New Jersey Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time

Description

How to fill out Irrevocable Trust For Future Benefit Of Trustor With Income Payable To Trustor After Specified Time?

If you want to accumulate, acquire, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site’s straightforward and user-friendly search function to locate the documents you require.

Various templates for business and personal purposes are sorted by categories and states, or keywords.

Step 4. Once you have located the form you need, click the Get now button. Select the payment plan you prefer and enter your credentials to register for an account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to obtain the New Jersey Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time with just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and click the Obtain button to retrieve the New Jersey Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time.

- You can also access forms you have previously acquired in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

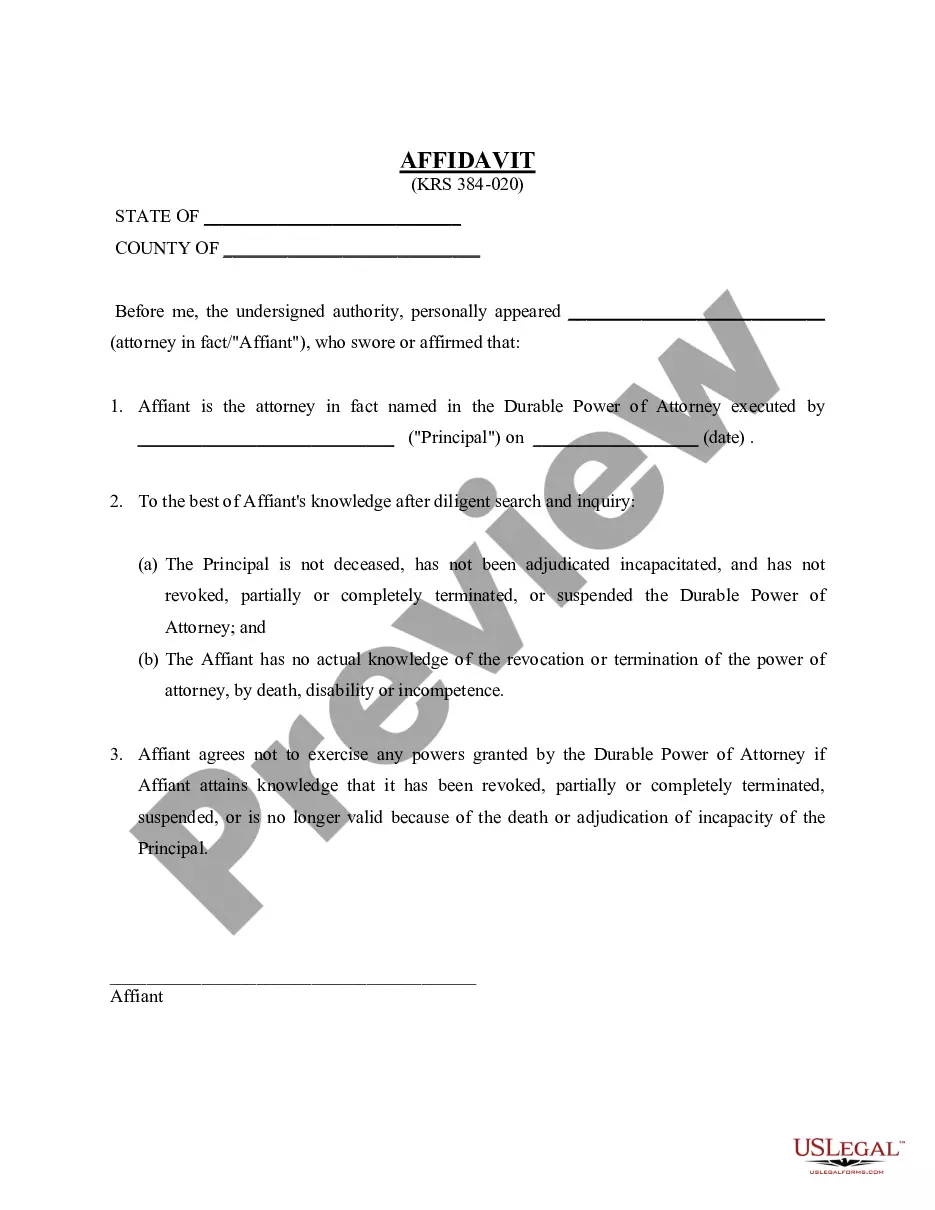

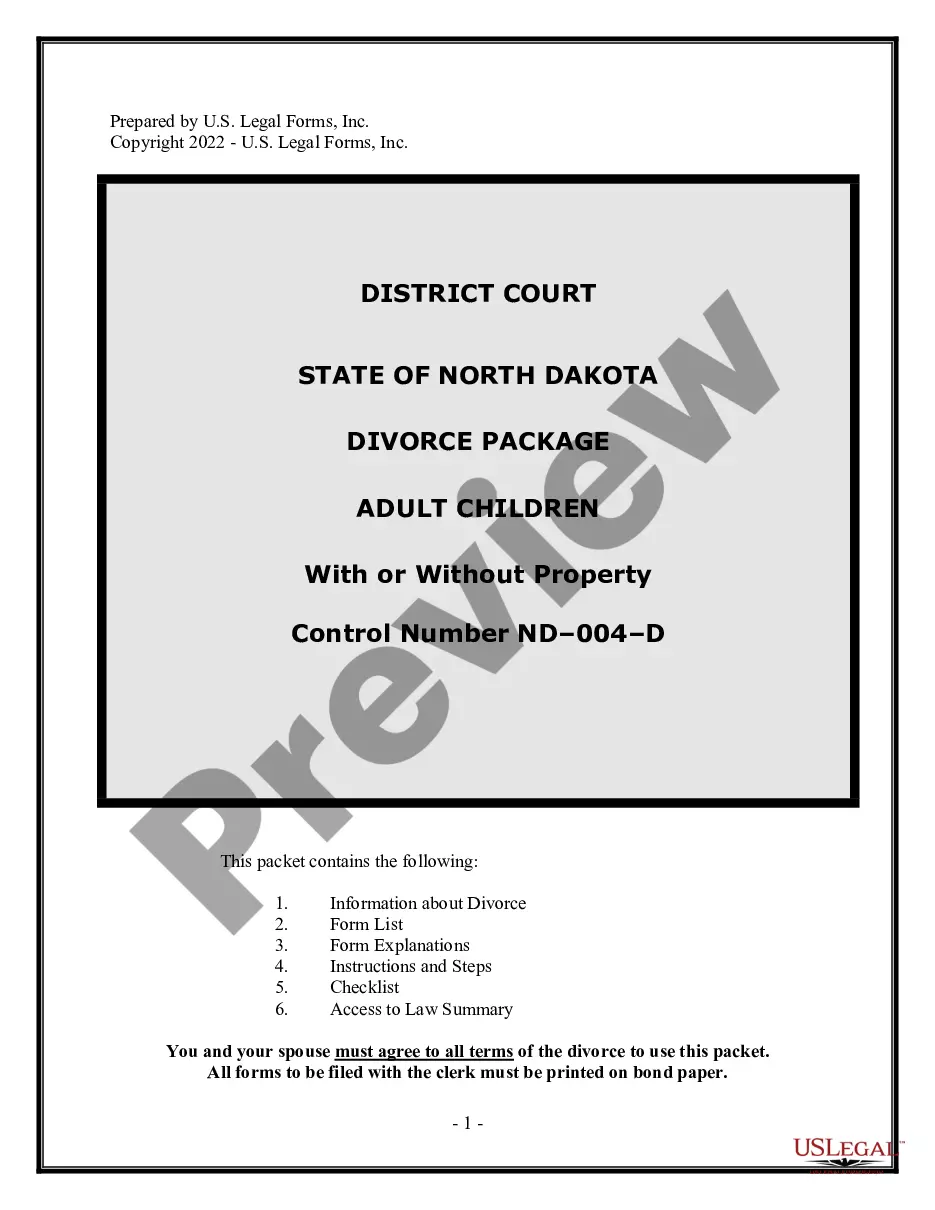

- Step 2. Use the Review option to inspect the form’s details. Don’t forget to read the description.

- Step 3. If you are not satisfied with the document, use the Search bar at the top of the screen to find other variations of the legal form template.

Form popularity

FAQ

Generally, a trustee is the only person allowed to withdraw money from an irrevocable trust.

Retained Interest Trusts This is a trust where a grantor makes an irrevocable transfer of assets but reserves the right to receive income or enjoyment of those assets for a period of time. When the trust then subsequently terminates, the assets are passed on to others.

