New Jersey Business Deductibility Checklist

Description

How to fill out Business Deductibility Checklist?

You can spend hours online searching for the legal document template that meets your state and federal requirements.

US Legal Forms offers thousands of legal forms that are reviewed by experts.

You can easily download or print the New Jersey Business Deductibility Checklist from your account.

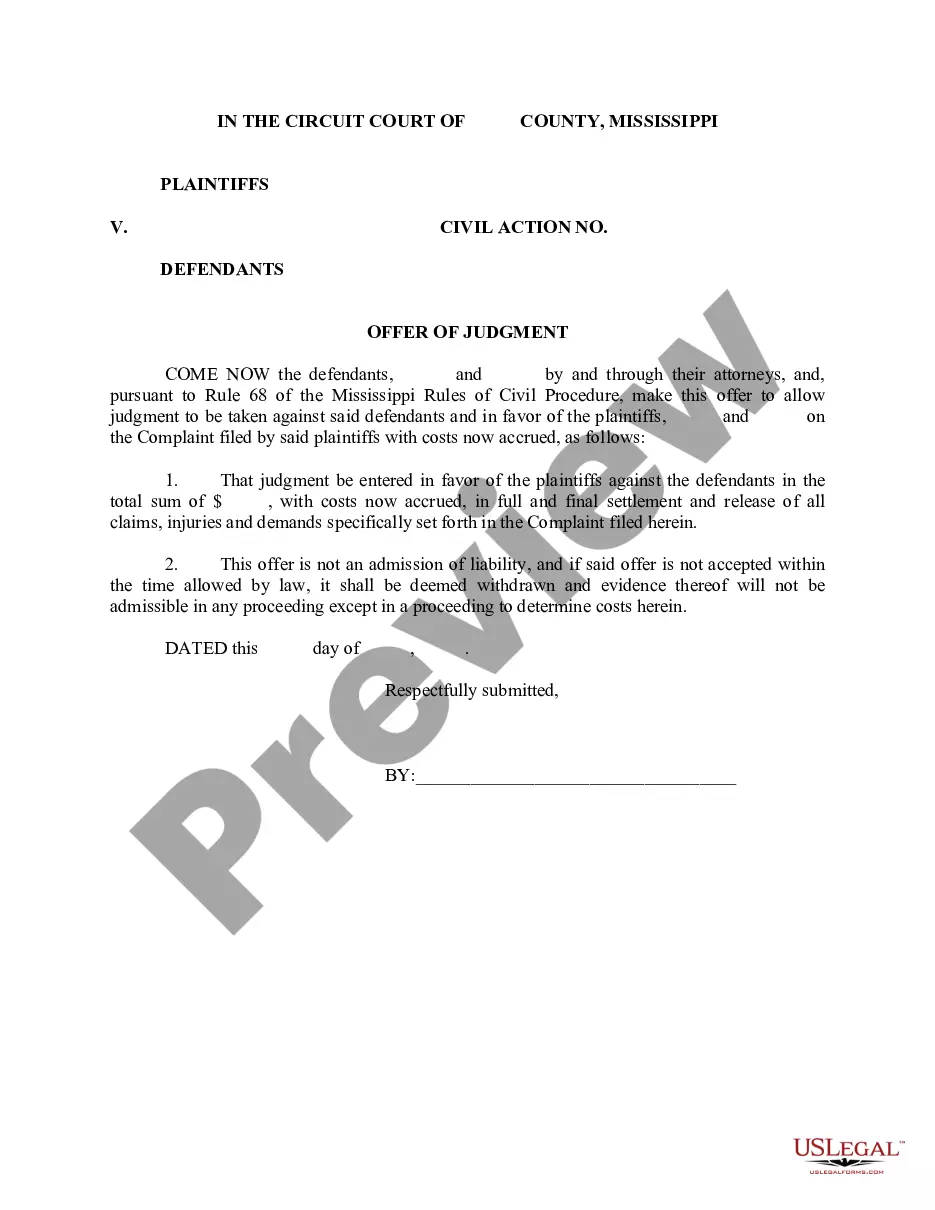

If available, use the Preview button to view the document template as well.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- After that, you can complete, edit, print, or sign the New Jersey Business Deductibility Checklist.

- Every legal document template you purchase is yours to keep permanently.

- To obtain another copy of any purchased form, visit the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your preferred state/city.

- Check the form description to confirm you have picked the right template.

Form popularity

FAQ

NJ instructions indicate the state taxable income is pulled from the W-2 box 16 entry. The state of New Jersey does not have a standard deduction amount. If you enter your itemized federal deductions into the return, amounts that apply to NJ will be pulled to the New Jersey return.

Federal Self-Employment Tax The current self-employment tax rate is 15.3 percent. You'll be able to deduct some of your business expenses from your income when calculating how much self-employment tax you owe.

You can claim 50% of what you pay in self-employment tax as an income tax deduction. For example, a $1,000 self-employment tax payment reduces taxable income by $500.

The State of New Jersey does not require the use of a signature document for New Jersey Gross Income Tax returns filed electronically. Both Form NJ 8879 (NJ-E FILE Signature Authorization) and Form NJ 8453 (State of New Jersey Individual Income tax Declaration for Electronic Filing) have been discontinued.

If you provide a service, own a business, or own and run a farm, you are self-employed. Self-employment income is reported as Net Profits From Business on your New Jersey Income Tax return.

You can claim a $1,000 exemption for yourself and your spouse/CU partner (if filing a joint return) or your Domestic Partner.Senior 65+ Exemptions.Blind or Disabled Exemptions.Veteran Exemptions.Dependent Exemptions.Dependent Attending College Exemptions.Medical Expenses.More items...?

For 2021, they get the normal standard deduction of $25,100 for a married couple filing jointly. They also both get an additional standard deduction of $1,350 for being over age 65. They get one more additional standard deduction because Susan is blind.

New Jersey 2021 Standard DeductionsNew Jersey does not have a standard deduction.

Yes, you can deduct self-employment tax as a business expense. It's actually one of the most common self-employment tax deductions. The self-employment tax rate is 15.3% of net earnings. That rate is the sum of a 12.4% Social Security tax and a 2.9% Medicare tax on net earnings.

The 2020 standard deduction is increased to $24,800 for married individuals filing a joint return; $18,650 for head-of-household filers; and $12,400 for all other taxpayers.