New Jersey Employment of Independent Contractors Package

Description

How to fill out Employment Of Independent Contractors Package?

US Legal Forms - among the biggest libraries of lawful forms in the United States - provides a variety of lawful papers themes you are able to acquire or printing. While using web site, you can get a huge number of forms for business and person reasons, categorized by classes, says, or key phrases.You will discover the newest versions of forms like the New Jersey Employment of Independent Contractors Package within minutes.

If you currently have a registration, log in and acquire New Jersey Employment of Independent Contractors Package from your US Legal Forms collection. The Acquire button will show up on each kind you view. You gain access to all earlier delivered electronically forms within the My Forms tab of your profile.

In order to use US Legal Forms the very first time, here are basic recommendations to obtain started:

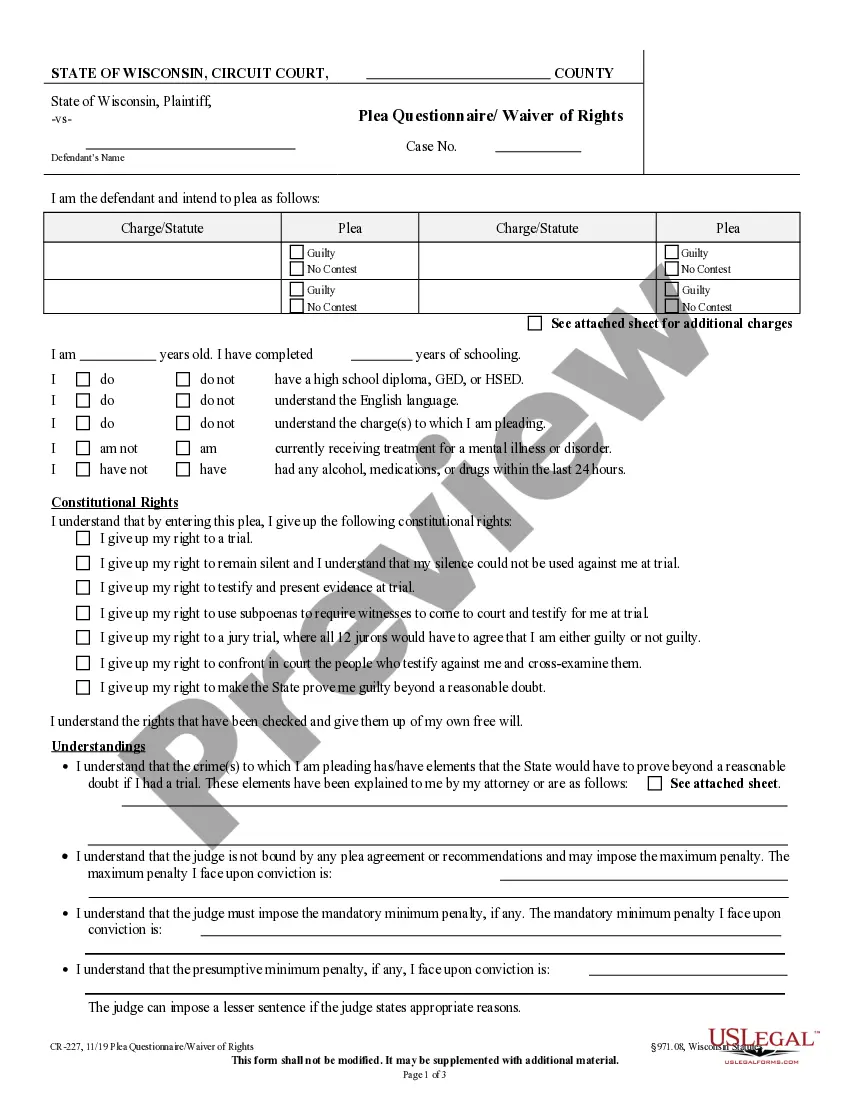

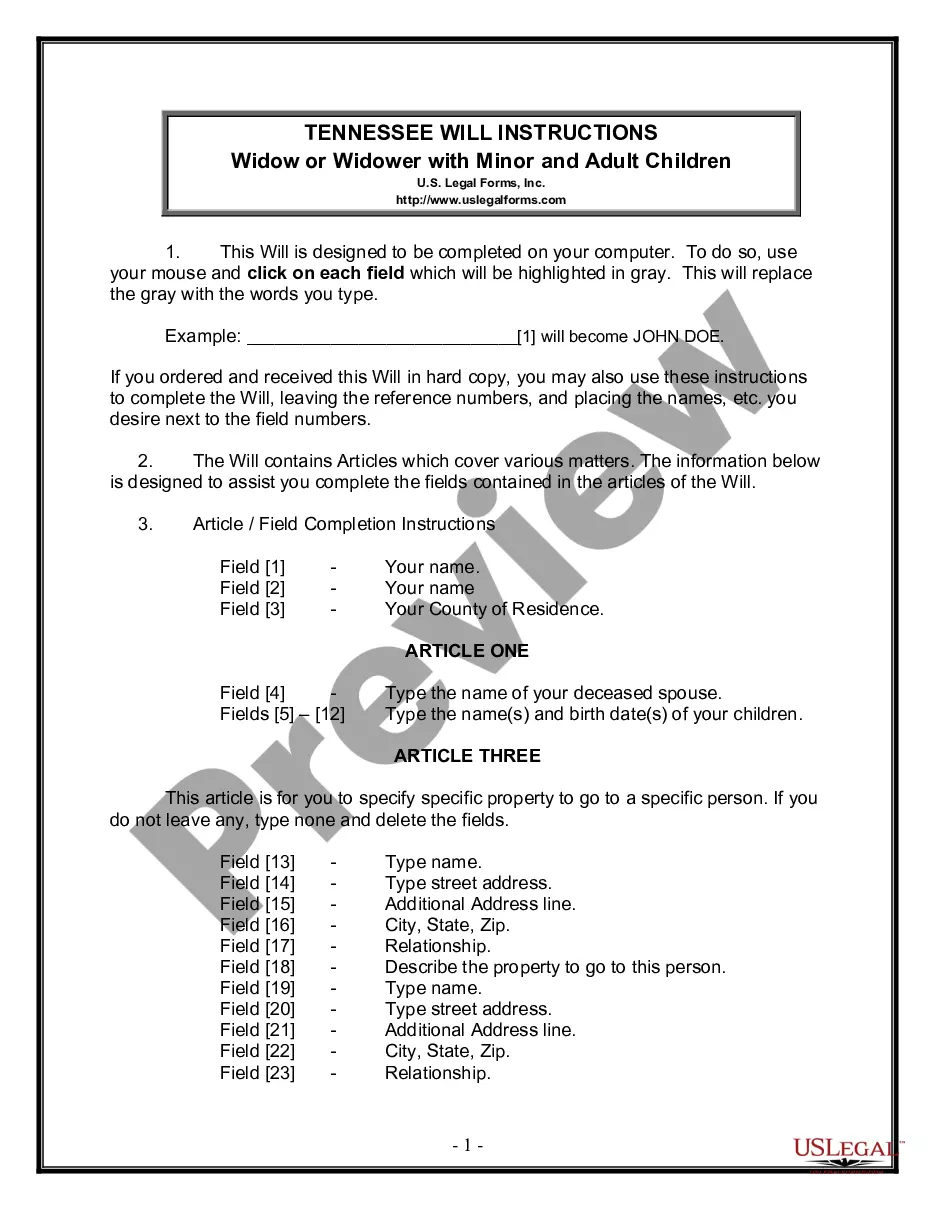

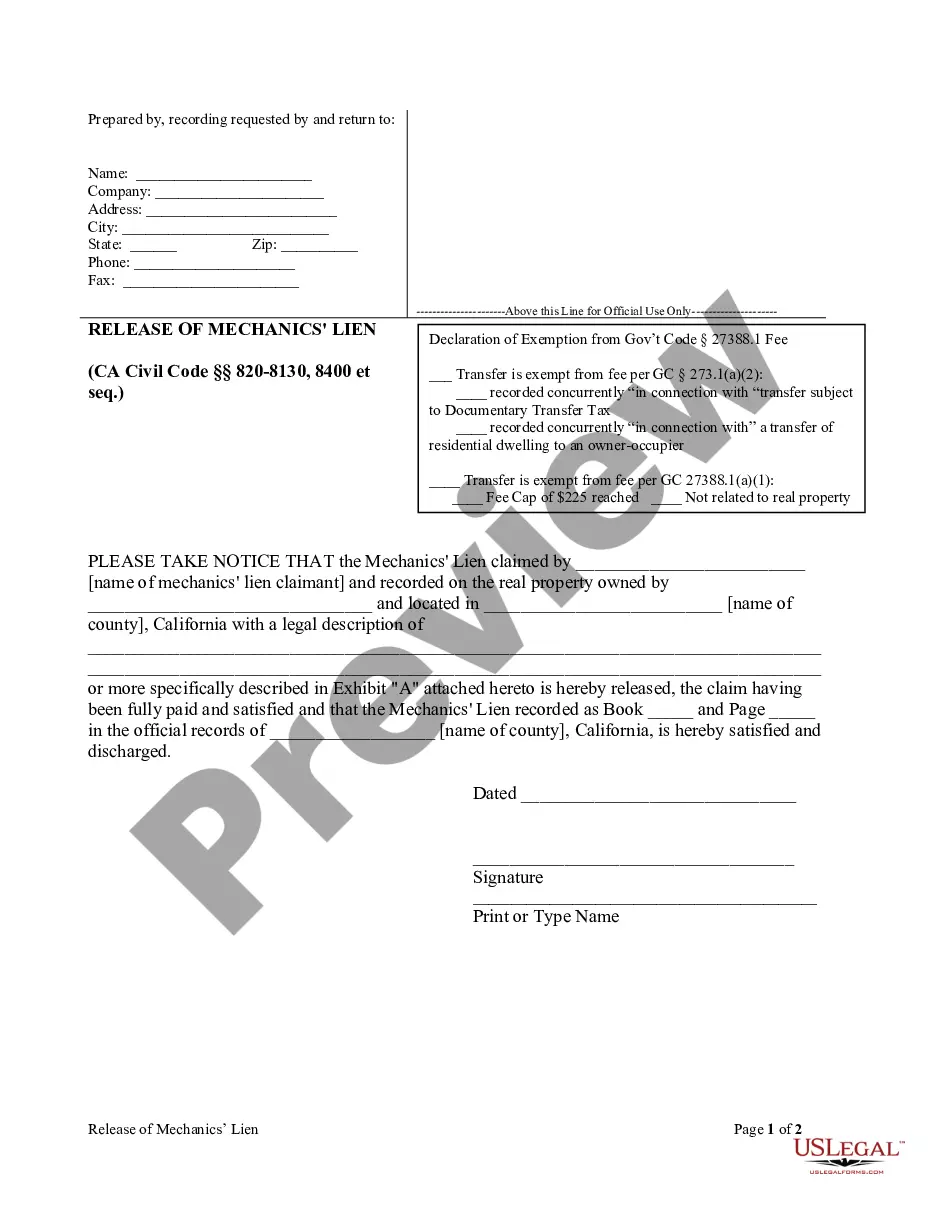

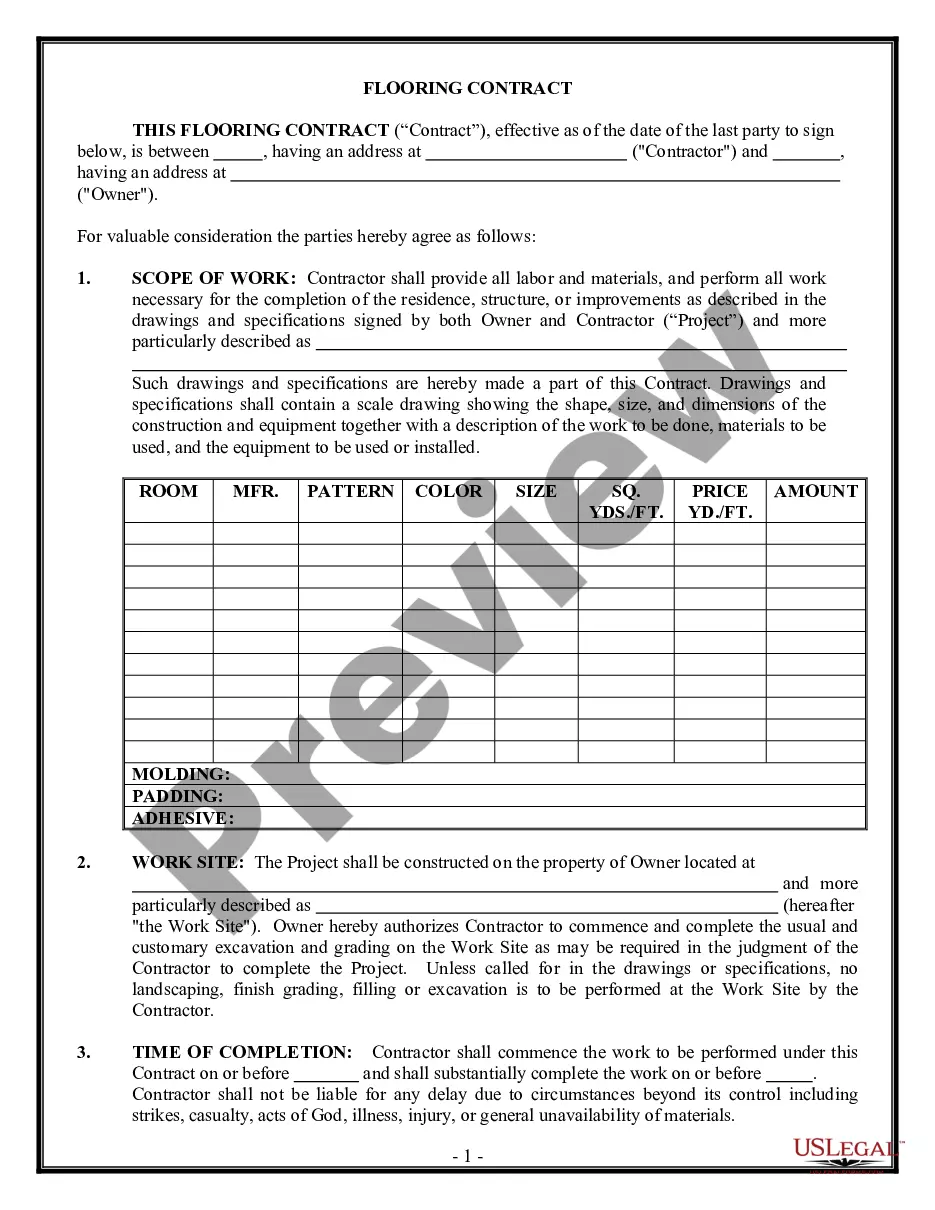

