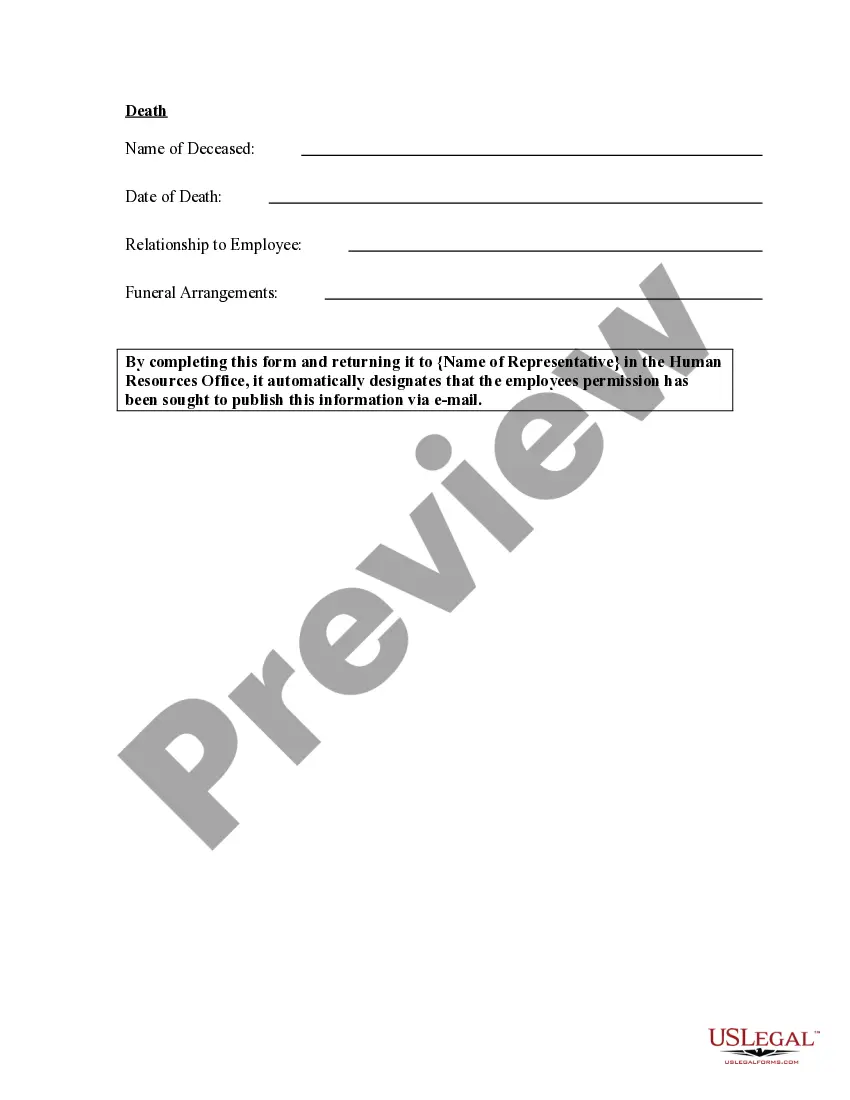

New Jersey Employee News Form

Description

How to fill out Employee News Form?

Locating the appropriate legal document template can be challenging. Certainly, there are numerous templates accessible online, but how do you find the legal form you need? Utilize the US Legal Forms website. The platform offers thousands of templates, including the New Jersey Employee News Form, which can be used for both business and personal purposes.

All of the forms are reviewed by professionals and comply with federal and state regulations.

If you are already a member, Log Into your account and click the Acquire button to locate the New Jersey Employee News Form. Use your account to browse through the legal forms you have purchased previously. Visit the My documents section of your account to retrieve another copy of the document you need.

Complete, modify, print, and sign the acquired New Jersey Employee News Form. US Legal Forms is the largest library of legal forms where you can find a wide array of document templates. Leverage the service to access professionally crafted documents that adhere to state regulations.

- If you are a new user of US Legal Forms, here are simple steps you should follow.

- First, ensure you have selected the correct form for your city/state. You can preview the form using the Preview button and review the form description to confirm it is suitable for you.

- If the form does not satisfy your needs, use the Search field to find the right form.

- Once you are certain that the form is appropriate, click the Buy Now button to obtain the form.

- Choose the payment plan you prefer and enter the necessary information. Create your account and pay for your order using your PayPal account or credit card.

- Select the file format and download the legal document template to your device.

Form popularity

FAQ

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

In general, an employee only needs to complete Form NJ-W4 once. An employee completes a new form only when they want to revise their withholding information.

How to e-file NJ-W3Go to the Employees menu and select Payroll Tax Forms & W-2's.Choose Tax Form Worksheets in Excel.Click Annual W-2/W3.Pick Last Year in the Dates section.Hit Create Report.

All WR-30 forms must be completed and submitted through the State of New Jersey, Division of Taxation website. To do so, you will need a New Jersey taxpayer identification number and Personal Identification Number (PIN). A PIN can be obtained by registering your business with the Division of Taxation.

Before you can add an employee to your team, you are legally responsible for confirming the employee is eligible to work in the United States.Form I-9.Form W-4.State W-4.Emergency contact form.Employee handbook acknowledgment form.Bank account information form.Benefits forms.

A single person who lives alone and has only one job should place a 1 in part A and B on the worksheet giving them a total of 2 allowances. A married couple with no children, and both having jobs should claim one allowance each.

How to e-file NJ-W3Go to the Employees menu and select Payroll Tax Forms & W-2's.Choose Tax Form Worksheets in Excel.Click Annual W-2/W3.Pick Last Year in the Dates section.Hit Create Report.

New Jersey employers should provide new employees with both the IRS Form W-4 and the Form NJ-W4. See Employee Withholding Forms. New Jersey employers just provide new employees with notice of employee rights under New Jersey wage and hour laws.

A single person who lives alone and has only one job should place a 1 in part A and B on the worksheet giving them a total of 2 allowances. A married couple with no children, and both having jobs should claim one allowance each.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.