New Jersey Jury Instruction - Tax Evasion - General Charge

Description

How to fill out Jury Instruction - Tax Evasion - General Charge?

Finding the right authorized file template can be a struggle. Naturally, there are a variety of templates available online, but how do you obtain the authorized type you need? Use the US Legal Forms website. The support offers 1000s of templates, including the New Jersey Jury Instruction - Tax Evasion - General Charge, which can be used for organization and personal requires. Every one of the kinds are checked by professionals and fulfill state and federal demands.

When you are already authorized, log in for your accounts and click on the Down load key to get the New Jersey Jury Instruction - Tax Evasion - General Charge. Make use of accounts to look through the authorized kinds you have ordered in the past. Visit the My Forms tab of your respective accounts and have an additional version in the file you need.

When you are a whole new end user of US Legal Forms, listed here are easy recommendations so that you can comply with:

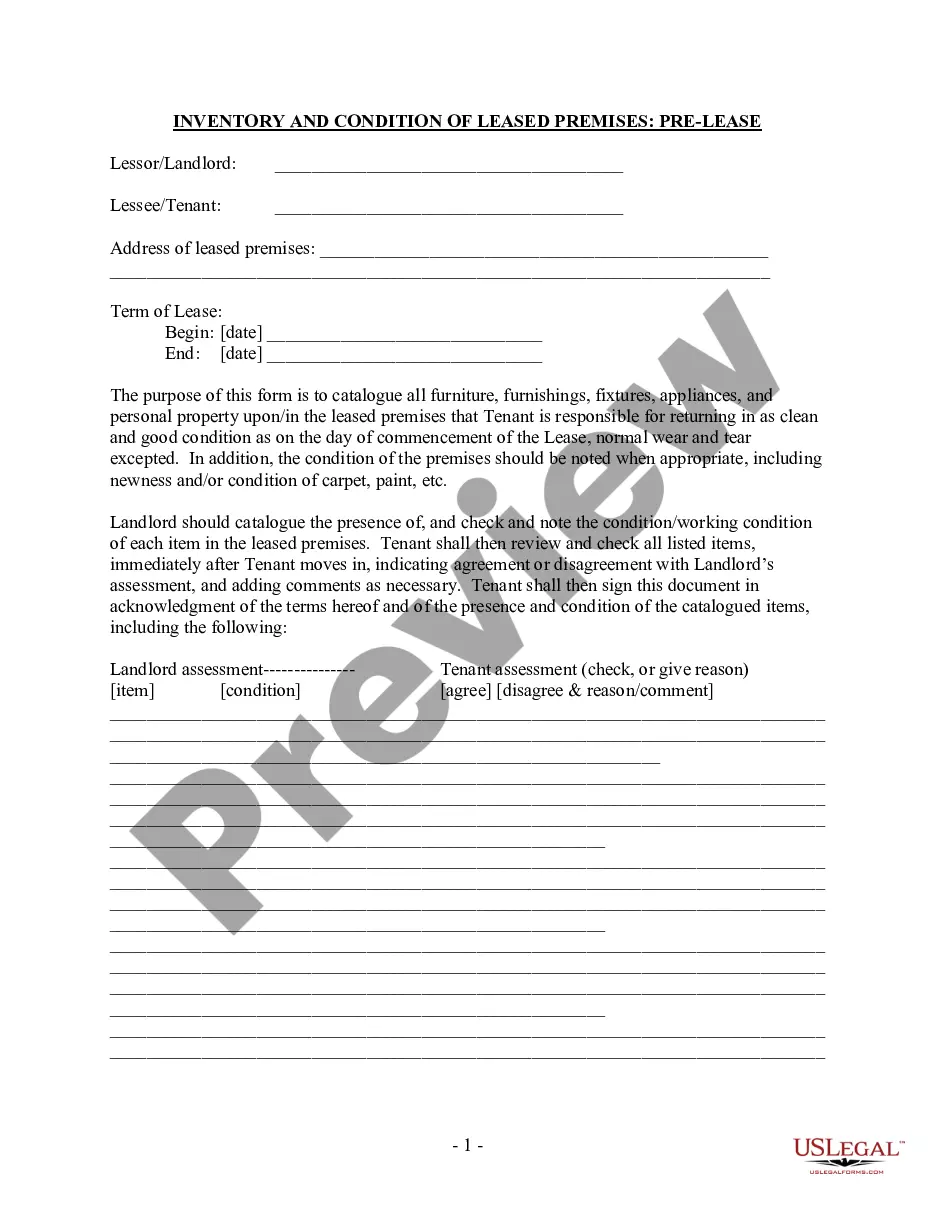

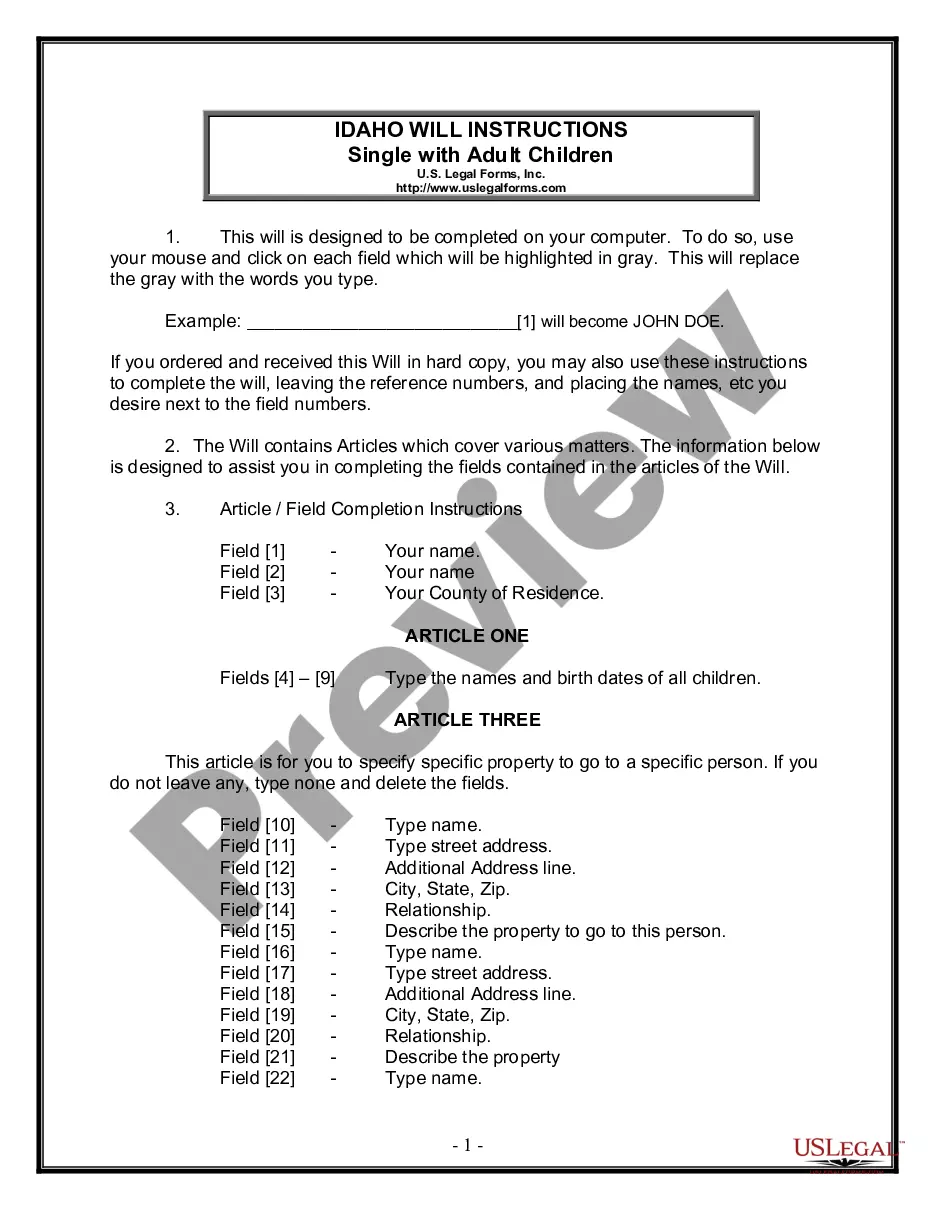

- First, ensure you have chosen the appropriate type for your personal area/area. You are able to look over the shape utilizing the Review key and study the shape description to ensure this is basically the best for you.

- In the event the type fails to fulfill your preferences, take advantage of the Seach field to discover the appropriate type.

- When you are certain the shape is suitable, go through the Get now key to get the type.

- Select the costs strategy you want and enter in the required info. Create your accounts and pay for the transaction utilizing your PayPal accounts or charge card.

