New Jersey Self-Employed Tour Guide Services Contract

Description

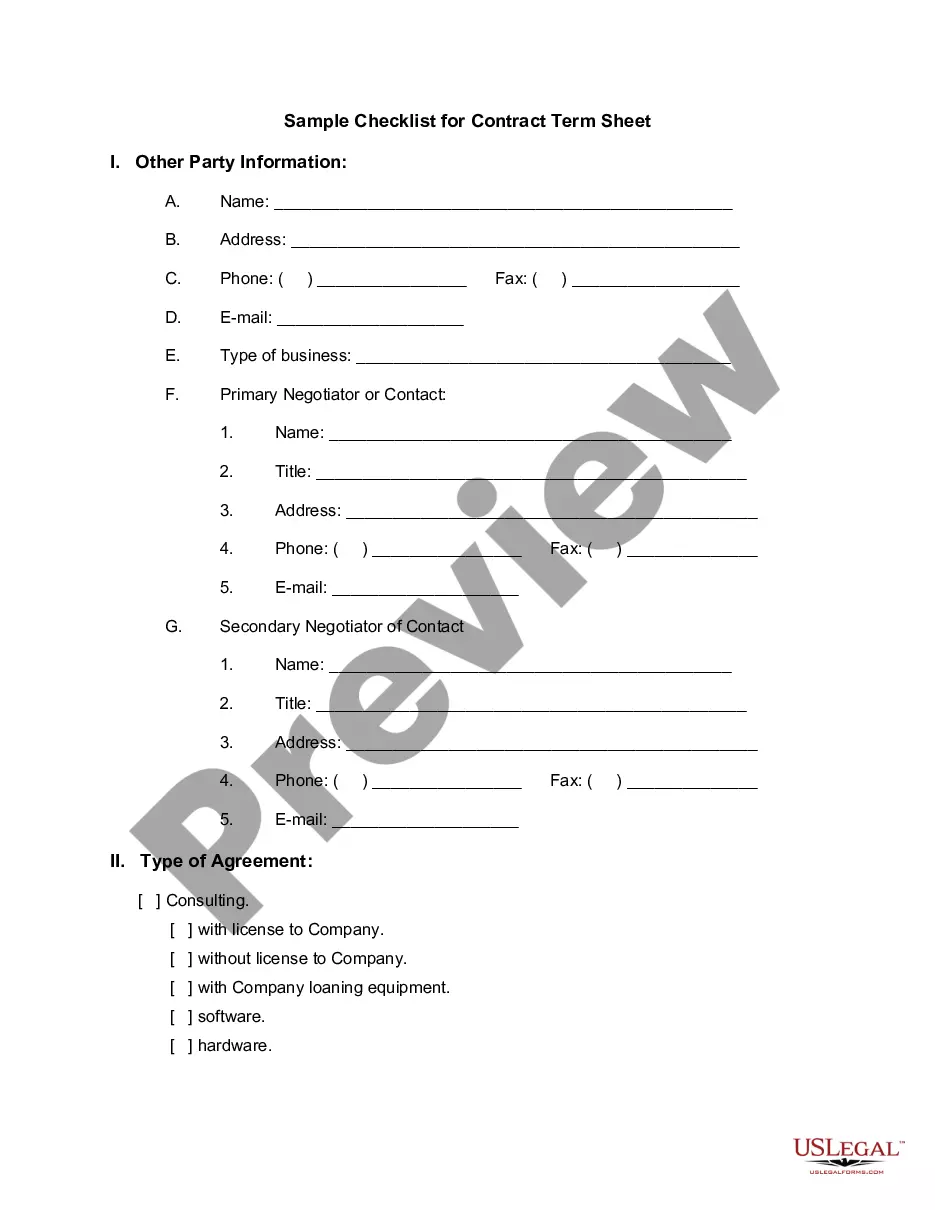

How to fill out Self-Employed Tour Guide Services Contract?

You can spend time online trying to find the official document template that fulfills the federal and state requirements you will need.

US Legal Forms provides countless legal forms that are reviewed by professionals.

It is easy to download or print the New Jersey Self-Employed Tour Guide Services Contract from their service.

If available, use the Review button to look through the document template as well. If you want to get another version of the form, use the Search field to find the template that meets your needs and requirements. Once you have found the template you need, click Buy now to continue. Choose the payment plan you desire, enter your credentials, and register for a free account on US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to purchase the legal document. Choose the format of the document and download it to your device. Make changes to the document if necessary. You can complete, edit, sign, and print the New Jersey Self-Employed Tour Guide Services Contract. Download and print countless document templates using the US Legal Forms website, which offers the largest assortment of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already have a US Legal Forms account, you can Log In and then click the Download button.

- After that, you can complete, edit, print, or sign the New Jersey Self-Employed Tour Guide Services Contract.

- Each legal document template you purchase is yours permanently.

- To obtain another copy of the acquired form, visit the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the area/city of your choice.

- Review the form description to confirm you have chosen the correct form.

Form popularity

FAQ

To get on a New Jersey state contract, you must first register your business with the New Jersey Division of Revenue. Next, you should complete the necessary forms and provide all required documentation, including your New Jersey Self-Employed Tour Guide Services Contract if applicable. Additionally, ensure that you meet all compliance requirements and submit your application through the appropriate state portal. Once your application is approved, you can start benefiting from state contracts.

While New Jersey does not legally require an operating agreement for an LLC, having one is strongly recommended for clarity and to outline the management structure. This is especially important for individuals running a business, such as a self-employed tour guide, under a New Jersey Self-Employed Tour Guide Services Contract. An operating agreement can help prevent misunderstandings and provide a clear framework for your business operations.

