New Jersey Woodworking Services Contract - Self-Employed

Description

How to fill out Woodworking Services Contract - Self-Employed?

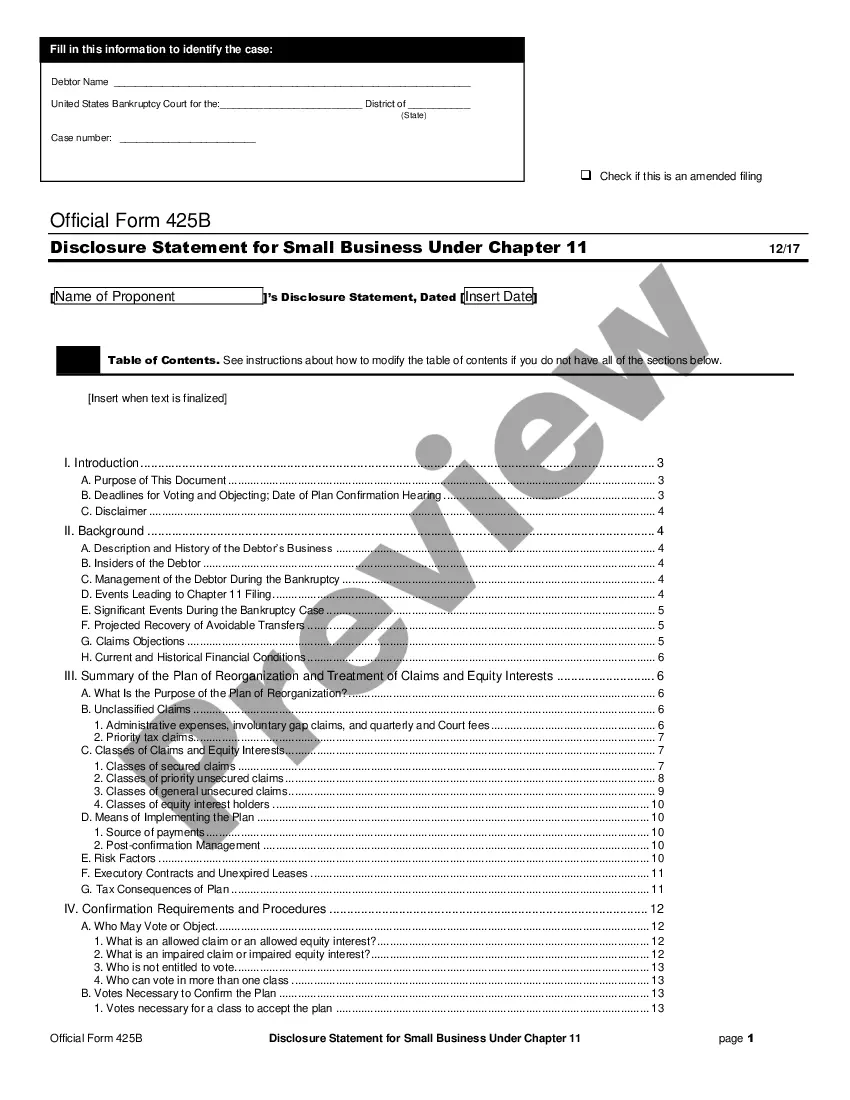

US Legal Forms - one of the largest collections of legal documents in the country - offers a broad selection of legal paperwork categories that you can download or print. By using the site, you can discover thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can obtain the latest editions of forms such as the New Jersey Woodworking Services Contract - Self-Employed in moments.

If you have a subscription, Log In and download the New Jersey Woodworking Services Contract - Self-Employed from the US Legal Forms repository. The Download button will appear on every form you examine. You have access to all previously downloaded forms within the My documents section of your account.

If you are using US Legal Forms for the first time, here are simple instructions to help you begin: Ensure you have selected the correct form for your specific city/region. Click on the Review button to evaluate the form's content. Read the form description to confirm you have chosen the appropriate form. If the form does not meet your needs, use the Search field at the top of the screen to find one that does. When you are satisfied with the form, confirm your choice by clicking the Purchase now button. Then, select the payment plan you prefer and provide your details to register for the account. Complete the transaction. Use your credit card or PayPal account to finish the transaction. Choose the format and download the form to your device. Make modifications. Complete, edit, and print and sign the downloaded New Jersey Woodworking Services Contract - Self-Employed. Every format you added to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another version, simply go to the My documents section and click on the form you desire.

