New Jersey Notice Regarding Introduction of Restricted Share-Based Remuneration Plan

Description

How to fill out Notice Regarding Introduction Of Restricted Share-Based Remuneration Plan?

Have you been in a placement where you require papers for either organization or person purposes nearly every working day? There are a variety of lawful papers web templates accessible on the Internet, but locating types you can trust is not simple. US Legal Forms delivers a huge number of form web templates, such as the New Jersey Notice Regarding Introduction of Restricted Share-Based Remuneration Plan, which can be published in order to meet state and federal specifications.

In case you are currently knowledgeable about US Legal Forms web site and also have your account, simply log in. Following that, it is possible to down load the New Jersey Notice Regarding Introduction of Restricted Share-Based Remuneration Plan format.

Should you not have an profile and wish to start using US Legal Forms, follow these steps:

- Get the form you require and ensure it is for your right city/county.

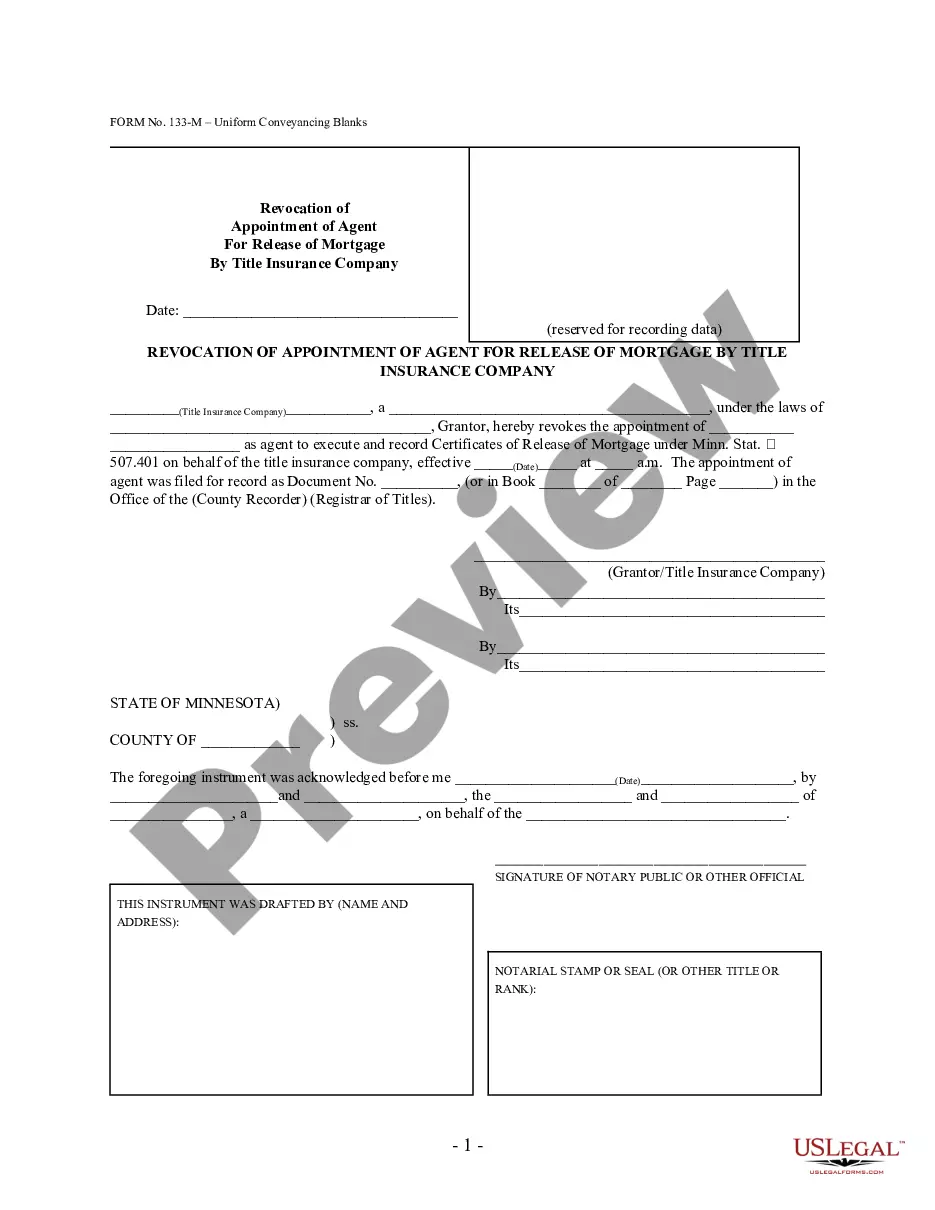

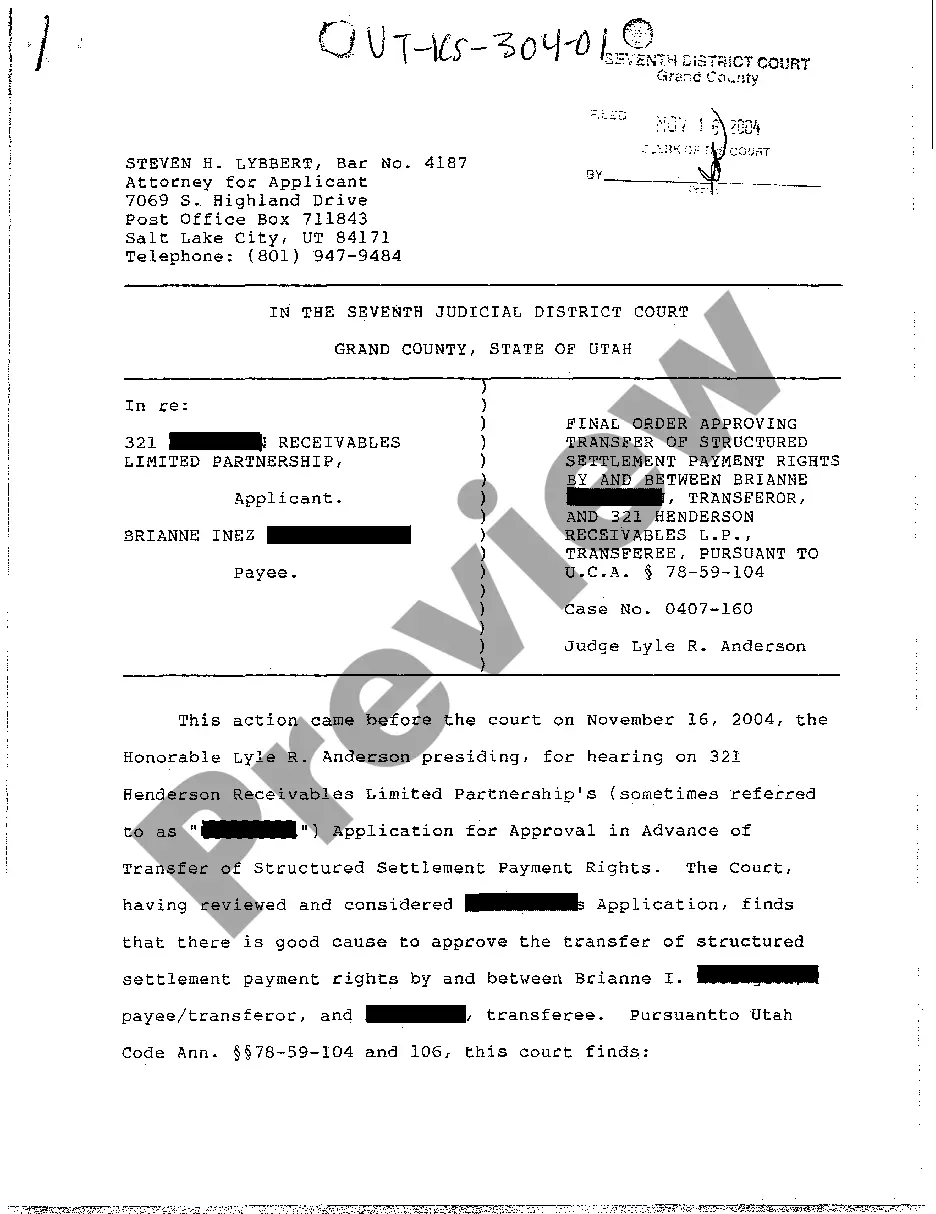

- Take advantage of the Preview switch to review the form.

- See the explanation to actually have chosen the correct form.

- If the form is not what you`re searching for, take advantage of the Lookup field to discover the form that suits you and specifications.

- If you find the right form, click Purchase now.

- Select the costs strategy you desire, fill out the desired info to produce your account, and buy your order with your PayPal or Visa or Mastercard.

- Select a handy document file format and down load your version.

Locate each of the papers web templates you have purchased in the My Forms food selection. You can obtain a further version of New Jersey Notice Regarding Introduction of Restricted Share-Based Remuneration Plan whenever, if necessary. Just go through the essential form to down load or print out the papers format.

Use US Legal Forms, by far the most considerable assortment of lawful varieties, in order to save time as well as avoid errors. The service delivers appropriately created lawful papers web templates which you can use for a variety of purposes. Create your account on US Legal Forms and start producing your way of life easier.

