New Jersey Hardware, Locks And Screens Installation And Services Contract - Self-Employed

Description

How to fill out Hardware, Locks And Screens Installation And Services Contract - Self-Employed?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a range of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can obtain the most recent versions of forms such as the New Jersey Hardware, Locks And Screens Installation And Services Contract - Self-Employed in moments.

If you already have an account, Log In and download the New Jersey Hardware, Locks And Screens Installation And Services Contract - Self-Employed from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously saved forms from the My documents section of your account.

Edit. Fill out, modify, print, and sign the saved New Jersey Hardware, Locks And Screens Installation And Services Contract - Self-Employed.

Each form you added to your account has no expiration date and is yours permanently. Therefore, to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the New Jersey Hardware, Locks And Screens Installation And Services Contract - Self-Employed with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal requirements.

- If you are using US Legal Forms for the first time, here are simple instructions to help you get started.

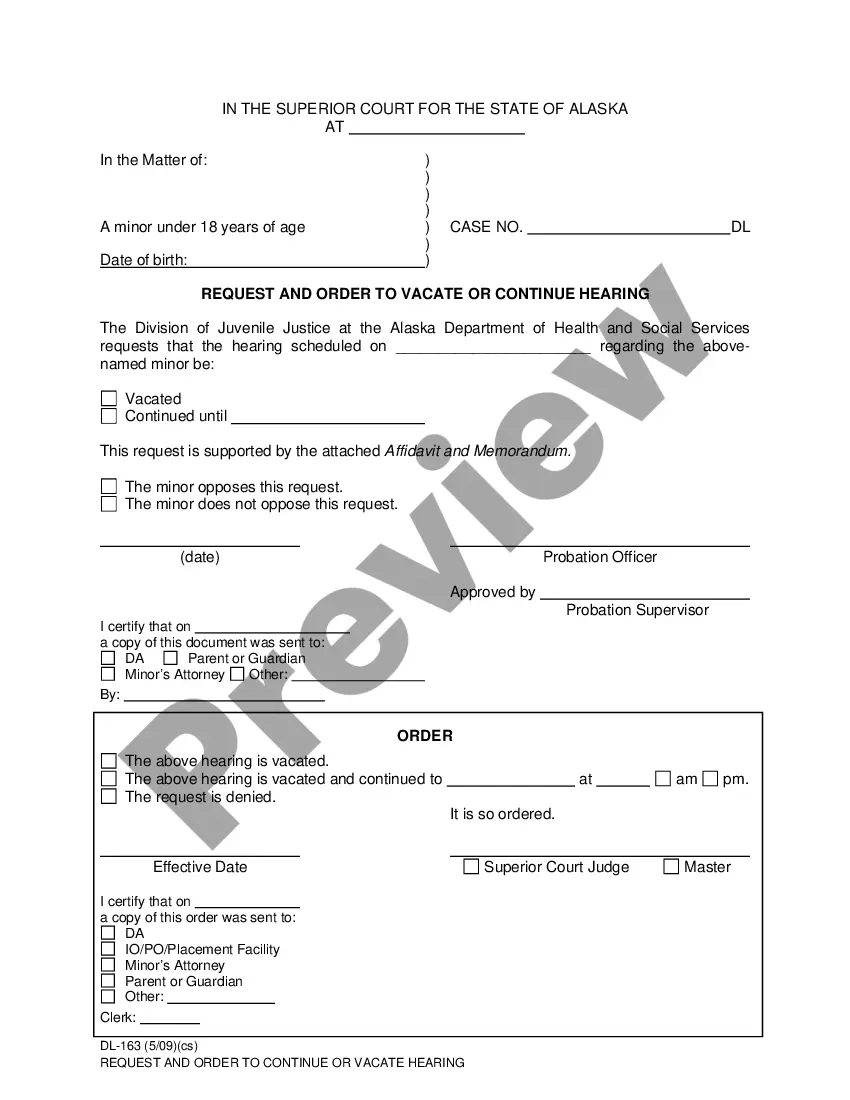

- Make sure you have selected the correct form for your city/state. Click on the Review button to examine the form's details. Check the form information to ensure you have chosen the right form.

- If the form does not meet your needs, utilize the Search field at the top of the page to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Get now button. Then, choose the payment plan you prefer and provide your information to register for an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the transaction.

- Select the format and download the form to your device.

Form popularity

FAQ

Both terms—self-employed and independent contractor—can be used interchangeably, especially when discussing the New Jersey Hardware, Locks And Screens Installation And Services Contract - Self-Employed. However, 'independent contractor' may imply a specific legal relationship with clients and a focus on contract-based work. Ultimately, the choice may depend on your business context and preferred terminology.

Recent changes in tax law have introduced various updates for self-employed individuals, including those who work under the New Jersey Hardware, Locks And Screens Installation And Services Contract - Self-Employed. For instance, new deductions and credits may be available, and understanding these can help you maximize your earnings. Additionally, staying informed about changes in health care and retirement account contributions can benefit your business.

As an independent contractor operating under the New Jersey Hardware, Locks And Screens Installation And Services Contract - Self-Employed, you are responsible for self-employment taxes. This includes both the employer and employee portions of Social Security and Medicare taxes. You may also owe income tax based on your total earnings. It’s crucial to keep accurate records and consider making quarterly estimated tax payments.

As a self-employed individual under the New Jersey Hardware, Locks And Screens Installation And Services Contract - Self-Employed, you must report all income, no matter how small. Generally, if you earn $600 or more from a single client, they will issue a 1099 form. Keep in mind that even if you earn less than this threshold, you are still responsible for paying taxes on your self-employment income.

Yes, you need a license to operate as a contractor in New Jersey. This requirement helps maintain industry standards and protects consumers. If you plan on offering New Jersey Hardware, Locks And Screens Installation And Services Contract - Self-Employed, securing your license is essential to operate legally and professionally. You can find the necessary forms and guidance on the US Legal Forms platform, simplifying the process for you.

Yes, flooring installation is considered a taxable service in New Jersey. If you are involved in flooring installation as part of your New Jersey Hardware, Locks And Screens Installation And Services Contract - Self-Employed, you should include tax on your invoices. Understanding the tax obligations related to your services can help ensure compliance and prevent future issues. For questions on how to navigate these regulations, uslegalforms provides helpful resources and templates to assist you.

In New Jersey, certain services may be exempt from sales tax, including specific labor services. However, under your New Jersey Hardware, Locks And Screens Installation And Services Contract - Self-Employed, most installation services typically do not fall under this exemption. It's crucial to review the specifics of your services to determine if any aspects qualify for tax exemption. For accurate guidance, consider consulting uslegalforms for resources on tax-related questions.

When it comes to your New Jersey Hardware, Locks And Screens Installation And Services Contract - Self-Employed, it's important to understand state tax regulations. Generally, services related to hardware installation are taxable in New Jersey. You may need to add sales tax to your invoice to ensure compliance. However, checking with a tax professional is always advisable to avoid any errors.