New Jersey Jury Instruction - 1.9.4.2 Joint Employers

Description

How to fill out Jury Instruction - 1.9.4.2 Joint Employers?

Are you currently within a position that you need to have papers for both organization or person functions virtually every day? There are a lot of lawful document templates accessible on the Internet, but getting kinds you can rely on is not simple. US Legal Forms delivers 1000s of form templates, such as the New Jersey Jury Instruction - 1.9.4.2 Joint Employers, that are created in order to meet state and federal demands.

If you are previously knowledgeable about US Legal Forms internet site and get a merchant account, simply log in. Next, you may down load the New Jersey Jury Instruction - 1.9.4.2 Joint Employers web template.

Should you not come with an accounts and wish to start using US Legal Forms, follow these steps:

- Discover the form you want and make sure it is to the proper city/county.

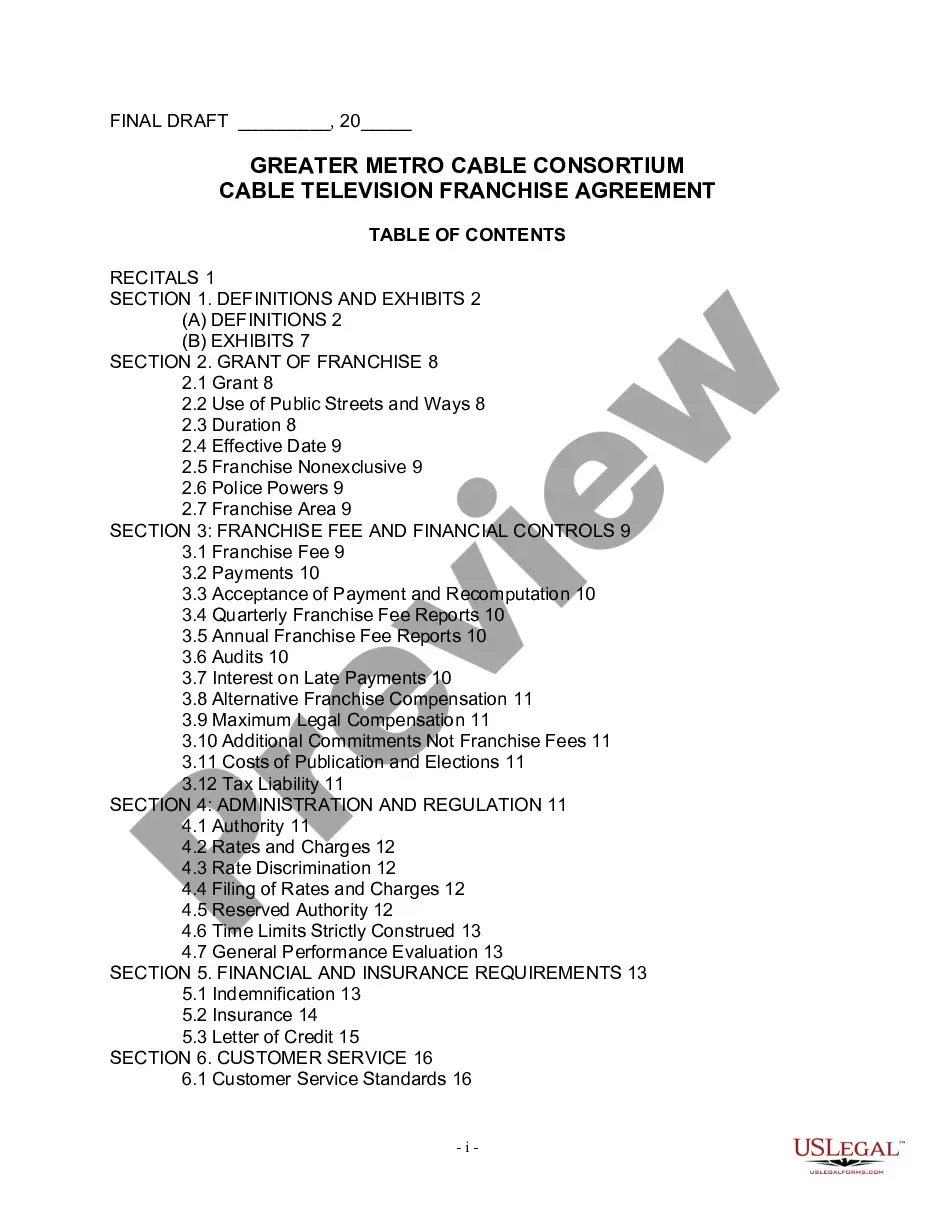

- Utilize the Review option to analyze the form.

- Read the description to actually have chosen the appropriate form.

- In the event the form is not what you are trying to find, make use of the Research industry to get the form that fits your needs and demands.

- When you get the proper form, click Buy now.

- Select the pricing prepare you would like, fill out the specified information to produce your money, and purchase your order utilizing your PayPal or Visa or Mastercard.

- Decide on a hassle-free file format and down load your duplicate.

Locate all the document templates you have bought in the My Forms food list. You can obtain a extra duplicate of New Jersey Jury Instruction - 1.9.4.2 Joint Employers whenever, if needed. Just select the required form to down load or print the document web template.

Use US Legal Forms, the most extensive assortment of lawful forms, to save lots of time and prevent errors. The services delivers expertly manufactured lawful document templates that you can use for an array of functions. Create a merchant account on US Legal Forms and start producing your daily life a little easier.