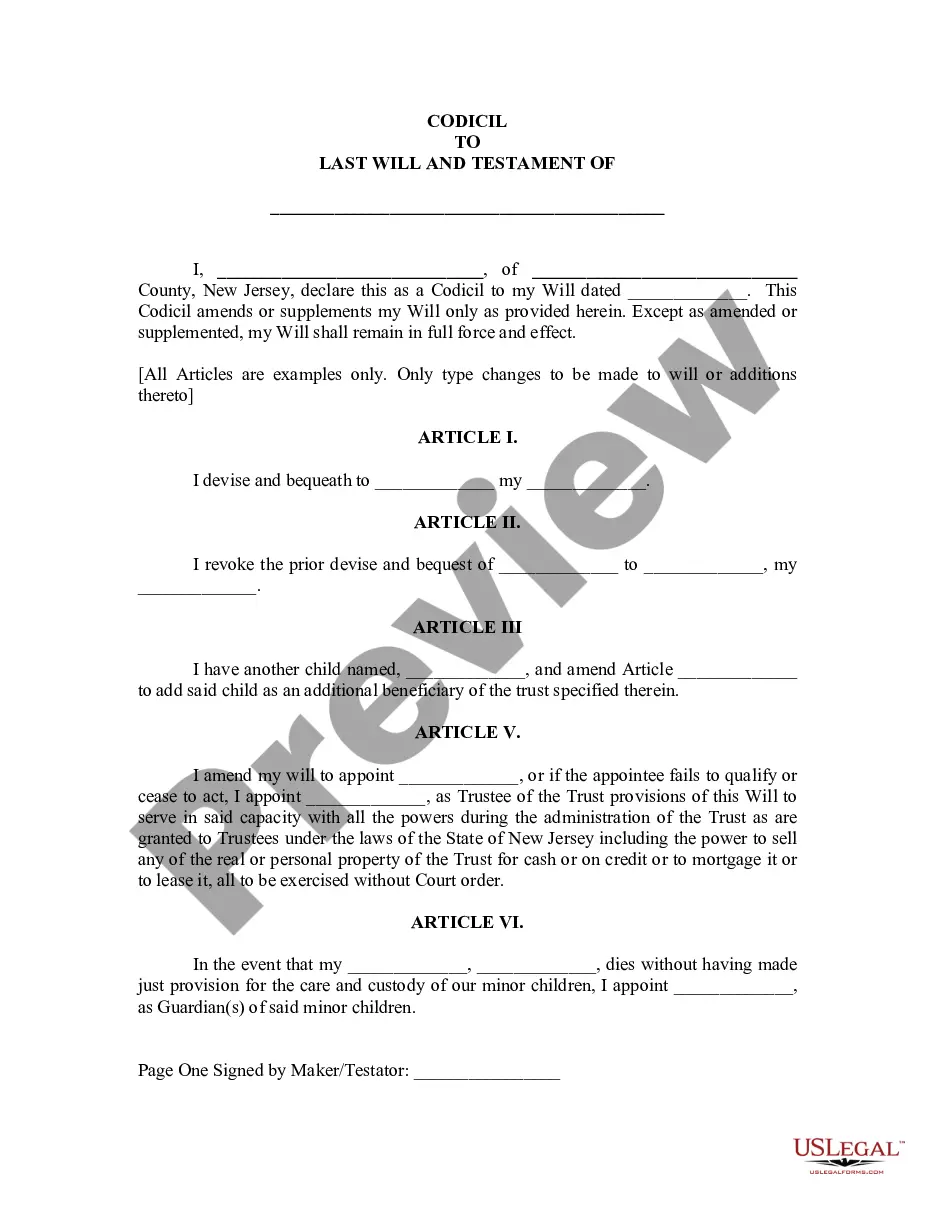

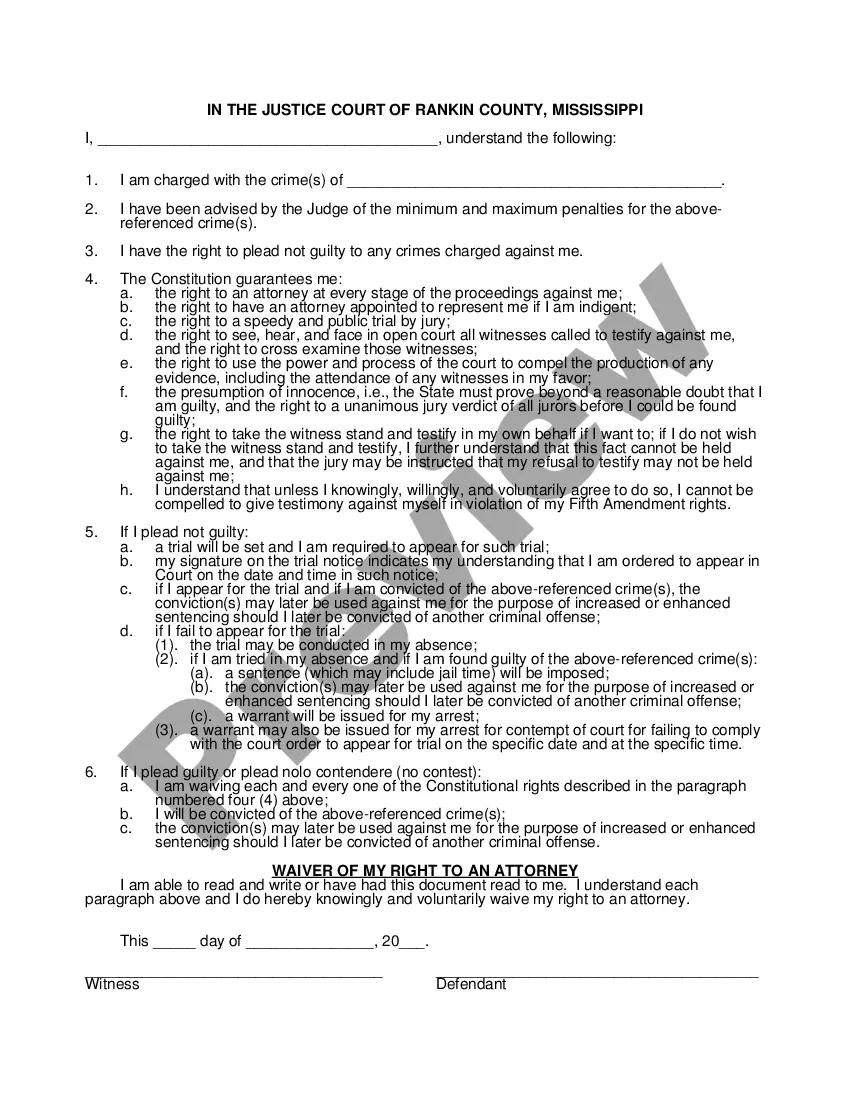

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

New Jersey Assignment of Pre-Employment Works

Description

How to fill out Assignment Of Pre-Employment Works?

Are you presently in a situation where you require documents for either business or personal purposes frequently? There are numerous legal document templates accessible online, but finding trustworthy options can be challenging.

US Legal Forms offers thousands of form templates, including the New Jersey Assignment of Pre-Employment Works, that are designed to comply with state and federal regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the New Jersey Assignment of Pre-Employment Works template.

- Obtain the form you need and ensure it is for the correct area/state.

- Utilize the Review button to examine the form.

- Check the description to confirm that you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the form that meets your needs and requirements.

- Once you locate the appropriate form, click on Purchase now.

- Select the pricing plan you desire, fill in the required details to create your account, and complete the transaction using your PayPal or credit card.

- Choose a convenient file format and download your copy.

Form popularity

FAQ

The approval time for NJ working papers can vary, but generally it takes between one to two weeks. This timeframe depends on various factors including the completeness of your application and the current workload of the approving authority. Ensuring that your New Jersey Assignment of Pre-Employment Works documentation is accurate can help speed up this process. If you have concerns about the approval time, US Legal Forms offers resources to guide you through obtaining your working papers efficiently.

Yes, filling out the NJ W4 is important for any employee in New Jersey. This form helps determine the correct amount of state tax to withhold from your paycheck. By completing your NJ W4, you ensure compliance with state regulations, which is a crucial step in your New Jersey Assignment of Pre-Employment Works. For assistance in completing your forms, consider using the tools available on the US Legal Forms platform.

In New Jersey, certain medical expenses can be deductible, including medical fees, prescriptions, and some out-of-pocket costs. Understanding these deductions can be especially beneficial while managing finances under the New Jersey Assignment of Pre-Employment Works. Be sure to maintain records to support your claims and consult with a tax professional for personalized guidance.

