New Jersey Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years

Description

How to fill out Grantor Retained Income Trust With Division Into Trusts For Issue After Term Of Years?

If you wish to obtain, secure, or generate authentic document templates, utilize US Legal Forms, the largest repository of valid forms available online.

Take advantage of the site's straightforward and user-friendly search function to find the documents you require.

Countless templates for professional and personal needs are organized by categories, states, or keywords. Use US Legal Forms to obtain the New Jersey Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years with just a few clicks.

Every legal document template you purchase is yours permanently. You have access to every form you downloaded in your account. Click on the My documents section and select a form to print or download again.

Compete and acquire, and create the New Jersey Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years with US Legal Forms. There are numerous professional and state-specific forms you can utilize for your business or personal needs.

- If you are already registered as a US Legal Forms user, Log In to your account and click the Acquire option to obtain the New Jersey Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years.

- You can also access forms you previously downloaded in the My documents tab of your account.

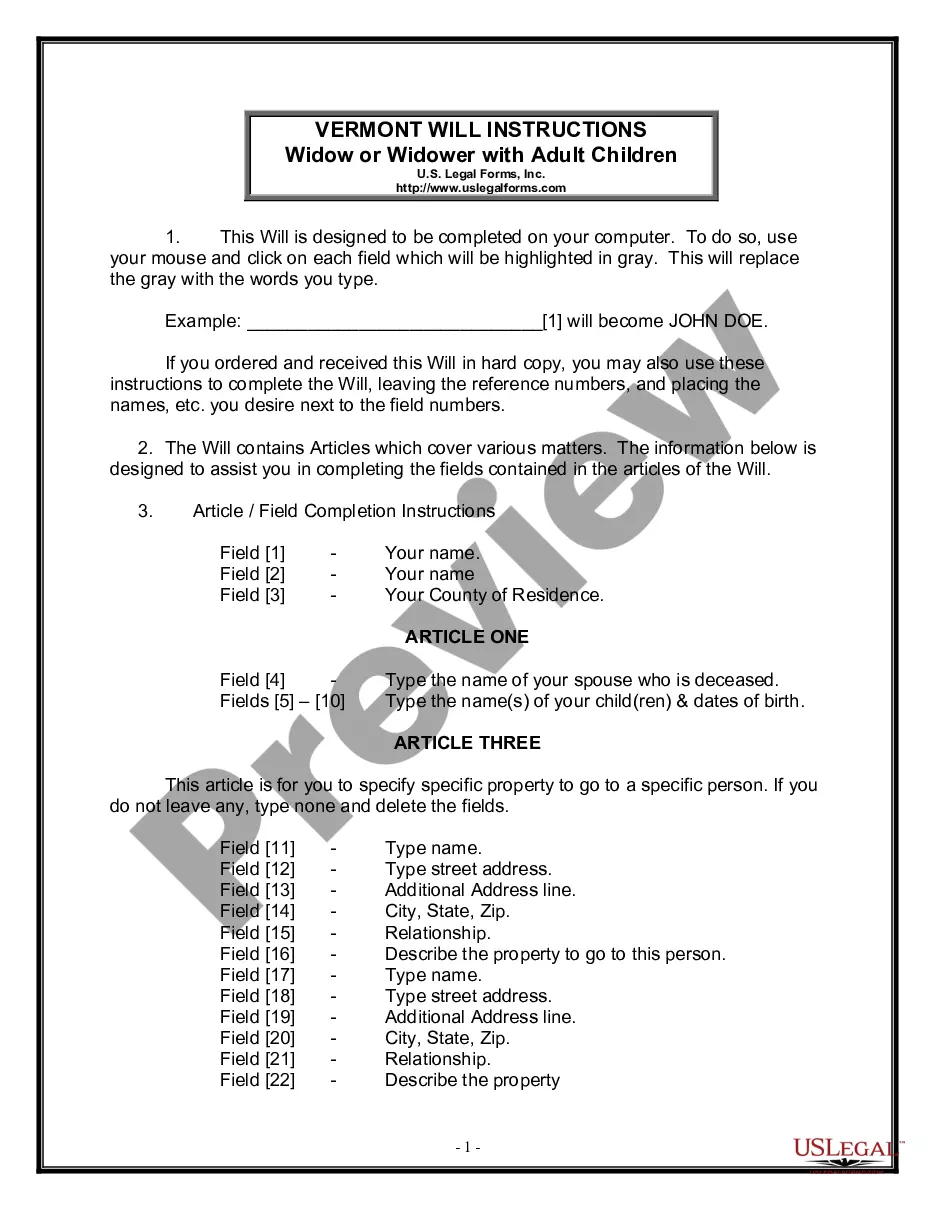

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Make sure you have selected the form for the correct area/state.

- Step 2. Use the Preview option to review the details of the form. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search bar at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have located the form you need, choose the Buy now option. Select the pricing plan you prefer and enter your information to register for an account.

- Step 5. Complete the financial transaction. You can use your Мisa or credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of your legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the New Jersey Grantor Retained Income Trust with Division into Trusts for Issue after Term of Years.

Form popularity

FAQ

A grantor trust is a trust for which the grantor of the trust (i.e., the person who creates and funds the trust) is treated as the owner of the trust assets for federal income tax purposes by virtue of the inclusion of certain provisions in the trust instru- ment.

California, Georgia, Montana, North Carolina, North Dakota, and Tennessee tax a trust if it has one or more resident beneficiaries. Generally, only income attributable to the resident beneficiary is taxed by the state.

Most states but not all recognize the federal rules of grantor trust status for income tax purposes. Of note, Alabama, Tennessee, Pennsylvania, Louisiana, and the District of Columbia do not follow in all regards federal law with respect to grantor trust taxation.

Grantor Retained Income Trust, Definition A grantor retained income trust allows the person who creates the trust to transfer assets to it while still being able to receive net income from trust assets. The grantor maintains this right for a fixed number of years.

If the trust was divided into fractional shares, the trust allocation is updated by recalculating the fraction each time distributions are made, as well as each time income is allocated to principal.

Grantor Trust.Grantor trusts are required to file a New Jersey Gross Income Tax Fiduciary Return. If the grantor trust income is reportable by or taxable to the grantor for federal income tax purposes, it also is taxable to the grantor for New Jersey Income Tax purposes.

Too bad, says the IRS, unless you are an estate or trust. Under Section 663(b) of the Internal Revenue Code, any distribution by an estate or trust within the first 65 days of the tax year can be treated as having been made on the last day of the preceding tax year.

A federal Electing Small Business Trust can elect to be taxed in New Jersey in the same manner as for federal tax purposes.

At the end of the initial term retained by the Grantor, if the Grantor is still living, the remainder beneficiaries (or a trust to be administered for the benefit of the remainder beneficiaries) receive $100,0000 plus all capital growth (which is the amount over and above the net income that was paid to the Grantor).

The creator of the trust (the Grantor) transfers assets to the GRAT while retaining the right to receive fixed annuity payments, payable at least annually, for a specified term of years. After the expiration of the term, the Grantor will no longer receive any further benefits from the GRAT.