Form popularity

FAQ

When an employee exercises stock options, you'll credit Common Stock for the number of shares x par value, debit Cash for the number of shares x the exercise price, then debit Additional Paid-In Capital for the difference, representing the increase in value of the shares during the service period.

2 Income statement. Stock-based compensation expense should be included in the same income statement line or lines as the cash compensation paid to the employees receiving the stock-based awards (for example, cost of sales, research and development costs, or general and administrative costs).

The ASC 718 report mandates the disclosure of the accounting for options and shares and a few associated measures that may be used to forecast future costs and liabilities.

The RSUs are assigned a fair market value (FMV) when they vest. Restricted stock units are considered income once vested, and a portion of the shares is withheld to pay income taxes. The employee then receives the remaining shares and has the right to sell them.

Under US GAAP, stock based compensation (SBC) is recognized as a non-cash expense on the income statement. Specifically, SBC expense is an operating expense (just like wages) and is allocated to the relevant operating line items: SBC issued to direct labor is allocated to cost of goods sold.

FIN 28: Accounting for Stock Appreciation Rights and Other Variable Stock Option or Award Plans. which the changes occur until the date the number of shares and purchase price, if any, are both known.

Stock Compensation Is an Expense For many companies, compensation is their most significant expense. Most forms of stock compensation are compensatory in nature; as such, they result in expense that the company recognizes in its P&L. Occasionally stock compensation is not considered compensatory.

ASC 718 is an abbreviation of Financial Accounting Standards Board (FASB) Accounting Standards Codification Topic 718, Compensation?Stock Compensation. That is a mouthful, but the basic purpose of ASC 718 is to outline how companies should expense equity awards in their income statements.