To qualify for sales tax exemption in New Jersey, you typically need to be a non-profit organization, a governmental entity, or meet specific criteria outlined by the state. For self-employed individuals, including tour guides, having a New Jersey Self-Employed Tour Guide Services Contract that involves specific exempt services may also qualify you. Always verify your eligibility and the necessary documentation with a tax professional or the New Jersey Division of Taxation.

The ST-4 form in New Jersey is used to claim an exemption from sales tax for certain purchases, such as those made by non-profit organizations or for specific types of services. If you operate under a New Jersey Self-Employed Tour Guide Services Contract and believe you qualify for exemption, you may need to submit an ST-4 form to vendors. It’s advisable to keep this form readily available for any tax-exempt purchases related to your business.

Recently, New Jersey has announced a program providing $500 checks to eligible residents as part of a broader financial relief initiative. However, this is not applicable to everyone, and eligibility criteria may vary. To stay informed about such programs and how they might affect your New Jersey Self-Employed Tour Guide Services Contract, consider checking official state resources or contacting your local government office.

Generally, consulting services are not taxable in New Jersey unless they involve the sale of tangible personal property or specific taxable services. As a self-employed tour guide, your contract may define the nature of your services and whether they include taxable elements. Always check with a tax advisor or refer to the New Jersey Division of Taxation for the most accurate information regarding your New Jersey Self-Employed Tour Guide Services Contract.

In New Jersey, certain services are exempt from sales tax, including professional services such as legal, healthcare, and educational services. However, as a provider of New Jersey Self-Employed Tour Guide Services, it’s important to understand that your services may be subject to sales tax unless specifically exempted. You should review the latest tax guidelines or consult with a tax professional to ensure compliance.

Yes, you can write your own legally binding contract as long as it meets the necessary legal requirements. Ensure that it includes clear terms, conditions, and signatures from both parties. Utilizing a New Jersey Self-Employed Tour Guide Services Contract template can simplify this process and help you create a strong agreement.

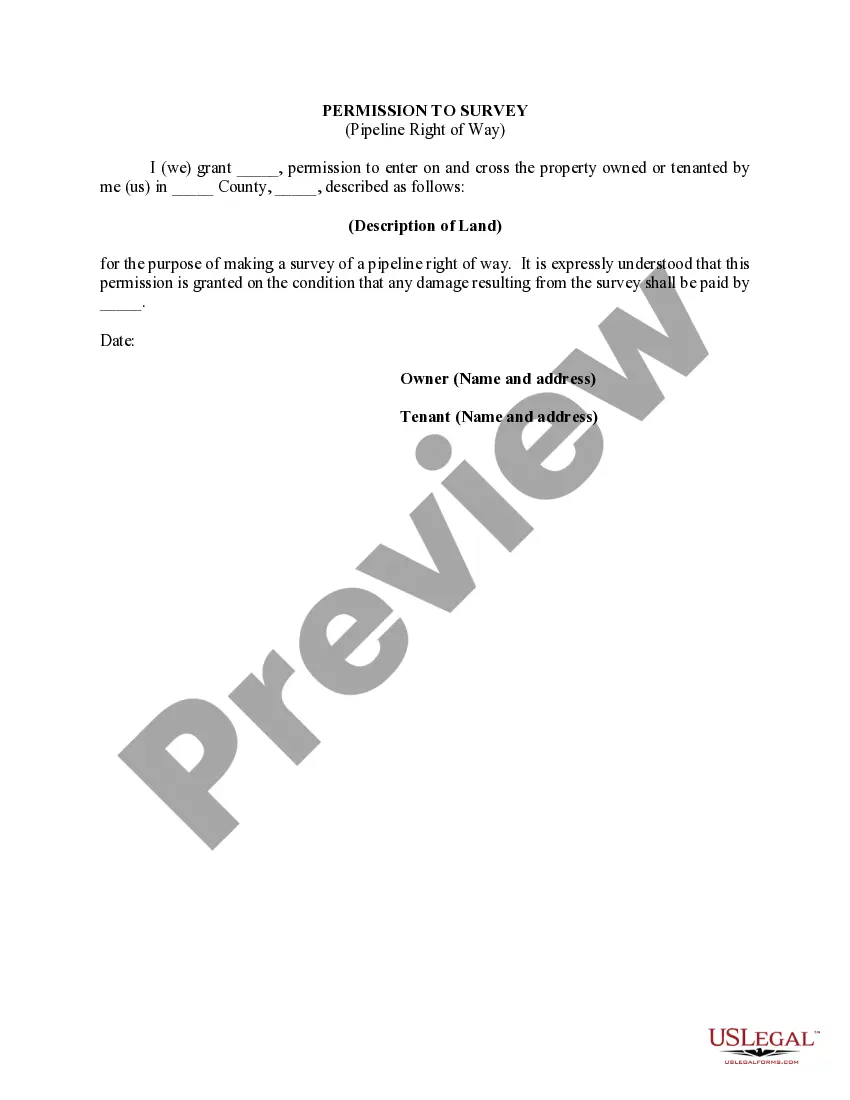

In New Jersey, specific locations may require a permit to operate as a tour guide. It’s important to check local regulations to ensure compliance. Having a New Jersey Self-Employed Tour Guide Services Contract can demonstrate professionalism and commitment to your services while navigating these requirements.

When writing a contract for a 1099 employee, clearly define the services provided, payment structure, and any deadlines. Specify that the individual is responsible for their own taxes. A New Jersey Self-Employed Tour Guide Services Contract is an effective way to formalize this arrangement for your tour guide business.