To file your WR-30 form in New Jersey, you can complete it online or submit a paper version to the appropriate state department. This step is important for your compliance when engaging in the New Jersey Assignment of Pre-Employment Works, as it enables you to report hours worked and wages accurately. Make sure to check deadlines to avoid penalties.

The NJ 500 form is the New Jersey Employer’s Quarterly Report, which provides details about employment and wages. Filing this form is crucial when dealing with aspects of the New Jersey Assignment of Pre-Employment Works. Accurately reporting your information ensures adherence to state regulations and contributes to effective payroll management.

To amend your WR-30 form in New Jersey, you need to fill out the necessary sections of the form accurately and submit it to the Division of Revenue and Enterprise Services. If you are involved in the New Jersey Assignment of Pre-Employment Works, ensure that all the information is up-to-date to avoid discrepancies. This process can help maintain compliance and reflect any changes in your employment status.

Yes, SEP contributions are tax-deductible in New Jersey. This means that you can reduce your income tax liability by the amount contributed to your SEP plan. While navigating the New Jersey Assignment of Pre-Employment Works, it's beneficial to understand how these contributions work within both state and federal tax frameworks.

In New Jersey, SEP contributions are typically deductible, aligning with federal standards. When exploring the New Jersey Assignment of Pre-Employment Works, remember to check for any specific state regulations that might affect how these deductions apply to you. Consulting with a tax professional can help clarify these details to maximize your savings.

Yes, your SEP contribution is generally tax-deductible on your federal tax return. When considering the New Jersey Assignment of Pre-Employment Works, it's important to ensure that your contributions conform to IRS guidelines, allowing you to capitalize on these benefits. This deduction can reduce your taxable income, providing a potential financial advantage.

Upon starting a new job, an employee must complete various forms to fulfill legal and company requirements. These typically include the W-4 and I-9 forms, along with any other specific forms relevant to the New Jersey Assignment of Pre-Employment Works. Properly completing these forms is essential for tax purposes and employment eligibility.