New Jersey Employee Payroll Records Checklist

Description

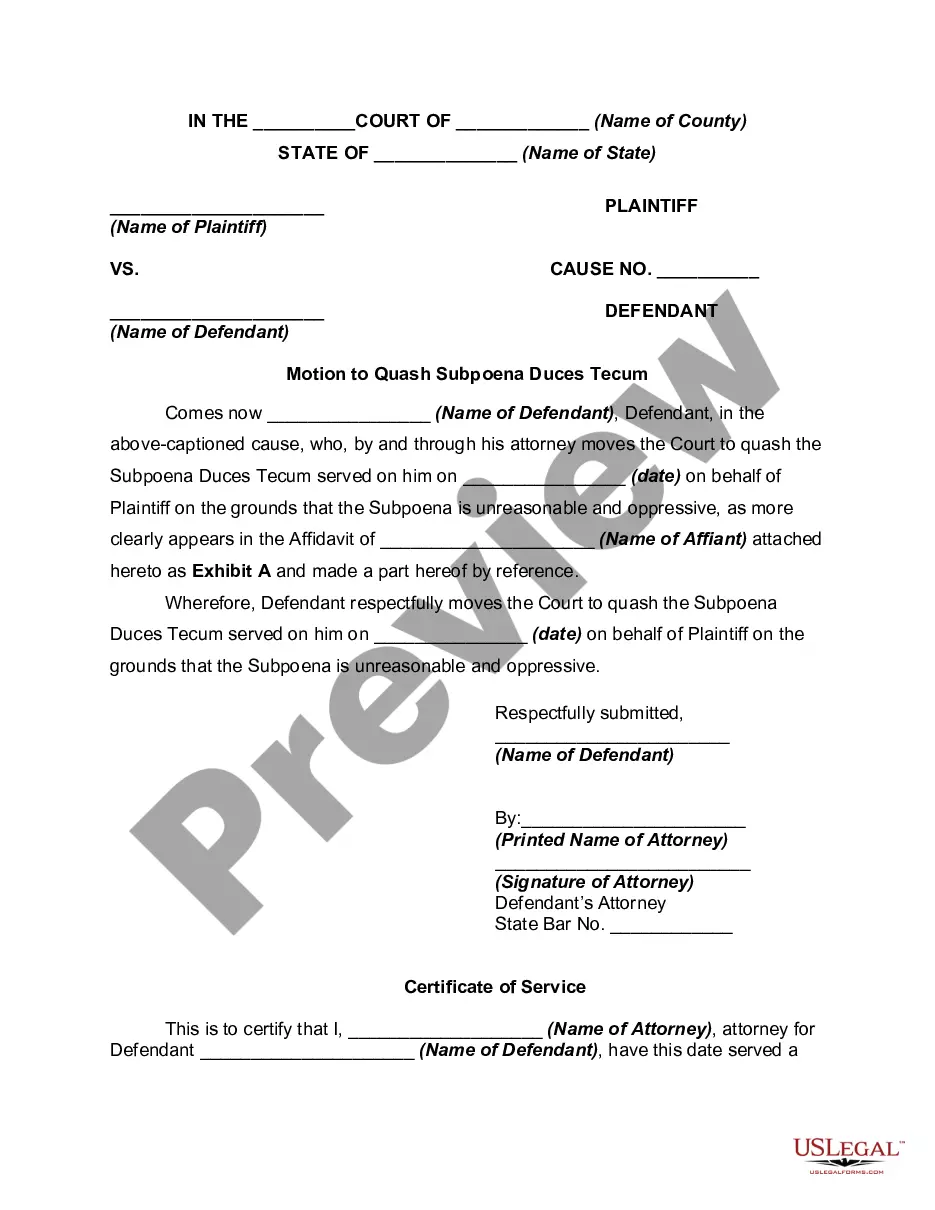

How to fill out Employee Payroll Records Checklist?

