New Jersey Telephone Systems Service Contract - Self-Employed

Description

How to fill out Telephone Systems Service Contract - Self-Employed?

Have you ever found yourself in a scenario where you require documents for either business or personal reasons almost daily.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers a vast array of document templates, including the New Jersey Telephone Systems Service Contract - Self-Employed, designed to comply with federal and state regulations.

Use US Legal Forms, one of the most extensive collections of legal documents, to save time and avoid mistakes.

The service offers well-crafted legal document templates that can be used for various purposes. Create your account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the New Jersey Telephone Systems Service Contract - Self-Employed template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the document you need and ensure it is for the correct city/region.

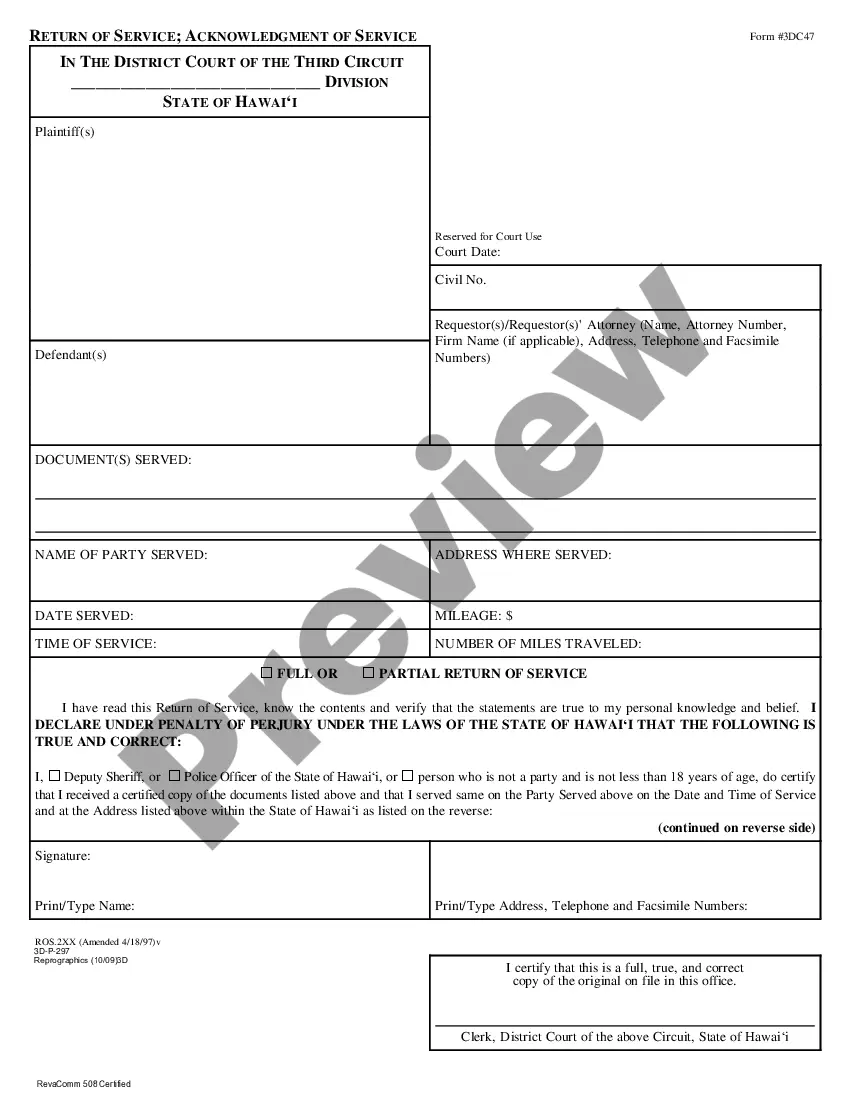

- Utilize the Review button to examine the document.

- Read the description to ensure you have selected the correct template.

- If the document is not what you need, use the Search field to find the template that suits your needs and specifications.

- When you find the right document, click Purchase now.

