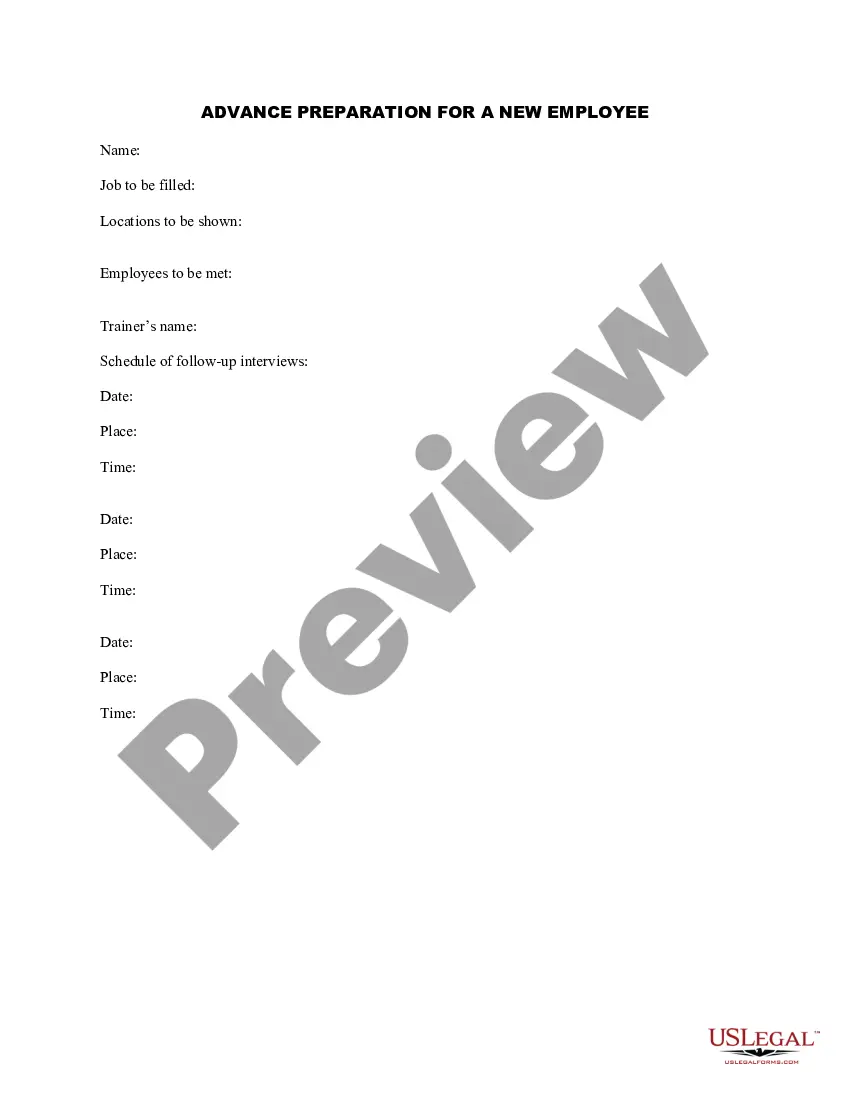

New Jersey Advance Preparation for a New Employee

Description

How to fill out Advance Preparation For A New Employee?

Have you ever entered a location where you need to have documents for either business or personal purposes every day.

There are numerous legitimate document templates accessible online, but finding ones you can trust isn’t straightforward.

US Legal Forms offers thousands of form templates, including the New Jersey Advance Preparation for a New Employee, that are crafted to meet federal and state requirements.

Utilize US Legal Forms, one of the largest collections of legitimate forms, to save time and avoid mistakes.

The service provides professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the New Jersey Advance Preparation for a New Employee template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and confirm it is for the correct city/county.

