New Jersey Outside Project Manager Agreement - Self-Employed Independent Contractor

Description

How to fill out Outside Project Manager Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a vast selection of legal form templates for you to download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the most recent versions of forms such as the New Jersey Outside Project Manager Agreement - Self-Employed Independent Contractor in just a few minutes.

If you already have a monthly subscription, Log In and access the New Jersey Outside Project Manager Agreement - Self-Employed Independent Contractor from your US Legal Forms library. The Download button will appear on each form you view. You can access all previously obtained forms in the My documents section of your account.

Select the format and download the form to your device.

Edit the document. Complete, modify, and print or sign the downloaded New Jersey Outside Project Manager Agreement - Self-Employed Independent Contractor. Each form you added to your account has no expiration date and is yours forever. Thus, if you wish to download or print another copy, just visit the My documents section and click on the form you need. Access the New Jersey Outside Project Manager Agreement - Self-Employed Independent Contractor through US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are some simple steps to help you get started.

- Ensure you have chosen the correct form for your city/county.

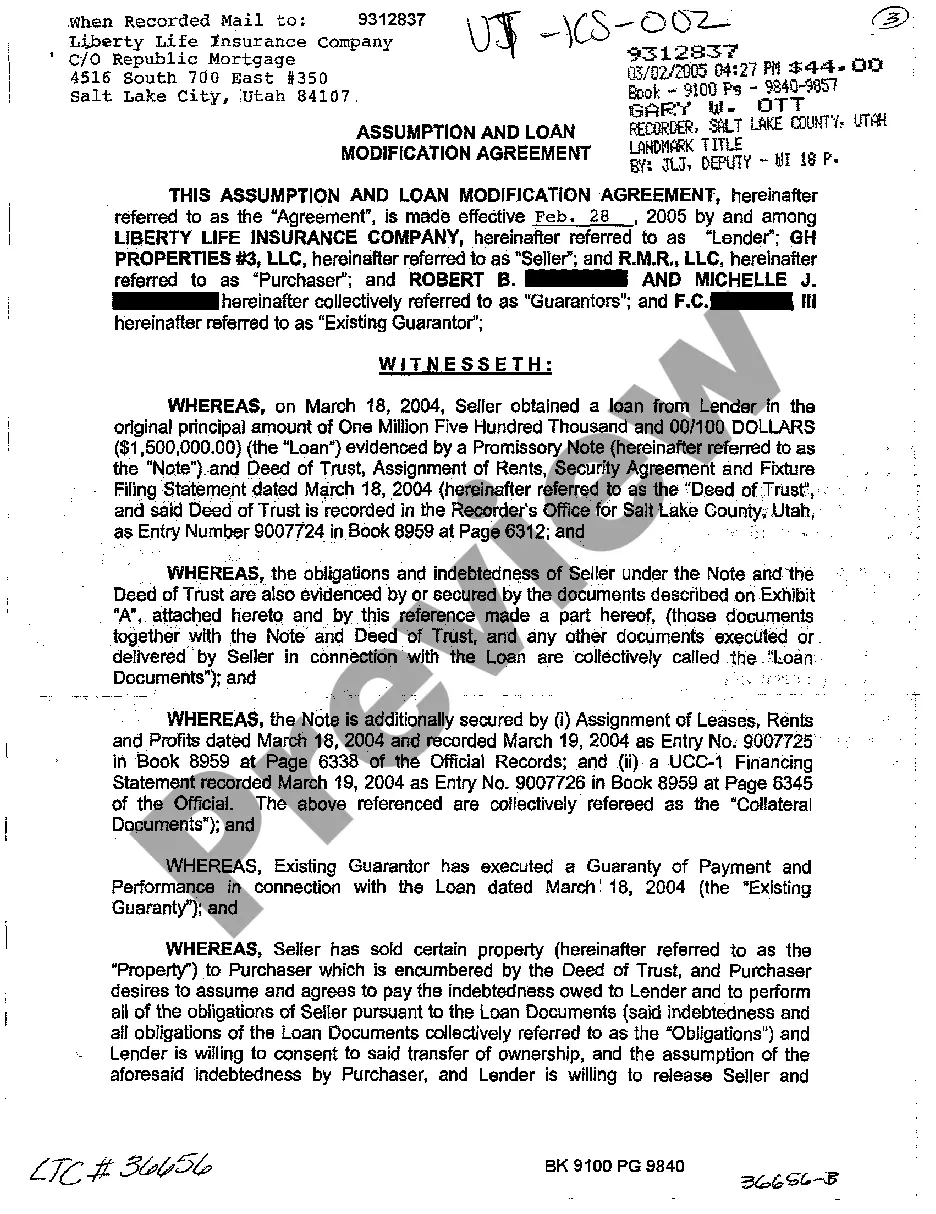

- Click the Preview button to review the form’s details.

