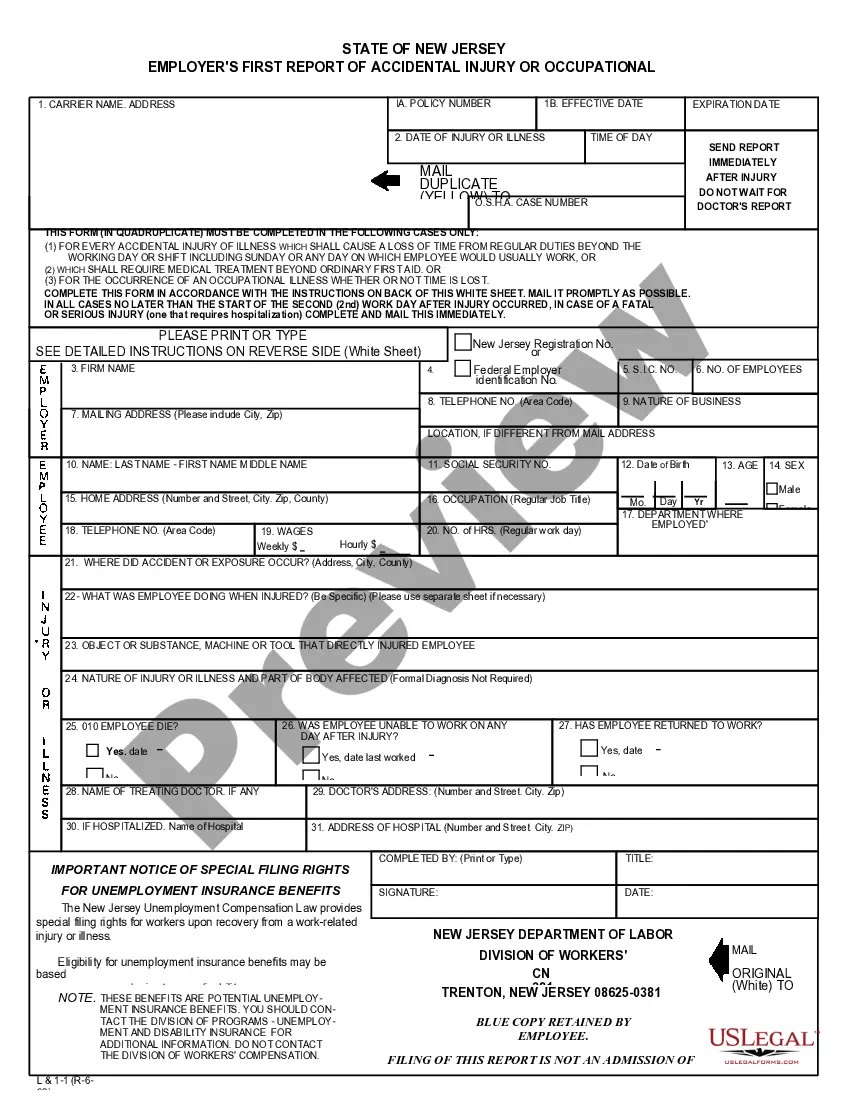

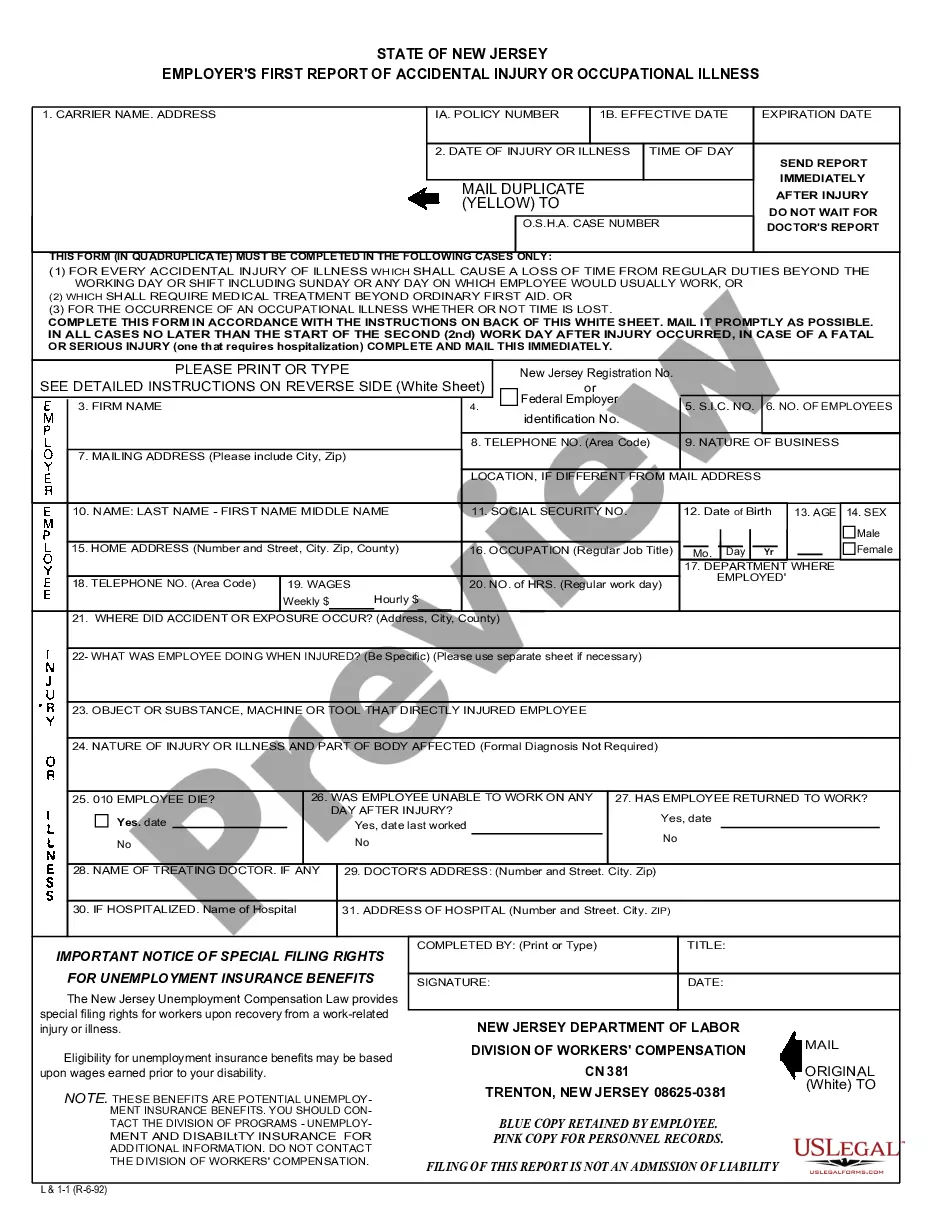

New Jersey Employers Report for Workers' Compensation

Description

How to fill out New Jersey Employers Report For Workers' Compensation?

US Legal Forms is a unique system where you can find any legal or tax template for completing, including New Jersey Employers Report for Workers' Compensation. If you’re tired of wasting time seeking appropriate samples and paying money on papers preparation/lawyer charges, then US Legal Forms is precisely what you’re trying to find.

To experience all the service’s advantages, you don't have to download any software but simply select a subscription plan and sign up your account. If you already have one, just log in and find an appropriate sample, download it, and fill it out. Saved files are all stored in the My Forms folder.

If you don't have a subscription but need to have New Jersey Employers Report for Workers' Compensation, check out the guidelines listed below:

- check out the form you’re checking out applies in the state you want it in.

- Preview the form and read its description.

- Simply click Buy Now to get to the sign up webpage.

- Select a pricing plan and keep on registering by entering some info.

- Decide on a payment method to finish the registration.

- Download the document by choosing your preferred file format (.docx or .pdf)

Now, submit the document online or print it. If you are unsure about your New Jersey Employers Report for Workers' Compensation template, speak to a attorney to review it before you decide to send out or file it. Begin hassle-free!

Form popularity

FAQ

In most cases, filing a workers' comp claim in California is actually a three-step process: reporting the injury. filing the actual claim with your employer, and. filing an application for adjudication of claim with the Workers' Compensation Appeals Board (WCAB).

In summary, you can stay on workers' comp in New Jersey as follows: Temporary total disability maximum of 400 weeks. Permanent total disability potentially for life. Permanent partial disability maximum of 600 weeks, depending on injury (see chart)