US Legal Forms ensures that you have a seamless experience in obtaining legal documents tailored to your specific needs.

With a commitment to providing quality legal forms, US Legal Forms remains a trusted resource for individuals and businesses alike.

- Access the New Jersey Woodworking Services Contract - Self-Employed with US Legal Forms, one of the most extensive collections of legal document categories.

- Utilize a vast number of professional and state-specific templates that fulfill your business or personal requirements.

- Enjoy the convenience of downloading and printing legal forms easily.

- Find forms categorized by area, purpose, or keywords to streamline your search.

- Benefit from a user-friendly interface designed for quick navigation.

- Take advantage of the extensive library to meet various legal documentation needs.

Form popularity

FAQ

Getting a contractor's license in New Jersey generally takes about 4 to 6 weeks after submitting all required documents and completing any necessary examinations. However, processing times can vary due to the volume of applications or any issues that arise during the review. If you are preparing to work under a New Jersey Woodworking Services Contract - Self-Employed, it's advisable to start the licensing process as early as possible. This way, you can meet your clients' needs and avoid unnecessary delays.

In New Jersey, you can perform small-scale projects without a contractor's license, such as basic woodworking tasks for personal use or minor home repairs. However, for any larger constructions or professional services under a New Jersey Woodworking Services Contract - Self-Employed, a license is usually necessary. Always verify local ordinances to understand your limitations while working, ensuring that you stay within the law. Completing projects correctly can also lead to more business opportunities.

In New Jersey, not all contractors need a license, but it often depends on the project. For woodworking services, such as those detailed in a New Jersey Woodworking Services Contract - Self-Employed, certain tasks may require specific certifications or permits. It is wise to check local regulations before starting your work to ensure compliance and avoid penalties. Moreover, having the proper licensing increases your credibility and appeal to clients.

The new federal rule clarifies the classification of independent contractors, focusing on their work relationship with businesses. It emphasizes that independent contractors should have the ability to control their work processes and make independent decisions. If you’re engaged under a New Jersey Woodworking Services Contract - Self-Employed, understanding these rules can affect your financial and legal obligations. Staying informed about these changes helps you operate within the law and manage your business effectively.

Yes, New Jersey mandates that specific contractors obtain a license to perform certain types of work. Licensing ensures that contractors meet the state's standards for quality and safety. If your self-employed work includes woodworking services, a New Jersey Woodworking Services Contract - Self-Employed may need to comply with licensing regulations. Keeping your license up-to-date is crucial for maintaining your professional standing.

You do not need to form an LLC to work as a contractor in New Jersey, but establishing one can offer significant benefits. An LLC, or limited liability company, helps protect your personal assets and can provide a more professional image in the marketplace. When engaging in a New Jersey Woodworking Services Contract - Self-Employed, operating as an LLC can also simplify tax reporting and attract more clients. Consider consulting with a legal advisor to determine the best structure for your needs.

Some states, like California and New Jersey, have strict licensing requirements, while others do not require a license for general contractors. States such as Maine, South Dakota, and Wyoming allow contractors to operate without a state license, making it easier for self-employed individuals to start. If you're considering starting a New Jersey Woodworking Services Contract - Self-Employed, it's vital to explore the specific requirements in your state. This knowledge can save you time and help you navigate your business efficiently.

Yes, New Jersey requires contractors to be licensed for certain types of work, especially in construction and renovation. If you plan to engage in woodworking services under a New Jersey Woodworking Services Contract - Self-Employed, obtaining the appropriate license is essential. Not only does this ensure compliance with state regulations, but it also builds trust with your clients. Always check state guidelines to avoid any legal issues.

In New Jersey, even if your income is under $10,000, you may still need to file a tax return, particularly if you have self-employment income. Filing your taxes keeps you compliant with state law and may affect your eligibility for certain benefits. Using a New Jersey Woodworking Services Contract - Self-Employed can also provide documentation to support your income declaration. Always consult a tax professional to understand your specific situation.

In New Jersey, you do not need a state license specifically for general contracting. However, certain specialized trades, such as plumbing or electrical work, require a license. If you use a New Jersey Woodworking Services Contract - Self-Employed to operate your business, ensure you comply with any local requirements and permits. Proper adherence to licensing laws can help safeguard your work and reputation.