New Jersey Stock Option Plan For Federal Savings Association

Description

How to fill out Stock Option Plan For Federal Savings Association?

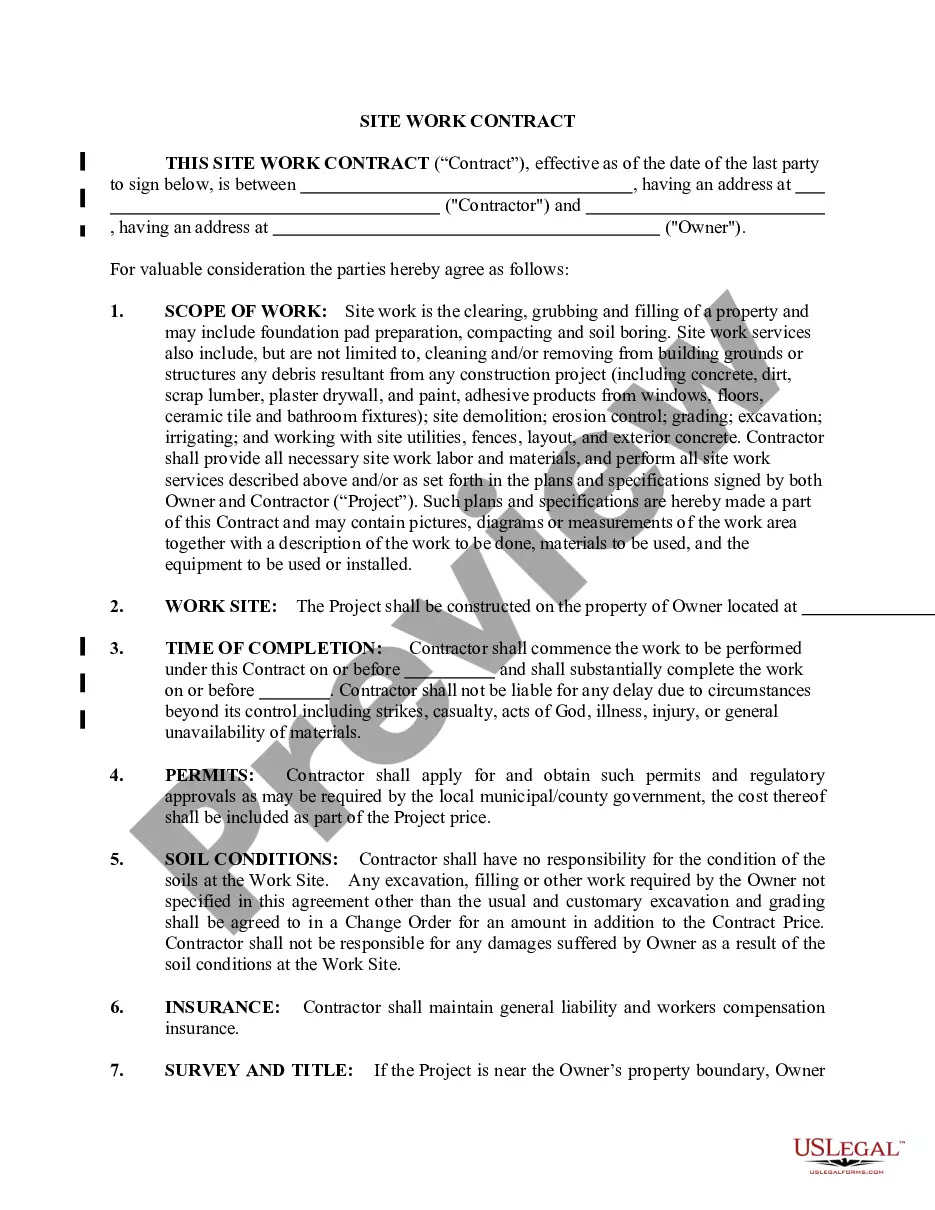

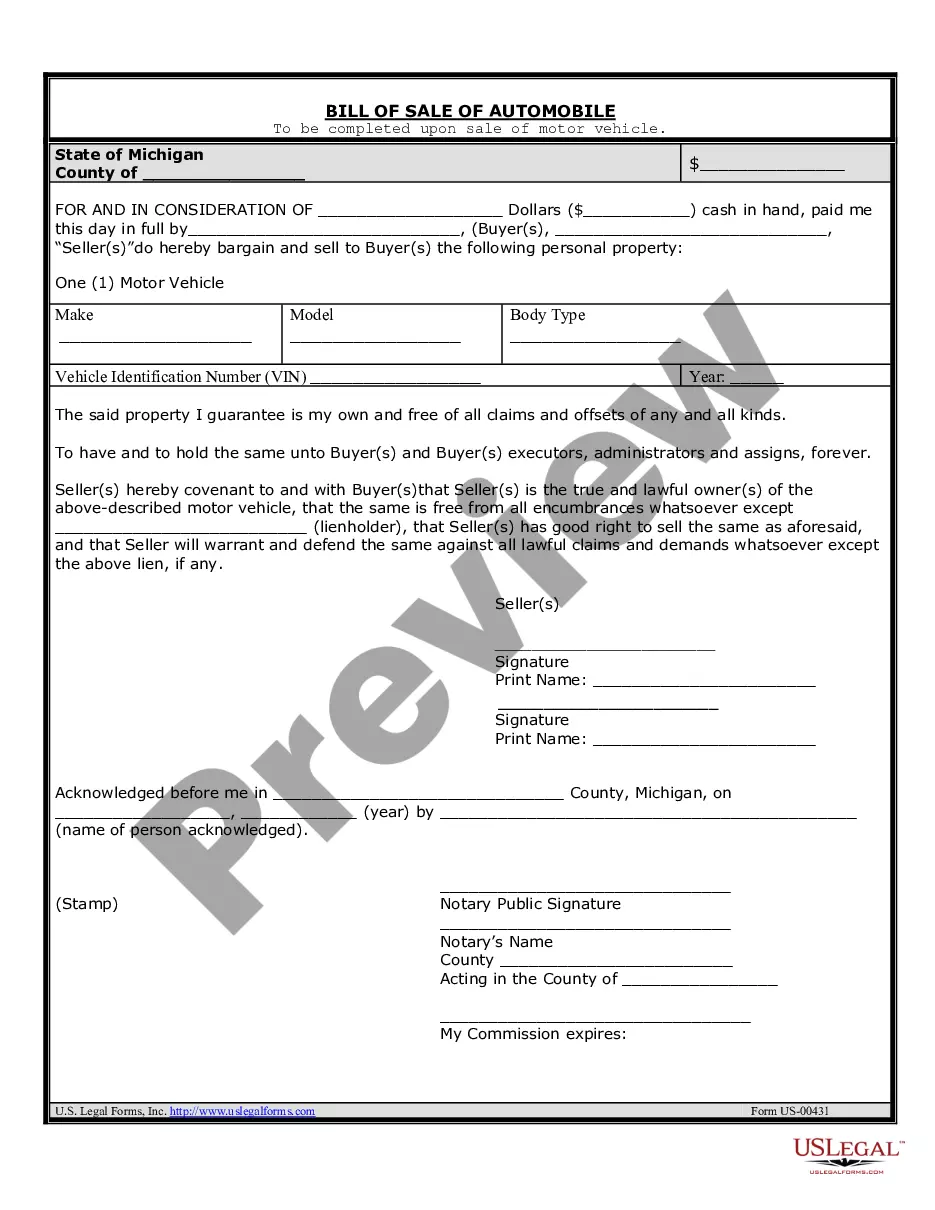

Have you been in a place that you need papers for either enterprise or specific functions virtually every working day? There are plenty of legal papers templates available online, but getting ones you can trust isn`t simple. US Legal Forms offers 1000s of type templates, just like the New Jersey Stock Option Plan For Federal Savings Association, that happen to be published to fulfill federal and state requirements.

When you are presently acquainted with US Legal Forms web site and possess your account, simply log in. Next, it is possible to obtain the New Jersey Stock Option Plan For Federal Savings Association design.

Unless you have an bank account and wish to start using US Legal Forms, adopt these measures:

- Discover the type you will need and make sure it is for that proper area/area.

- Use the Preview button to analyze the shape.

- See the description to actually have chosen the right type.

- When the type isn`t what you are looking for, make use of the Search field to find the type that suits you and requirements.

- When you find the proper type, simply click Purchase now.

- Opt for the prices strategy you need, complete the necessary info to produce your account, and pay money for the order making use of your PayPal or credit card.

- Select a hassle-free paper formatting and obtain your version.

Find all the papers templates you have purchased in the My Forms menu. You can obtain a further version of New Jersey Stock Option Plan For Federal Savings Association at any time, if necessary. Just click the required type to obtain or printing the papers design.

