New Jersey Notice to Debt Collector - Unlawful Messages to 3rd Parties

Description

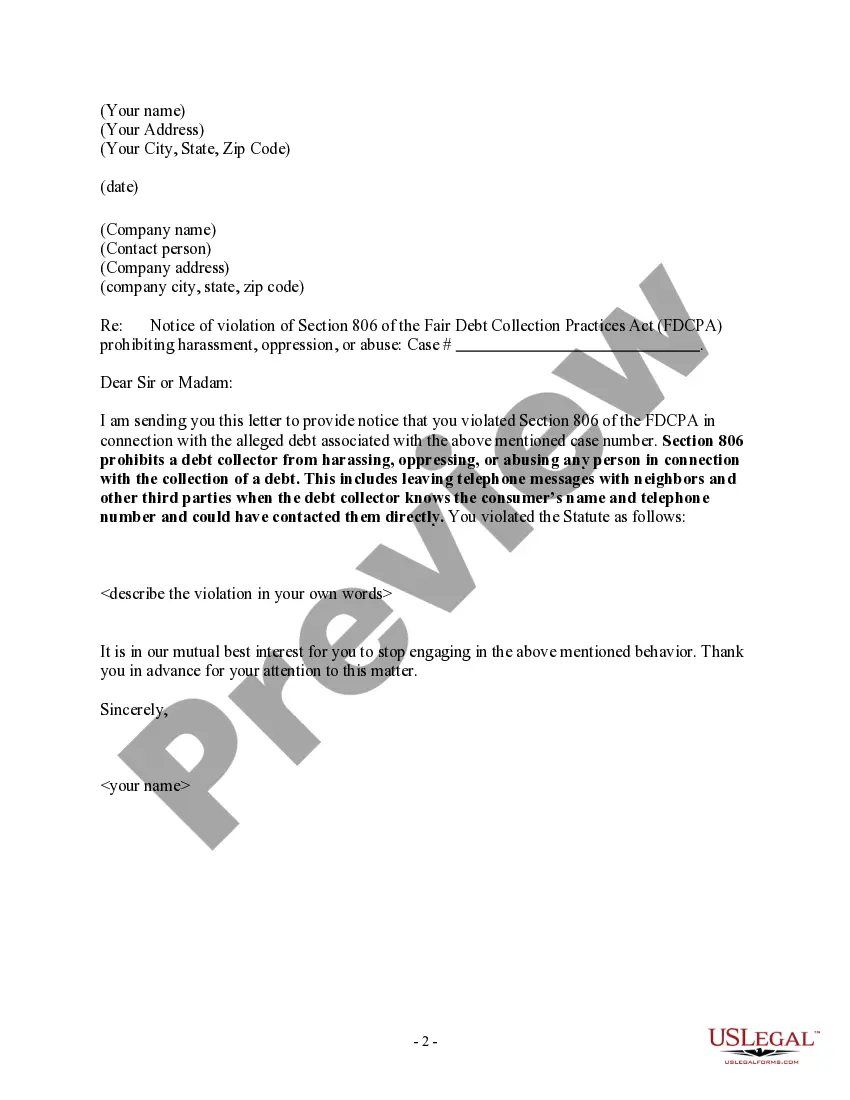

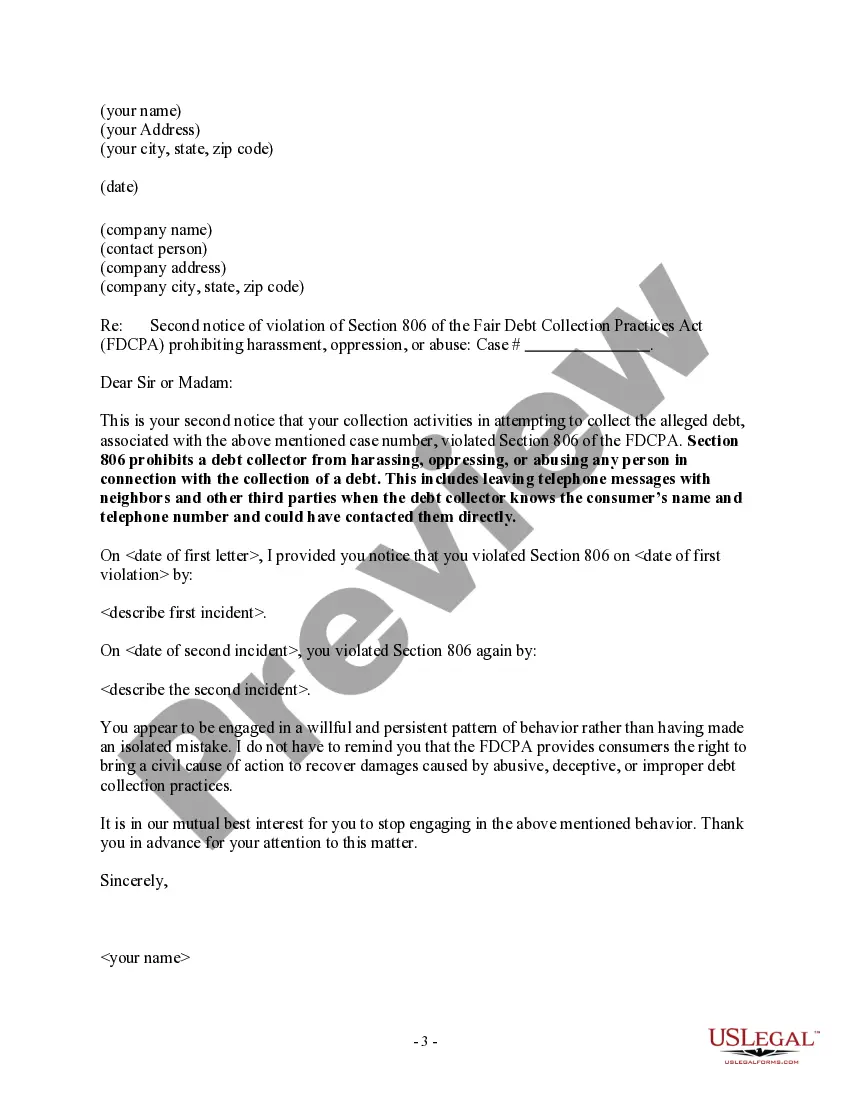

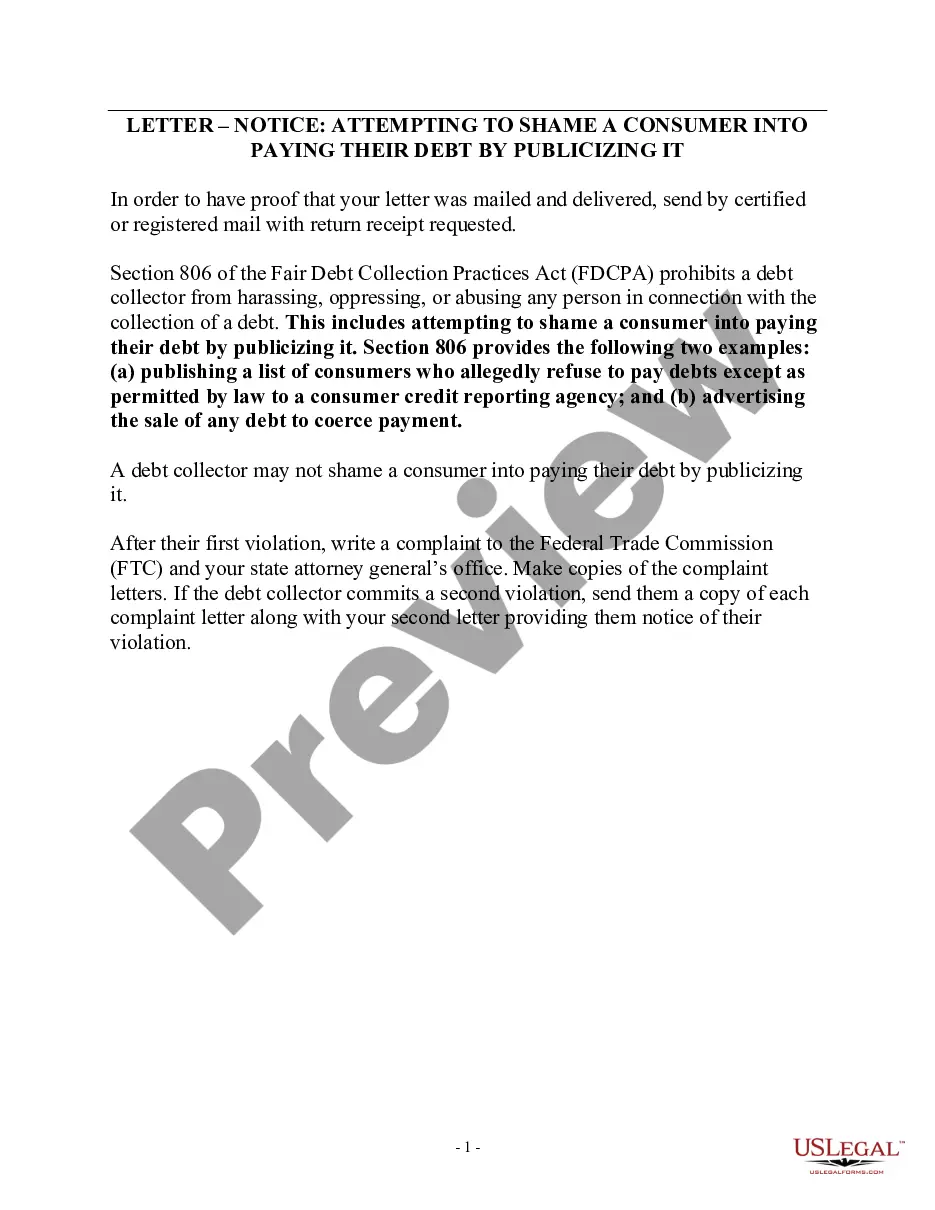

A debt collector may not harass, oppress, or abuse any person in connection with the collection of a debt. This includes leaving telephone messages with neighbors or other 3rd parties when the debt collector knows the consumer's name and telephone number and could have contacted the consumer directly.

How to fill out Notice To Debt Collector - Unlawful Messages To 3rd Parties?

You might spend hours online searching for the legal document template that meets the federal and state requirements you need.

US Legal Forms offers thousands of legal templates that can be reviewed by professionals.

You can conveniently obtain or create the New Jersey Notice to Debt Collector - Unlawful Messages to 3rd Parties from our services.

If available, use the Preview button to review the document template as well.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- After that, you can complete, modify, create, or sign the New Jersey Notice to Debt Collector - Unlawful Messages to 3rd Parties.

