New Jersey Assignment of LLC Company Interest to Living Trust

Description

How to fill out Assignment Of LLC Company Interest To Living Trust?

Are you in a situation where you require documents for either commerce or specific purposes almost every day.

There is a range of legal document templates available online, but locating ones you can trust isn't simple.

US Legal Forms provides thousands of template options, such as the New Jersey Assignment of LLC Company Interest to Living Trust, designed to meet federal and state requirements.

Once you locate the right template, click Get now.

Select the pricing plan you prefer, complete the necessary information to create your account, and pay for the transaction via your PayPal or credit card. Choose a convenient file format and download your copy. Access all the document templates you have purchased in the My documents menu. You can retrieve another version of the New Jersey Assignment of LLC Company Interest to Living Trust at any time as needed. Click on the desired template to download or print the document format. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and eliminate errors. The service offers professionally created legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life a little easier.

- If you are already familiar with the US Legal Forms website and possess a merchant account, just Log In.

- Then, you can download the New Jersey Assignment of LLC Company Interest to Living Trust template.

- If you do not have an account and wish to begin using US Legal Forms, follow these steps.

- Find the template you need and ensure it is for your correct locality/area.

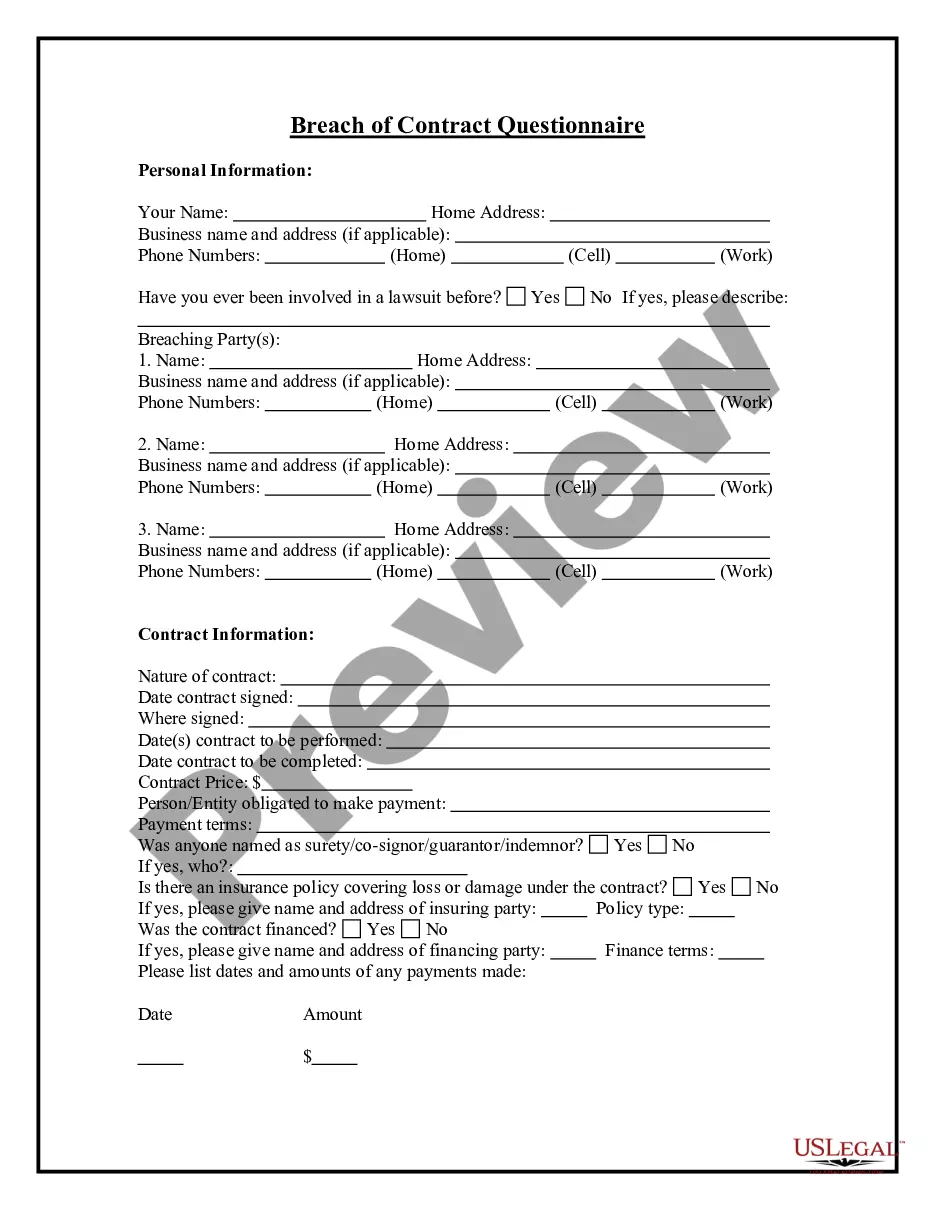

- Use the Preview button to review the form.

- Read the information to confirm you have chosen the correct template.

- If the template isn’t what you’re looking for, utilize the Search bar to find the form that fits your needs.

Form popularity

FAQ

While membership interests are freely transferable in the sense that any member generally can transfer his or her economic rights in the LLC (subject to the operating agreement, a stand-alone buy-sell agreement, and state law), the management or voting rights in the LLC are usually what are restrictedotherwise, other

A membership interest represents an investor's (called a "member") ownership stake in an LLC. A person who holds a membership interest has a profit and voting interest in the LLC (although these may be amended by contract). Ownership in an LLC can be expressed by percentage ownership interest or membership units.

If an LLC member's interest is held in a trust, then the administrator, sometimes called a "trustee," will vote and otherwise exercise the duties and rights of the LLC member. Transferring the membership interest to the trust could require an official transfer document, which is similar to a bill of sale.

The assignment of interest is typically different from selling the ownership stake. Selling a member's ownership stake in the LLC requires unanimous approval by the other members. A departing member may also assign his membership to another member.

Here is how you can transfer your LLC to your Trust:Draft and Execute the Transfer Document.Draft and File an Amendment to your Articles of Organization with the Arizona Corporation Commission.Amend the Operating Agreement.Have LLC Members Sign a Resolution Accepting Transfer.

The answer is yes, a trust can own an LLC, either as the sole owner or as one of many owners.

By placing a business into a living trust -- a trust that is created for you and your family's benefit while you are alive -- you transfer legal ownership of your business to the trustee, which is usually a third party but can also be the business owner.

The answer is yes. First, trust law permits trusteeswho are acting on behalf of trusts, including revocable truststo own any asset, or almost any asset, that an individual can own, and this includes an interest in an LLC, which qualifies as an asset.