New Jersey Electronic Software Distribution Agreement

Description

How to fill out Electronic Software Distribution Agreement?

Have you ever found yourself in a situation where you need documents for business or personal purposes quite often.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms provides a vast array of document templates, including the New Jersey Electronic Software Distribution Agreement, designed to meet state and federal requirements.

Select the pricing plan you prefer, complete the necessary information to create your account, and process your order using PayPal or a credit card.

Choose a convenient file format and download your copy.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Afterward, you can download the New Jersey Electronic Software Distribution Agreement template.

- If you don't have an account and wish to start using US Legal Forms, follow these steps.

- 1. Locate the form you need and ensure it is for the correct city/region.

- 2. Use the Review button to inspect the form.

- 3. Read the description to confirm that you've chosen the right document.

- 4. If the form is not what you are looking for, use the Search section to find the document that meets your requirements.

- 5. Once you find the correct form, click Get now.

Form popularity

FAQ

New Jersey's current sales tax statute exempts electronically delivered software used exclusively in the conduct of the purchaser's business. The exemption applies even if purchaser receives written manuals or training manuals.

Receipts from sales of a specified digital product that is accessed but not delivered electronically to the purchaser are exempt from tax. Nor is tax imposed on other types of property that are delivered electronically, such as digital photographs, digital magazines, etc.

Additionally, software subscriptions services are considered tangible property and are subject to sales and use taxes.

Fees for the service of installing software for the customer are subject to Sales Tax. They are treated as charges for the installation of tangible personal property. N.J.S.A. B-3(b)(2).

Requirements for prewritten software are still subject to sales and use tax regardless of the method of delivery (whether with a physical medium, downloadable or accessed via the Internet) or if possession or control is given.

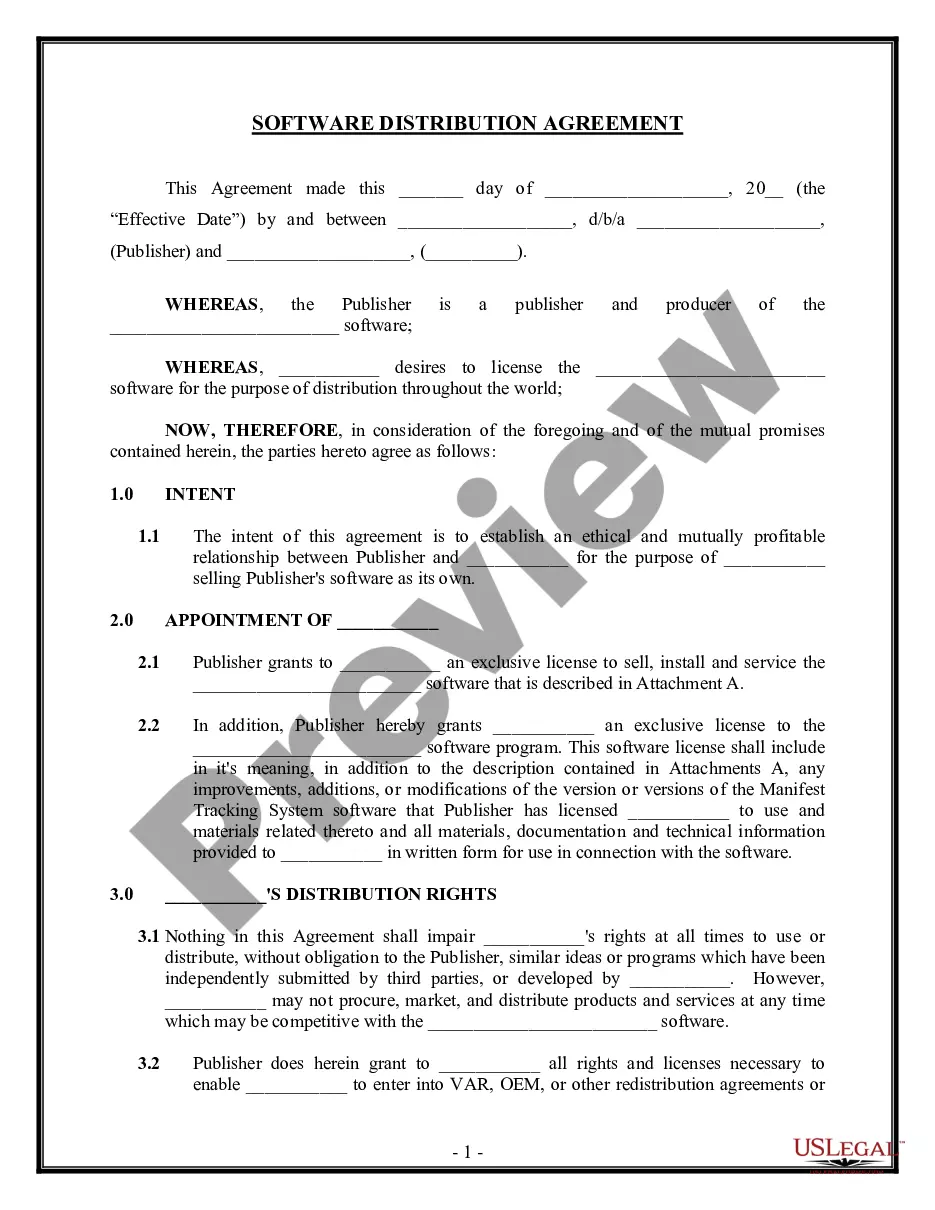

Under the terms of a licence or distribution agreement a licensee is generally granted the right to use your intellectual property (including your trade mark) or to distribute your product within a defined territory.

A distribution deal (also known as distribution contract or distribution agreement) is a legal agreement between one party and another, to handle distribution of a product. There are various forms of distribution deals. There are exclusive and non-exclusive distribution agreements.

Software distribution agreements specifically allow distributors to market and sell the developer's software to end users. A software distribution agreement sets forth the rights and duties of both the developer and the distributor to avoid disputes later on.

A software license agreement should include the licensor's reservation of all its rights not specifically granted to the licensee and the licensee's acknowledgment of the licensor's ownership of the licensed software. Payment terms.

Services delivered into New Jersey are taxable when they are specifically listed under N.J.S.A. B-3. Use of a software application is not listed as a taxable service. Therefore, most charges for SaaS are not subject to Sales Tax.