District of Columbia Share Appreciation Rights Plan with amendment

Description

How to fill out Share Appreciation Rights Plan With Amendment?

Are you presently in a place the place you need papers for either business or personal purposes just about every working day? There are plenty of lawful document templates accessible on the Internet, but finding versions you can trust is not simple. US Legal Forms delivers 1000s of form templates, just like the District of Columbia Share Appreciation Rights Plan with amendment, that are written in order to meet federal and state requirements.

If you are previously acquainted with US Legal Forms web site and also have a free account, just log in. Following that, it is possible to down load the District of Columbia Share Appreciation Rights Plan with amendment template.

If you do not come with an accounts and want to begin using US Legal Forms, follow these steps:

- Discover the form you want and make sure it is for the appropriate town/county.

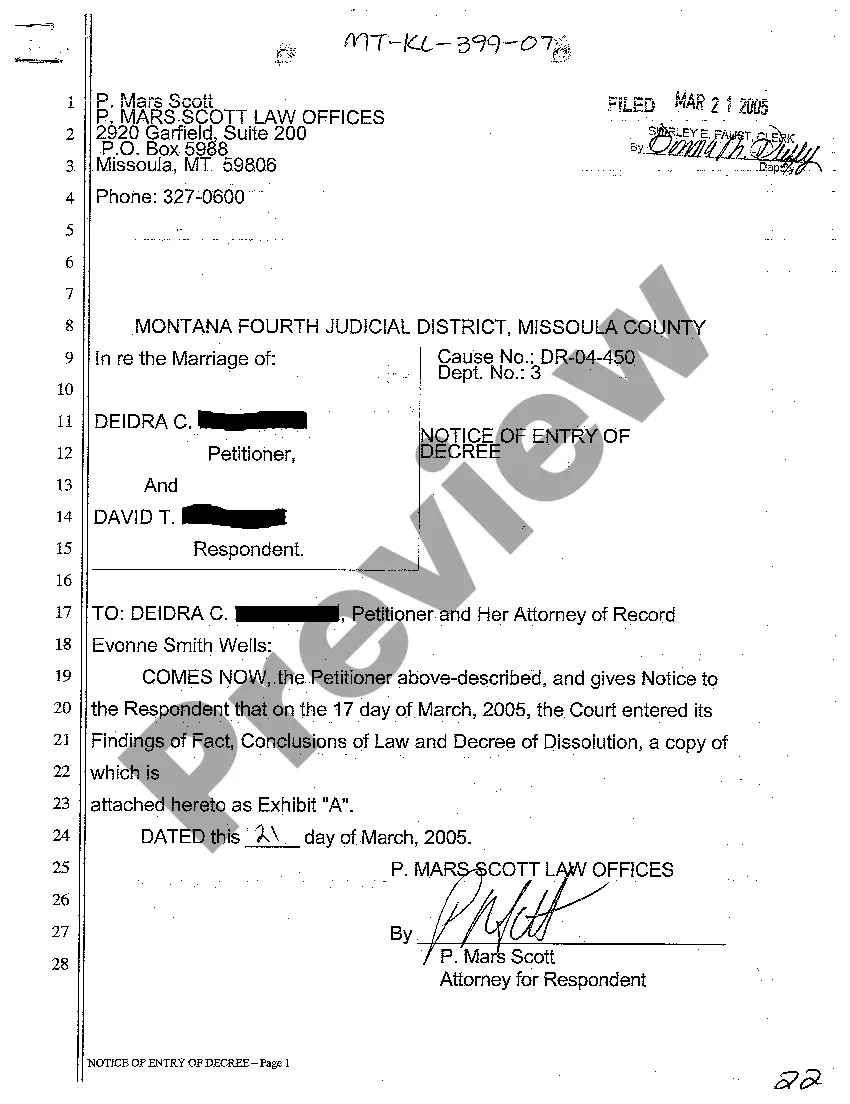

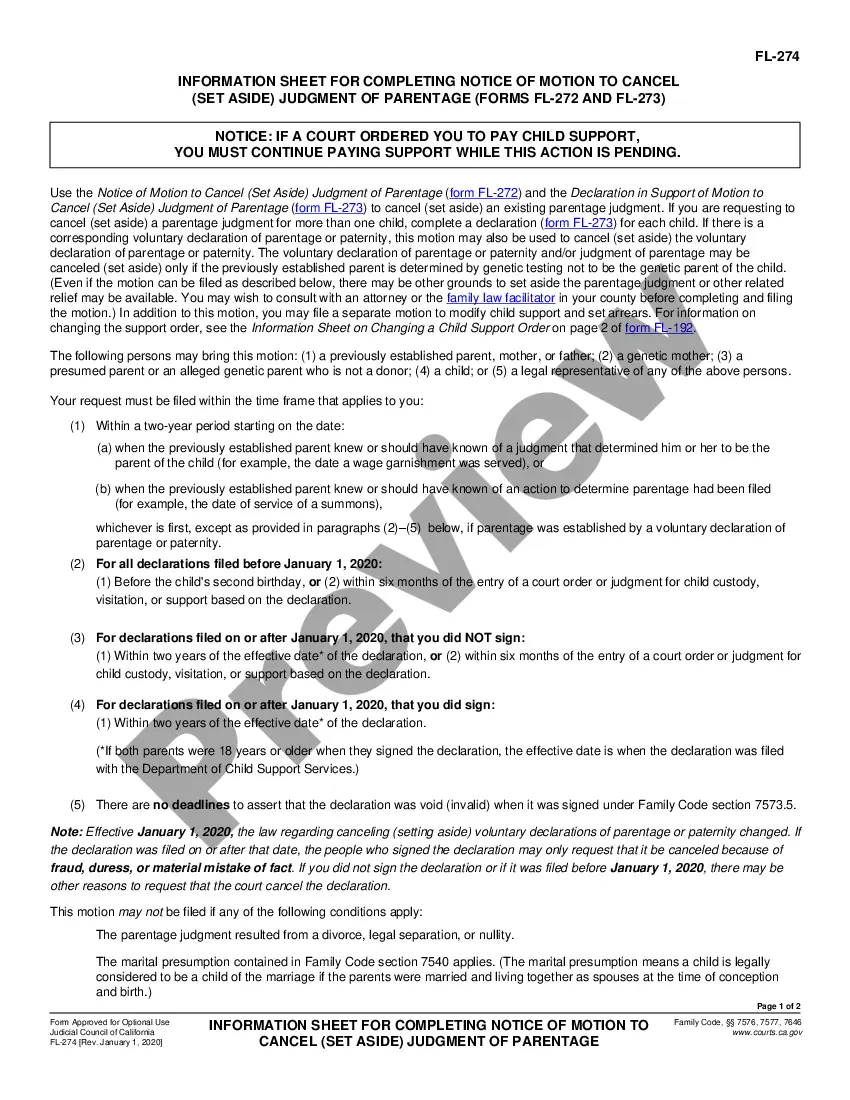

- Take advantage of the Review key to analyze the form.

- See the description to actually have chosen the appropriate form.

- If the form is not what you`re trying to find, utilize the Search area to get the form that fits your needs and requirements.

- Once you obtain the appropriate form, click on Get now.

- Pick the rates plan you need, submit the necessary information and facts to make your money, and purchase your order making use of your PayPal or bank card.

- Select a practical document formatting and down load your backup.

Discover every one of the document templates you might have purchased in the My Forms menus. You may get a additional backup of District of Columbia Share Appreciation Rights Plan with amendment whenever, if required. Just select the necessary form to down load or print out the document template.

Use US Legal Forms, by far the most considerable assortment of lawful forms, to save lots of efforts and steer clear of faults. The assistance delivers expertly produced lawful document templates which you can use for an array of purposes. Make a free account on US Legal Forms and start generating your way of life a little easier.