- Select the submit format and download the authorized file template for your system.

- Full, change and print out and indication the obtained New Jersey Jury Instruction - Tax Evasion - General Charge.

US Legal Forms will be the most significant library of authorized kinds for which you can find different file templates. Use the service to download expertly-created papers that comply with state demands.

Form popularity

FAQ

If you earn compensation for serving on a jury, the Canada Revenue Agency requires you to report it as income. Include it with miscellaneous types of income such as training allowances or trust payments on Line 13000 ? Other Income of your Income Tax and Benefit Return, but remember you may deduct expenses.

Am I required to allow time off for jury duty and to pay for the time off? A. You are required to allow employees time off to attend court for jury duty. However, there is no requirement for the employer to compensate the employee for the time.

Jurors paid $600 or more for their term of service will receive a 1099 form for taxes from the New Jersey Department of the Treasury.

New Jersey exempts the following from jury duty: state legislators; members and employees of state and local police forces; firefighters (paid and volunteer); members of first aid and rescue squads; fish and game wardens; practicing physicians and dentists; employees and officers of hospitals or any agency under the ...

If you are a New Jersey resident, wages you receive from all employers are subject to New Jersey Income Tax. Wages include salaries, tips, fees, commissions, bonuses, and any other payments you receive for services you perform as an employee. You must report all payments, whether in cash, benefits, or property.