New Jersey Telecommuting Policy

Description

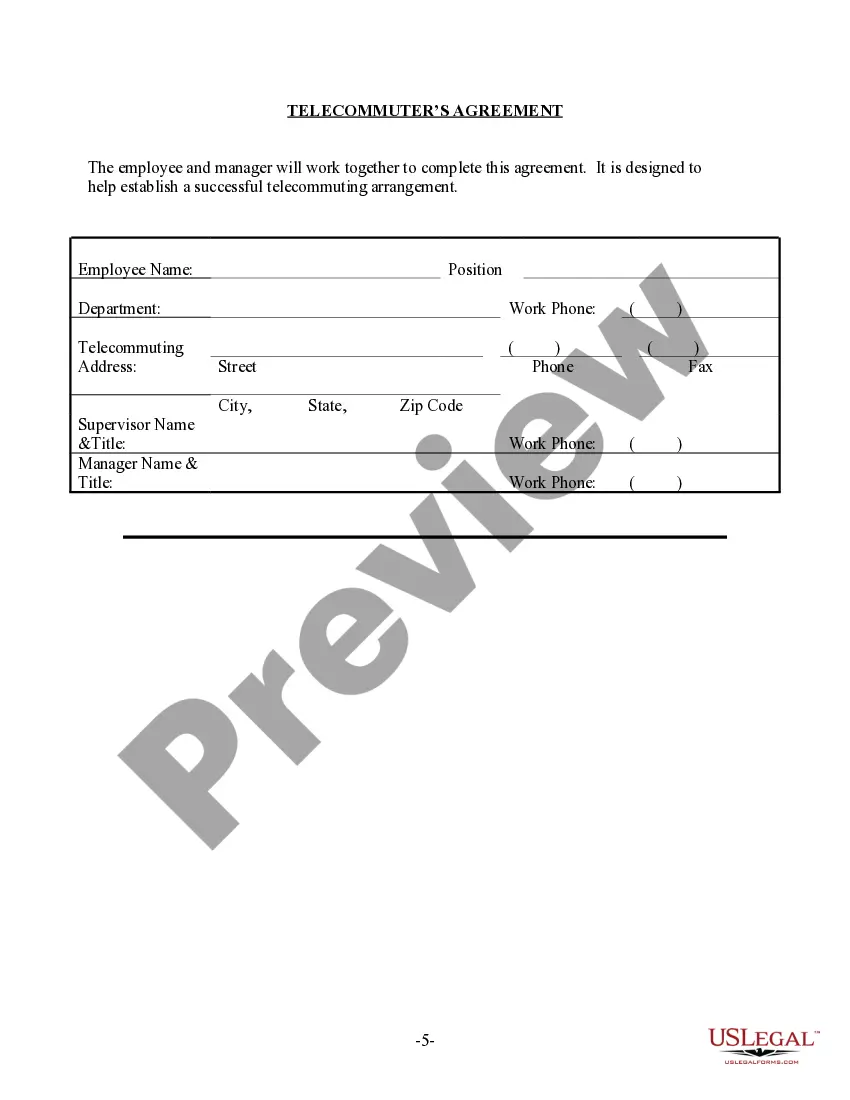

How to fill out Telecommuting Policy?

US Legal Forms - one of the foremost libraries of legal documents in the United States - offers an assortment of legal form templates that you can download or print.

By utilizing the site, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords.

You can find the latest forms such as the New Jersey Telecommuting Policy in just minutes.

Review the form details to ensure you have picked the appropriate form.

If the form does not align with your requirements, utilize the Search box at the top of the page to locate the one that does.

- If you have a subscription, sign in and download the New Jersey Telecommuting Policy from the US Legal Forms collection.

- The Download button will be visible on each form you view.

- You have access to all previously saved forms under the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple instructions to get started.

- Ensure you have selected the correct form for your city/county.

- Click the Review button to examine the form's content.

Form popularity

FAQ

If you're among the employed Americans who were allowed to work remotely during the pandemic last year, count your blessings. But if you worked from a state other than the one where your employer is based, you may have to pay up for that privilege come tax time.

In general, if you're working remotely you'll only have to file and pay income taxes in the state where you live. However, in some cases, you may be required to file tax returns in two different states. This depends on your particular situation, the company you work for, and the tax laws of the states involved.

The State of New Jersey employs over 70,000 people. They fill a broad spectrum of positions, providing essential support and services to the citizens of the State.

Here are the 10 best states for working from home, according to WalletHub's report:Delaware. Total score: 64.03.Connecticut. Total score: 62.18.Massachusetts. Total score: 61.87.Utah. Total score: 61.87.Texas. Total score: 61.59.Washington. Total score: 61.57.Maryland. Total score: 61.48.New York. Total score: 61.11.More items...?

U.S. National remote jobs can be worked from anywhere in the U.S. Anywhere remote jobs can be done from anywhere in the world.

Today, a preference for working from home is driving these decisions rather than concerns about the coronavirus. Fully 76% of workers who indicate that their workplace is available to them say a major reason why they are currently teleworking all or most of the time is that they prefer working from home.

New Jersey residents who work in New York State must file a New York Nonresident Income Tax return (Form IT-203) as well as a New Jersey Resident Income Tax Return (Form NJ-1040). Your employer will have withheld New York state taxes throughout the year but you'll need to file in New Jersey as well.

Effective October 1, 2021, the New Jersey Division of Taxation (the NJDT) ended the temporary relief period with regard to employers' obligation to withhold income taxes for teleworking employees who work in New Jersey.

Employee possesses skills critical to unit functioning. Employee has compelling family health circumstances that impact their ability to report to work (outside of their own disability accommodation). Employee's job duties require them to be in a specific remote location.

New Jersey's Civil Service Commission has approved a pilot program under which state departments and authorities, with two notable exceptions, will be tasked with offering telework to their employees for one year, beginning no later than July 1.