New Mexico Agreement and Release for Working at a Novelty Store - Self-Employed

Description

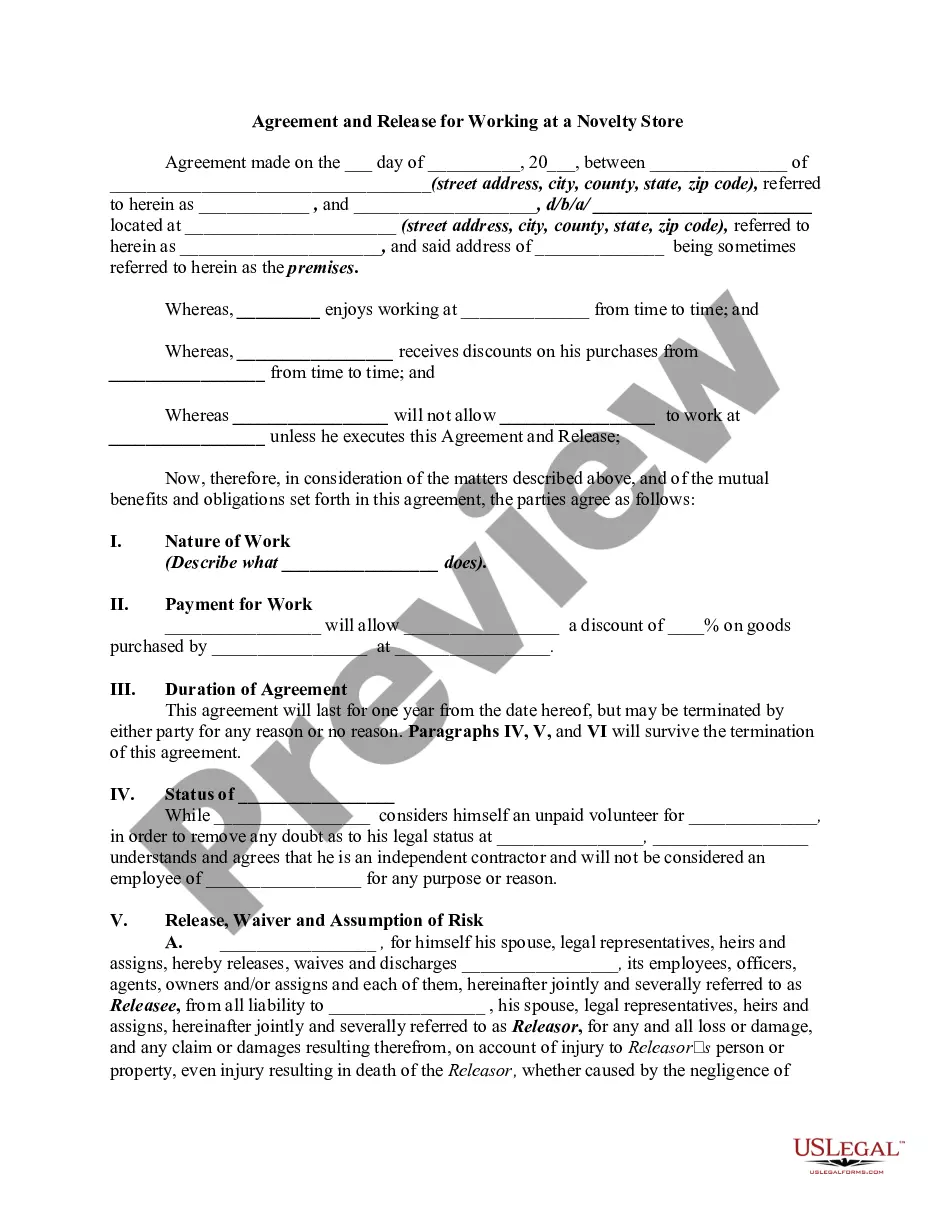

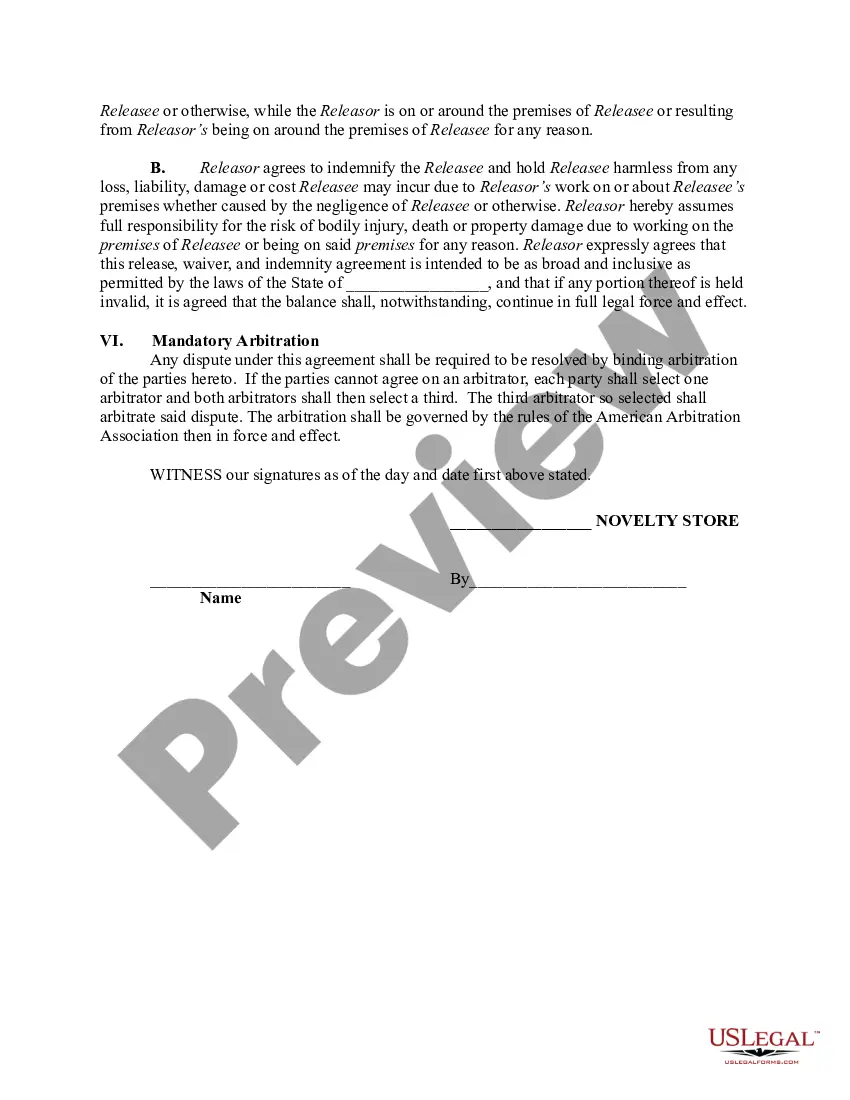

How to fill out Agreement And Release For Working At A Novelty Store - Self-Employed?

If you want to be thorough, download, or create legal document templates, utilize US Legal Forms, the largest collection of legal forms, available online.

Utilize the site's straightforward and user-friendly search to locate the documents you require. A diverse range of templates for business and personal purposes are categorized by groups and claims or keywords.

Use US Legal Forms to locate the New Mexico Agreement and Release for Working at a Novelty Store - Self-Employed with just a few clicks.

Every legal document template you obtain is yours forever. You have access to every form you downloaded within your account. Check the My documents section and select a form to print or download again.

Stay competitive and download, and print the New Mexico Agreement and Release for Working at a Novelty Store - Self-Employed with US Legal Forms. There are numerous professional and state-specific forms you can use for your business or personal requirements.

- If you are already a US Legal Forms customer, Log In to your account and click on the Download button to retrieve the New Mexico Agreement and Release for Working at a Novelty Store - Self-Employed.

- You can also access forms you have previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Make sure you have chosen the template for the correct city/state.

- Step 2. Use the Preview option to review the form's contents. Be sure to read the details.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other versions of your legal document template.

