New Jersey Affidavit of No Coverage by Another Group Health Plan

Description

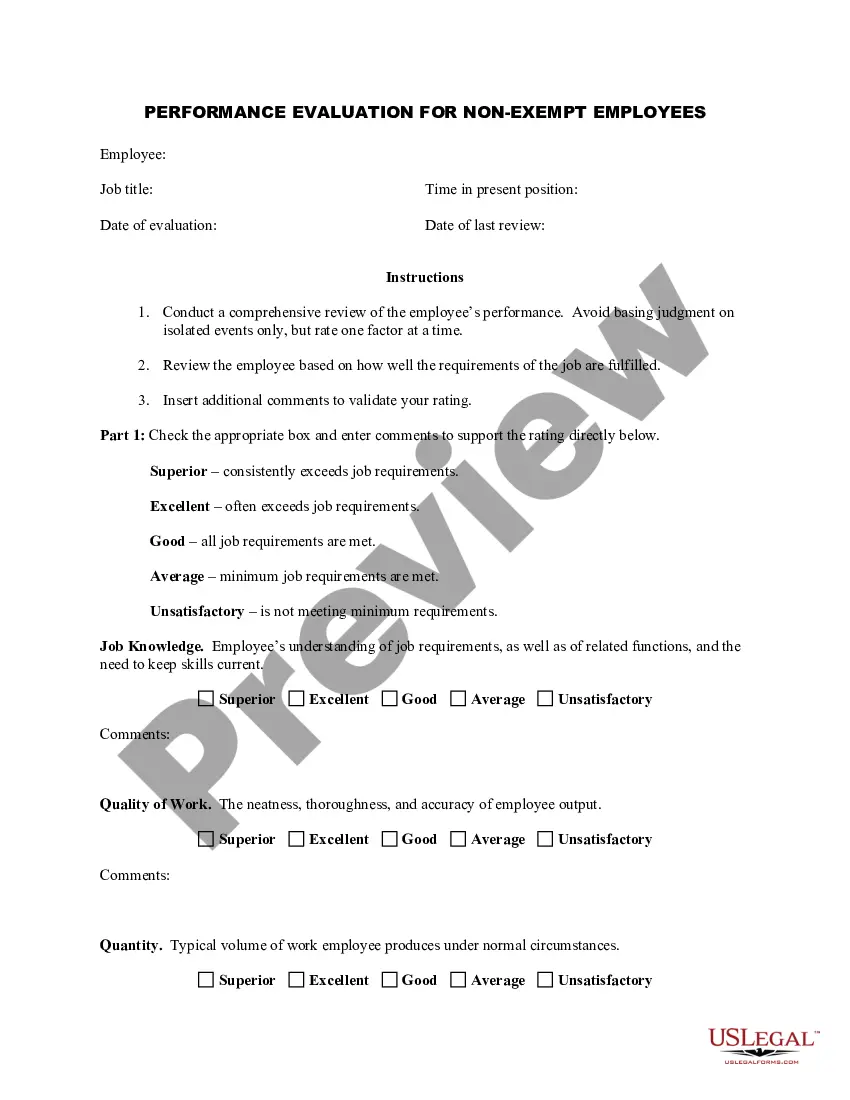

How to fill out Affidavit Of No Coverage By Another Group Health Plan?

If you wish to gather, acquire, or produce official document templates, utilize US Legal Forms, the premier collection of legal forms available online.

Take advantage of the site's straightforward and user-friendly search feature to locate the documents you require.

An assortment of templates for business and personal purposes are organized by categories and jurisdictions, or keywords.

Step 4. Once you have located the form you want, click the Buy now button.

Choose the payment plan you prefer and enter your credentials to register for the account.

- Utilize US Legal Forms to locate the New Jersey Affidavit of No Coverage by Another Group Health Plan in just a few clicks.

- If you are already a US Legal Forms customer, sign into your account and click the Purchase button to find the New Jersey Affidavit of No Coverage by Another Group Health Plan.

- You can also access templates you previously obtained in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the directions below.

- Step 1. Ensure you have selected the form for your specific city/region.

- Step 2. Use the Review option to examine the details of the form. Don't forget to read the information.

- Step 3. If you are not satisfied with the template, use the Search field at the top of the screen to find other variations of the legal form design.

Form popularity

FAQ

The New Jersey Health Insurance Market Preservation Act requires most state residents to maintain health coverage. You and your tax household must have minimum essential health coverage, qualify for an exemption, or remit a Shared Responsibility Payment when you file your New Jersey Income Tax return.

Yes, the Domestic Partnership Act allows local employers to require the employee to pay for the coverage of his or her domestic partner. In other words, If an employee wants his partner to be covered, he may have to pay for that coverage.

Many companies do allow for "domestic partners," which is what your fiance would be if you live together, but not all and it totally depends on your company. Be aware that if you ARE able to add your fiance to your policy that any premiums will come out of your check post-tax.

The minimum amount of New Jersey auto insurance coverage is $15,000/$30,000/$5,000. In the event of a covered accident, your limits for bodily injury are $15,000 per person, with a total maximum of $30,000 per incident. It also covers up to $5,000 for damage to another person's property.

Auto insurance is mandatory in New Jersey, but the type and cost of that coverage can vary significantly. Every day, consumers are finding that there are options available to make it easier to comply with the law. The Automobile Insurance Cost Reduction Act mandated that a Basic Policy be available to all drivers.

It is mandatory for all drivers in New Jersey. Its purpose is to pay for medical expenses or other costs for the driver or their passengers following an accident. It is awarded regardless of who is at fault in the accident. The minimum required is $15,000, but you can purchase up to $250,000 of PIP.

There is no penalty for not having ACA mandated coverage in 2022 unless you live in a state like New Jersey or Massachusetts where it is mandated by the state.

New Jersey law requires all drivers to carry auto insurance that includes both liability and personal injury protection (PIP) coverages. Uninsured motorist and collision and comprehensive coverages aren't required in New Jersey but can be added to your policy.

For most lower-income single adults, the penalty will be $695 per year. The penalty applies for every month you do not have minimum essential coverage (MEC).

New Jersey's mandate, which mirrors the federal requirement, includes an annual penalty of 2.5 percent of a household's income or a per-person charge whichever is higher. The maximum penalty based on a per-person charge will be $2,085.