New Jersey Lab Worker Employment Contract - Self-Employed

Description

How to fill out Lab Worker Employment Contract - Self-Employed?

If you want to be thorough, obtain, or print legal document templates, utilize US Legal Forms, the largest assortment of legal forms that are available online.

Take advantage of the site’s straightforward and user-friendly search to find the documents you need.

Numerous templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to locate the New Jersey Lab Worker Employment Contract - Self-Employed with just a few clicks.

Every legal document template you purchase is yours forever. You have access to every form you downloaded within your account. Click the My documents section and select a form to print or download again.

Compete and download, and print the New Jersey Lab Worker Employment Contract - Self-Employed with US Legal Forms. There are thousands of professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to get the New Jersey Lab Worker Employment Contract - Self-Employed.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for your correct area/state.

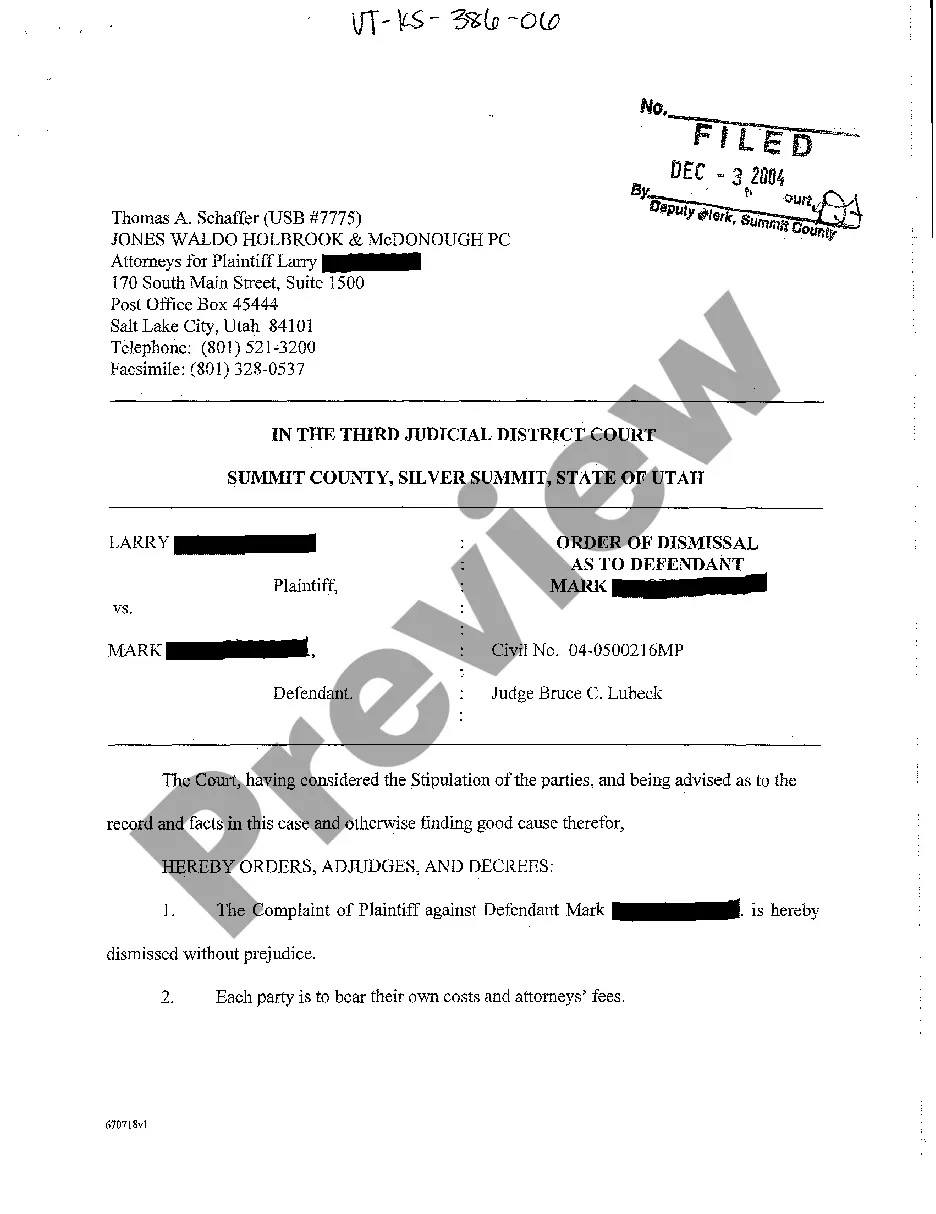

- Step 2. Use the Preview option to review the form’s details. Don’t forget to check the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and provide your details to register for an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the New Jersey Lab Worker Employment Contract - Self-Employed.

Form popularity

FAQ

The 7 minute rule in New Jersey refers to a guideline concerning the payment for work done by self-employed individuals. It ensures that workers are compensated promptly for the time they have dedicated to a project. Being familiar with this rule can help you structure your New Jersey Lab Worker Employment Contract - Self-Employed to include payment timelines that comply with state regulations.

Yes, having a contract is not only possible but also beneficial for self-employed individuals. A contract helps outline expectations, payment terms, and the scope of work, thereby protecting your interests. A New Jersey Lab Worker Employment Contract - Self-Employed can provide the necessary legal framework to support your business dealings.

A contract employee is typically not considered self-employed, as they often work under specific agreements with an employer. In contrast, self-employed individuals manage their own businesses and work independently. If you're developing a New Jersey Lab Worker Employment Contract - Self-Employed, it's essential to differentiate between these classifications to ensure compliance with labor laws.

While it may seem unusual, you can create a contract with yourself when operating as a self-employed individual. This type of private contract can help formalize your business processes and establish clear guidelines. A New Jersey Lab Worker Employment Contract - Self-Employed can serve as a useful template to ensure you're meeting all necessary requirements.

Writing a self-employed contract involves outlining key details such as the scope of work, payment structure, and termination conditions. Be sure to include both parties' obligations to ensure clarity. Utilizing resources like US Legal Forms can help you create a comprehensive New Jersey Lab Worker Employment Contract - Self-Employed that meets legal standards.

The terms self-employed and independent contractor are often used interchangeably, but they may have different implications. Generally, self-employed refers to anyone running their own business, while independent contractor specifically describes individuals who provide services to others under a contract. For your New Jersey Lab Worker Employment Contract - Self-Employed, it's vital to choose the term that accurately reflects your professional situation.

Yes, you can be self-employed and have a contract. In fact, having a well-defined contract can help clarify the terms of your work and protect your rights. A New Jersey Lab Worker Employment Contract - Self-Employed can establish your responsibilities and expectations with clients, ensuring everyone is on the same page.

The new rules for the self-employed in New Jersey include specific guidelines that must be followed under state law. These rules help define how self-employed individuals should operate, including tax obligations and rights under employment contracts. Understanding these regulations is crucial, especially when creating a New Jersey Lab Worker Employment Contract - Self-Employed.

Proving employment as a self-employed individual can involve several strategies. You may use tax returns, invoices, or contracts, such as a New Jersey Lab Worker Employment Contract - Self-Employed, to verify your work history. These documents can help demonstrate your income and employment status, especially when applying for loans or services.

Yes, contract work usually indicates self-employment, but there are nuances. When you take on contract work under a New Jersey Lab Worker Employment Contract - Self-Employed, you operate as an independent party. This status means you control your work and business expenses, but bear in mind your tax obligations as well.