Delaware Internal Revenue Service Ruling Letter

Description

How to fill out Internal Revenue Service Ruling Letter?

You are able to spend several hours on the Internet trying to find the lawful document design that suits the federal and state demands you require. US Legal Forms supplies a huge number of lawful types which can be examined by professionals. It is simple to acquire or print out the Delaware Internal Revenue Service Ruling Letter from the services.

If you currently have a US Legal Forms profile, you are able to log in and click the Down load button. Next, you are able to full, modify, print out, or signal the Delaware Internal Revenue Service Ruling Letter. Every lawful document design you get is yours permanently. To have another version of the acquired form, go to the My Forms tab and click the corresponding button.

Should you use the US Legal Forms web site for the first time, follow the easy guidelines beneath:

- Very first, ensure that you have chosen the correct document design for the state/city of your liking. See the form outline to ensure you have chosen the right form. If readily available, take advantage of the Preview button to check from the document design as well.

- If you wish to discover another version of the form, take advantage of the Research industry to get the design that fits your needs and demands.

- After you have found the design you want, just click Acquire now to move forward.

- Choose the rates program you want, type your qualifications, and sign up for a merchant account on US Legal Forms.

- Complete the deal. You may use your bank card or PayPal profile to purchase the lawful form.

- Choose the file format of the document and acquire it for your system.

- Make modifications for your document if possible. You are able to full, modify and signal and print out Delaware Internal Revenue Service Ruling Letter.

Down load and print out a huge number of document templates making use of the US Legal Forms site, which offers the greatest assortment of lawful types. Use specialist and express-distinct templates to deal with your business or personal requires.

Form popularity

FAQ

Delaware does not provide a power of attorney declaration of representative that is separate from federal Form 2848. To authorize the release of Delaware tax information to an individual or organization, taxpayers must complete, sign and return Form 8821DE.

If the department needs to verify information reported on your return or request additional information, the process will take longer. Math errors in your return or other adjustments. You used more than one form type to complete your return. Your return was missing information or incomplete.

As a resident of Delaware, the amount of your pension and 401K income that is taxable for federal purposes is also taxable in Delaware. However, person's 60 years of age or older are entitled to a pension exclusion of up to $12,500 or the amount of the pension and eligible retirement income (whichever is less).

If you do not have a PIN or you PIN has expired, please contact the Division of Revenue at 1-302-577-8200 to receive a new PIN. Select ?I am adding Administrator Authorization and have a FEIN and my PIN? and ?Next? to proceed.

A: Resident individuals and resident businesses must file an annual return, even if no tax is due. Non-resident individuals who have income earned in Delaware that is not subject to employer withholding must file an annual return.

Delaware's ?convenience of the employer? rule requires that taxpayers who switch from commuting into Delaware to working remotely in another state still have to pay income taxes to Delaware.

A. Delaware's Gross Receipts Tax is a tax on the total gross revenues of a business, regardless of their source. This tax is levied on the seller of goods or services, rather than on the consumer.

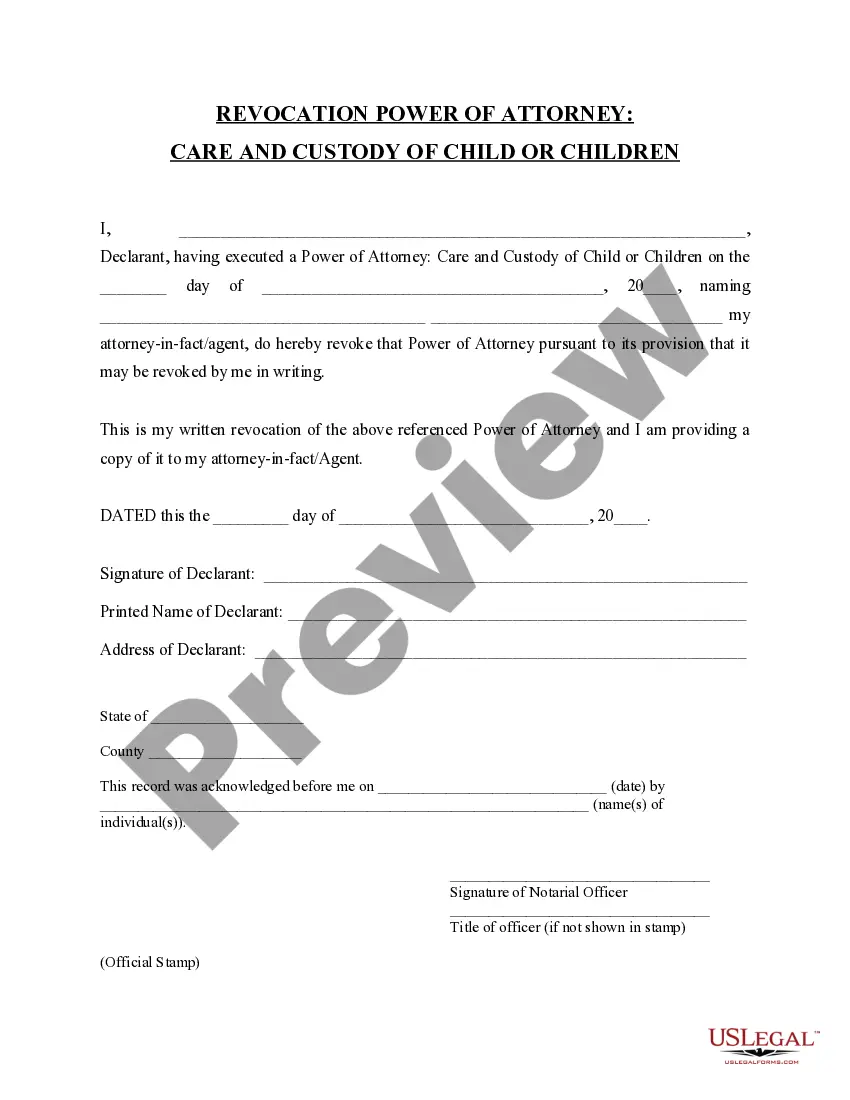

Power of Attorney (POA) for the Delaware Division of Revenue Complete all fields regarding your business information in box 1. Owner/operator will need to sign at the bottom of the form. Email your completed Power of Attorney form, along with your 10-digit PIN to hello@onpay.com.