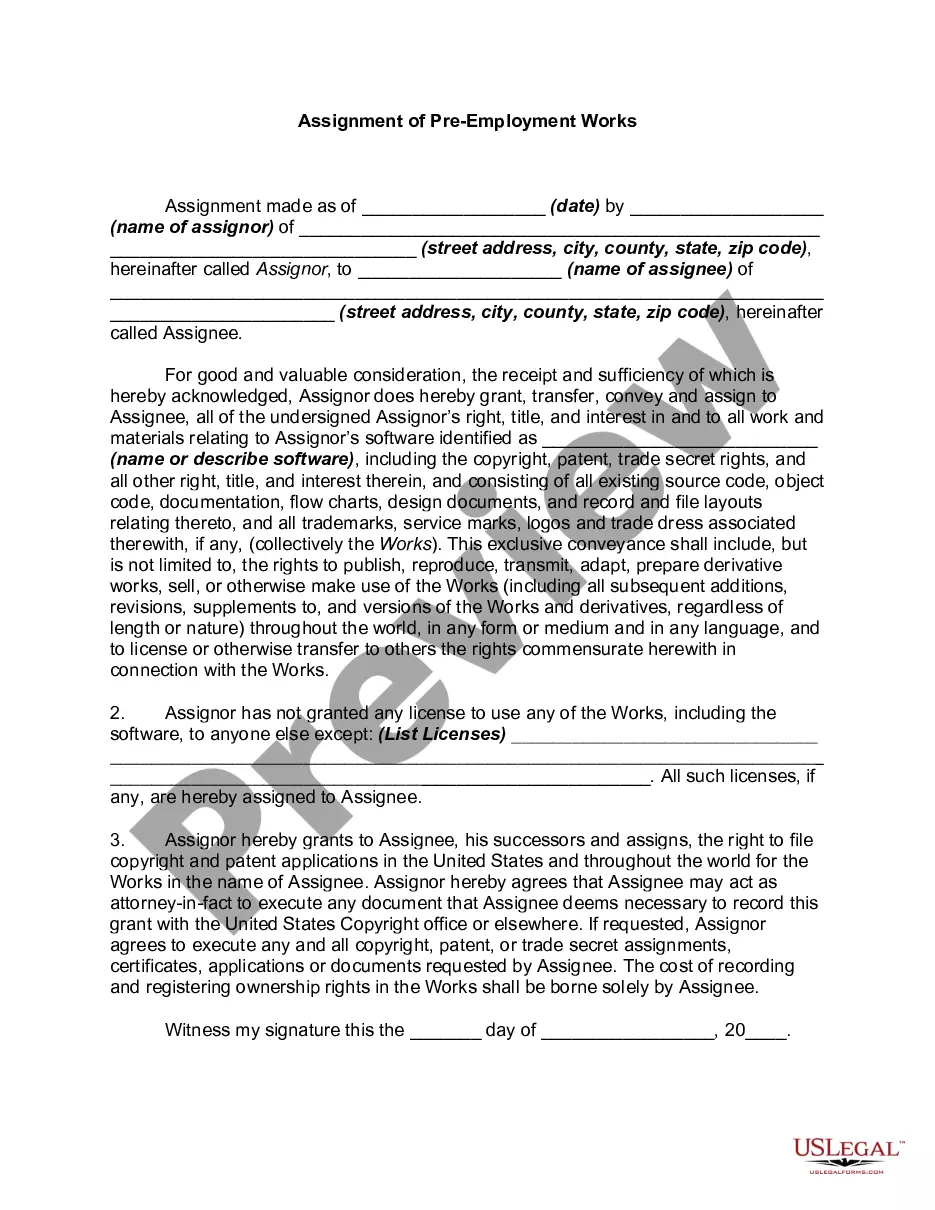

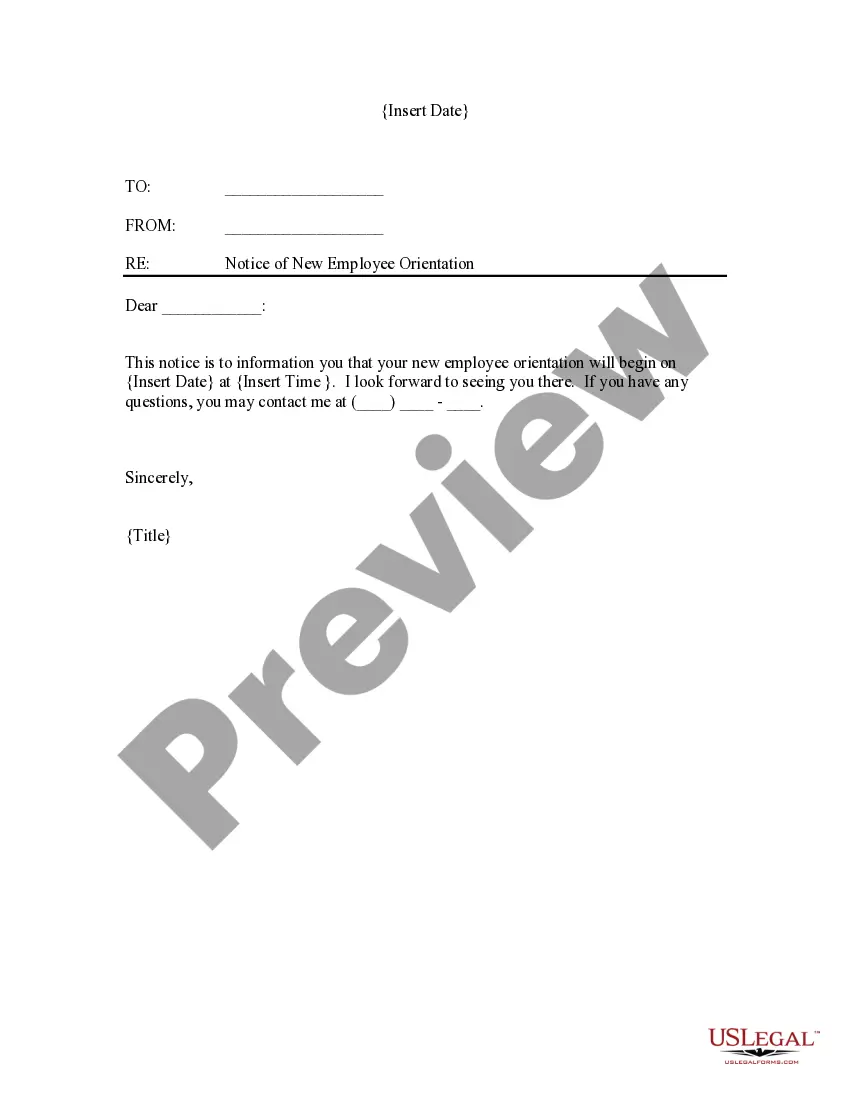

- Use the Preview button to review the form.

- Check the description to ensure that you have chosen the correct form.

- If the form isn’t what you are looking for, use the Search field to locate the form that meets your needs and specifications.

- Once you find the right form, click Get now.

- Choose the pricing plan you prefer, complete the necessary information to create your account, and pay for the order using PayPal or Visa or Mastercard.

- Select a convenient format and download your copy.

- Find all the document templates you have purchased in the My documents section.

- You can download an additional copy of New Jersey Advance Preparation for a New Employee at any time, if needed. Just click the appropriate form to download or print the document template.

Form popularity

FAQ

The program provides a safety net for New Jersey workers and their families during periods of economic downturn. The Workforce Development Partnership Fund provides funding that supports our job training efforts.

The law requires employers to: Provide schedules at least 14 days in advance, posted in a conspicuous place, including on-call shifts. Pay employees a penalty for shift changes without notice, with various rates depending on the type of violation.

Steps to Hiring your First Employee in New JerseyStep 1 Register as an Employer.Step 2 Employee Eligibility Verification.Step 3 Employee Withholding Allowance Certificate.Step 4 New Hire Reporting.Step 5 Payroll Taxes.Step 6 Workers' Compensation Insurance.Step 7 Labor Law Posters and Required Notices.More items...?

