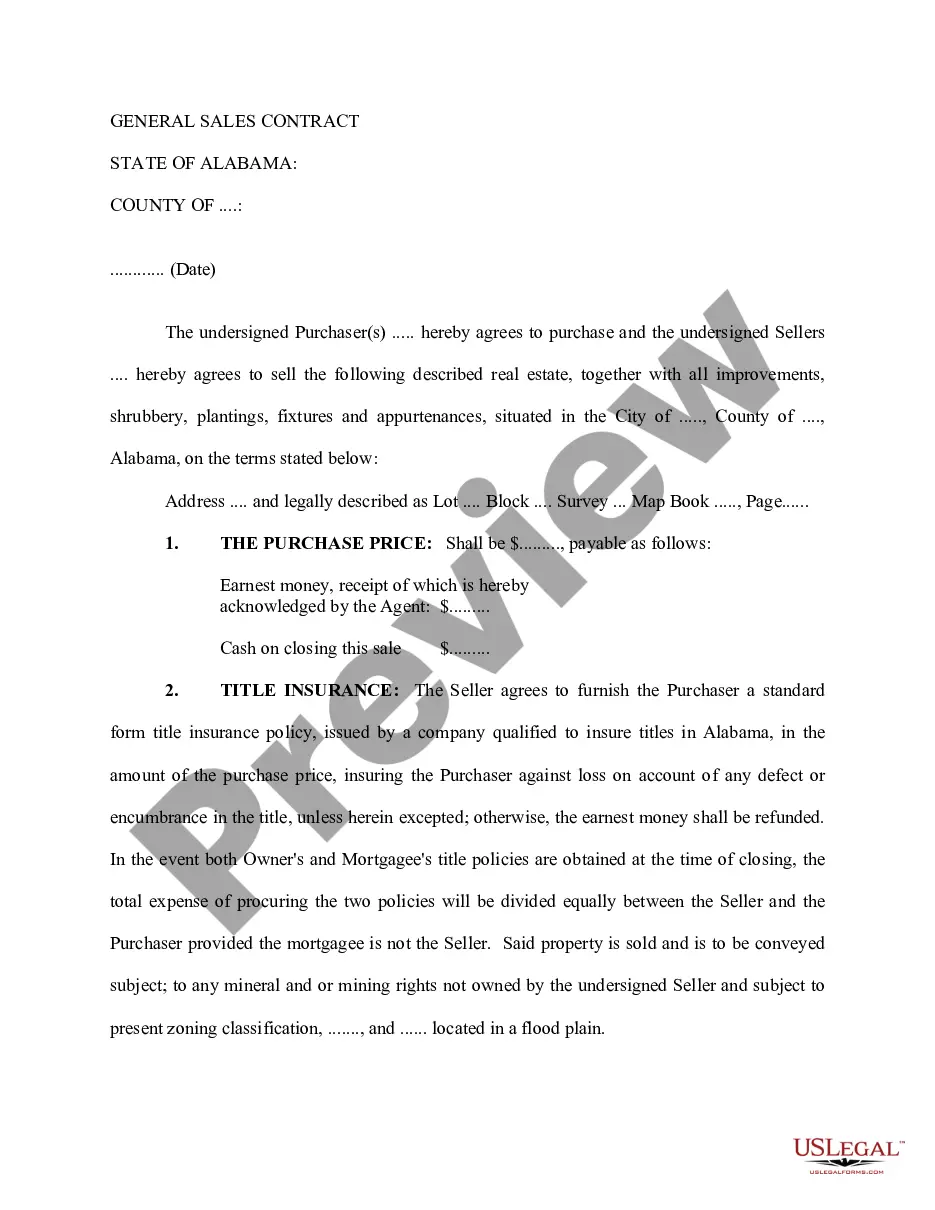

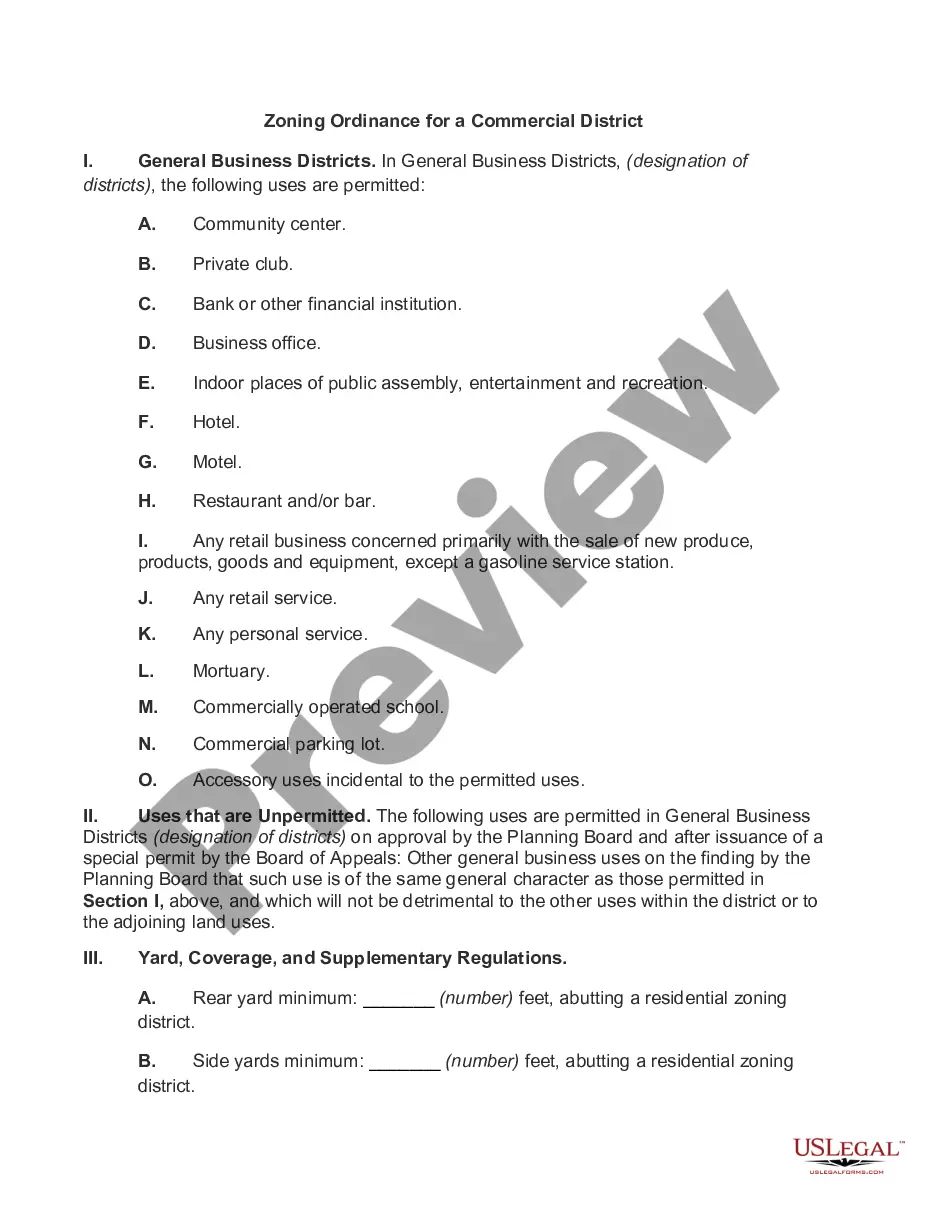

- Step 2. Use the Preview feature to review the form's content. Remember to check the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other templates of the legal document.

- Step 4. Once you have found the form you need, click the Purchase now button. Select the pricing option you prefer and enter your details to create an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of your legal document and download it to your device.

- Step 7. Fill out, edit, and print or sign the New Mexico Angel Investor Agreement.

Form popularity

FAQ

While there is no set amount, many angel investors start with a minimum of $25,000 to $100,000 in capital for initial investments. Keep in mind that having access to more funds can broaden your investment opportunities. Creating a New Mexico Angel Investor Agreement helps you clarify financial contributions and expectations.

The process typically starts with the angel investor identifying startups or entrepreneurs seeking funding. Once you find a promising project, you negotiate the terms of the investment, often using a New Mexico Angel Investor Agreement to formalize the agreement. This document protects both parties and outlines expectations, making the experience smoother.

In New Mexico, you do not need a specific license to become an angel investor. However, it is crucial to follow financial regulations concerning investments. You should consider consulting legal experts for guidance on a New Mexico Angel Investor Agreement, ensuring compliance with relevant laws.

The minimum amount to be an angel investor varies widely, typically starting around $25,000. However, in New Mexico, these numbers can fluctuate based on the investor's resources and the startup's needs. Having a structured New Mexico Angel Investor Agreement allows both parties to clearly define expectations and contributions, fostering a healthy investment relationship.

Securing an angel investor can be challenging, but it’s certainly achievable with the right preparation. Building a solid business plan and engaging proposal will increase your chances. Moreover, using a well-drafted New Mexico Angel Investor Agreement can clarify your vision and signal your commitment, making you a more attractive candidate.

