New Jersey LLC Operating Agreement for Two Partners

Description

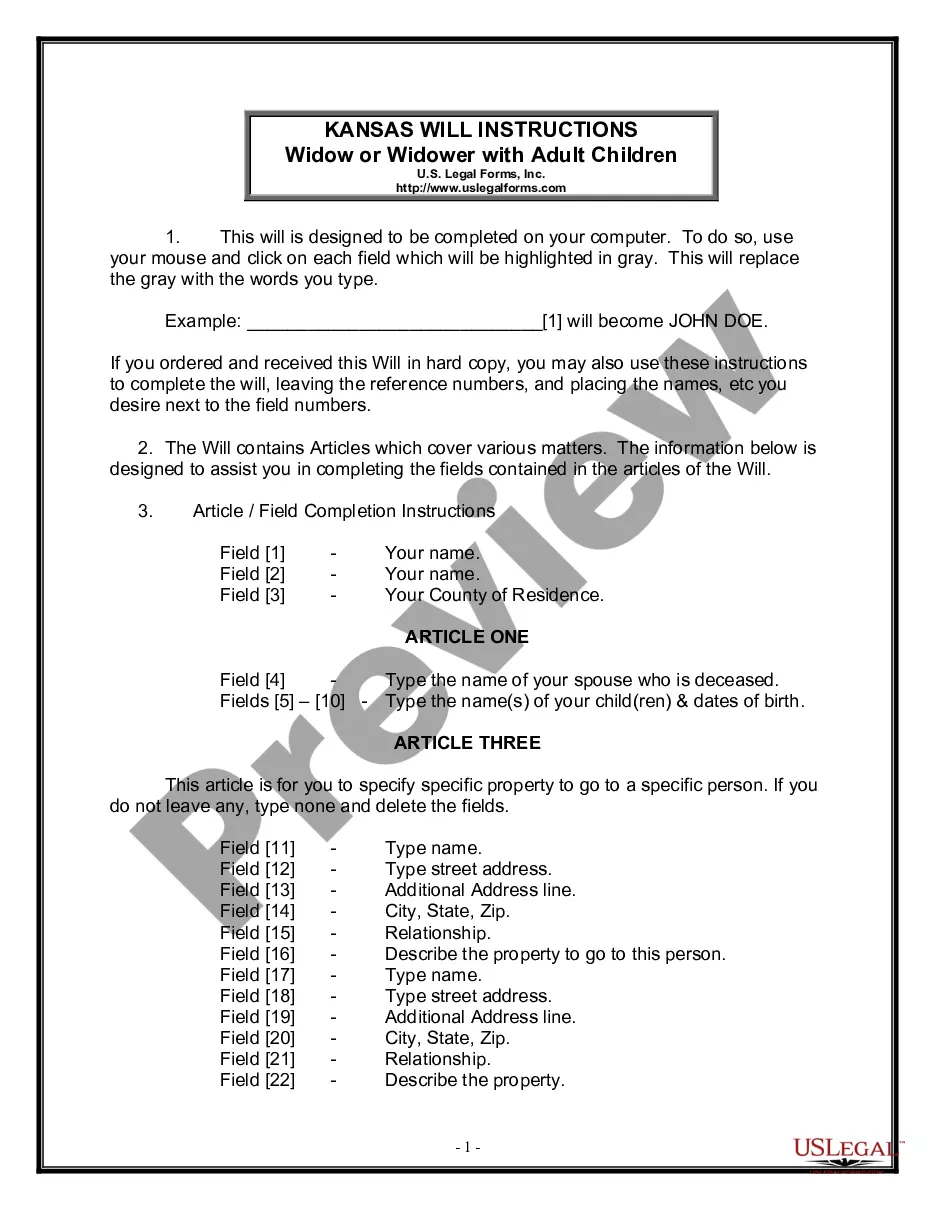

How to fill out LLC Operating Agreement For Two Partners?

US Legal Forms - one of the largest repositories of authentic documents in the United States - offers a diverse range of legal document templates that you can download or print.

By using the site, you can access numerous forms for both business and personal purposes, categorized by types, states, or keywords.

You can obtain the latest versions of forms such as the New Jersey LLC Operating Agreement for Two Partners in just seconds.

Select the Preview button to review the form's content.

Check the form description to confirm that you have chosen the correct document.

- If you have an account, Log In and download the New Jersey LLC Operating Agreement for Two Partners from the US Legal Forms library.

- The Download button will be available for every form you see.

- You can access all previously saved forms in the My documents section of your account.

- To use US Legal Forms for the first time, here are simple instructions to help you get started.

- Ensure you have selected the correct form for your specific city/state.

Form popularity

FAQ

New Jersey does not require an operating agreement in order to form an LLC, but executing one is highly advisable.

Every New Jersey LLC owner should have an operating agreement in place to protect the operations of their business. While not legally required by the state, having an operating agreement will set clear rules and expectations for your LLC while establishing your credibility as a legal entity.

Most LLC operating agreements are short and sweet, and they typically address the following five points:Percent of Ownership/How You'll Distribute Profits.Your LLC's Management Structure/Members' Roles And Responsibilities.How You'll Make Decisions.What Happens If A Member Wants Out.More items...?

The multimember operating agreement is specially designed for LLCs with more than one owner. It is the only document that designates an LLC's owners and the percentage of the company they own. Both members should sign the operating agreement in the presence of a notary public.

Member LLC Operating Agreement is a document that establishes how an entity with two (2) or more members will be run. Without putting the contract into place, the entity is governed in accordance with the rules and standards established by the state, which may or may not align with the company's goals.

How to Form an LLC in New Jersey (6 steps)Step 1 Registered Agent. Managing members of the LLC must elect a Registered Agent before filing in the State.Step 2 Choose your LLC Type.Step 3 File the Application.Step 4 Pay the Fee.Step 5 LLC Operating Agreement.Step 6 Employer Identification Number (EIN)

The IRS treats multi-member LLCs the same as partnerships. When filing taxes, a multi-member LLC must file a Form 1065 Partnership Return. This is an informational return only, as the tax liability will pass to the individual members on their personal tax returns.

member LLC operating agreement is a legal contract that outlines the agreedupon ownership structure and sets forth the governing terms for a multimember LLC. In addition, it sets clear expectations about each member's powers, roles, and responsibilities.

member LLC (also called a membermanaged LLC) is a limited liability company that has more than one owner but no managers. Instead, owners run the daytoday operations of the LLC.