New Jersey Nonexempt Employee Time Report

Description

How to fill out Nonexempt Employee Time Report?

You could spend hours online seeking the legal document format that satisfies the federal and state requirements you need.

US Legal Forms provides a vast array of legal templates that can be evaluated by professionals.

You can conveniently download or print the New Jersey Nonexempt Employee Time Report from their service.

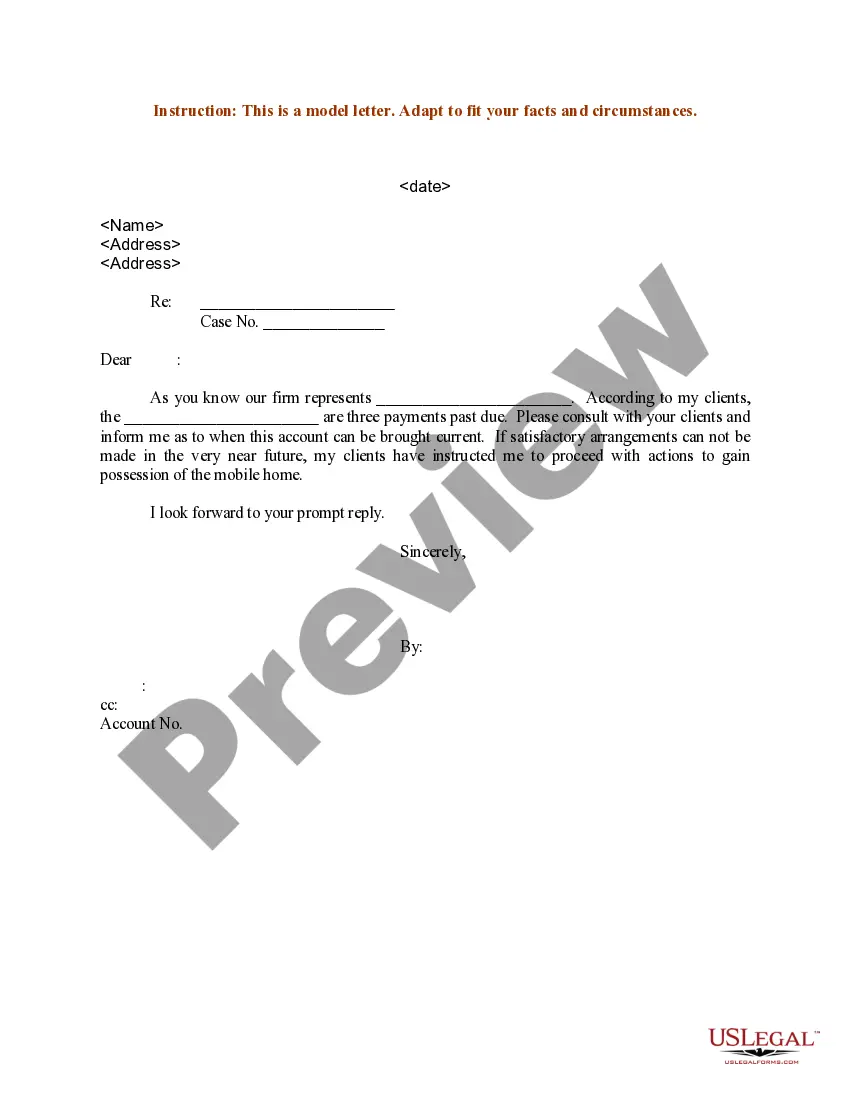

If available, use the Preview button to review the format as well.

- If you already have a US Legal Forms account, you can Log In and press the Acquire button.

- Then, you can fill out, modify, print, or sign the New Jersey Nonexempt Employee Time Report.

- Each legal document format you obtain is yours indefinitely.

- To acquire another copy of any purchased form, navigate to the My documents section and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct format for the state/city you choose.

- Review the form details to confirm you have selected the appropriate template.

Form popularity

FAQ

New Jersey's overtime laws In New Jersey, the law requires that nonexempt workers are paid one-and-one-half times their regular hourly rate for all hours that they work beyond 40 in a week. Overtime pay is not required when workers work more than eight hours in one day.

An employer should give an employee who works an irregular shift pattern reasonable notice of their hours. Normally this would be included in the contract of employment and the standard notice period is around 7 days.

A New Jersey employee reporting for duty must be paid for at least one hour of work, unless the employer has made available to the employee the minimum number of hours of work previously agreed upon for that day. There are no further exceptions.

653a and the New Jersey Statutes Annotated 2A:17-56.61 requires all employers to report newly hired and re-hired employees to a state directory within 20 days of their hire date. New hire reporting is required by law in all 50 states, and has been mandatory since October, 1998.

Reg. 285/01, which is being retained for transitional purposes. Subsection 21.2(1) provides that, under certain circumstances, employees must be paid at least three hours' pay at the employee's regular rate of pay, even though the employee has worked less than three hours.

Employers must provide employees with a written work schedule, including on-call shifts, before the schedule begins (commonly around 14 days preceding the first day of the schedule).

A. "Reporting time pay is a form of wages that compensate employees who are scheduled to report to work but who are not put to work or furnished with less than half of their usual or scheduled day's work because of inadequate scheduling or lack of proper notice by the employer.

Employer are required to post written schedules 14 days in advance, which identifies all employees scheduled to work as well as those who are not scheduled. Predictability Pay.

If you are a non-exempt employee, you have the right to receive minimum hourly wages, overtime at a rate of one-and-one-half times your hourly rate and the right to be paid for all of the hours you work under federal and state law.

No more than 40 hours per week. No more than eight hours per day. Not before 6 a.m. or after 11 p.m. Not before 6 a.m. or after 12 midnight on Fridays and Saturdays or days not followed by a school day.