- Every legal document template you purchase is yours forever.

- To obtain another copy of any purchased form, visit the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the state/city of your choice.

- Check the form description to confirm that you have selected the correct template.

Form popularity

FAQ

Debt collectors are allowed to call you, but they cannot always leave a message on your answering machine. There are a few main instances when debt collectors might be sued for violating the privacy of those who are in debt, through a voicemail message. One of those instances is when it is accessed by a third party.

Generally, a debt collector can't discuss your debt with anyone other than:You.Your spouse.Your parents (if you are a minor)Your guardian, executor, or administrator.Your attorney, if you are represented with respect to the debt.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

Under the FDCPA, a communication from a debt collector must meaningfully disclose the identity of the debt collector and provide what is called a "mini-Miranda" warning. The communication must identify the debt collector (name, employer, and telephone number).

Don't be surprised if debt collectors slide into your DMs. A new rule allows debt collectors to contact you on social media, text or email not just by phone. The rule, which was approved last year by the Consumer Financial Protection Bureau's former president Kathleen L. Kraninger, took effect Tuesday, Nov.

If you're dealing with a third-party debt collector, there are five things you can do to handle the situation.Don't ignore them. Debt collectors will continue to contact you until a debt is paid.Get information on the debt.Get it in writing.Don't give personal details over the phone.Try settling or negotiating.

If you do have a legitimate issue with a debt collection that shows up on your credit report, you can dispute it through the collector or the credit bureaus. To contact the collector directly, be sure you file a letter in writing within 30 days of first receiving communication about the debt.

Debt collectors are allowed to contact third parties to obtain or confirm location information, but the FDCPA does not allow debt collectors to leave messages with third parties. Location information is defined as a consumer's home address and home phone number or workplace and workplace address.