New Jersey Specific Guaranty

Description

How to fill out Specific Guaranty?

You have the ability to spend hours online looking for the legal document template that meets the federal and state requirements that you need.

US Legal Forms offers a vast array of legal forms that can be reviewed by professionals.

You can easily download or print the New Jersey Specific Guaranty from my services.

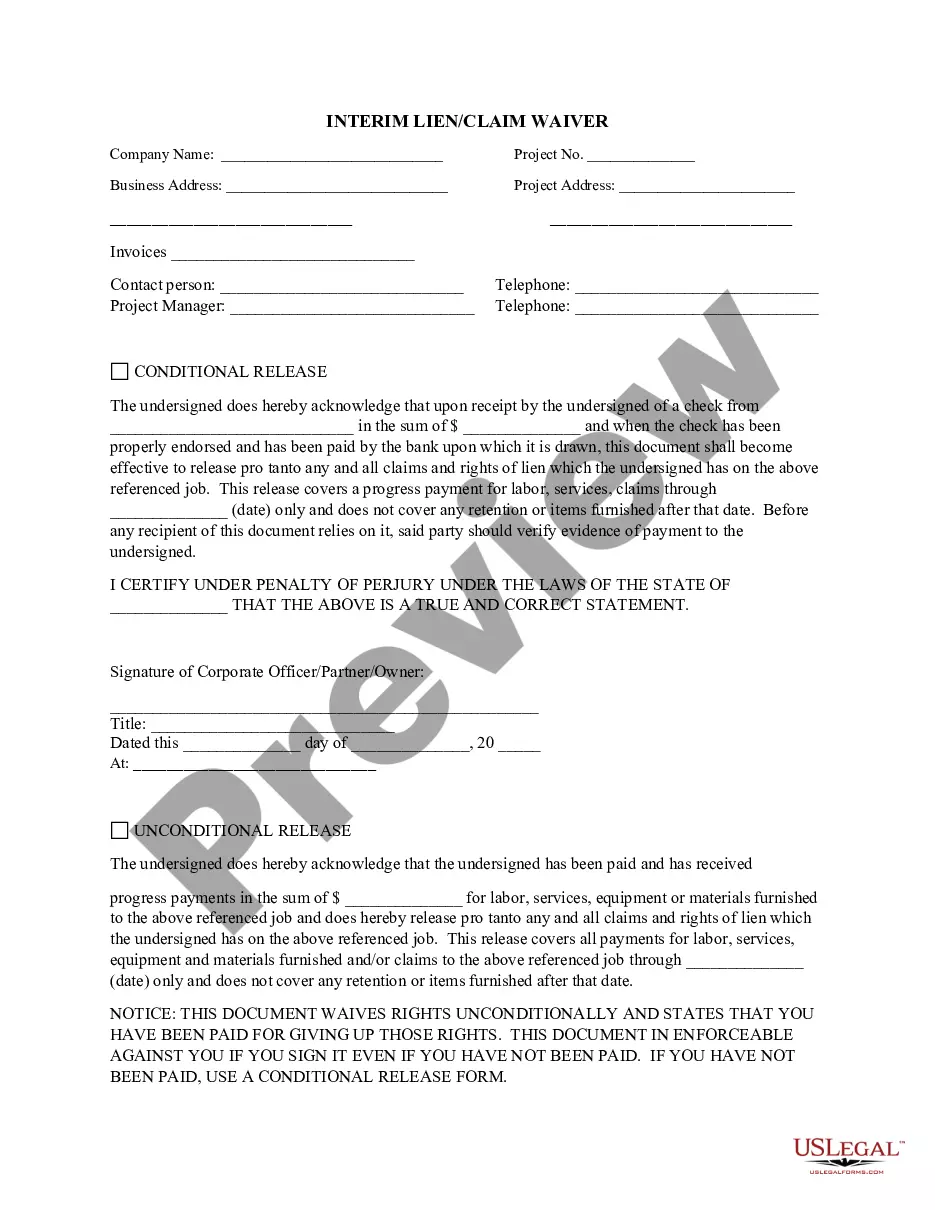

If available, make use of the Preview button to view the document template as well.

