New Jersey Masonry Services Contract - Self-Employed

Description

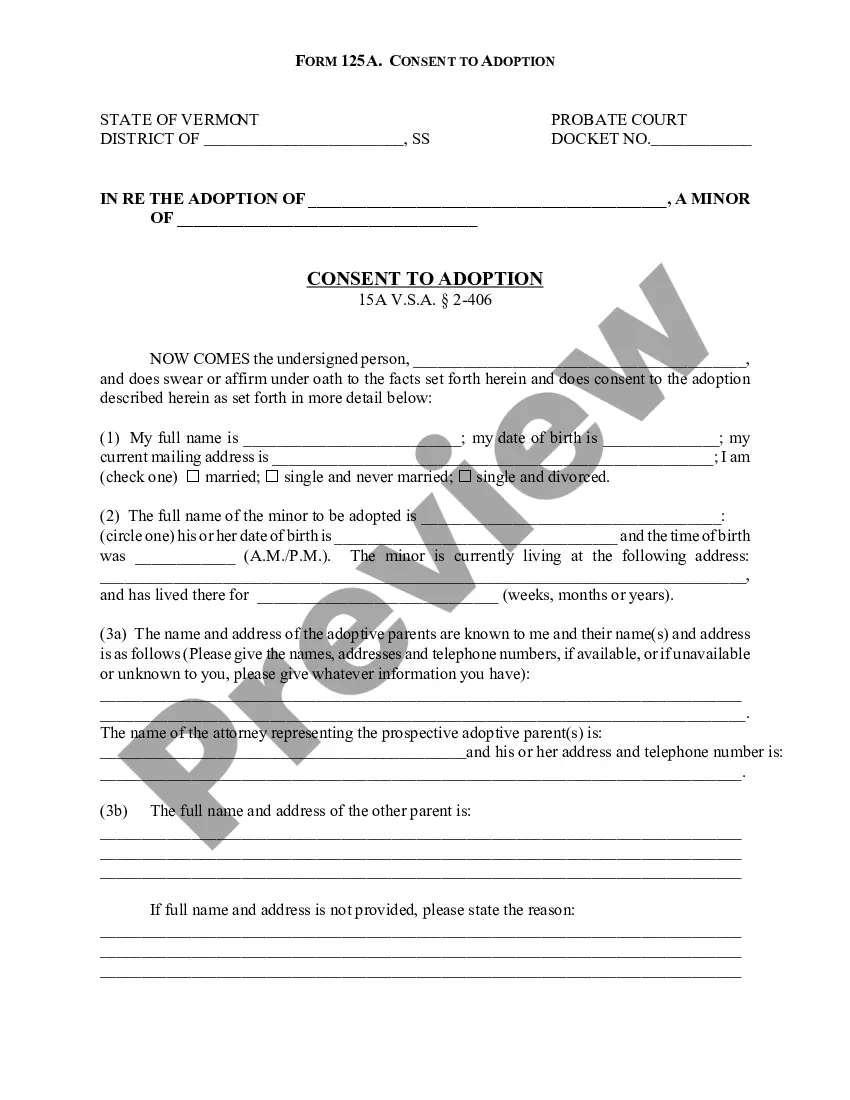

How to fill out Masonry Services Contract - Self-Employed?

You might spend hours online attempting to locate the sanctioned document template that complies with the federal and state standards you require.

US Legal Forms offers countless legal forms that have been examined by experts.

You can conveniently download or print the New Jersey Masonry Services Contract - Self-Employed from your service.

If available, utilize the Preview button to view the document template as well.

- If you already possess a US Legal Forms account, you can sign in and click on the Download button.

- Subsequently, you can complete, modify, print, or sign the New Jersey Masonry Services Contract - Self-Employed.

- Every legal document template you obtain is yours for an extended period.

- To receive an additional copy of a purchased form, visit the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the straightforward instructions below.

- First, ensure you have selected the correct document template for your region/town of choice.

- Check the form description to verify you have selected the appropriate document.

Form popularity

FAQ

Choosing to act as your own general contractor (GC) can indeed seem cheaper at first glance. However, with a New Jersey Masonry Services Contract - Self-Employed, you take on full responsibility for project management and budgeting. This means you must account for potential mistakes or delays, which can add unexpected costs. Therefore, while you may save on contractor fees, it's essential to weigh this option carefully.

Having a license to work as a contractor in New Jersey depends on the nature of your services. For many trades, a license is necessary to operate legally and protect consumers. If you aim to engage in work related to a New Jersey Masonry Services Contract - Self-Employed, make sure to confirm the licensing criteria applicable to your projects for a smooth operation.

Yes, New Jersey requires certain contractors to be licensed, depending on the type of work they perform. However, not all trades mandate licensing, so it is vital to determine your specific needs. If your New Jersey Masonry Services Contract - Self-Employed involves regulated work, ensure you meet all licensing requirements to maintain compliance.

Yes, independent contractors typically file taxes as self-employed individuals. This classification comes with specific tax obligations, including self-employment tax. If you are working on a New Jersey Masonry Services Contract - Self-Employed, understanding your tax responsibilities is crucial for financial success in your work.

The process to obtain a contractor's license in New Jersey can take anywhere from a few weeks to several months. This timeline often depends on your preparation and the specific type of license you need. For those pursuing opportunities under the New Jersey Masonry Services Contract - Self-Employed, being diligent about required documents and exams will help expedite the process.

In New Jersey, you can build certain small projects without a contractor's license, including fences, decks, and sheds, as long as they comply with local regulations. However, it is essential to check your municipality's rules because they can vary. If you are considering a New Jersey Masonry Services Contract - Self-Employed, make sure your proposed work falls within the permitted categories to avoid legal issues.

Yes, you can write your own legally binding contract by following certain legal guidelines. Use the New Jersey Masonry Services Contract - Self-Employed as a model to understand the necessary components that make a contract enforceable. Including specific details and having both parties sign ensures the contract holds up in legal situations.

When writing a self-employed contract, emphasize the services to be provided and payment details. The New Jersey Masonry Services Contract - Self-Employed provides a solid framework, covering aspects like work timelines and obligations. Ensure clarity in each section to minimize misunderstanding and facilitate a positive working relationship.

Filling out an independent contractor agreement involves entering key details such as the contractor’s name, scope of work, and payment terms. Utilize the New Jersey Masonry Services Contract - Self-Employed to ensure you cover all necessary sections, including clauses related to termination and liability. A well-completed agreement fosters a strong foundation for collaboration.

Writing a self-employment contract begins with outlining the scope of work and specifying the payment arrangement. Use the New Jersey Masonry Services Contract - Self-Employed as a guide to include important sections like duration of the contract and confidentiality. This clarity helps avoid disputes and ensures a smooth working relationship.