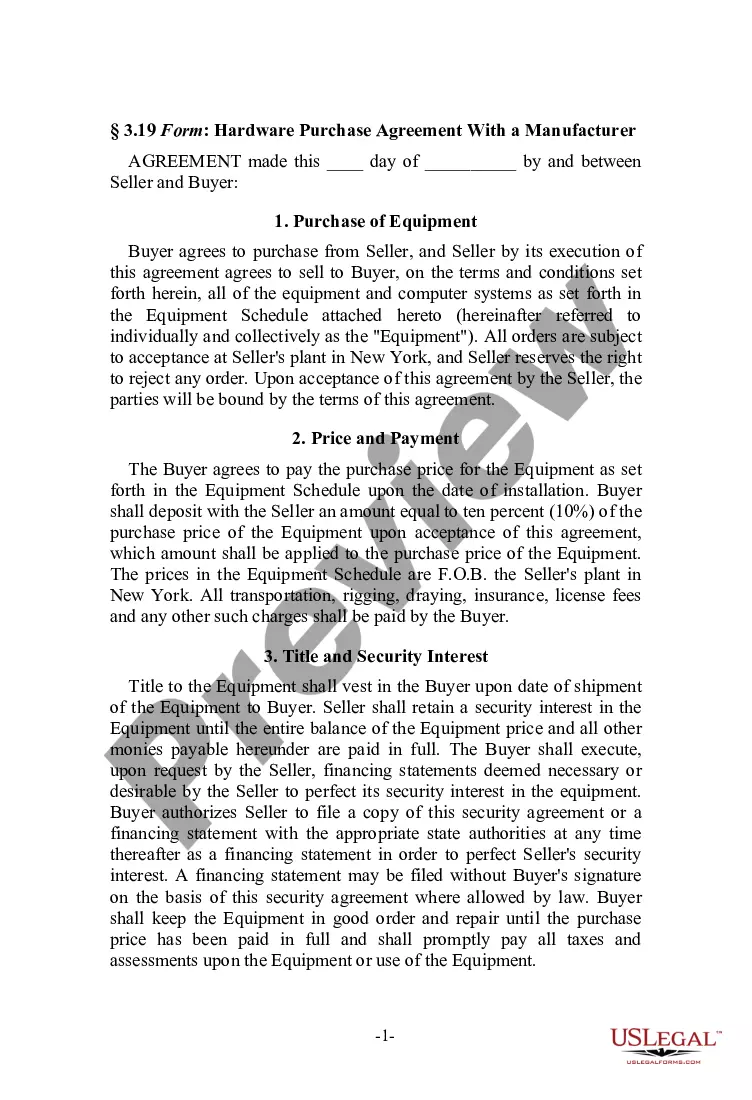

New Jersey Computer Hardware Purchase Agreement with a Manufacturer

Description

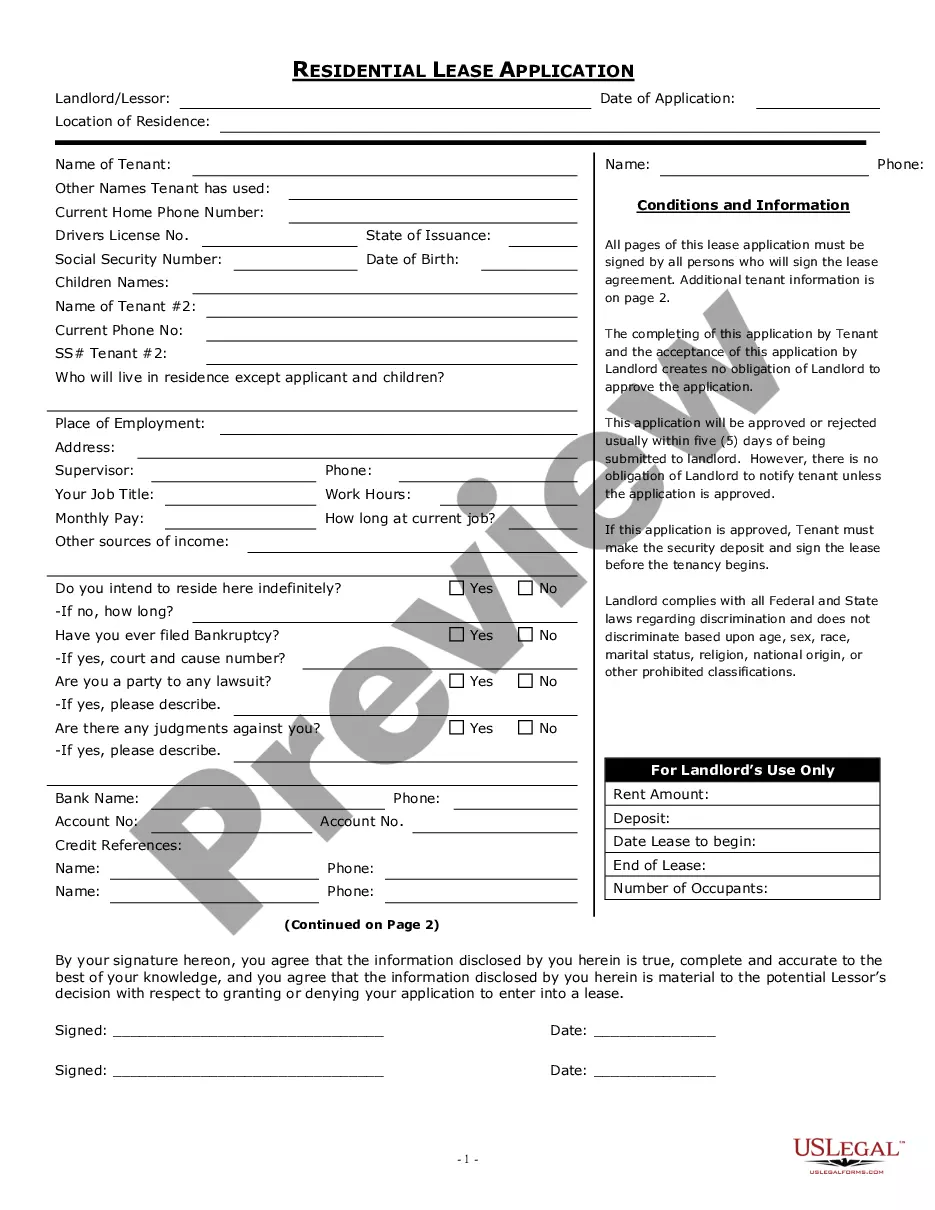

How to fill out Computer Hardware Purchase Agreement With A Manufacturer?

You can spend countless hours online trying to locate the legal template that satisfies the state and federal requirements you need.

US Legal Forms provides a vast collection of legal documents that are reviewed by experts.

You can obtain or create the New Jersey Computer Hardware Purchase Agreement with a Manufacturer from our service.

If available, utilize the Review button to view the document template as well. If you wish to find another version of the form, use the Search field to locate the template that meets your needs and requirements.

- If you already possess a US Legal Forms account, you may Log In and click on the Acquire button.

- After that, you can fill out, modify, create, or sign the New Jersey Computer Hardware Purchase Agreement with a Manufacturer.

- Each legal document template you receive is yours permanently.

- To obtain another copy of any purchased form, go to the My documents tab and click the corresponding button.

- If you are accessing the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the correct document template for the region/city that you choose.

- Review the form description to confirm you have selected the correct template.

