New Mexico UCC-1 for Real Estate

Description

How to fill out UCC-1 For Real Estate?

Are you in a circumstance where you require documentation for both business or personal reasons almost every day.

There are numerous legal document templates available online, but finding reliable versions can be challenging.

US Legal Forms offers thousands of template options, including the New Mexico UCC-1 for Real Estate, which is designed to meet state and federal requirements.

Once you find the appropriate form, click Get now.

Choose the pricing plan you require, fill out the necessary information to create your account, and finalize your purchase using your PayPal or credit card. Select a convenient document format and download your copy. Retrieve all the forms you have purchased from the My documents menu. You can obtain an additional copy of the New Mexico UCC-1 for Real Estate at any time if needed. Just click the desired form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal documents, to save time and minimize errors. The service provides professionally crafted legal document templates for a variety of purposes. Create an account on US Legal Forms and begin making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the New Mexico UCC-1 for Real Estate template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for your correct jurisdiction/state.

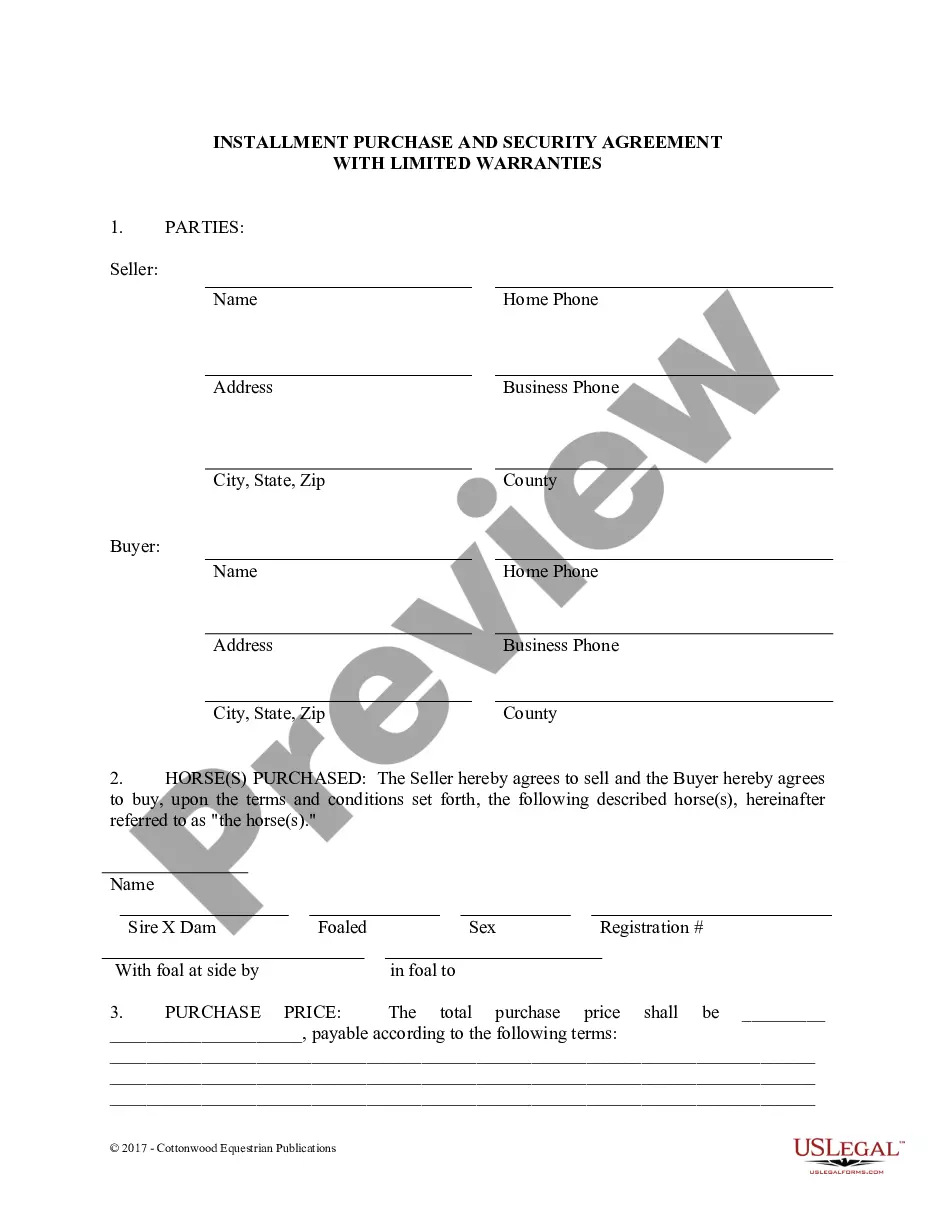

- Use the Preview button to review the form.

- Check the description to confirm that you have selected the correct form.

- If the form isn’t what you’re looking for, use the Search field to find the template that meets your needs.

Form popularity

FAQ

The Uniform Commercial Code (UCC) is a set of business laws that regulate financial contracts and transactions employed across states. The UCC code consists of nine separate articles, each of which covers separate aspects of banking and loans.

Filing a UCC-1 allows creditors to collateralize or secure their loan by utilizing the personal property assets of their customers. In the event of the customer defaulting on their loan or filing for bankruptcy, a UCC-1 elevates the lender's status to a secured creditor, ensuring they will be paid.

Uniform Closing Dataset (UCD) Specification. Issued by Fannie Mae and Freddie Mac.

UCC filings or liens are legal forms that a creditor files to give notice that it has an interest in the personal or business property of a debtor. Essentially, UCC lien filings allow a lender to formally lay claim to collateral that a debtor pledges to secure their financing.

The U.C.C. stands for the Uniform Commercial Code. The laws concerning commercial and private transactions for the sale and leasing of goods developed out of the common law of both England and the United States.

How to complete a UCC1 (Step by Step)Filer Information. Name and phone number of contact at filer. Email contact at filer.Debtor Information. Organization or individual's name. Mailing address.Secured Party Information. Organization or individual's name. Mailing address.Collateral Information. Description of collateral.

A creditor files a UCC-1 to provide notice to interested parties that he or she has a security interest in a debtor's personal property. This personal property is being used as collateral in some type of secured transaction, usually a loan or a lease.

A UCC3 is a change statement to a UCC1. It's an amendment filing to an original UCC1 financing statement that changes or adds information to the originally filed UCC1. It's a filing tool secured parties use to manage their UCC portfolio to maintain their perfected security interests.

Most lenders will require UCC-1 filings and collateral to secure their loans, and you don't want to spread your assets across multiple lenders. In the event you can't repay your loans, lenders could seize a significant portion of your personal and business assets.

Addresses. Technically, a correct address is not required for a financing statement to be effective. However, a filing office can (and usually will) reject financing statement without addresses for the Debtor or the Secured Party as allowed under Section 9-516(b)(4) and (5).