New Jersey Diver Services Contract - Self-Employed

Description

How to fill out Diver Services Contract - Self-Employed?

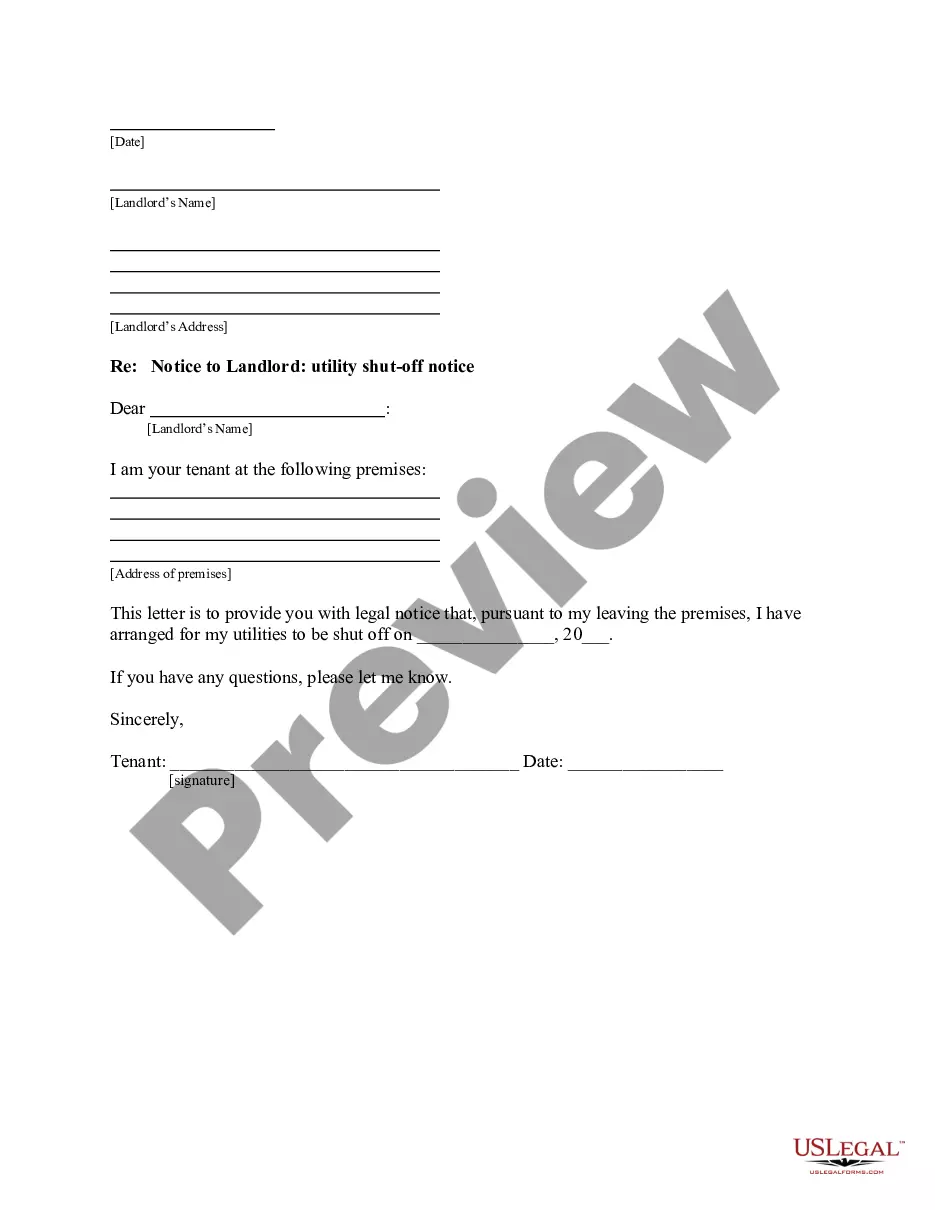

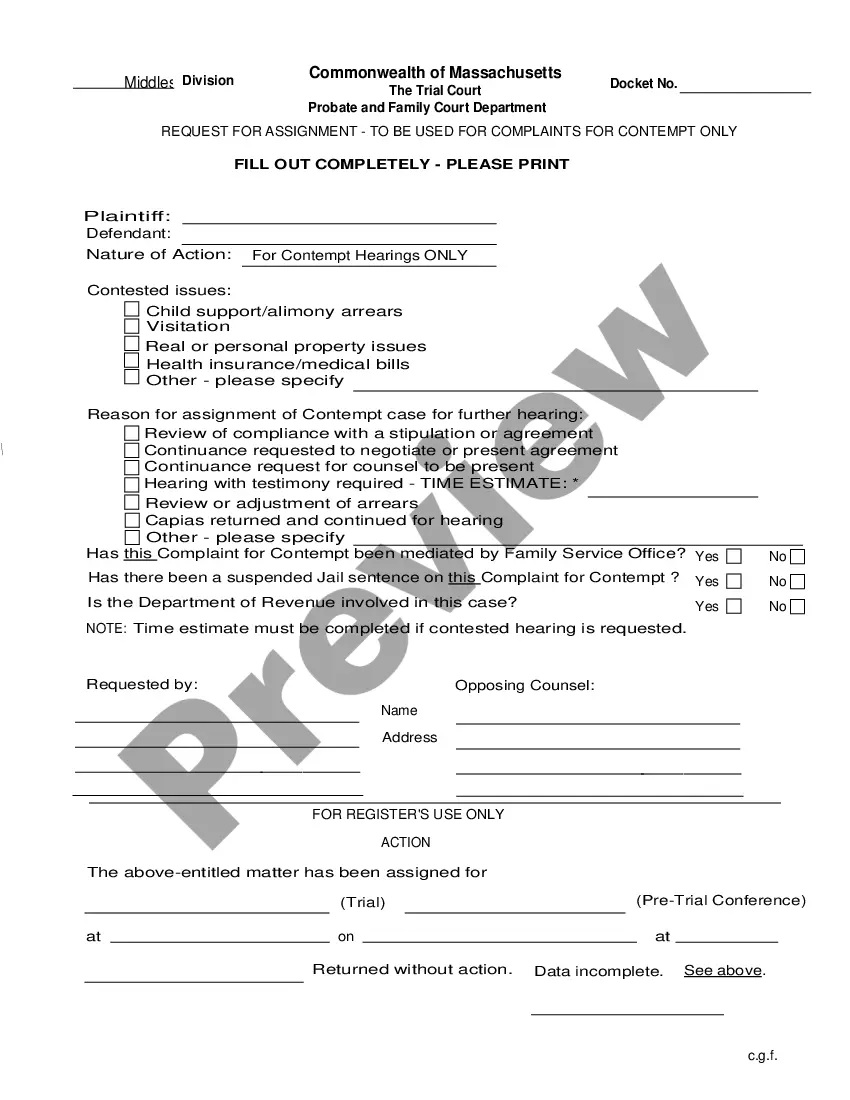

Selecting the optimal legal documents template can be quite a challenge. Naturally, there are numerous templates accessible online, but how can you find the legal form you require? Utilize the US Legal Forms website. The service provides a vast array of templates, including the New Jersey Diver Services Contract - Self-Employed, which can be employed for both business and personal purposes. All of the forms are reviewed by professionals and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to obtain the New Jersey Diver Services Contract - Self-Employed. Use your account to search through the legal forms you have previously acquired. Navigate to the My documents section of your account and retrieve another copy of the document you need.

If you are a first-time user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have selected the correct form for your city/county. You can examine the form using the Review button and read the form description to confirm it is the right one for you. If the form does not meet your needs, use the Search bar to find the appropriate form. Once you are confident that the form is suitable, click on the Get now button to obtain the form. Choose the pricing plan you desire and input the necessary information. Create your account and pay for your order using your PayPal account or credit card. Select the file format and download the legal documents template to your device. Complete, edit, print, and sign the received New Jersey Diver Services Contract - Self-Employed.

By using US Legal Forms, you can simplify the process of obtaining legal templates that are tailored to meet your requirements.

- US Legal Forms is the largest repository of legal documents where you can find various document templates.

- Utilize the service to acquire professionally crafted documents that comply with state regulations.

- Ensure all information is accurately entered during the registration process.

- Check the form details thoroughly before proceeding to payment.

- Take advantage of the comprehensive search function to find specific forms quickly.

- Review past orders for easy access to previously downloaded documents.

Form popularity

FAQ

Absolutely, a self-employed person can and should have a contract. Having a New Jersey Diver Services Contract - Self-Employed establishes a clear agreement between you and your clients, laying out the scope of work, payment terms, and other obligations. This contract not only protects your rights but also promotes professionalism in your business dealings.

In New Jersey, the threshold for receiving a 1099 form is generally $600 for the calendar year. If you earn more than this amount through your New Jersey Diver Services Contract - Self-Employed, clients should provide you with a 1099 form by January 31st of the following year. Understanding this requirement helps you keep track of your income and ensures you file your taxes accurately.

