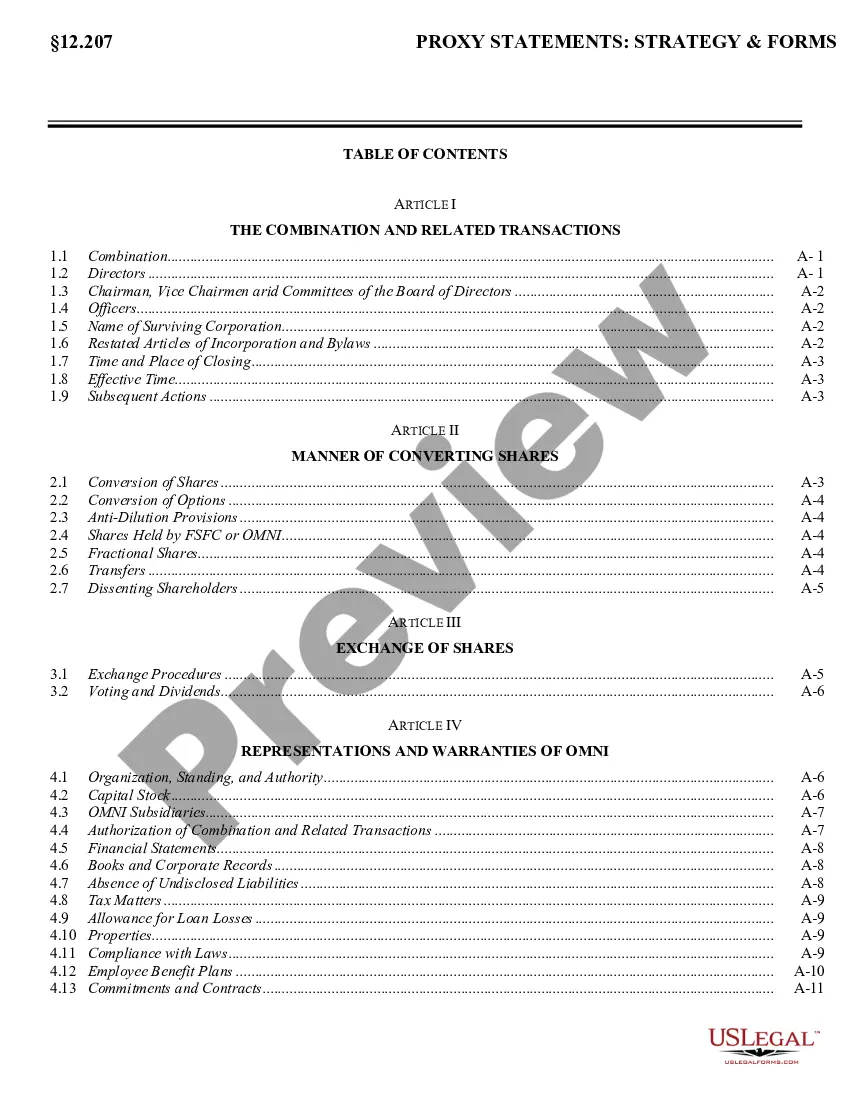

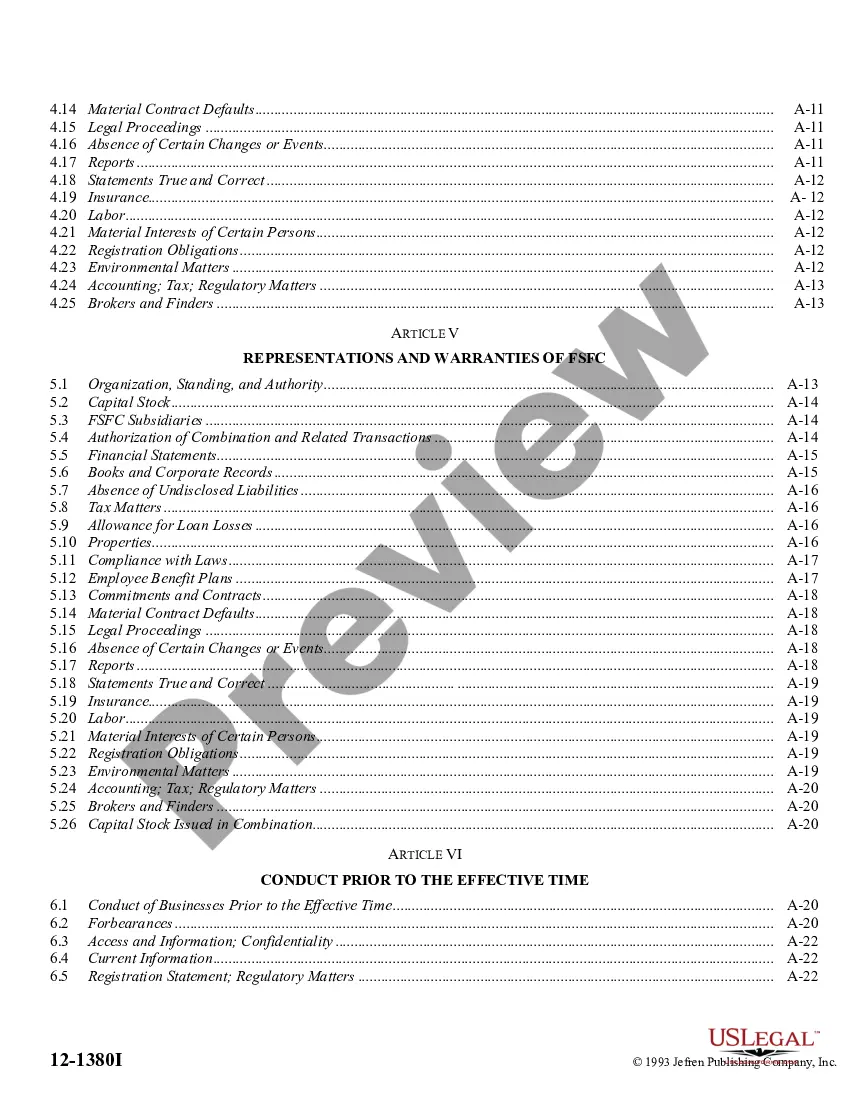