Use US Legal Forms, probably the most extensive assortment of legal varieties, to save lots of time and steer clear of faults. The assistance offers appropriately created legal papers templates that you can use for a range of functions. Generate your account on US Legal Forms and commence making your daily life easier.

Form popularity

FAQ

A stock option plan is a mechanism for affording selected employees and executives or managers of a company the opportunity to acquire stock in their company at a price determined at the time the options are granted and fixed for the term of the options.

A capital gain is the profit you realize when you sell or exchange property such as real estate or shares of stock. If you are a New Jersey resident, all of your capital gains, except gains from the sale of exempt obligations, are subject to tax.

The receipt of consideration for the option is not taxable until the option either is exercised or has lapsed. If the option is exercised, the consideration is treated as part of the selling price and included in computing the gain or loss in the sale of the stock.

TLDR Exercise early and File an 83(b) Election. Exercise and Hold for Long Term Capital Gains. Exercise Just Enough Options Each Year to Avoid AMT. Exercise ISOs In January to Maximize Your Float Before Paying AMT. Get Refund Credit for AMT Previously Paid on ISOs. Reduce the AMT on the ISOs by Exercising NSOs.

The receipt of consideration for the option is not taxable until the option either is exercised or has lapsed. If the option is exercised, the consideration is treated as part of the selling price and included in computing the gain or loss in the sale of the stock.

When you exercise nonqualified stock options, your employer will most likely withhold a flat 22% for federal income taxes. However, you might be under-withheld if you're in the 32%, 35%, or 37% tax bracket. Stock options can be advantageous but can also create unexpected tax consequences.