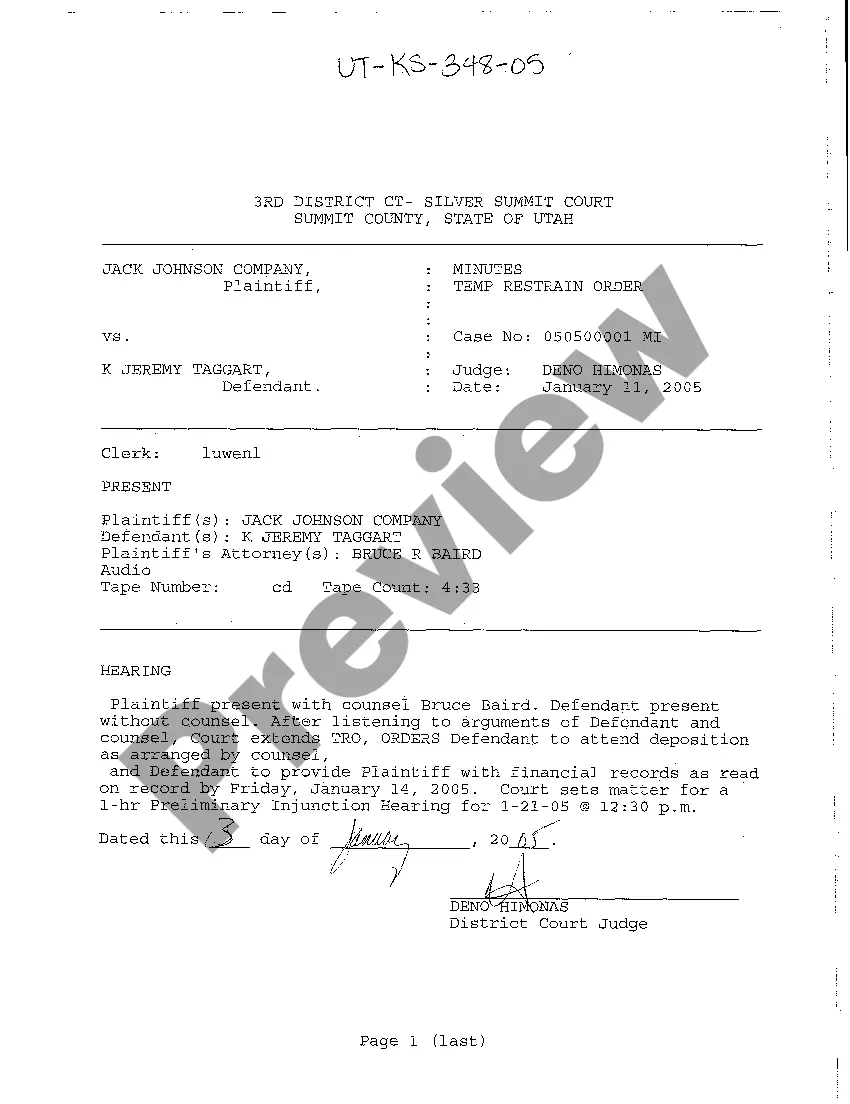

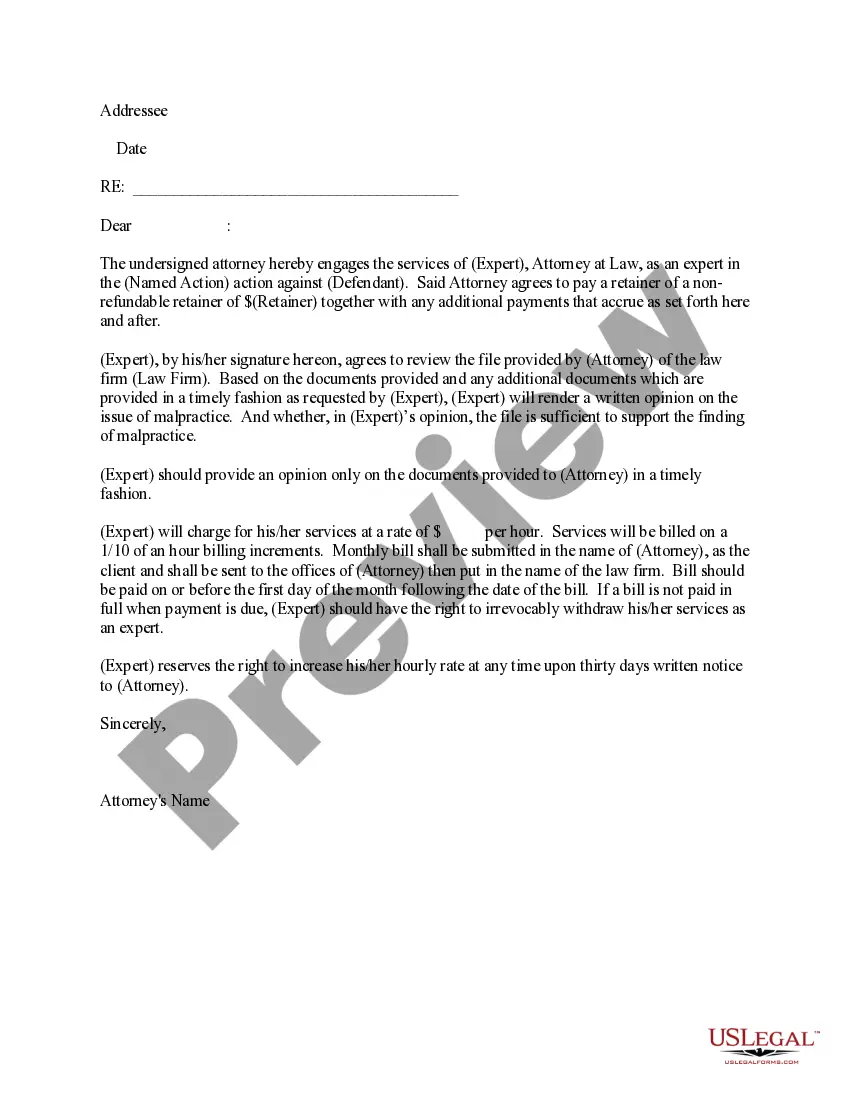

In the absence of a provision in a trust instrument giving the trustee power to terminate the trust, a trustee generally has no control over the continuance of the trust. In this form, the trustee had been given the authority to terminate the trust. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