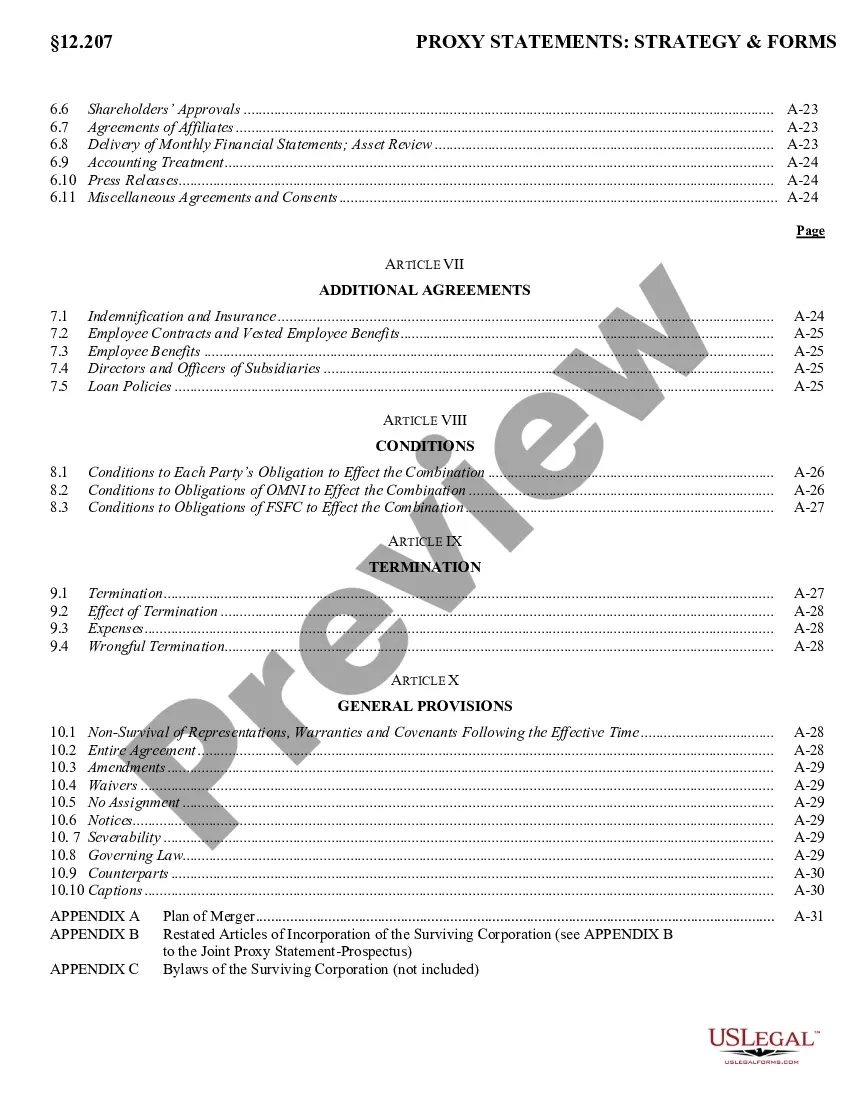

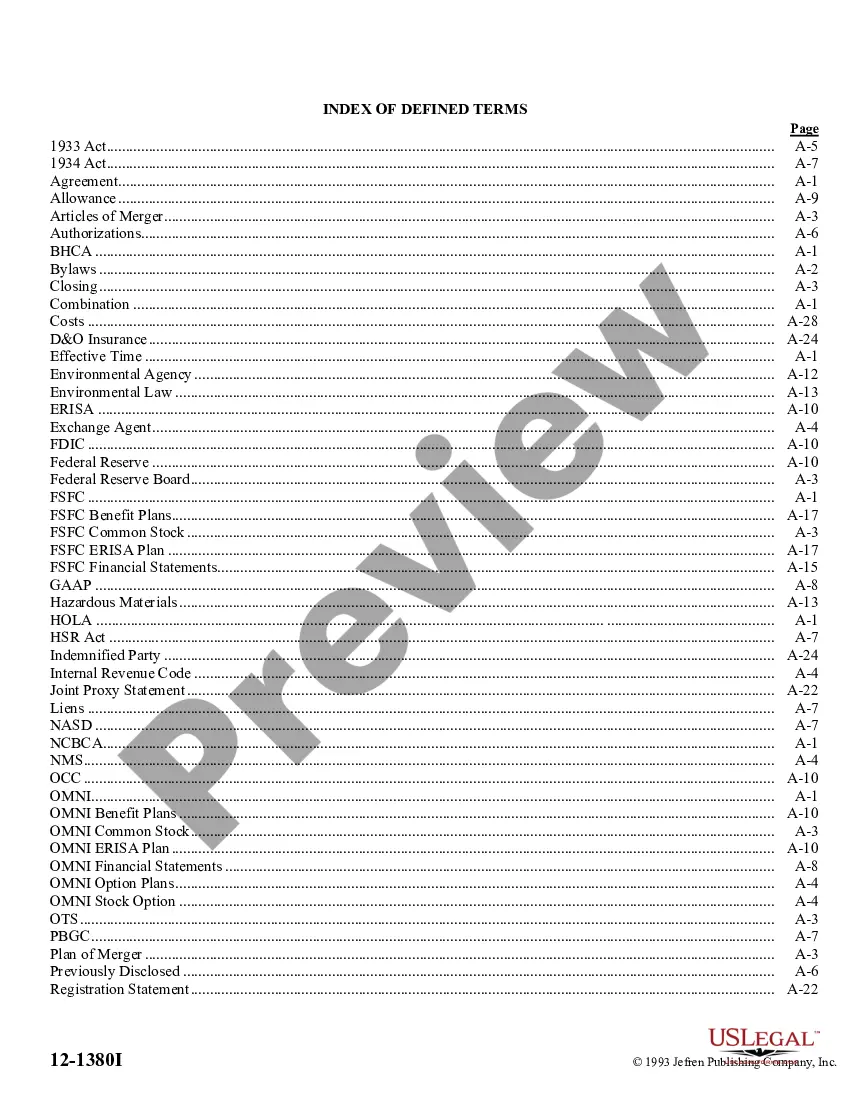

New Jersey Agreement of Combination

Description

How to fill out Agreement Of Combination?

