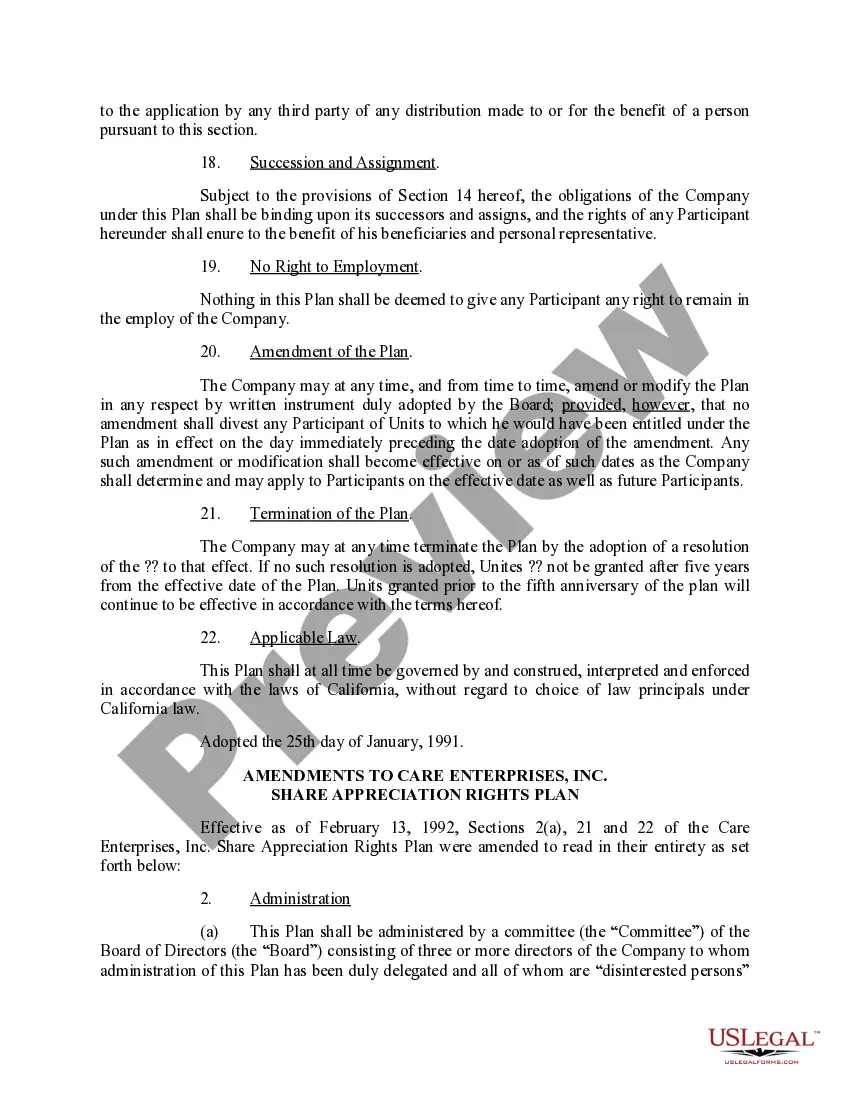

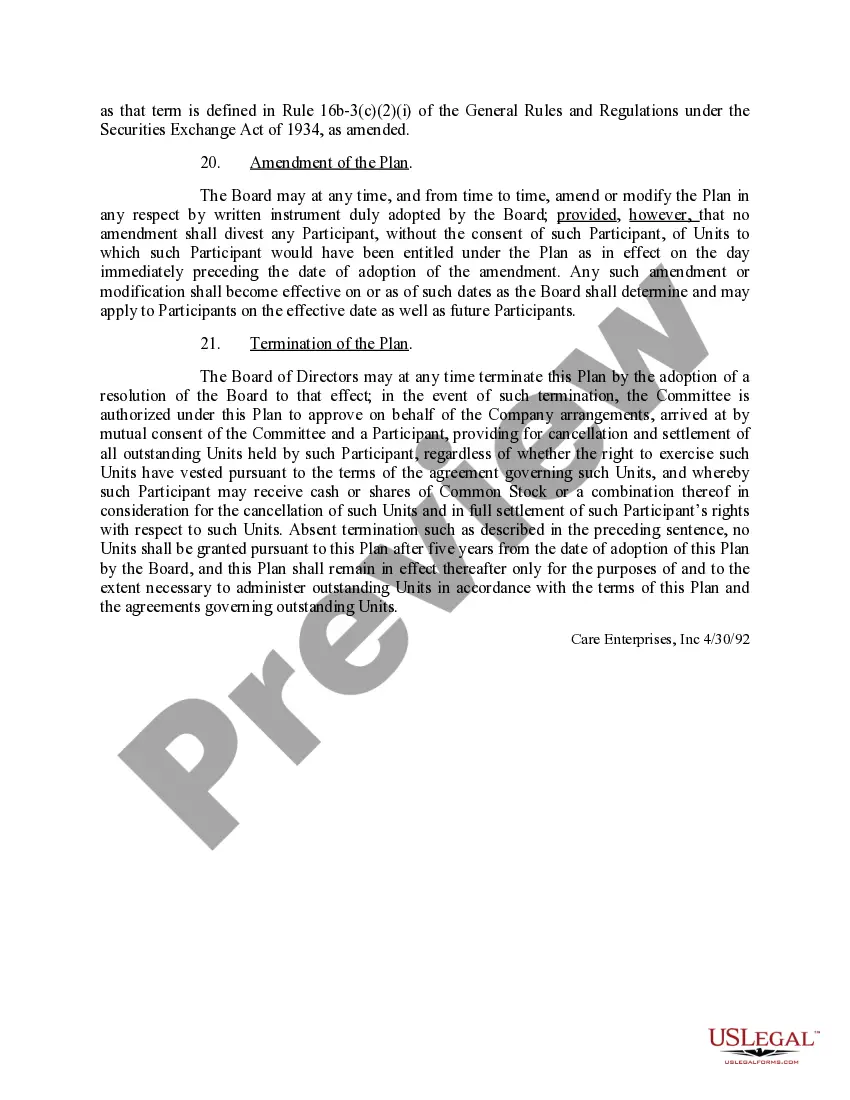

California Share Appreciation Rights Plan with amendment

Description

How to fill out Share Appreciation Rights Plan With Amendment?

Discovering the right legitimate papers format can be a have difficulties. Naturally, there are plenty of layouts available on the net, but how can you discover the legitimate type you require? Make use of the US Legal Forms internet site. The services provides a huge number of layouts, including the California Share Appreciation Rights Plan with amendment, that you can use for organization and personal requires. All the kinds are checked by professionals and satisfy state and federal specifications.

In case you are presently registered, log in for your bank account and then click the Obtain option to find the California Share Appreciation Rights Plan with amendment. Use your bank account to look from the legitimate kinds you may have bought earlier. Go to the My Forms tab of the bank account and acquire an additional duplicate of your papers you require.

In case you are a new customer of US Legal Forms, listed here are simple guidelines that you should stick to:

- Very first, make certain you have chosen the right type for your city/region. It is possible to examine the form using the Preview option and browse the form information to guarantee this is basically the right one for you.

- If the type is not going to satisfy your needs, utilize the Seach industry to get the proper type.

- When you are sure that the form is suitable, go through the Get now option to find the type.

- Opt for the costs strategy you need and type in the required information and facts. Build your bank account and pay for the transaction with your PayPal bank account or credit card.

- Select the submit format and download the legitimate papers format for your product.

- Complete, revise and produce and indicator the acquired California Share Appreciation Rights Plan with amendment.

US Legal Forms is the largest library of legitimate kinds where you can find different papers layouts. Make use of the company to download skillfully-created paperwork that stick to state specifications.