Form popularity

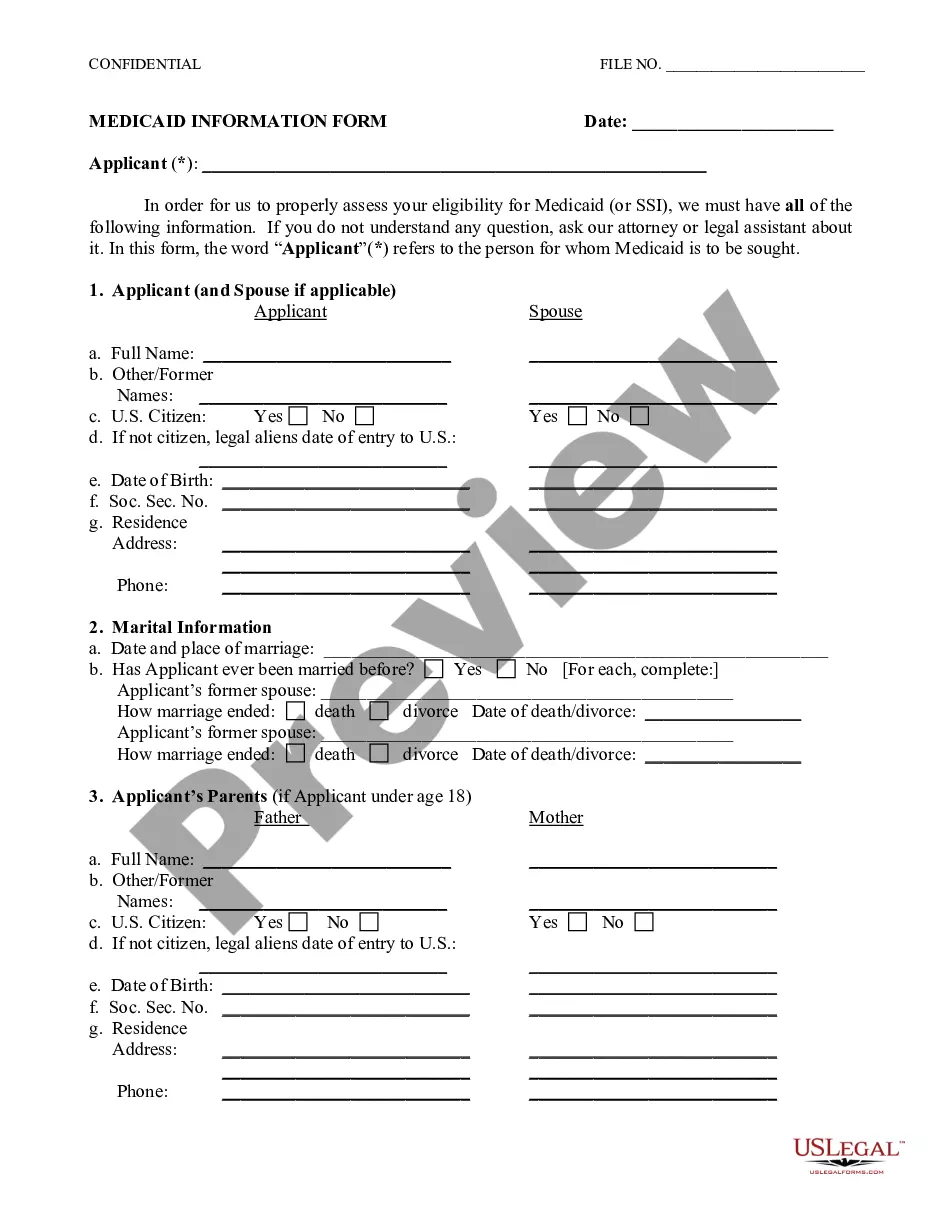

FAQ

Sales Tax Law Exempt items include most food sold as grocery items, most clothing and footwear, disposable paper products for household use, prescription drugs, and over-the-counter drugs.

The ST-5 exemption certificate grants your organization exemption from New Jersey sales and use tax on the organization's purchases of goods, meals, services, room occupancies and admissions that are directly related to the purposes of the organization, except purchases of energy and utility services.

If you don't know your NJ Corporate ID number, you can access it through the Division of Revenue & Enterprise Services' Business Records Service using the "Business Entity Name Search." If you are unable to use this form, contact our Customer Service Center.

ST-3 (3-17) The seller must collect the tax on a sale of taxable property or services unless the purchaser gives them a fully completed New Jersey exemption certificate. State of New Jersey. Division of Taxation. SALES TAX.

BUSINESS REGISTRATION FORM (NJ-REG) INSTRUCTIONS The procedure covers tax/employer registration for ALL types of businesses, and also covers the filing of NEW legal business entities such as domestic/foreign corporations or limited liability companies (Public Records Filing, pages 23-24).

BRNC Certificate A Business Register Number is basically like an ID document for businesses. If you wish to register your vehicle under your business name, you need to apply for a BRNC (Business Register Number Certificate).

Business Entity ID: This is the ten-digit ID assigned to all corporations, LLC's and limited partnerships. Enter all ten digits, including leading zeros.

The New Jersey sales and use tax exemption for manufacturers enables machinery, apparatuses, or equipment to be purchased without paying New Jersey sales and use tax.

Whether or Not New Jersey a registration state? The answer is that it is not. However201a to sell a franchise in New Jersey you must maintain a current and updated FDD that satisfies the federal FTC Franchise Rule and disclosure obligations.

The Sales and Use Tax Act provides an exemption for sales of machinery, apparatus or equipment for use or consumption directly and primarily in the production of tangible personal property by manufacturing, processing, assembling or refining. N.J.S.A.