New Mexico Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary

Description

How to fill out Termination Of Trust By Trustee And Acknowledgment Of Receipt Of Trust Funds By Beneficiary?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a broad selection of legal document templates that you can download or print.

Through the website, you can access thousands of forms for business and personal needs, categorized by types, states, or keywords. You can quickly obtain the most recent forms like the New Mexico Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary.

If you hold a subscription, Log In to download New Mexico Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary from the US Legal Forms library. The Download button will be visible on every document you view.

Once you are satisfied with the form, confirm your choice by clicking the Get now button. After that, choose the pricing plan you prefer and provide your details to register for an account.

Process the transaction. Use your credit card or PayPal account to complete the transaction. Choose the format and download the form to your device. Make edits. Fill out, modify, print, and sign the saved New Mexico Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary.

Every template you add to your account does not have an expiration date and is yours indefinitely. Therefore, to download or print another version, simply go to the My documents section and click on the form you need.

Access the New Mexico Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary with US Legal Forms, one of the most extensive collections of legal document templates. Utilize numerous professional and state-specific templates that meet your business or personal requirements and specifications.

- You can access all previously saved forms from the My documents section of your account.

- If you're new to US Legal Forms, here are simple steps to get you started.

- Ensure you have selected the correct form for your area/county.

- Click the Preview button to examine the form's content.

- Review the form description to confirm you have the right document.

- If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does.

Form popularity

FAQ

Disinheriting someone from a trust is possible, provided the trust document explicitly states this intention. In New Mexico, clarity in the trust's language is vital to ensure that the disinheritance is legally valid. Consulting with a legal expert familiar with trust laws can help you achieve this, ensuring it aligns with the procedures surrounding termination of trust by the trustee and acknowledgment of receipt of trust funds by the beneficiary.

A beneficiary can initiate the termination of a trust in New Mexico by requesting the trustee to distribute the trust assets. This generally requires the approval of all beneficiaries and can depend on the terms outlined in the trust agreement. Understanding your rights and those of other beneficiaries is essential, which is why legal guidance is recommended for smooth navigation of the termination process.

To remove someone as a beneficiary, it is crucial to follow the trust document's guidelines. This may involve drafting a trust amendment or, in some cases, a new trust instrument. Seek legal advice, especially in relation to New Mexico's rules on termination of trust by trustee and the acknowledgment of the receipt of trust funds by the beneficiary, to navigate this process effectively.

To remove someone from a deed of trust, you typically must execute a release or an amendment to the deed. This requires following the legal procedures dictated by New Mexico law. Working with a qualified attorney ensures that you meet all requirements, particularly when addressing the specifics of trust termination and beneficiary acknowledgment.

Removing a beneficiary from a trust deed in New Mexico requires adherence to specific legal steps. You should first review the trust document to understand the removal provisions. Additionally, it may involve drafting a trust amendment and having it executed properly. Legal assistance is beneficial to ensure the removal aligns with the New Mexico termination of trust by the trustee and acknowledgment of receipt of trust funds by the beneficiary.

Yes, a beneficiary can be removed from a trust under certain circumstances. In New Mexico, the process involves the trustee making a formal decision based on the trust's terms. It is advisable to consult with a legal professional to ensure compliance with the trust's provisions and New Mexico laws regarding termination of trust by the trustee and acknowledgment of receipt of trust funds by the beneficiary.

Verification refers to confirming the accuracy of information, often requiring evidence to support claims, while acknowledgment is the act of affirming receipt of a document or payment. In the realm of New Mexico Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary, acknowledgment focuses on confirming receipt rather than validating data. Understanding this distinction can help clarify roles within the trust process and enhance communication between trustees and beneficiaries.

A receipt from a beneficiary of a trust is a document that confirms a beneficiary has received their share of the trust assets. This is an important component in the New Mexico Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary process, allowing beneficiaries to formally acknowledge the transfer. It ensures that all parties are on the same page regarding what has been delivered. This documentation can protect both the trustee and the beneficiary in case of any future disputes.

An example of trust termination occurs when the goals set forth in the trust document have been fully met, such as distributing assets to beneficiaries. In the context of New Mexico Termination of Trust By Trustee, this process involves the trustee formally dissolving the trust once all terms are fulfilled. The beneficiaries receive their respective shares in compliance with the trust's guidelines. Properly acknowledging receipt of these funds is vital for both transparency and legal protection.

In legal terms, acknowledgment refers to a formal declaration where one party confirms the receipt of a document or funds. It plays a crucial role in the New Mexico Termination of Trust By Trustee and Acknowledgment of Receipt of Trust Funds By Beneficiary process. By acknowledging receipt, the beneficiary ensures they understand their rights and responsibilities under the trust agreement. This step is essential for clear communication and transparency between the trustee and the beneficiary.