- Choose the payment plan you prefer, fill in the required information to create your account, and complete the purchase using your PayPal or credit card.

- Select a convenient file format and download your copy.

- Find all the document templates you have purchased in the My documents section. You can obtain another copy of the New Jersey Telephone Systems Service Contract - Self-Employed at any time, if necessary. Just click on the desired document to download or print the template.

Form popularity

FAQ

To qualify as an independent contractor, you must meet specific criteria established by the IRS and state laws. Key factors include the level of control you have over your work, whether you provide your own tools and equipment, and if you have the ability to make a profit or incur a loss. Additionally, maintaining your own business structure often solidifies your status. Platforms like USLegalForms can assist you in drafting a comprehensive New Jersey Telephone Systems Service Contract - Self-Employed that reflects your independent status.

In New Jersey, an independent contractor is a person or entity that provides services to another person or business under a contract. They operate autonomously and are not subject to the same control as employees. This means independent contractors in New Jersey handle their taxes, benefits, and other business responsibilities independently. If you're considering a New Jersey Telephone Systems Service Contract - Self-Employed, understanding this definition helps you navigate your rights and obligations effectively.

To determine if you are an independent contractor, consider your relationship with the client. Independent contractors usually have control over how they complete their work, unlike employees who follow a company's directives. Additionally, if you provide services to multiple clients and maintain your own business license, you likely qualify as an independent contractor. For clarity on your status, consult legal resources or platforms like USLegalForms that can guide you through the nuances of the New Jersey Telephone Systems Service Contract - Self-Employed.

Using the term self-employed or independent contractor often depends on context. In New Jersey, a self-employed individual typically operates their own business, while an independent contractor may work on a contract basis for other companies. Both terms convey independence and flexibility but can imply different legal and tax obligations. When discussing your New Jersey Telephone Systems Service Contract - Self-Employed, clarity in terminology can enhance your contracts and agreements.

To secure government contracts in New Jersey, start by registering your business with the state and obtaining a DUNS number. You should then explore the New Jersey Division of Revenue and Enterprise Services to find contract opportunities. Networking with local agencies and attending procurement events can also help you connect with decision-makers. For self-employed professionals looking for government contracts, leveraging a New Jersey Telephone Systems Service Contract can enhance your visibility and credibility.

Yes, you can act as your own general contractor in New Jersey, provided you follow the state regulations and licensing requirements. However, you must ensure that you comply with local building codes and obtain necessary permits for your projects. Being your own contractor can save costs but requires thorough planning and management. For self-employed individuals working under a New Jersey Telephone Systems Service Contract, understanding these requirements is crucial for project success.

In New Jersey, a single member LLC is not legally required to have an operating agreement, but it is highly recommended. An operating agreement outlines the structure of your business and the management duties of the owner. This document can protect your personal assets and help prevent disputes down the line. For self-employed individuals considering a New Jersey Telephone Systems Service Contract, having an operating agreement can clarify business operations.

New Jersey does not legally require an LLC to have an operating agreement, but having one is highly recommended. An operating agreement provides essential guidelines for managing your business and helps prevent misunderstandings among members. For those engaged in a New Jersey Telephone Systems Service Contract - Self-Employed, this document can be crucial for defining roles and responsibilities. To create an effective agreement, explore the resources offered by uslegalforms.

Yes, an LLC can exist without an operating agreement in New Jersey, but it is not advisable. An operating agreement outlines the management structure and operational procedures of your business, which is particularly important for a New Jersey Telephone Systems Service Contract - Self-Employed. Without it, you may face challenges in resolving disputes or making decisions. To ensure clarity and protection, consider drafting an operating agreement using templates from uslegalforms.

Yes, contributions made to a Simplified Employee Pension (SEP) plan are generally deductible in New Jersey. This means you can lower your taxable income by contributing to your SEP as a self-employed individual. Utilizing a New Jersey Telephone Systems Service Contract - Self-Employed may also provide you with financial benefits that can complement your retirement savings. For detailed tax advice, consult with a tax professional or use resources available at uslegalforms.