- If you already possess a US Legal Forms account, you may Log In and click the Obtain button.

- After that, you can complete, edit, print, or sign the New Jersey Specific Guaranty.

- Every legal document template you purchase is your own property indefinitely.

- To get another copy of any purchased form, navigate to the My documents tab and click the appropriate button.

- If you're using the US Legal Forms website for the first time, follow the simple instructions outlined below.

- First, ensure that you have selected the correct document template for the area/town of your choice.

- Check the form description to confirm that you have chosen the correct form.

Form popularity

FAQ

Filling out a W4 in New Jersey involves a few straightforward steps. Start by providing your personal information, including your name, address, and Social Security number. Then, you'll need to indicate your filing status and any additional allowances you wish to claim. By completing this form correctly, you can ensure that your employer withholds the right amount of taxes, which is essential for managing your finances and making the most of your New Jersey Specific Guaranty options.

The guaranty fund for real estate in New Jersey serves as a safeguard for consumers against financial loss due to unethical actions by licensed real estate agents. Under the New Jersey Specific Guaranty, individuals can seek compensation if they suffer a loss linked to fraud or misrepresentation by an agent. This fund highlights New Jersey's commitment to enhancing the security of its real estate environment, benefiting both buyers and sellers. For tailored resources and forms regarding the New Jersey Specific Guaranty, consider exploring the USLegalForms platform.

The guaranty fund in real estate is a financial reserve designed to protect buyers and investors from losses caused by the dishonesty or misdeeds of real estate professionals. This fund provides a safety net, ensuring that stakeholders have a level of insurance against potential fraud. When discussing the New Jersey Specific Guaranty, it’s important to understand that this fund plays a crucial role in maintaining trust in the real estate market. By offering this protection, it promotes confidence among buyers and sellers alike.

The New Jersey state guarantee refers to the protection offered by programs like NJ Pliga, which safeguards policyholders when an insurance company fails. This guarantee ensures that you can still receive compensation for valid claims, promoting confidence in the insurance market. By participating in the New Jersey Specific Guaranty system, you are further safeguarded against unforeseen circumstances affecting your coverage.

The tax ID number in New Jersey, also known as the Employer Identification Number (EIN), usually consists of nine digits formatted as XX-XXXXXXX. This number is vital for businesses when filing taxes, hiring employees, and complying with state regulations. Securing your tax ID and understanding its use is a key part of your business operations, aligning with the requirements of the New Jersey Specific Guaranty.

In New Jersey, the contact number for inquiries related to surplus lines insurance is typically available through the Department of Banking and Insurance. It's crucial for you to have this number handy for any questions regarding filings or regulations. They can provide assistance tailored to your needs, ensuring you navigate the requirements effectively. This resource helps maintain the efficiency of the New Jersey Specific Guaranty process.

The SLA number, or Surplus Lines Authorization number, in New Jersey follows a specific format. Generally, it is a combination of letters and numbers, often containing the letters 'SLA' followed by several numeric digits. This identification number is essential for insurers operating in the surplus lines market, ensuring compliance with New Jersey laws. When dealing with the New Jersey Specific Guaranty, always ensure your SLA number is accurate.

The NJ Pliga surcharge is typically calculated as a percentage of the premiums collected by insurers for specific coverages. This surcharge is designed to fund the guaranty association, thereby ensuring support for claims made when an insurer fails. The exact rate may vary, so it is best to check current guidelines to understand how it will affect your premiums. This aspect is part of New Jersey's commitment to maintaining the integrity of its Specific Guaranty framework.

The business entity ID number in New Jersey is a unique identifier assigned to businesses registered in the state. This number is essential for various legal and financial transactions, as it helps distinguish your business from others. You will often need this ID for compliance purposes and when applying for licenses or permits. Make sure you have your New Jersey Specific Guaranty and your business ID all squared away.

The CEO of the New Jersey Property Liability Insurance Guaranty Association (NJPLIGA) plays a pivotal role in overseeing operations and ensuring policyholder protection. As the head of NJPLIGA, this individual oversees the management of funds, ensuring that the New Jersey Specific Guaranty operates efficiently. You can find updated information about leadership through official NJPLIGA resources.