New Jersey Resolution of Meeting of LLC Members to Pursue Lawsuit

Description

How to fill out Resolution Of Meeting Of LLC Members To Pursue Lawsuit?

Selecting the optimal legal document template can be a challenge. Clearly, there are numerous templates accessible online, but how do you locate the legal form you require.

Utilize the US Legal Forms website. This service offers a vast array of templates, such as the New Jersey Resolution of Meeting of LLC Members to Pursue Lawsuit, which can be utilized for both business and personal purposes. All forms are vetted by experts and comply with federal and state regulations.

If you are already a registered user, Log In to your account and click the Download button to retrieve the New Jersey Resolution of Meeting of LLC Members to Pursue Lawsuit. Use your account to browse the legal forms you have acquired previously. Navigate to the My documents tab in your account and obtain another copy of the document you need.

Select the file format and download the legal document template to your device. Finally, complete, edit, and print/sign the obtained New Jersey Resolution of Meeting of LLC Members to Pursue Lawsuit. US Legal Forms is the largest repository of legal forms where you can access a variety of document templates. Take advantage of the service to download expertly crafted documents that meet state standards.

- First, ensure you have selected the correct form for your area/state.

- You can review the form by clicking the Review button and read the form description to confirm it is suitable for you.

- If the form does not meet your requirements, utilize the Search field to find the appropriate form.

- Once you are confident that the form is correct, click the Purchase now button to obtain the form.

- Choose the pricing plan you prefer and enter the necessary details.

- Create your account and finalize your purchase using your PayPal account or credit/debit card.

Form popularity

FAQ

For investment companies like mutual funds, corporate indemnification of a director is not permitted under Section 17(h) of the Investment Company Act of 1940 (1940 Act) for willful misfeasance, bad faith, gross negligence or reckless disregard of the duties involved in the conduct of his sic officeso called

Unfortunately, many LLCs form without drafting any sort of contracts about the rights and duties of the parties. In those cases, members in an LLC can only sue one another if they can prove that they have been personally harmed apart from the other members or the business.

Under most circumstances, members of a limited liability company, or LLC, are protected against being personally named in a lawsuit against the business entity, but that is not always the case.

LLC members and managers are generally not liable for the LLC's debts and other liabilities. However, California Corporations Code Section 17703.04 establishes specific instances in which members or managers may be held personally liable for company debts and other liabilities.

This means that the company is a legal entity itself and, therefore, it can: Sue and be sued. Own property. Take out loans.

The eponymous characteristic of the limited liability company (LLC) is that the LLC, as a separate legal entity, is liable for its obligations to others and that no other person, whether as owner or agent, is vicariously liable for those same obligations.

Indemnification is a key protection for officers, directors and key employees, and the scope of an LLC's or corporation's indemnity provisions demands close attention. In an LLC, indemnification is completely discretionary and the scope of indemnification, if any, can be defined in the LLC's Operating Agreement.

Many LLC Acts have a provision dealing with indemnification. Some have a general statement that an LLC must indemnify members or managers for liabilities they incurred in the ordinary course of the business of the company.

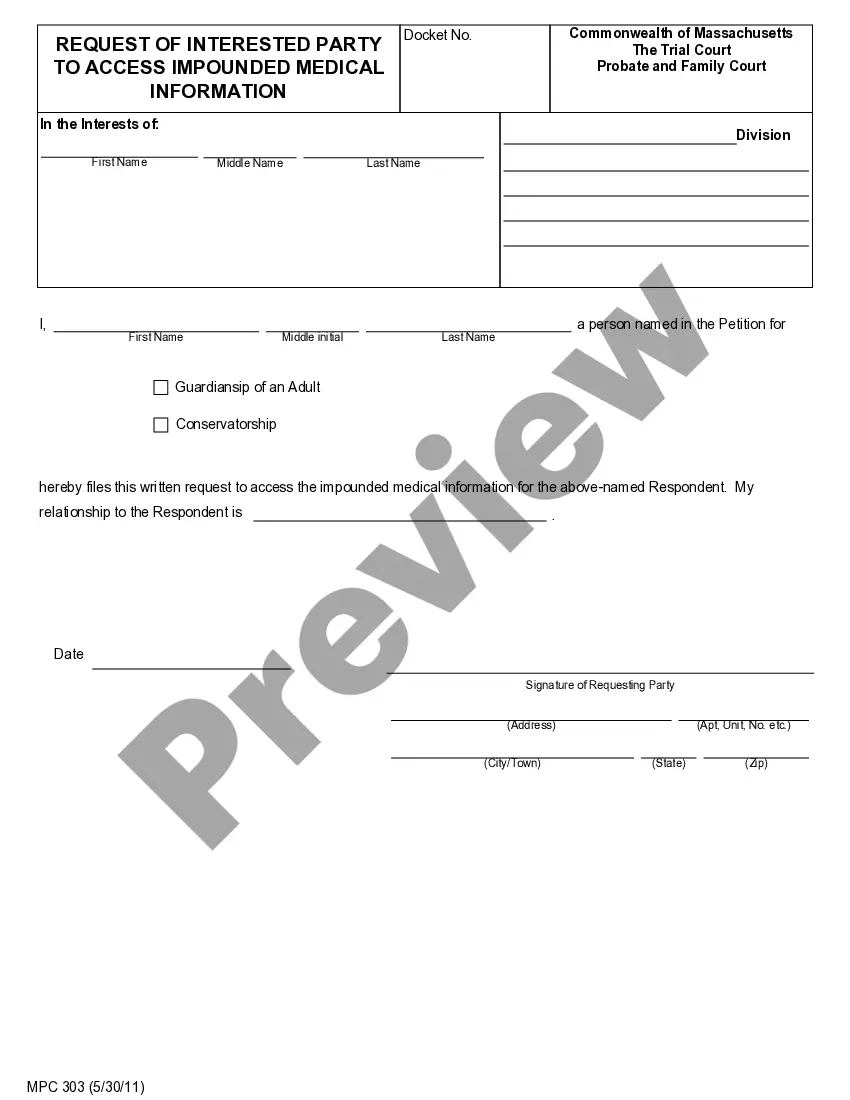

An LLC resolution is a document describing an action taken by the managers or owners of a company, with a statement regarding the issue that needs to be voted on. This does not need to be a complicated document, and need only include necessary information.

3. Negligence. A common question that many people have is, Can I sue my business partner for negligence? The short answer to this question is yes.