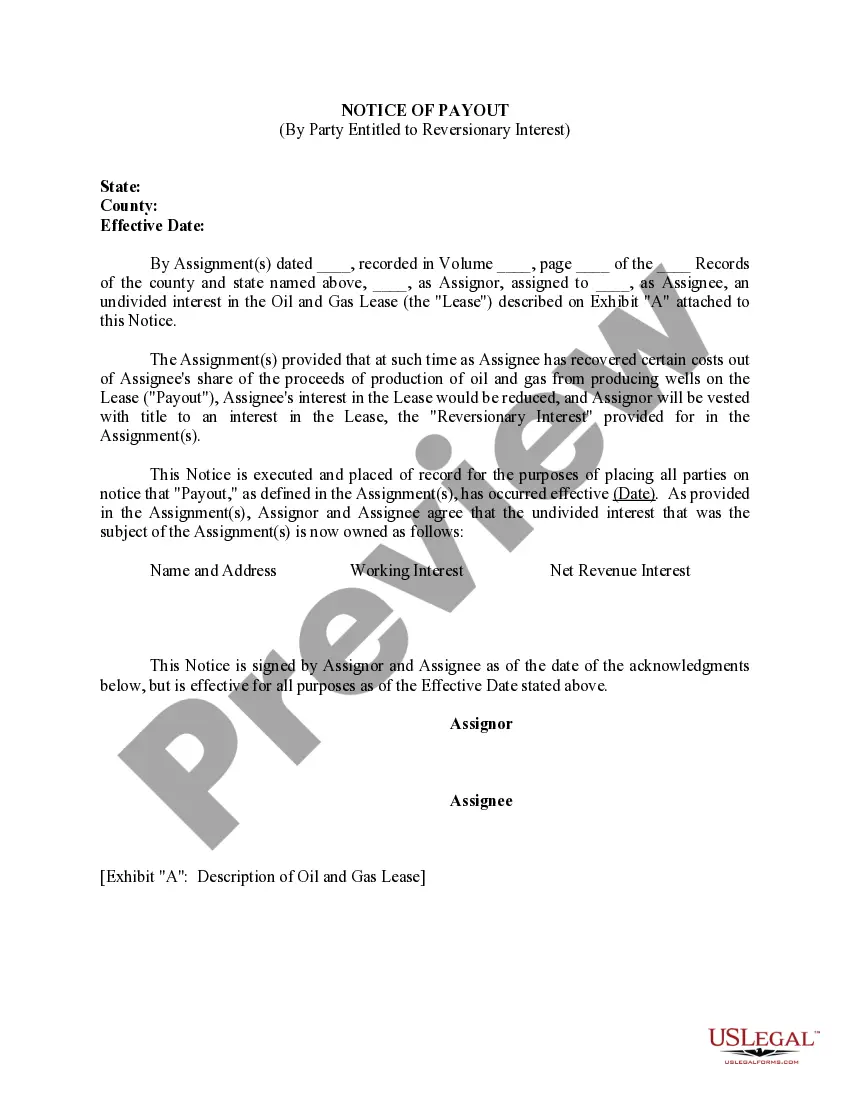

New Jersey Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest

Description

How to fill out Notice Of Payout, Election To Convert Interest To Party With Right To Convert An Overriding Royalty Interest To A Working Interest?

US Legal Forms - one of several biggest libraries of legal forms in the USA - delivers an array of legal document layouts you can acquire or printing. Utilizing the web site, you may get thousands of forms for business and individual reasons, sorted by classes, states, or search phrases.You will discover the newest models of forms just like the New Jersey Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest in seconds.

If you already possess a subscription, log in and acquire New Jersey Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest from the US Legal Forms library. The Download button can look on each kind you see. You get access to all previously acquired forms inside the My Forms tab of your respective account.

If you would like use US Legal Forms for the first time, listed here are straightforward directions to help you started out:

- Ensure you have picked the proper kind to your town/region. Go through the Review button to analyze the form`s information. Look at the kind explanation to actually have selected the right kind.

- In case the kind does not match your specifications, utilize the Research industry at the top of the monitor to discover the the one that does.

- In case you are content with the shape, affirm your decision by visiting the Purchase now button. Then, pick the pricing program you want and offer your references to register on an account.

- Approach the purchase. Utilize your bank card or PayPal account to finish the purchase.

- Select the structure and acquire the shape on your gadget.

- Make alterations. Load, change and printing and indicator the acquired New Jersey Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest.

Each and every web template you put into your account lacks an expiration time and is also your own property for a long time. So, in order to acquire or printing yet another duplicate, just check out the My Forms section and click in the kind you want.

Gain access to the New Jersey Notice of Payout, Election to Convert Interest to Party With Right to Convert An Overriding Royalty Interest to A Working Interest with US Legal Forms, the most considerable library of legal document layouts. Use thousands of expert and express-particular layouts that meet your small business or individual requires and specifications.

Form popularity

FAQ

An overriding royalty agreement is a contract that gives an entity the right to receive revenue from certain productions or sales. The specific type of occurence that royalties are required to be paid on is included in the overriding royalty agreement.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

Overriding Royalty Interest Conveyance means an assignment, in the form attached hereto as Exhibit F, pursuant to which Subsidiary Borrower grants to Lender a cost-free overriding royalty interest equal to a percentage determined pursuant to Section 8.5 of the Hydrocarbons and other minerals attributable to Subsidiary ...

1. n. [Oil and Gas Business] Ownership in a share of production, paid to an owner who does not share in the right to explore or develop a lease, or receive bonus or rental payments. It is free of the cost of production, and is deducted from the royalty interest.

Overriding royalty interest: Unlike mineral and royalty interests, an overriding royalty interest runs with a lease and not with the land. Therefore, they only remain in effect for as long as a lease is in effect and they expire when a lease expires.

Several factors determine the value of an overriding royalty interest in a working lease. They include: Location ? A mineral interest in high producing shale basins will be more valuable. Producing Wells ? Producing wells are valued higher than non-producing wells.