- Check the form outline to ensure you have selected the right document.

- If the form does not meet your requirements, use the Search field at the top of the page to find a suitable one.

- If you are satisfied with the form, confirm your choice by clicking the Get now button. Then, choose your preferred payment plan and provide your information to create an account.

- Process the payment. Use your credit card or PayPal account to complete the transaction.

Form popularity

FAQ

As an independent contractor, including those under a New Jersey Outside Project Manager Agreement - Self-Employed Independent Contractor, it’s crucial to have the right insurance. General liability insurance protects against claims of negligence, while professional liability insurance covers errors in your services. Depending on your industry, you may also want to consider additional coverage options, ensuring you are fully protected.

Independent contractors in New Jersey must adhere to several legal requirements, primarily defined by the contract terms, such as a New Jersey Outside Project Manager Agreement - Self-Employed Independent Contractor. These often include proper business registration, tax obligations, and compliance with local laws. Staying clear on these requirements helps you operate legally and avoid unwanted issues down the line.

Certain individuals can be exempt from carrying workers' compensation insurance in New Jersey. Generally, self-employed individuals and business owners without employees may qualify for exemption. However, this can become more complex when dealing with contracts, like a New Jersey Outside Project Manager Agreement - Self-Employed Independent Contractor, so it's wise to consult a professional to confirm your specific situation.

In New Jersey, workers' compensation is not typically required for independent contractors, including those operating under a New Jersey Outside Project Manager Agreement - Self-Employed Independent Contractor. However, if you are classified as an independent contractor but fulfill the criteria of an employee, your client may need to provide coverage. It's important to understand your status and ensure that you have sufficient protection in place.

To fill out an independent contractor agreement, begin with the basic information, such as names and contact details of both parties. Next, specify the services to be provided, including timelines and payment methods. It is crucial to review and understand each section before finalizing the form. Leveraging tools from UsLegalForms can help streamline this process, offering templates for the New Jersey Outside Project Manager Agreement - Self-Employed Independent Contractor that keep you compliant.

Writing an independent contractor agreement involves outlining the scope of work, payment terms, and deadlines. Start by clearly defining the roles and responsibilities of both parties. Incorporate important clauses to protect your interests, such as confidentiality and termination conditions. Using a template like the New Jersey Outside Project Manager Agreement - Self-Employed Independent Contractor can simplify the process and ensure you cover all necessary details.

In New Jersey, independent contractors do not typically need workers' compensation insurance. However, if you are classified as an employee under certain conditions, you may require this insurance. It's important to understand your specific situation, including the terms of your New Jersey Outside Project Manager Agreement - Self-Employed Independent Contractor, to determine your obligations. Consulting with a legal expert can provide clarity on your responsibilities.

Yes, a 1099 employee can be subject to a noncompete agreement, provided it is specified in their contract. This is relevant under the New Jersey Outside Project Manager Agreement - Self-Employed Independent Contractor. As a 1099 employee, knowing the terms of your agreement can help you navigate your rights, allowing you to make informed decisions before signing.

An independent contractor can indeed have a non-compete agreement, depending on the terms negotiated in their contract. Under the New Jersey Outside Project Manager Agreement - Self-Employed Independent Contractor, such agreements must be reasonable and clearly defined to be enforceable. It's wise to consult legal advice to fully understand your rights and obligations regarding non-compete clauses.

Yes, it is possible for someone to be labeled as an independent contractor while functioning as an employee. This misclassification can lead to legal complications and tax implications. Understanding the distinctions outlined in the New Jersey Outside Project Manager Agreement - Self-Employed Independent Contractor can help clarify roles and responsibilities, ensuring compliance and protection for all parties involved.