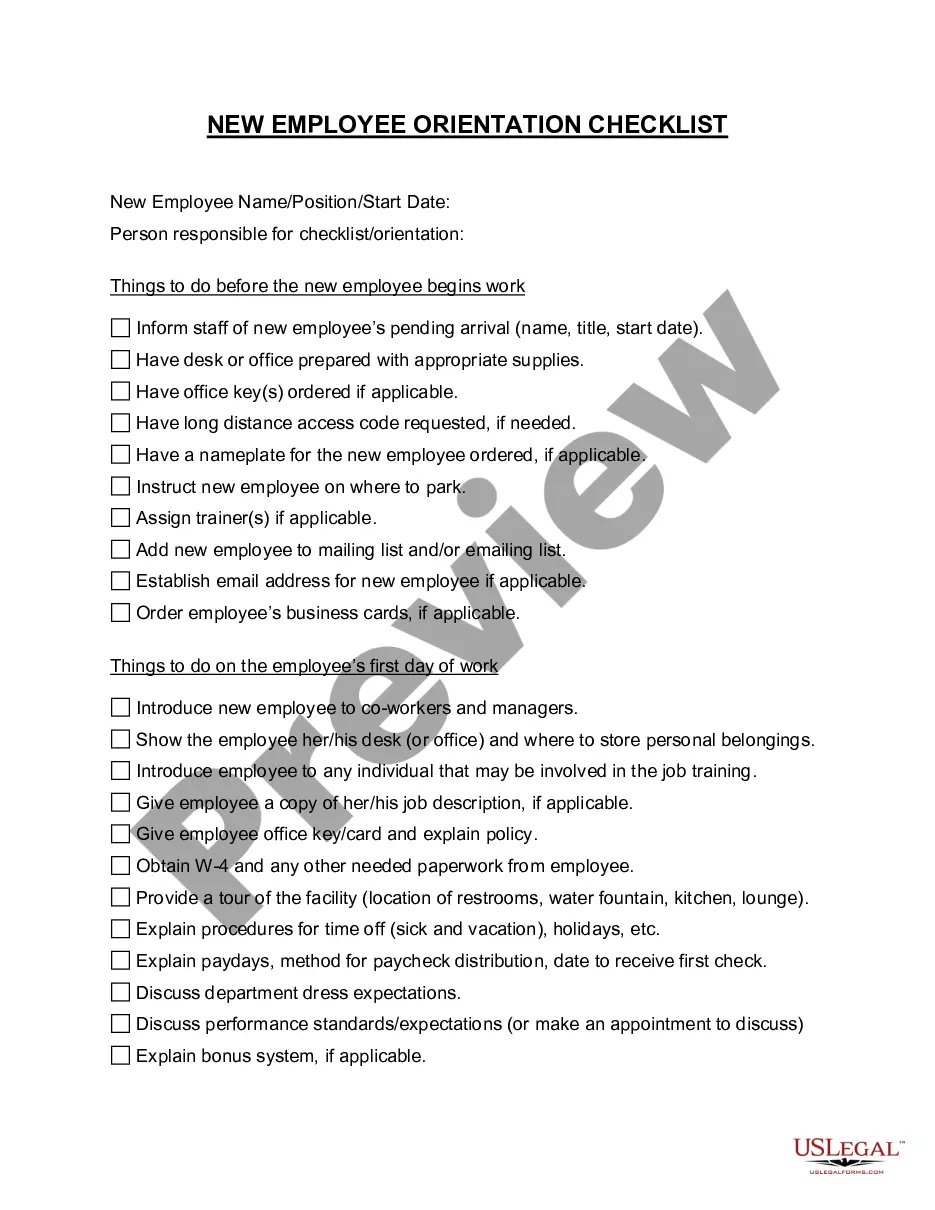

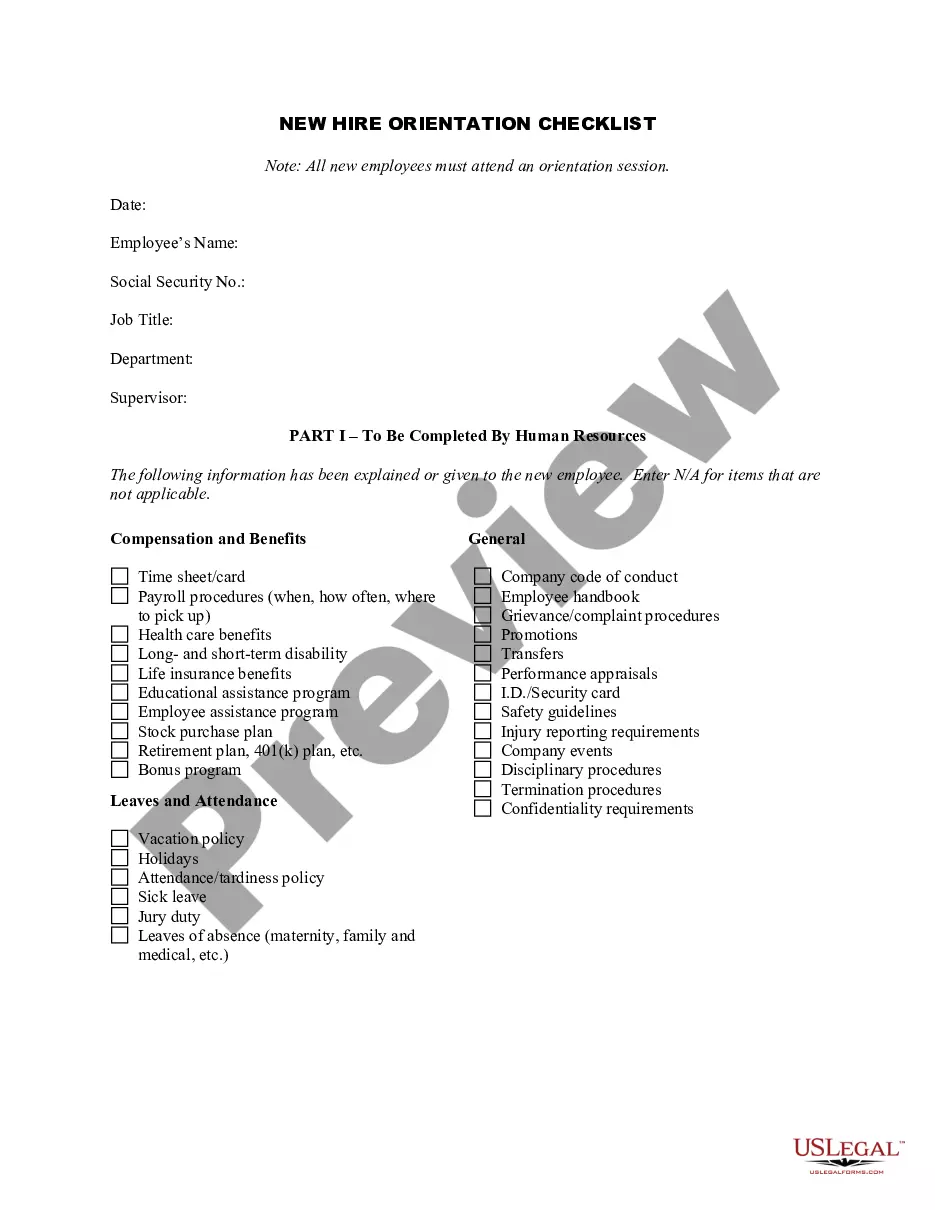

Make sure you and new hires complete employment forms required by law.W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

New Jersey employers should provide new employees with both the IRS Form W-4 and the Form NJ-W4. See Employee Withholding Forms. New Jersey employers just provide new employees with notice of employee rights under New Jersey wage and hour laws.

The new employer rate remains at 2.8% for FY 2022. The fiscal year 2022 tax rates continue to include the 0.1% Workforce Development Fund rate and the 0.0175% Supplemental Workforce Fund rate. (New Jersey Department of Labor & Workforce Development website.)

The program provides a safety net for New Jersey workers and their families during periods of economic downturn. Workforce Development. The Workforce Development Partnership Fund provides funding that supports our job training efforts.

Employees must submit basic information including name, Social Security number and citizenship status. Employees also must supply documentation along with this form to prove they are eligible to work in the United States. Documentation examples include a current passport, state issued I.D. and Social Security card.

In general, an employee only needs to complete Form NJ-W4 once.

CEAS - The Certificate of Eligibility with Advanced Standing (CEAS) is a credential issued to an individual who HAS completed a teacher preparation program and has met the basic requirements for certification including academic study and applicable test requirements.