New Jersey Collections Agreement - Self-Employed Independent Contractor

Description

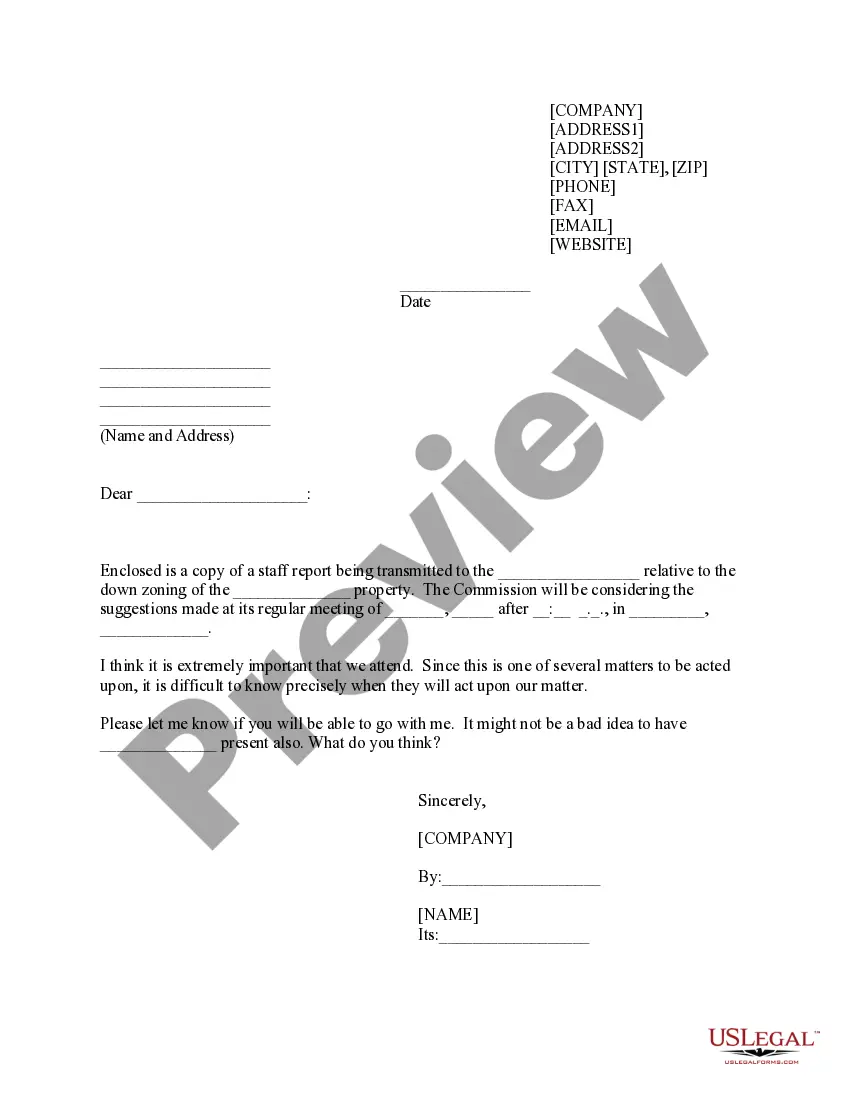

How to fill out Collections Agreement - Self-Employed Independent Contractor?

You may devote time on the web trying to find the authorized papers web template that meets the state and federal specifications you need. US Legal Forms gives a large number of authorized varieties which are evaluated by specialists. You can easily down load or print the New Jersey Collections Agreement - Self-Employed Independent Contractor from your assistance.

If you have a US Legal Forms bank account, you are able to log in and click the Acquire switch. Following that, you are able to total, edit, print, or indicator the New Jersey Collections Agreement - Self-Employed Independent Contractor. Every single authorized papers web template you get is your own for a long time. To have one more version for any acquired develop, visit the My Forms tab and click the corresponding switch.

If you are using the US Legal Forms internet site for the first time, keep to the easy recommendations beneath:

- Very first, make sure that you have chosen the right papers web template for your region/metropolis of your choosing. Look at the develop information to ensure you have picked the appropriate develop. If available, take advantage of the Preview switch to check with the papers web template also.

- If you wish to find one more variation from the develop, take advantage of the Research discipline to discover the web template that meets your requirements and specifications.

- Once you have located the web template you would like, click on Buy now to carry on.

- Choose the pricing program you would like, type in your references, and register for an account on US Legal Forms.

- Full the transaction. You can utilize your credit card or PayPal bank account to cover the authorized develop.

- Choose the format from the papers and down load it to your gadget.

- Make adjustments to your papers if possible. You may total, edit and indicator and print New Jersey Collections Agreement - Self-Employed Independent Contractor.

Acquire and print a large number of papers web templates utilizing the US Legal Forms web site, that provides the biggest collection of authorized varieties. Use skilled and express-specific web templates to deal with your company or individual needs.

Form popularity

FAQ

If you are classified as an "independent contractor," you may be paid with a 1099 with no deductions made for taxes, unemployment, or other contributions that an employee pays.

Who pays independent contractor taxes? Independent contractors generally pay self-employment tax. So, although employers may not be responsible for withholding and depositing taxes for these individuals, they must be careful not to misclassify employees as independent contractors.

Under the law, the general rule is that the copyright in and to the work product of an individual employee or independent contractor is owned by that individual unless an exception applies. The Work for Hire doctrine is an exception to such rule.

Federal and State Anti-Discrimination Laws. Laws such as the Americans with Disabilities Act, the Family Medical Leave Act, the Civil Rights Act of 1964 or ADEA are only applicable to employees, not contract workers or independent contractors.

The general rule regarding independent contractors states that a person who hires an independent contractor cannot be held vicariously liable for the wrongdoing of the independent contractor.

General liability insurance is essential for independent contractors because: It protects you and your business. Independent contractors have the same legal obligations and liability exposures as larger firms. They can be sued for damaging client property, causing bodily harm, or advertising injury.

Protect Yourself When Hiring a ContractorGet Proof of Bonding, Licenses, and Insurance.Don't Base Your Decision Solely on Price.Ask for References.Avoid Paying Too Much Upfront.Secure a Written Contract.Be Wary of Pressure and Scare Tactics.Consider Hiring Specialized Pros for Additional Guidance.Go With Your Gut.

Doing Work as an Independent Contractor: How to Protect Yourself and Price Your ServicesProtect your social security number.Have a clearly defined scope of work and contract in place with clients.Get general/professional liability insurance.Consider incorporating or creating a limited liability company (LLC).More items...?

The independent contractor's responsibilities include completing assigned tasks with minimal supervision. You should also complete and file your tax returns in a timely manner. To ensure success as an independent contractor, you should possess excellent communication, analytical, and problem-solving skills.