- Step 4. Once you have found the form you need, click on the Buy now button. Select the payment method you prefer and enter your information to sign up for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finish the purchase.

- Step 6. Choose the format of your legal document and download it to your device.

- Step 7. Complete, modify, and print or sign the New Mexico Agreement and Release for Working at a Novelty Store - Self-Employed.

Form popularity

FAQ

Schedule C is a form used by sole proprietors to report their business income and expenses to the IRS. If you are self-employed, such as operating under the New Mexico Agreement and Release for Working at a Novelty Store - Self-Employed, this form is essential for accurately declaring your earnings. It allows you to distinguish between personal and business finances, which is crucial for tax deductions. Proper completion of Schedule C can maximize your tax benefits and ensure compliance with tax regulations.

The C method of accounting is commonly associated with Schedule C, which is the form used by sole proprietors to report their income and expenses. Under this method, self-employed individuals using the New Mexico Agreement and Release for Working at a Novelty Store - Self-Employed will categorize their earnings and expenses in a structured manner. Understanding this method is key to managing your business finances and fulfilling IRS requirements. This method can help you paint a clear picture of your business's financial health.

The Schedule C method of accounting refers to the reporting format used by sole proprietors to document their business income and expenses. If you are using the New Mexico Agreement and Release for Working at a Novelty Store - Self-Employed, you will likely file a Schedule C form. This form requires you to detail your business revenues and deductions, helping you determine net profit or loss. Accurate reporting is crucial for compliance and for determining your tax responsibilities.