US Legal Forms - among the largest libraries of legitimate forms in America - delivers a variety of legitimate document themes you can acquire or print out. While using web site, you can get 1000s of forms for enterprise and personal functions, categorized by groups, says, or keywords and phrases.You can find the most recent versions of forms such as the New Jersey Agreement of Combination in seconds.

If you already have a monthly subscription, log in and acquire New Jersey Agreement of Combination in the US Legal Forms collection. The Download switch can look on every develop you view. You have access to all earlier delivered electronically forms in the My Forms tab of your respective account.

In order to use US Legal Forms the first time, listed here are straightforward guidelines to help you get started off:

- Be sure you have selected the best develop for the area/county. Click on the Preview switch to check the form`s content. See the develop information to actually have selected the appropriate develop.

- If the develop does not fit your demands, utilize the Search discipline near the top of the display screen to obtain the one that does.

- If you are content with the form, validate your decision by simply clicking the Get now switch. Then, opt for the prices strategy you favor and provide your accreditations to register to have an account.

- Approach the purchase. Make use of your credit card or PayPal account to accomplish the purchase.

- Select the structure and acquire the form on the device.

- Make adjustments. Load, modify and print out and sign the delivered electronically New Jersey Agreement of Combination.

Each format you included with your account lacks an expiration day and is also your own permanently. So, in order to acquire or print out yet another backup, just proceed to the My Forms area and then click around the develop you will need.

Gain access to the New Jersey Agreement of Combination with US Legal Forms, one of the most substantial collection of legitimate document themes. Use 1000s of specialist and status-certain themes that meet your organization or personal requirements and demands.

Form popularity

FAQ

New Jersey has now adopted the Finnigan2 method, where all New Jersey-sourced receipts of all members are included in the apportionment formula, regardless of the nexus status of each member.

New Jersey has now adopted the Finnigan2 method, where all New Jersey-sourced receipts of all members are included in the apportionment formula, regardless of the nexus status of each member.

There are broadly two ways of doing this: combined reporting, which requires a multi-state corporation to add together profits of all of its subsidiaries, regardless of their location, into one report, and separate accounting, which allows companies to report the profit of each of its subsidiaries independently.

Joyce Rule: If the seller, Corporation X, has nexus in State A and is therefore taxable in State A, the sale is a State A sale. If not, the sale is thrown back to California. Finnigan Rule: ? If the seller, Corporation X, has nexus and is therefore taxable in State A, the sale is a State A sale.

Nevada, South Dakota, and Wyoming have no corporate or individual income tax (though Nevada imposes gross receipts tax. Unlike a sales tax, a gross receipts tax is assessed on businesses and apply to business-to-business transactions in addition to final consumer purchases, leading to tax pyramiding.

For example, if a New York business manufactures a machine and sells it to a customer in Pennsylvania, this sale counts toward that business' total Pennsylvania sales, but does not count toward its New York sales.

New York tops the list for highest overall tax burden, and the highest income tax, too. Hawaii has the highest sales and excise taxes and New Hampshire has the lowest.

Compensation paid to Pennsylvania residents employed in New Jersey is not subject to New Jersey Income Tax under the terms of the Reciprocal Personal Income Tax Agreement between the states. Similarly, New Jersey residents are not subject to Pennsylvania income tax either.

Joyce Rule: If the seller, Corporation X, has nexus in State A and is therefore taxable in State A, the sale is a State A sale. If not, the sale is thrown back to California. Finnigan Rule: If the seller, Corporation X, has nexus and is therefore taxable in State A, the sale is a State A sale.

The District of Columbia, Massachusetts, Michigan, Texas, New York, Vermont, West Virginia, and Wisconsin all enacted legislation to institute combined reporting within the past five years.