To get in front of angel investors, start by networking within local business communities or attending startup events. Create a compelling pitch and refine your New Mexico Angel Investor Agreement to attract interest. Additionally, leverage platforms like UsLegalForms to ensure your paperwork is organized and professional, making a positive impression on potential investors.

Investing in an angel investor can be a game-changer for your startup. Angel investors often provide not just capital but also valuable mentorship and guidance. A New Mexico Angel Investor Agreement can help you establish a clear partnership, outlining the terms and expectations. Thus, securing an angel investor can significantly enhance your business trajectory.

To write a letter to an angel investor, start with a clear and engaging introduction that outlines your business concept and why it stands out. Include specific details about how their investment could impact your startup and mention key terms from the New Mexico Angel Investor Agreement. Be concise and respectful, expressing your appreciation for their time and consideration. Finally, invite them to discuss the opportunity further, encouraging an open dialogue.

To write off an angel investment, you need to demonstrate that the investment has become worthless or uncollectible. This often involves recording the loss on your tax return, ensuring you follow IRS guidelines regarding capital losses. The New Mexico Angel Investor Agreement can provide vital information regarding the terms and valuation, helping you establish the necessary documentation for this process. Consulting a tax professional can further clarify your specific circumstances.

A typical angel investor deal involves financing for a startup in exchange for equity or convertible debt. These agreements often include terms that describe the amount of investment, the ownership percentage, and potential exit strategies. In the context of a New Mexico Angel Investor Agreement, investors look for startups with strong growth potential, ensuring a mutually beneficial partnership. Therefore, understanding the specifics of these agreements is crucial for both parties.