In New Jersey, you will receive 70% of your average wages, subject to a maximum set by state law. (The maximum is $896 per week in 2017 and $903 per week in 2018.)

Under the NJ workers' compensation law, the employer and/or their insurance carrier can select the physician(s) to treat injured workers for work related injuries.If time out of work extends beyond 7 days, they will also provide the injured worker temporary disability benefits during the period of rehabilitation.

Is Your Employer Required to Provide Workers' Compensation? Under the California workers' compensation law, it is the responsibility of all employers and work situations, even with just one employee, to carry workers' compensation and secure each employee's workers' compensation benefits.

3. The employer files the claim. Usually, the employer is responsible for submitting the paperwork to the workers' comp insurance carrier, but the employee's doctor also needs to mail a medical report. Additionally, employers may need to submit documentation to the state workers' compensation board.

Workers' compensation provides coverage for medical expenses and a portion of your lost wages (commonly referred to as disability benefits) if you suffer an injury on the job. This means that you can be fired while receiving workers' compensation.

The EEOC says An employer may ask questions about an applicant's prior workers' compensation claims or occupational injuries after it has made a conditional offer of employment, but before employment has begun, as long as it asks the same questions of all entering employees in the same job category.

In New Jersey, it is calculated as: Seventy percent of your average weekly wage for a temporary or total disability with minimum and maximum rates set at $216 and $810, respectively; or. a minimum of $35 and a maximum of $810 for a permanent partial disability, depending on your injury's severity and type.