Filing taxes as an independent contractor involves reporting income and expenses on your tax forms. You’ll typically use a Schedule C (Form 1040) to report your earnings from your New Jersey Diver Services Contract - Self-Employed. It is important to keep accurate records of all your income and deductible expenses to make this process easier and more efficient.

New rules for self-employed individuals often focus on tax obligations and benefits eligibility. Recent changes may include updates to how you report income and what deductions you can claim. It is crucial to stay informed about these developments, particularly if you are utilizing a New Jersey Diver Services Contract - Self-Employed, as this can help you maximize your financial benefits and ensure compliance.

The terms self-employed and independent contractor are often used interchangeably, but they can have different implications. Generally, self-employed refers to anyone running their own business, while independent contractor specifically denotes a type of working agreement. Regardless of which term you use, a New Jersey Diver Services Contract - Self-Employed can clarify your position and responsibilities to clients.

Yes, contract work is considered a form of self-employment. When you engage in contract work, you operate your own business and provide services to clients without a direct employer. Therefore, by utilizing a New Jersey Diver Services Contract - Self-Employed, you formalize your business arrangement, allowing you to enjoy the benefits of independence while securing clear agreements with clients.

Yes, you can absolutely have a contract if you are self-employed. In fact, having a New Jersey Diver Services Contract - Self-Employed helps clarify the expectations between you and your client. This type of contract protects both parties, ensuring you receive payment for your services. Additionally, it outlines the tasks you will perform and any deadlines you need to meet.

Yes, it is essential to have a contract even if you are self-employed. A New Jersey Diver Services Contract - Self-Employed provides legal protection and defines the scope of your work. This clarity can prevent disputes and ensure timely payments. Having a formal agreement sets professional standards and strengthens your business relationships.

Self-employed individuals operate independently, owning their business, whereas contracted workers typically provide services under a specific agreement. Both can benefit from a New Jersey Diver Services Contract - Self-Employed, as it clarifies the terms of engagement. Understanding this distinction is vital for navigating tax obligations and business regulations. Both pathways offer unique advantages depending on your goals.

Yes, you can be classified as a 1099 employee without a formal contract, but it's not recommended. Without a New Jersey Diver Services Contract - Self-Employed, misunderstandings about job responsibilities and payment may arise. It's crucial to have documentation that outlines your role and compensation. A clear contract helps establish your status and protects your rights.