New Jersey Partial Release of Judgment Lien

Description

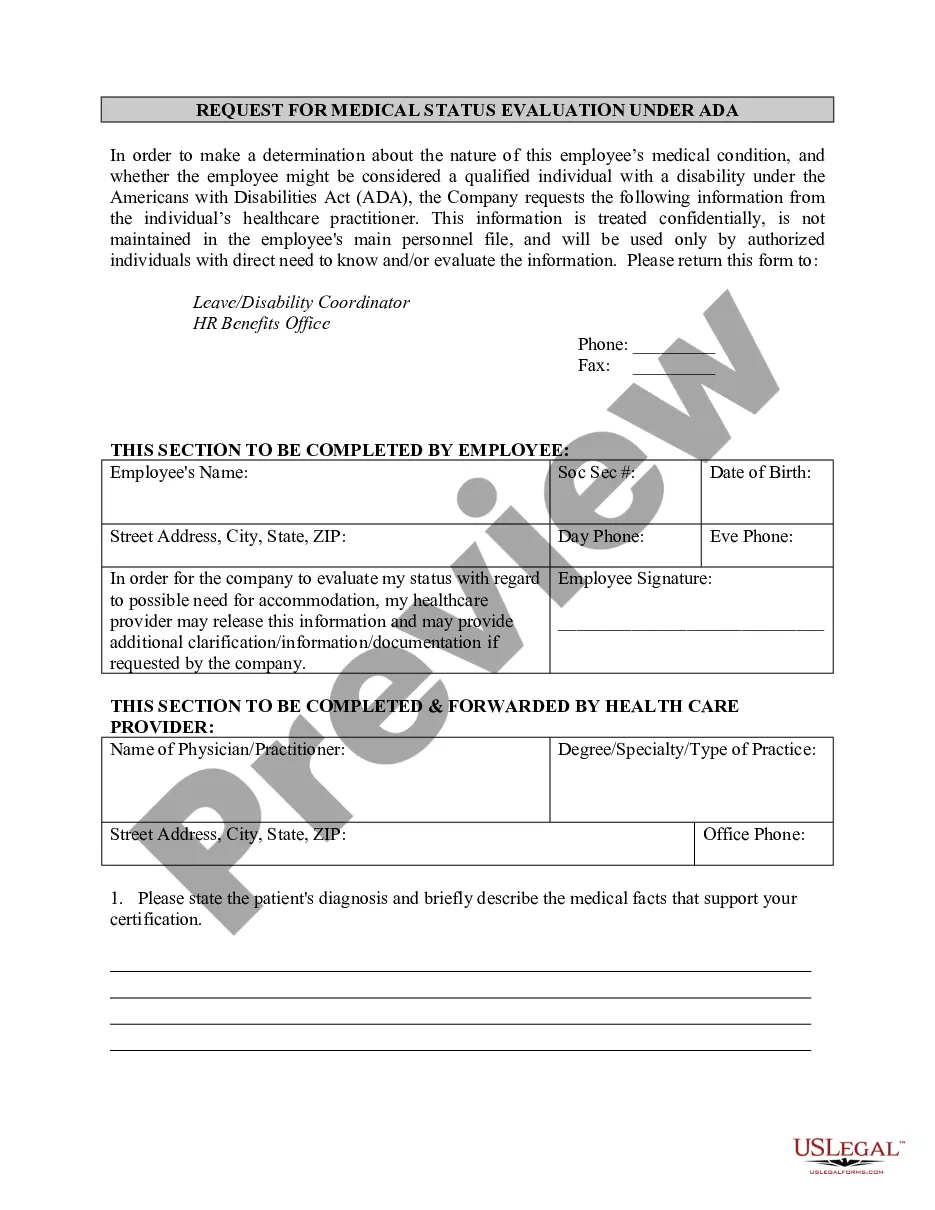

How to fill out Partial Release Of Judgment Lien?

Choosing the best lawful papers design could be a battle. Needless to say, there are a variety of themes accessible on the Internet, but how would you get the lawful form you require? Make use of the US Legal Forms web site. The assistance offers a huge number of themes, such as the New Jersey Partial Release of Judgment Lien, that can be used for organization and private requires. Every one of the forms are inspected by experts and meet federal and state requirements.

When you are already authorized, log in to your profile and click the Obtain button to obtain the New Jersey Partial Release of Judgment Lien. Utilize your profile to appear through the lawful forms you may have purchased previously. Check out the My Forms tab of your profile and get one more backup in the papers you require.

When you are a brand new user of US Legal Forms, allow me to share easy directions that you should stick to:

- Initially, make certain you have chosen the appropriate form to your metropolis/county. You may look through the form using the Review button and look at the form outline to make sure this is the right one for you.

- If the form does not meet your requirements, utilize the Seach industry to find the right form.

- When you are positive that the form would work, select the Purchase now button to obtain the form.

- Pick the rates strategy you would like and enter in the required information. Make your profile and pay money for an order using your PayPal profile or Visa or Mastercard.

- Pick the file format and obtain the lawful papers design to your gadget.

- Full, revise and print and indication the received New Jersey Partial Release of Judgment Lien.

US Legal Forms may be the most significant local library of lawful forms in which you will find numerous papers themes. Make use of the service to obtain expertly-created paperwork that stick to express requirements.

Form popularity

FAQ

For most types of debts in New Jersey, the statute of limitations is six years. However, the statute of limitations is 20 years on judgments, and there are other specific types of debts that may have a different statute of limitations.

One way to deal with a judgment is by getting the creditor to issue a warrant of satisfaction stating that the judgment is no longer owed. This will only be issued if the judgment is paid in full or the parties come to another arrangement through settlement.

And some states also allow judgment liens on the debtor's personal property -- things like jewelry, art, antiques, and other valuables. In New Jersey, a judgment lien can be attached to real estate only (not personal property).

Jointly owned accounts Thus, a bank levy may only freeze half the funds if the co-owner is not the debtor. New Jersey further protects the non-debtor co-owner from having his or her contributions levied if that person could prove his or her net contributions to the account (e.g. pay stubs). N.J. Ann. Stat.

The creditor can often place a lien on your property, such as a house or car. The lien must usually be paid off before you can sell the property. Seize assets. Sometimes, a creditor can get a court order to seize other assets or personal property you own, such as a vehicle or real estate, to satisfy the debt.

Under New Jersey law, each debtor is entitled to an exemption protecting $1,000 of personal property from collection to satisfy a judgment. In addition, welfare, social security and unemployment benefits are protected from judgment levy.

A judgment from another state can be enforced by docketing it with the Clerk of the Superior Court in Trenton. It will then be a lien on any real estate owned by the debtor in New Jersey and other collection efforts must be made through the Sheriff's Office in the county where the debtor has assets.

In New Jersey all plans, including IRAs, are generally exempt from creditor claims, until the money is distributed. Under federal law, many retirement accounts are generally protected except for Traditional IRAs and Roth IRAs.