Form popularity

FAQ

SARs are taxed the same way as non-qualified stock options (NSOs). There are no tax consequences of any kind on either the grant date or when they are vested. However, participants must recognize ordinary income on the spread at the time of exercise. 2 Most employers will also withhold supplemental federal income tax.

The part of the change in the value of the stocks held by a business over any period which is due to price changes.

Stock Appreciation Right (SAR) entitles an employee, who is a shareholder in a company, to a cash payment proportionate to the appreciation of stock traded on a public exchange market. SAR programs provide companies with the flexibility to structure the compensation scheme in a way that suits their beneficiaries.

How do I value it? For purposes of financial disclosure, you may value a stock appreciation right based on the difference between the current market value and the grant price. This formula is: (current market value ? grant price) x number of shares = value.

A stock appreciation right is a contract between an employer and an employee that grants the employee the right to receive a payment tied to any increase in the value of the employer's stock. When granting a stock appreciation right, the employer does not grant the employee any shares of the employer's stock.

Holders of share purchase rights may or may not buy an agreed number of shares of stock at a pre-determined price, but only if they are an existing stockholder. Options, on the other hand, are the right to buy or sell stocks at a pre-set price called the strike price.

A SAR is very similar to a stock option, but with a key difference. When a stock option is exercised, an employee has to pay the grant price and acquire the underlying security. However, when a SAR is exercised, the employee does not have to pay to acquire the underlying security.

Stock appreciation rights (SARs) are a type of employee compensation linked to the company's stock price during a predetermined period. An employee stock ownership plan (ESOP) enables employees to gain an ownership interest in their employer in the form of shares of company stock.