US Legal Forms - one of the most extensive collections of legal documents in the United States - offers a diverse selection of legal form templates that you can download or print.

By utilizing the website, you will find a vast number of forms for both business and personal use, organized by categories, states, or keywords. You can access the latest forms, including the New Jersey Employee Payroll Records Checklist, within moments.

If you already have an account, Log In to download the New Jersey Employee Payroll Records Checklist from the US Legal Forms collection. The Download button will appear on each form you view. You can find all previously downloaded forms in the My documents section of your account.

Complete the transaction using your credit card or PayPal account.

Choose the format and download the form to your device. Edit, fill out, and print or sign the downloaded New Jersey Employee Payroll Records Checklist. Every template you add to your account doesn't expire and remains your property indefinitely. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the form you need.

- Make sure you have selected the correct form for your city/state.

- Click the Preview button to review the form's contents.

- Check the form description to confirm you've chosen the right one.

- If the form doesn’t meet your needs, use the Search box at the top of the screen to find the appropriate one.

- When satisfied with the form, confirm your selection by clicking the Purchase now button.

- Then, select your preferred pricing plan and provide your information to create an account.

Form popularity

FAQ

New employees in New Jersey typically need to fill out the W-4 for federal taxes, the NJ-W4 for state taxes, and the I-9 form for employment verification. Completing these forms accurately is critical for proper payroll processing and compliance. The New Jersey Employee Payroll Records Checklist can guide new hires through these forms to ensure nothing is overlooked.

Employers must provide new employees with essential forms like the W-4, NJ-W4, and any company-specific documentation not limited to handbooks or policy agreements. These documents ensure that both the employer and employee are on the same page regarding tax withholdings and company expectations. The New Jersey Employee Payroll Records Checklist can be an invaluable tool in keeping track of these forms.

A New Jersey employment agreement should clearly outline the terms of employment, including job responsibilities, compensation, and duration of employment. It should also specify any confidentiality clauses or non-compete agreements, if applicable. Using the New Jersey Employee Payroll Records Checklist can provide a structured approach to drafting and maintaining this essential document for all employees.

New employees in New Jersey are typically required to complete several forms, including the W-4, NJ-W4, and possibly I-9, which verifies work eligibility. Completing these forms helps establish a proper payroll record for the employee. Consulting the New Jersey Employee Payroll Records Checklist can help new hires navigate these requirements efficiently and accurately.

When starting a new job in New Jersey, employees must complete the W-4 form and the NJ-W4. The W-4 form determines federal tax withholding, while the NJ-W4 focuses on state tax. Ensuring these forms are completed accurately is crucial for compliance, and referring to the New Jersey Employee Payroll Records Checklist can simplify the process for both employees and employers.

In New Jersey, employers are required to retain payroll records for at least six years. This requirement aligns with federal regulations, ensuring that businesses remain compliant with both state and federal laws. Not maintaining accurate payroll records can lead to legal challenges, so it's essential to follow the New Jersey Employee Payroll Records Checklist. This checklist can help you manage and archive your records effectively.

You can store payroll records via paper or online files. Develop a recordkeeping system that works best for you. With paper-based recordkeeping, you can store files in locked cabinets. Be sure to label each of your folders so you can easily access your records.

What to Include in an Employee Files ChecklistJob description.Job application and/or resume.Job offer.IRS Form W-4.Receipt or signed acknowledgment of employee handbook.Performance evaluations.Forms relating to employee benefits.Forms providing emergency contacts.More items...?

Payroll records are the combined documents pertaining to payroll that businesses must maintain for each individual that they employ. This includes pay rates, total compensation, tax deductions, hours worked, benefit contributions and more.

The documents commonly need for payroll recordkeeping include but are not limited to:Employee personal information.Employment information.Timesheets.Pay information.Tax documents.Deduction information.Paid and unpaid leave records.Direct deposit information.More items...