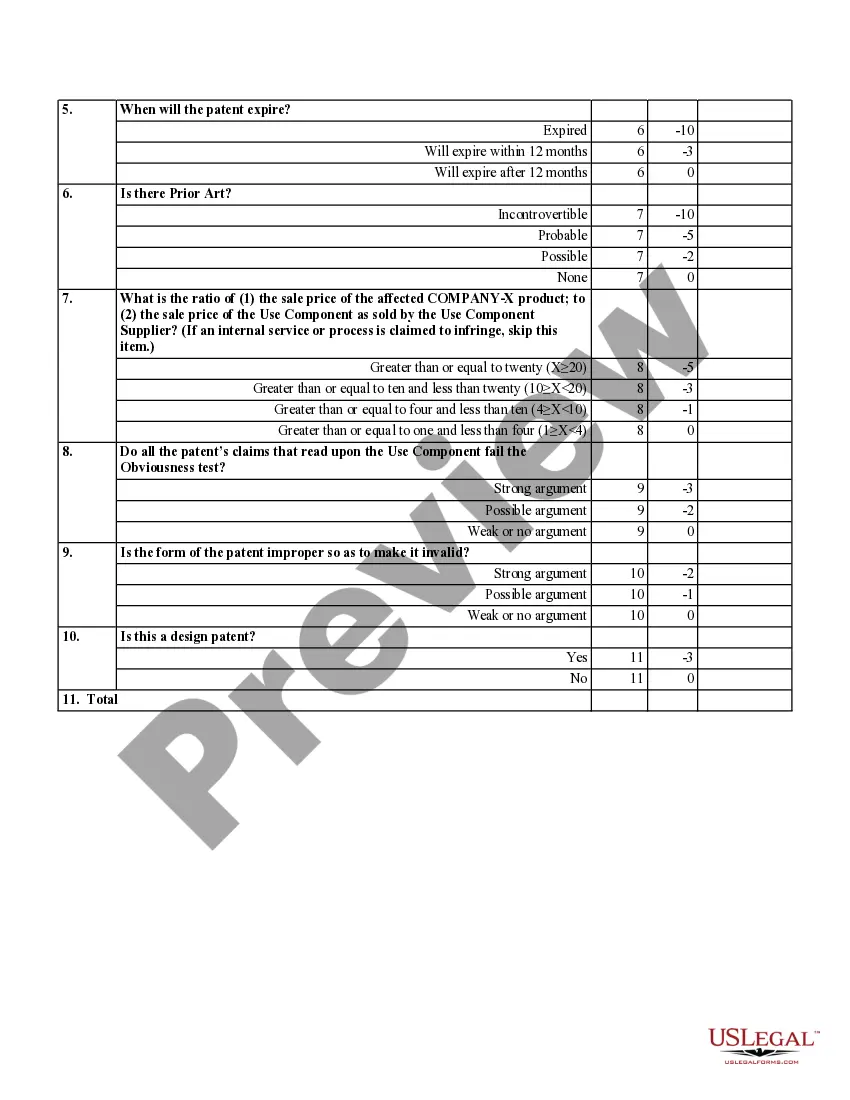

This is a patent use analysis worksheet for determining the overall likelihood of a royalty owing on a patent.

New Jersey Patent Use Analysis Worksheet

Description

How to fill out Patent Use Analysis Worksheet?

If you have to full, obtain, or print out legal file themes, use US Legal Forms, the greatest collection of legal varieties, which can be found on the Internet. Use the site`s basic and practical research to find the files you need. Numerous themes for company and individual reasons are categorized by groups and says, or keywords and phrases. Use US Legal Forms to find the New Jersey Patent Use Analysis Worksheet in a couple of click throughs.

When you are previously a US Legal Forms client, log in in your accounts and click the Acquire button to get the New Jersey Patent Use Analysis Worksheet. You can also entry varieties you formerly acquired from the My Forms tab of the accounts.

If you work with US Legal Forms the very first time, follow the instructions under:

- Step 1. Ensure you have chosen the shape for that proper area/country.

- Step 2. Utilize the Preview choice to examine the form`s content material. Don`t neglect to read through the information.

- Step 3. When you are unhappy together with the kind, use the Lookup discipline on top of the screen to get other types in the legal kind template.

- Step 4. After you have identified the shape you need, select the Buy now button. Choose the rates strategy you favor and put your accreditations to sign up to have an accounts.

- Step 5. Method the transaction. You can utilize your credit card or PayPal accounts to accomplish the transaction.

- Step 6. Choose the file format in the legal kind and obtain it on your system.

- Step 7. Comprehensive, change and print out or indication the New Jersey Patent Use Analysis Worksheet.

Each legal file template you get is the one you have permanently. You have acces to every kind you acquired within your acccount. Click on the My Forms segment and decide on a kind to print out or obtain once more.

Be competitive and obtain, and print out the New Jersey Patent Use Analysis Worksheet with US Legal Forms. There are millions of skilled and condition-distinct varieties you can utilize for the company or individual demands.

Form popularity

FAQ

The Division will trace the check. The New Jersey Gross Income amount from your 2021 return can be found on line 29 of your 2021 NJ-1040 return. Please note, if the Division of Taxation has made adjustments to your return for the previous year, the amount on the . pdf of your return may not match what is on file.

The NJ CBT only applies to C Corporations and S Corporations; LLCs are exempt from paying this tax.

The following payments can be made using our Pay Online service: Pay CBT-100-V / CBT-100S-V. File and Pay CBT-200-T Extension. Pay CBT-150 Estimated Payment(s) - Schedule Mutiple Payments by E-Check.

A corporation that has elected and qualifies to be an S corpora- tion pursuant to Section 1361 of the Internal Revenue Code is required to file Form CBT-100S unless the shareholders elect to be treated as a C corporation for New Jersey purposes. See Hybrid Corporations.

The process of filing a Corporate Tax Return (Form CBT 100) is very straightforward. You can file the form online by visiting the New Jersey Division of Taxation website. You can also use an accountant or a tax professional to file the form.

Late Payment Penalty: 5% of the balance of the taxes due and paid late. Interest: The annual interest rate is 3% above the average predominant prime rate. Interest is imposed each month (or fraction thereof) on the unpaid balance of the tax from the original due date to the date of payment.

You can make an estimated payment online or by mail. If you are mailing a payment you must file a Declaration of Estimated Tax Voucher (Form NJ-1040-ES ) along with your check or money order.

The due date for the filing of a CBT-100 is the 15th day of the fourth month following the ending month of the accounting period. For example, if a corporation's accounting period ends on December 31, 2022, the due date for filing the 2022 New Jersey CBT-100 is April 15, 2023.