A credit shelter trust, also known as a bypass trust or a family trust, is a trust fund that allows the trustor to grant the recipients an amount of assets or funds up to the estate-tax exemption.

An irrevocable trust provides an alternative to simply giving an asset to a beneficiary in order to reduce your taxable estate. With a trust, you can set the timing of distributions (i.e. when the beneficiary attains 30 years of age) as well as the reasons for distributions (i.e. for education only).

An irrevocable trust reports income on Form 1041, the IRS's trust and estate tax return. Even if a trust is a separate taxpayer, it may not have to pay taxes. If it makes distributions to a beneficiary, the trust will take a distribution deduction on its tax return and the beneficiary will receive IRS Schedule K-1.

An irrevocable trust is a very powerful tool for Medicaid Asset Protection, as it allows you to shelter assets from a nursing home after they have been in the trust for five years.

The trust remains revocable while both spouses are alive. The couple may withdraw assets or cancel the trust completely before one spouse dies. When the first spouse dies, the trust becomes irrevocable and splits into two parts: the A trust and the B trust.

To help you get started on understanding the options available, here's an overview the three primary classes of trusts.Revocable Trusts.Irrevocable Trusts.Testamentary Trusts.More items...?

Can a beneficiary withdraw money from an irrevocable trust? The trustee of an irrevocable Trust cannot withdraw money except to benefit the Trust. These terms include paying maintenance costs and disbursement income to beneficiaries. However, it is not possible to withdraw money for personal or business use.

The grantor (as an individual or couple) transfers their assets to an irrevocable trust. However, unlike other irrevocable trusts, the grantor can be the income beneficiary. Their children or spouse would be the residual beneficiaries.