Form popularity

FAQ

Enforceability. Covenants not to compete are disfavored in Maryland and are strictly construed against the employer. For a non-compete agreement to be enforceable, it must be necessary to protect the employer's legitimate business interests and cannot impose undue hardship on the employee.

To be enforceable, a restrictive covenant must be reasonably limited in duration. In some cases, a three year limitation might be acceptable, while, in other cases, one year would be too long. The restriction must also be sufficiently limited in a geographic scope.

In certain circumstances, it is possible to find non-compete contract loopholes that may void the contract. For example, if you can prove that you never signed the contract, or if you can prove the contract is against the public interest, you may be able to void the agreement.

As of October 1, 2022, a new District law makes it illegal for employers to impose noncompete clauses and policies (noncompetes) on many District employees.

Effective October 1, 2023, Maryland has raised the salary threshold on its non-compete ban to 150% of the state's minimum wage, meaning $19.88 or less per hour (the current minimum wage of $13.25 * 150%), or $41,350 annually.

The D.C. Non-Compete Clarification Amendment Act of 2022 amends the Ban on Non-Compete Agreements Amendment Act of 2020 "to clarify which provisions in workplace policies or employment agreements will not violate the law's restrictions on the use of non-compete provisions and agreements."

The Act is not retroactive. Employers do not need to amend any current non-compete agreements with covered employees. However, employers should consult with legal counsel before amending an existing agreement with a non-compete, to evaluate whether the amendment could subject the agreement to the Act.

Four states?California, Minnesota, North Dakota and Oklahoma?have banned noncompete agreements entirely, and many other states have enacted restrictions, such as setting a compensation threshold or requiring advance notice.