- Ensure you have chosen the proper kind for your personal town/region. Select the Preview button to review the form`s content. Look at the kind outline to actually have selected the appropriate kind.

- When the kind does not satisfy your needs, utilize the Research discipline towards the top of the display to get the the one that does.

- When you are pleased with the shape, validate your option by clicking the Purchase now button. Then, choose the prices prepare you like and supply your qualifications to sign up on an profile.

- Approach the purchase. Utilize your charge card or PayPal profile to perform the purchase.

- Pick the formatting and acquire the shape on the system.

- Make modifications. Fill up, change and printing and signal the delivered electronically New Jersey Employment of Independent Contractors Package.

Each and every template you added to your account does not have an expiry date and is also your own forever. So, if you wish to acquire or printing yet another duplicate, just check out the My Forms section and then click in the kind you require.

Get access to the New Jersey Employment of Independent Contractors Package with US Legal Forms, the most considerable collection of lawful papers themes. Use a huge number of skilled and express-particular themes that fulfill your business or person needs and needs.

Form popularity

FAQ

Any business doing business in the State that has employees is required to have Workers Comp Insurance, regardless if those employees are paid as a W-2 or a 1099. This is important because many employers think that they are not required to have workers compensation insurance for employees that they give a 1099.

Important note: Workers under your direct control may be considered your employees for workers' compensation purposes, regardless of their tax status. You may need insurance even for those receiving 1099s. Who does not need insurance? Sole proprietors with no employees.

Most employers must take part in two public insurance programs and deduct payroll taxes for employees working in New Jersey, or provide a private insurance plan. Temporary Disability Insurance and Family Leave Insurance provide cash benefits to employees to care for themselves or loved ones.

The number of hours that a 1099 employee can work is limitless. There are no hour laws for freelancers. If a contractor works over 40 hours weekly, that's the contractor's concern rather than that of the business owner.

Salaries and benefits As a rule of thumb, benefits are worth about 30% of a worker's total compensation package, ing to the US Bureau of Labor Statistics. This means, a 1099 contractor needs to make a minimum of 30% more than W-2 employees to match employee compensation, including benefits.

New Jersey Workers' Compensation Requirements Sole-Proprietors, Partners and LLC Members are automatically excluded on a policy, but they can elect to be covered. A Notice of Election ( ) must be filed with the state and insurance company.

Workers' compensation is a ?no fault? insurance program that provides medical treatment, wage replacement, and permanent disability compensation to employees who suffer job-related injuries or illnesses. It also provides death benefits to dependents of workers who have died as a result of their employment.

Can I apply for unemployment or disability benefits as an independent contractor? Maybe. Although independent contractors are not traditionally entitled to these benefits, if you believe you are misclassified, you can apply for unemployment or disability.